Mercury

$0 per month

Powerful banking and finance essentials included with every account.

Generate invoices with a personal touch in minutes

Customize your invoices with your company’s logo and preferred color scheme.

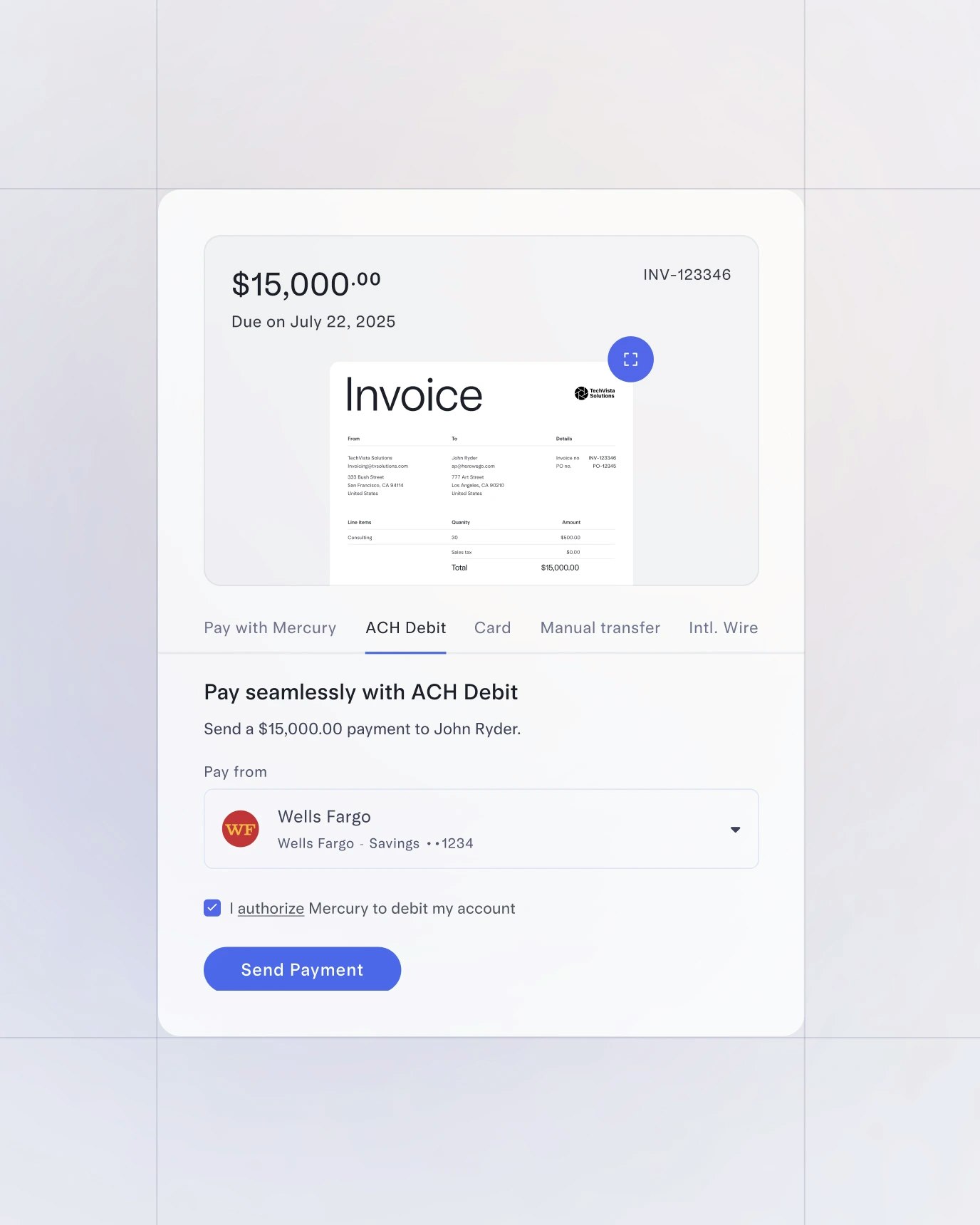

Receive payments the way you want

Give your customers the flexibility to pay by credit card, Apple Pay, Google Pay, wire, ACH transfer, or ACH debit for subscribers.

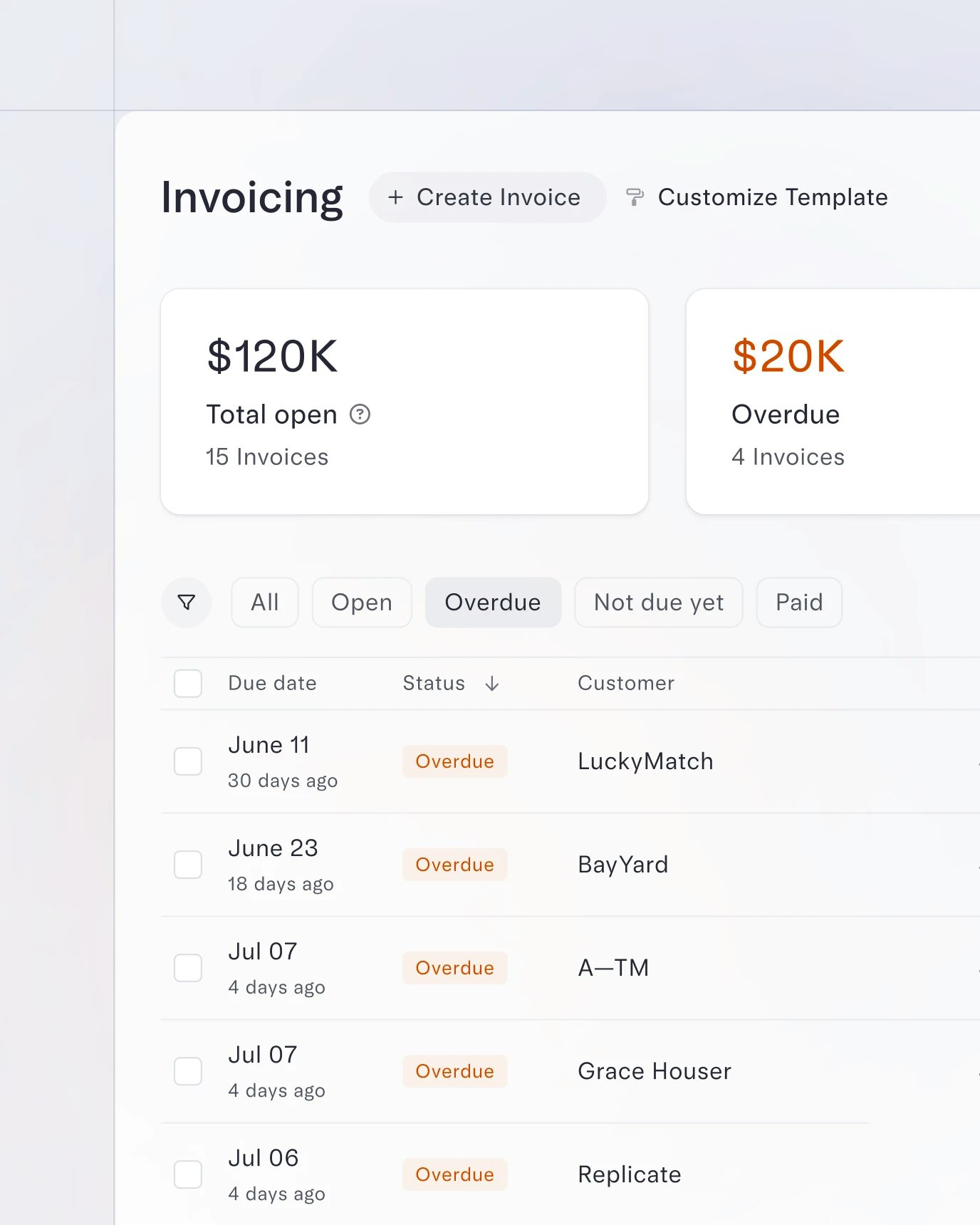

See the status of all your invoices at once

With a quick snapshot, you can view who owes you what, filter by status, and take action from there.

Power your revenue flow with our invoicing API

Create, send, and track invoices programmatically — so you can bill ten or ten thousand customers with clarity and control.

View API Docs

Reduce reconciliation time with invoicing and banking in one

Incoming payments are matched to the right invoices automatically, saving you time and brainpower.

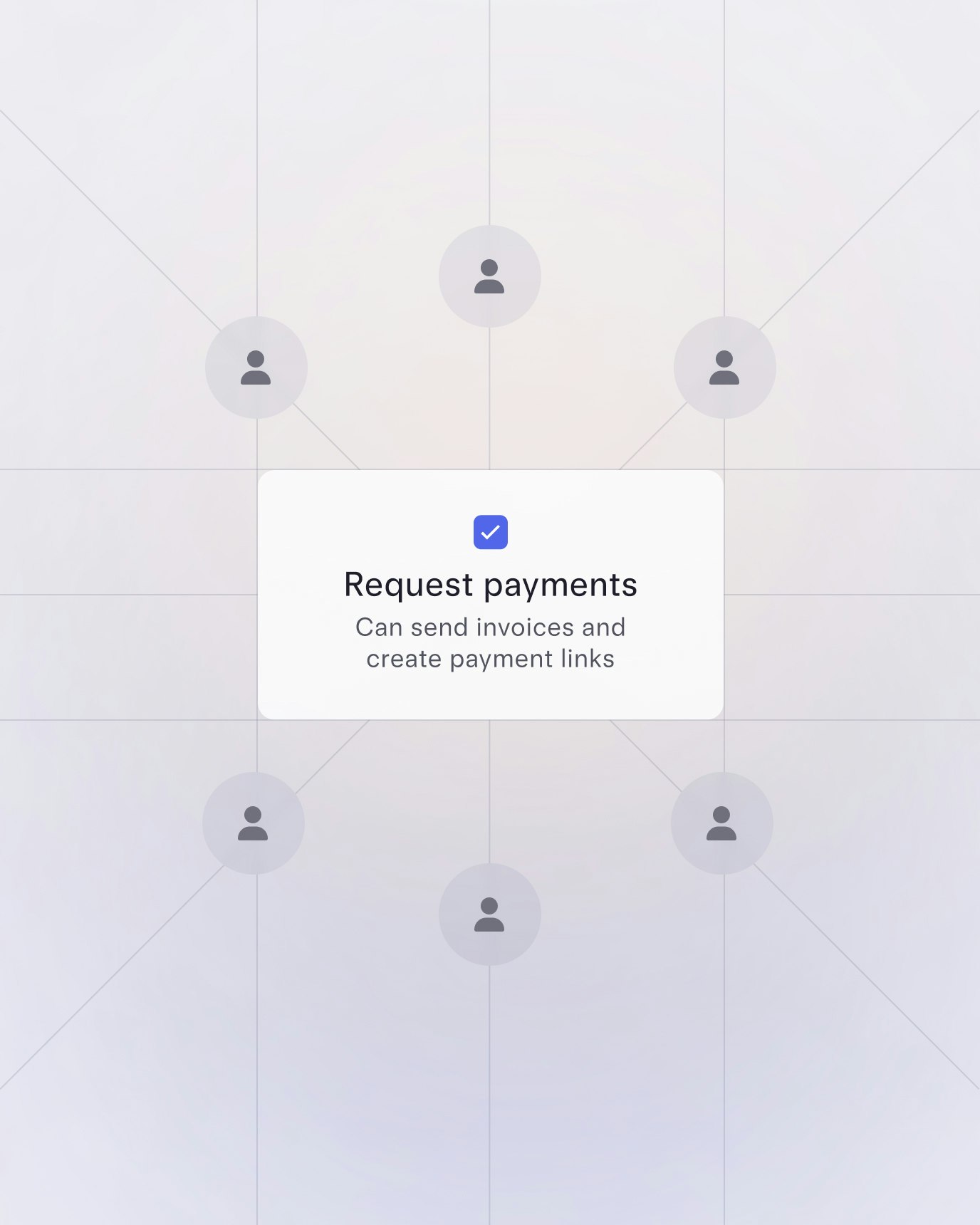

Empower your team with the right level of access

Grant special permissions to your finance team or bookkeepers and decide who has access to request payments.

Stay in sync with your accounting software

Automatically import all your invoice payments to QuickBooks, NetSuite, or Xero.

$0 per month

Powerful banking and finance essentials included with every account.

$29.90 per month

For businesses that need more efficiencies and streamlined invoicing.

Invoice with ACH debit ($1/transaction)

Recurring invoices

Invoicing API (500 invoices created/month)

Multiple GL codes for bill payments

Reimburse up to 20 users/month

+ $5/additional active user

Unlimited 1099 tax filings

$50 off eligible LegalZoom Compliance Plans

6 months free Xero

$299 per month

For businesses with complex operations that need a relationship manager.

Relationship manager

Invoice with ACH debit ($0/transaction)

Invoicing API (unlimited invoices created/mo)

NetSuite categorizations

Reimburse up to 250 active users

+ $5/additional active user

Unlimited 1099 tax filings

$50 off eligible LegalZoom Compliance Plans

6 months free Xero

It takes seconds to generate formal invoices, which I really appreciate. It's very easy and self-explanatory. Plus, it keeps everything organized – not only for us, but also for our clients.

Aizada Marat

Co-founder & CEO, Alma