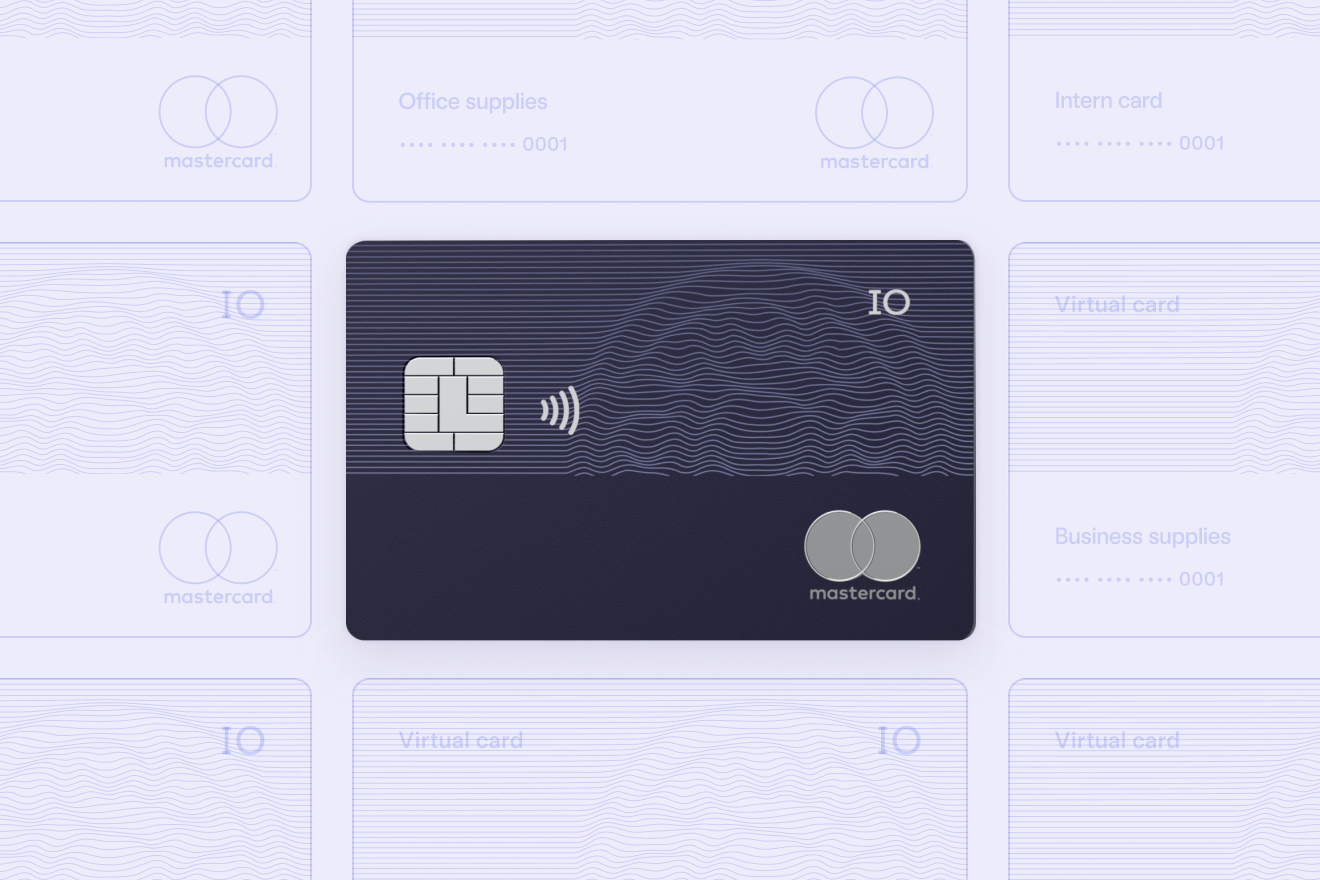

A card for day 1 to day 1,000 — and beyond

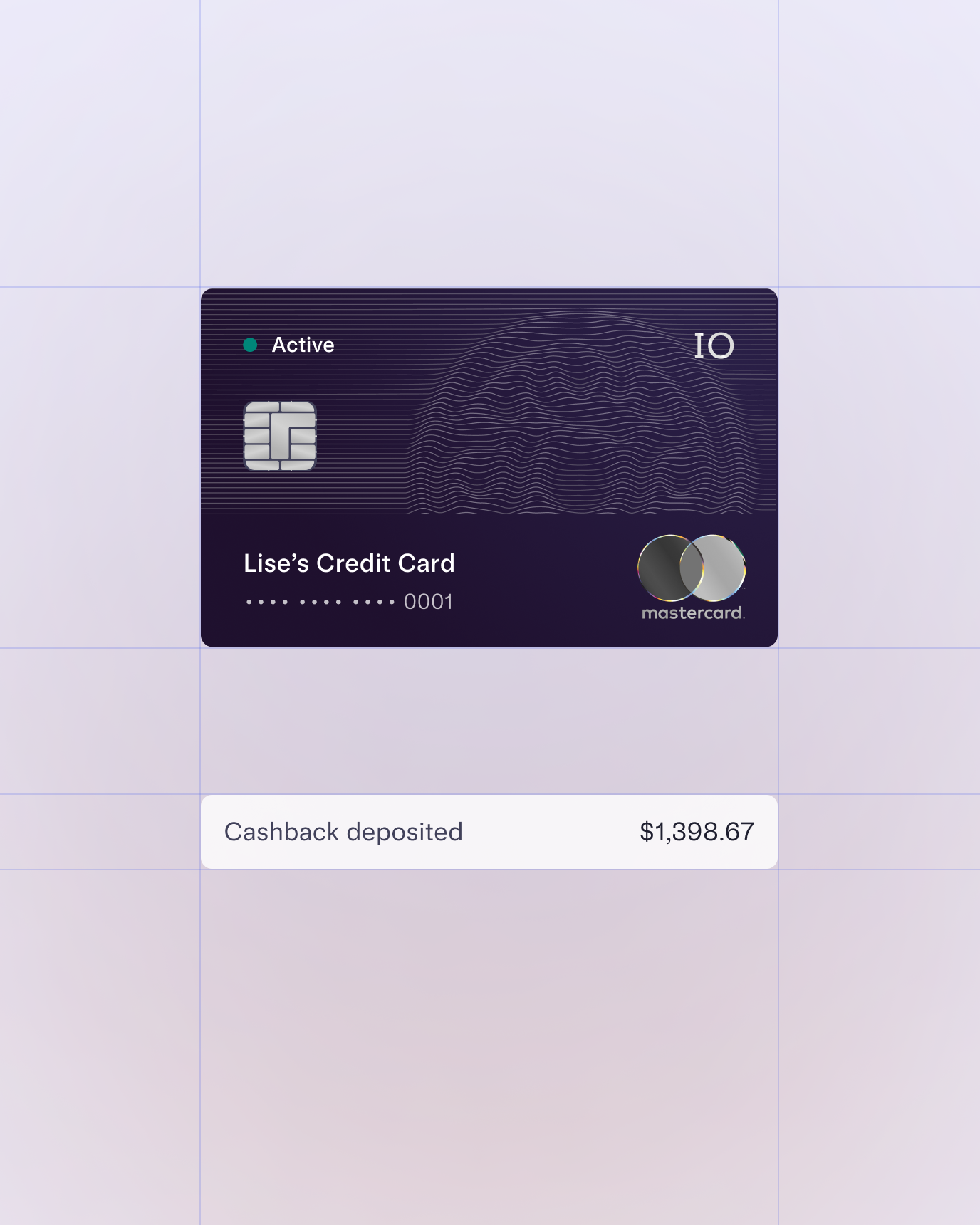

1.5% cashback on all spend

Higher credit limits

Access on day one for eligible orgs

Build business credit

Expense management tools

No personal guarantee

Scale confidently with powerful spend management tools

Cards for your team

Issue as many cards as needed — individually or in bulk with our HR and payroll system integrations.

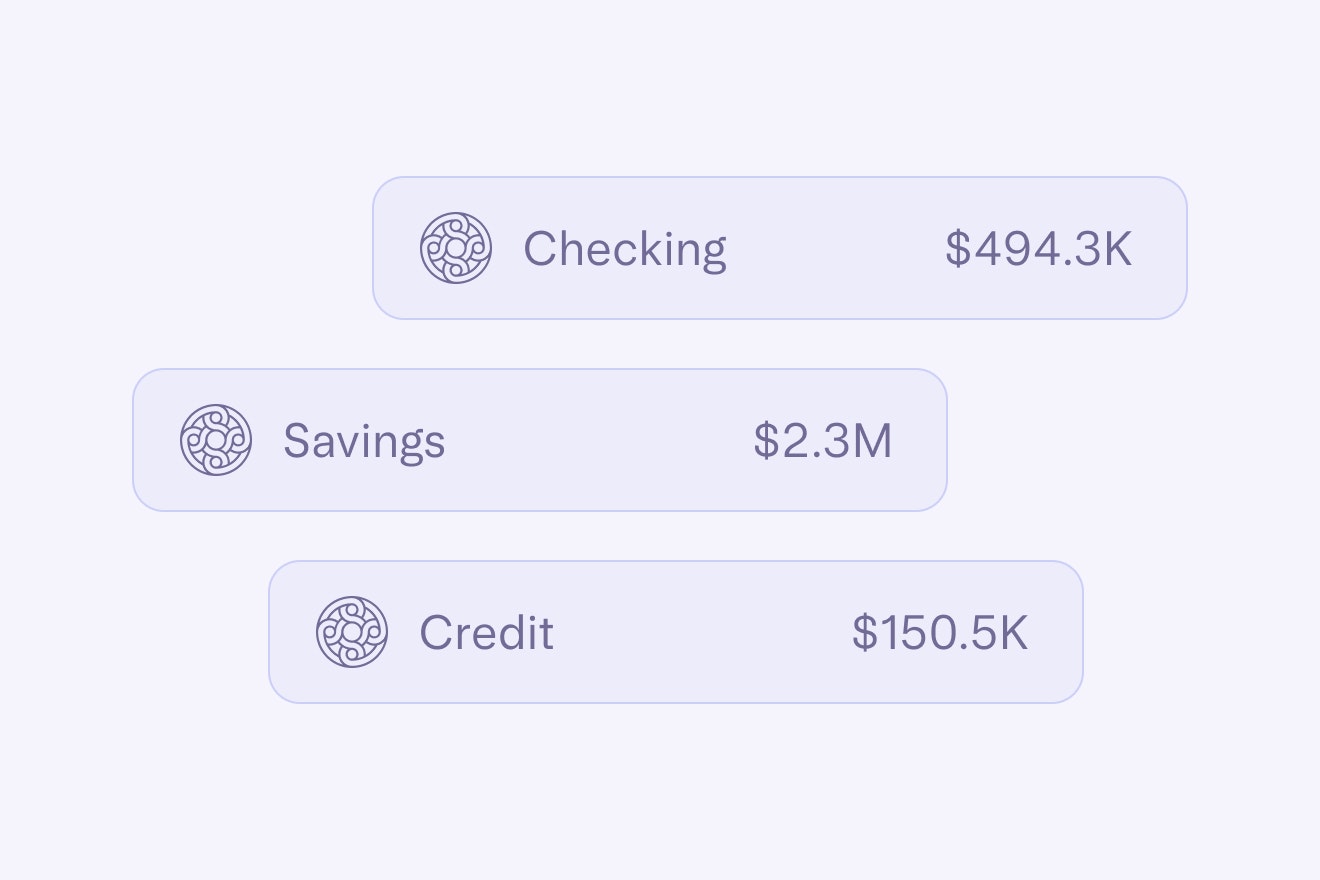

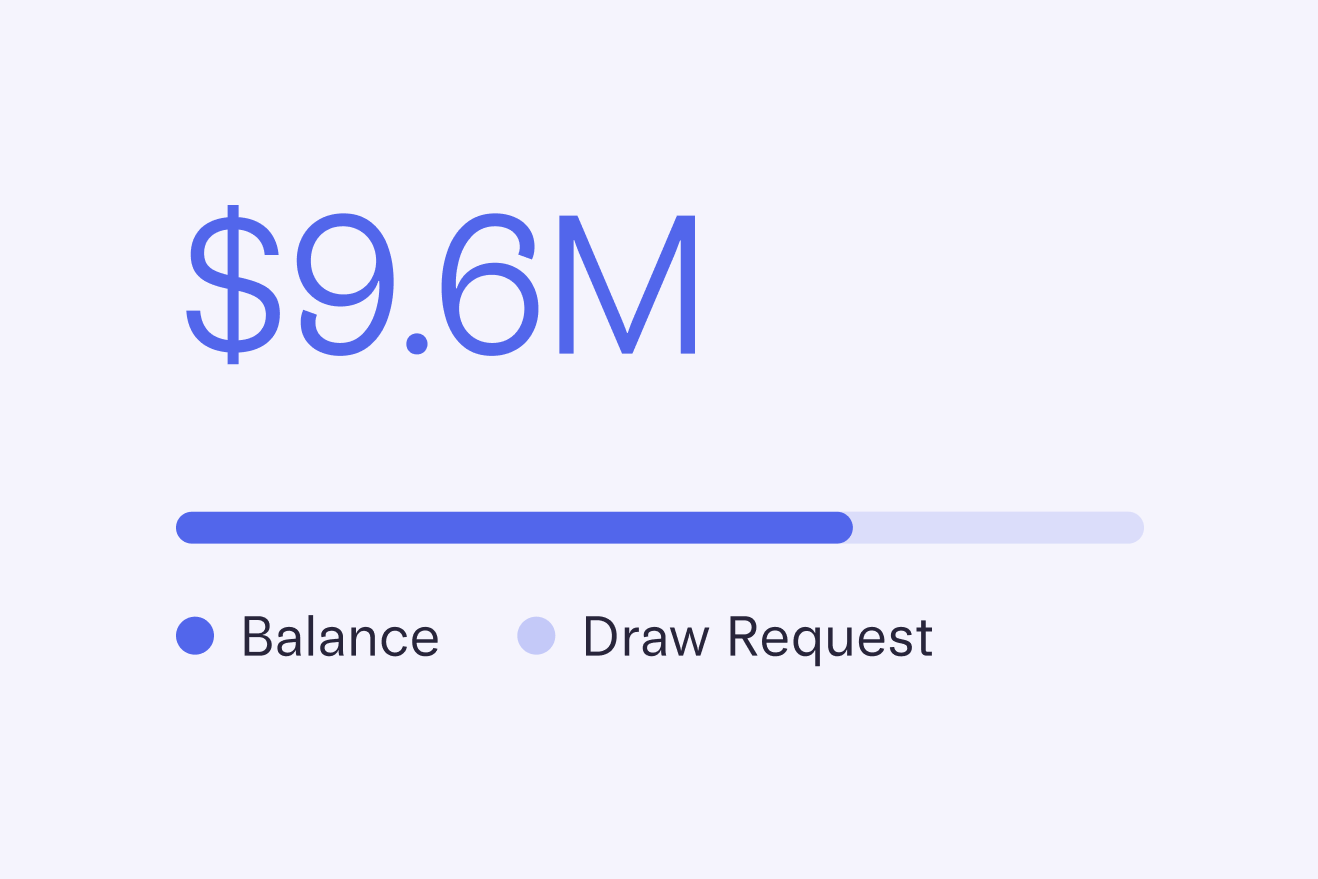

Easy to access, flexible to scale

Limits are based on your total balance in Mercury

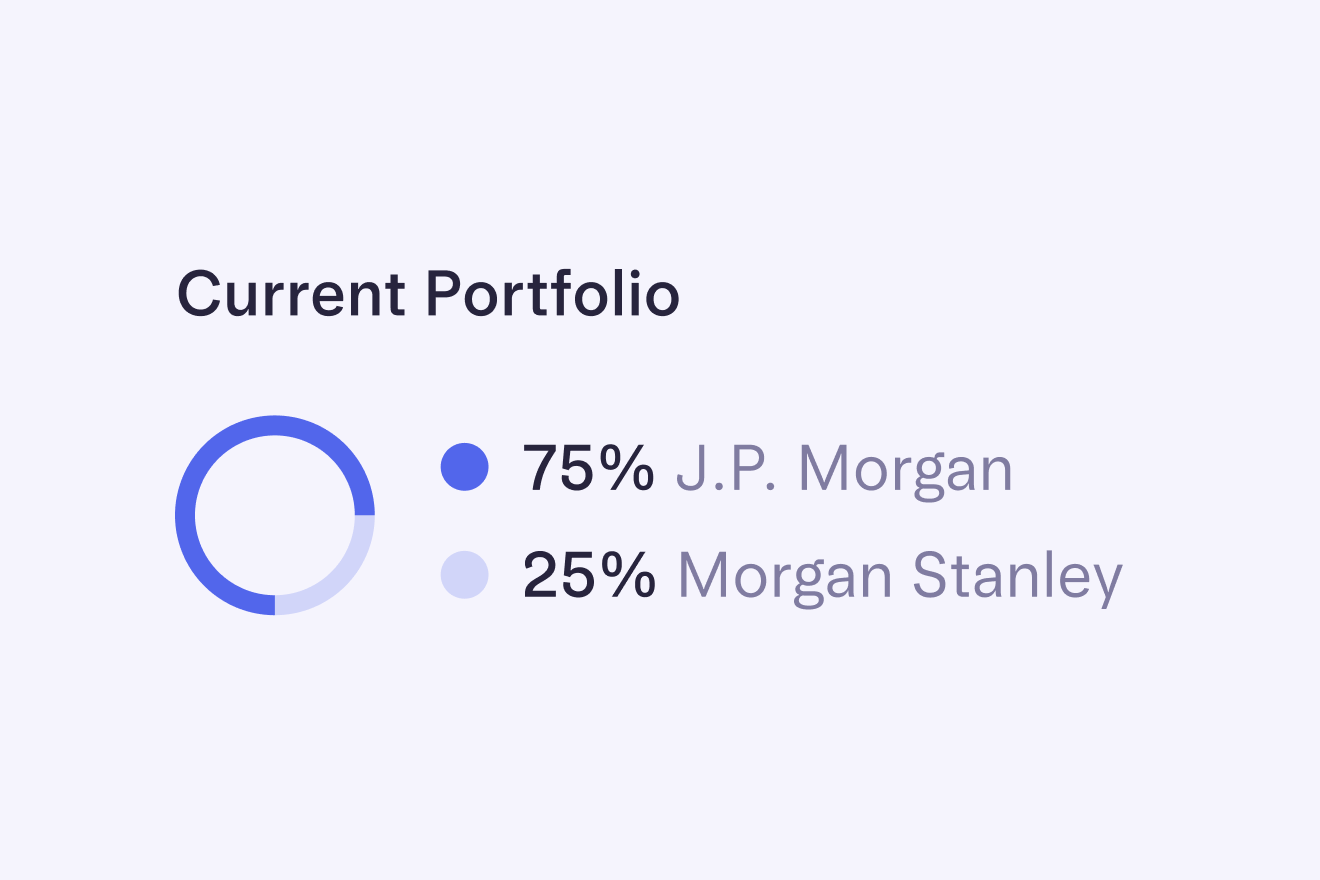

Get higher credit limits as you grow and connect external accounts for even higher limits

Start spending immediately with virtual cards

Get time back with built-in finance automations

Sync transactions to QuickBooks, Xero, and NetSuite

Automate categorization with accounting rules

Surface GL codes in Mercury for accurate categorization

There’s more to IO

- No interest or annual fees

- Mastercard Zero Liability and Fraud Protection

- Discounts on tools like Microsoft and Adobe

- Can help improve your business credit score

- Support when you need it