February 2023 — $1M FDIC insurance, merchant cards, and more

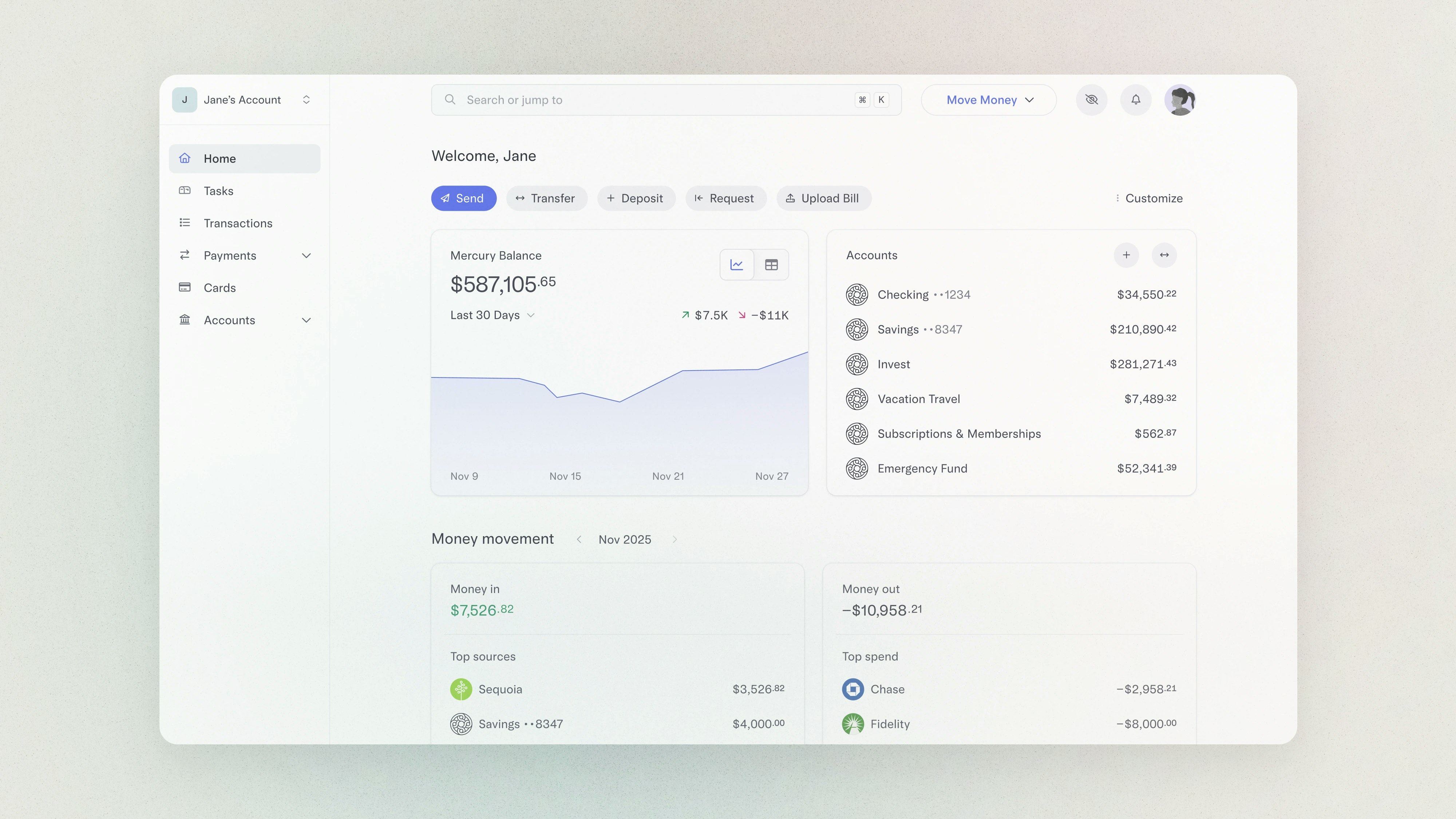

Mercury is engineered to make sure you don’t lose sleep thinking about banking. We’re constantly innovating and iterating our product because we believe your banking tasks should feel simpler, more intuitive, and maybe even a little enjoyable. Keep reading to discover the most recent updates to your banking experience.

💳 Unlock more precision with merchant card lock

Introducing merchant cards, created to help you maintain control of your company’s spend as you scale. Each merchant-locked card can only be used at the single vendor you specify

By creating a merchant-locked card or adding a merchant lock to an existing virtual card, be advised that this action does not nullify any existing contract between you and additional merchants. A merchant may still have the ability to force post and bypass our authorization. You must directly contact any additional merchant to update your card number or cancel your subscription. — for instance, a Google Ads-specific card for your marketing team — making it easier than ever to track employee and subscription spend. This means substantially higher daily and monthly card limits, and more spending power at your go-to vendors.

You can quickly issue new merchant cards from your Cards dashboard, as well as add a merchant lock to any existing virtual card by clicking on its details and selecting the vendor of your choice.

Debit and IO credit cards can both be merchant-locked, but only IO cards will give you 1.5% cashback on all your spend — find out if you qualify.

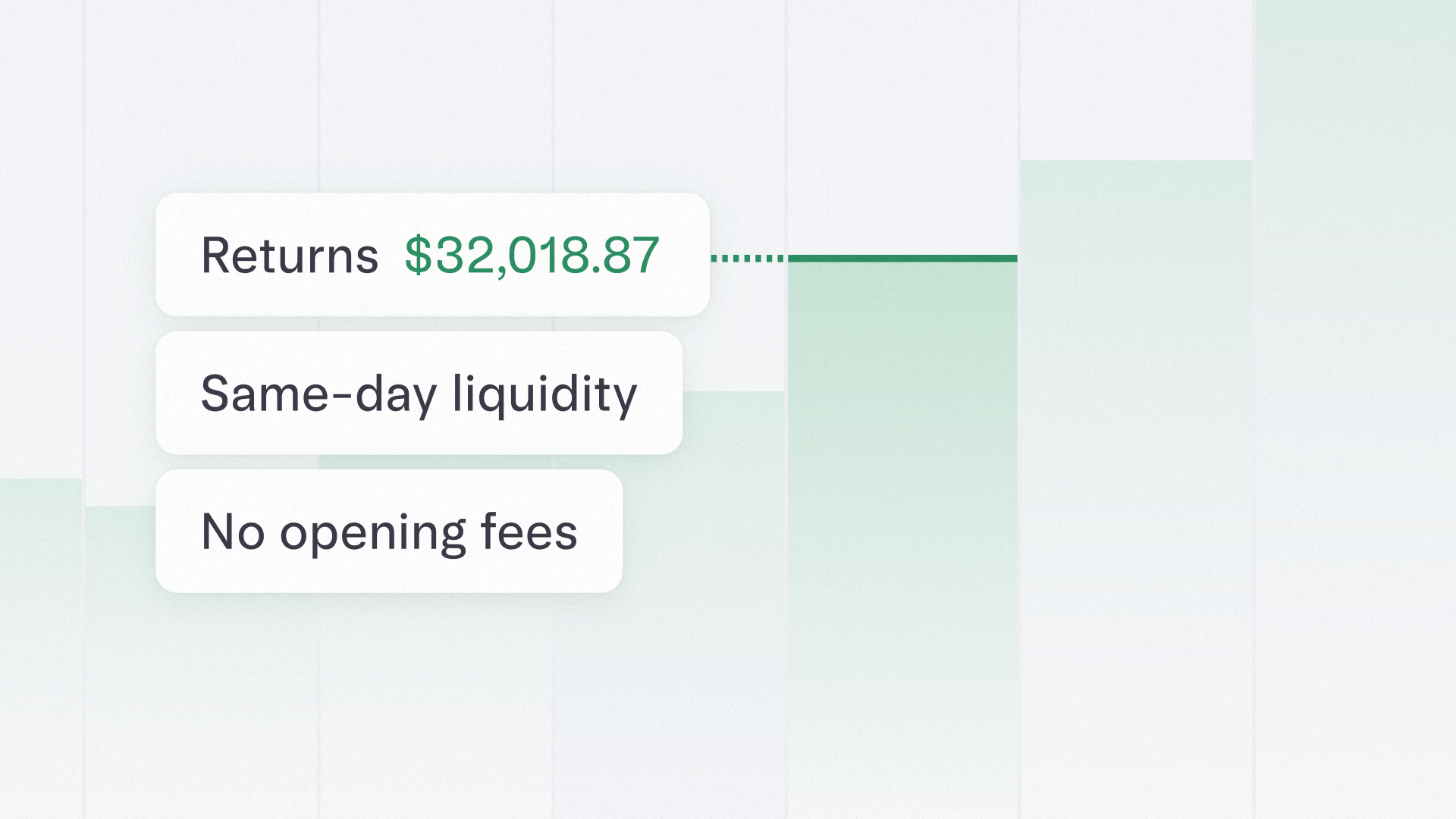

🧘 Enjoy the peace of mind that comes with expanded FDIC coverage

You’ve worked hard to build your company, so it’s only right that we work hard to protect it. Thanks to spreading your deposits across a sweep network of trusted partner banks, your checking and savings are now eligible for a total FDIC insurance coverage of $1M — four times the standard amount of $250K. Curious how a sweep network works? Learn more here.

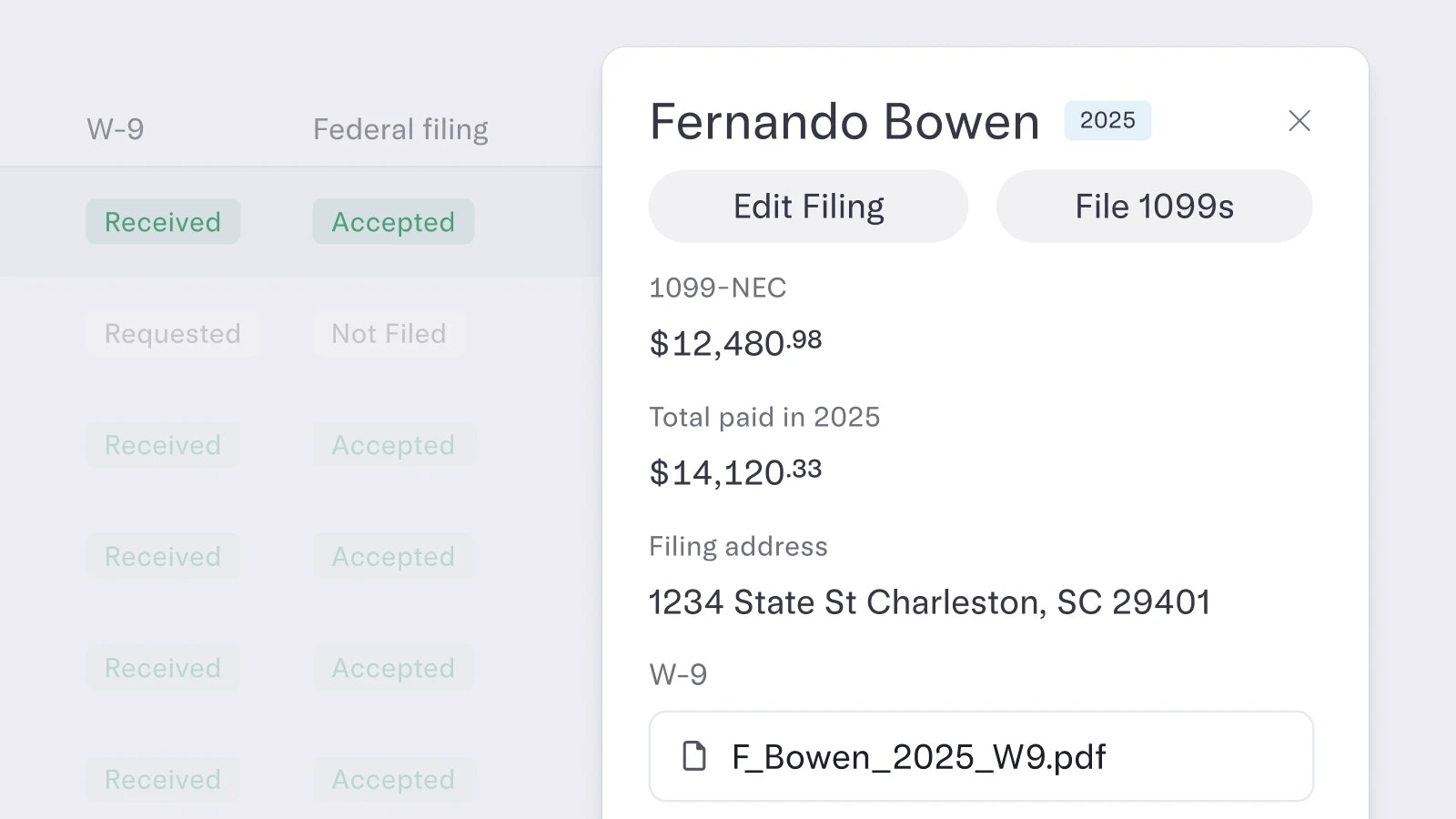

💸 Edit your scheduled payments without breaking a sweat

Updating your scheduled and recurring payments has never been easier. Simply select the payment you want to modify, then change the amount, cadence, and associated account details in less than a minute.

If this feature doesn’t work for you, it’s probably because your account doesn't have multi-admin approval enabled— stay tuned for updates as we work on expanding availability to you soon.

🤖 Android: Pay by ACH, spruce up your transaction notes, and more

Time to refresh your Mercury Android app — new changes have arrived. You can now pay someone via ACH, attach photos and documents to your transaction notes, manage your authorized devices, view your login activity, and get notified when your credit balance reaches your specified threshold.

📑 Submit your Venture Debt diligence without switching tabs

Your Mercury account dashboard already enjoys seamless integrations with your accounting software, so isn’t it time your Mercury Venture Debt dashboard did too? We’re on the same page. That’s why we've given Venture Debt applicants the ability to plug in their favorite accounting apps (like Quickbooks or Xero) when submitting their diligence — no logging out necessary.

Bug fixes & improvements:

- Whether you’re a scaling startup or an ecommerce company, you’re in good hands with Mercury. Explore the unique benefits we offer to each type of business by perusing our new dedicated landing pages.

- Curious how many approvers each of your payments requires? We now have a column on your Payments page for just that.

- To spare you the wild goose chase, we’ve added your EIN to your Company Profile.

- Save time on NetSuite reconciliations by directly downloading your transactions as NetSuite-friendly CSV files. Try it by heading to your Data Export page.

- Two new push notifications have been shipped for the Mercury iOS app: one for credit account-related notices (like when your balance is below your target threshold), and one to let team members know when they’ve been issued a new card.

- Just opened a Mercury account for your new business? Your timing is impeccable, because we’ve added some new updates to your account dashboard that make it easier than ever to link Plaid and initiate your first deposit.