No hidden or monthly fees. No minimums. So your business can thrive.

Businesses like yours love Mercury

Mercury takes the chaos out of company spending. We use different Mercury credit cards for different expense categories, and it’s never been easier to stay organized.

Myra Ahmad

CEO, Mochi Health

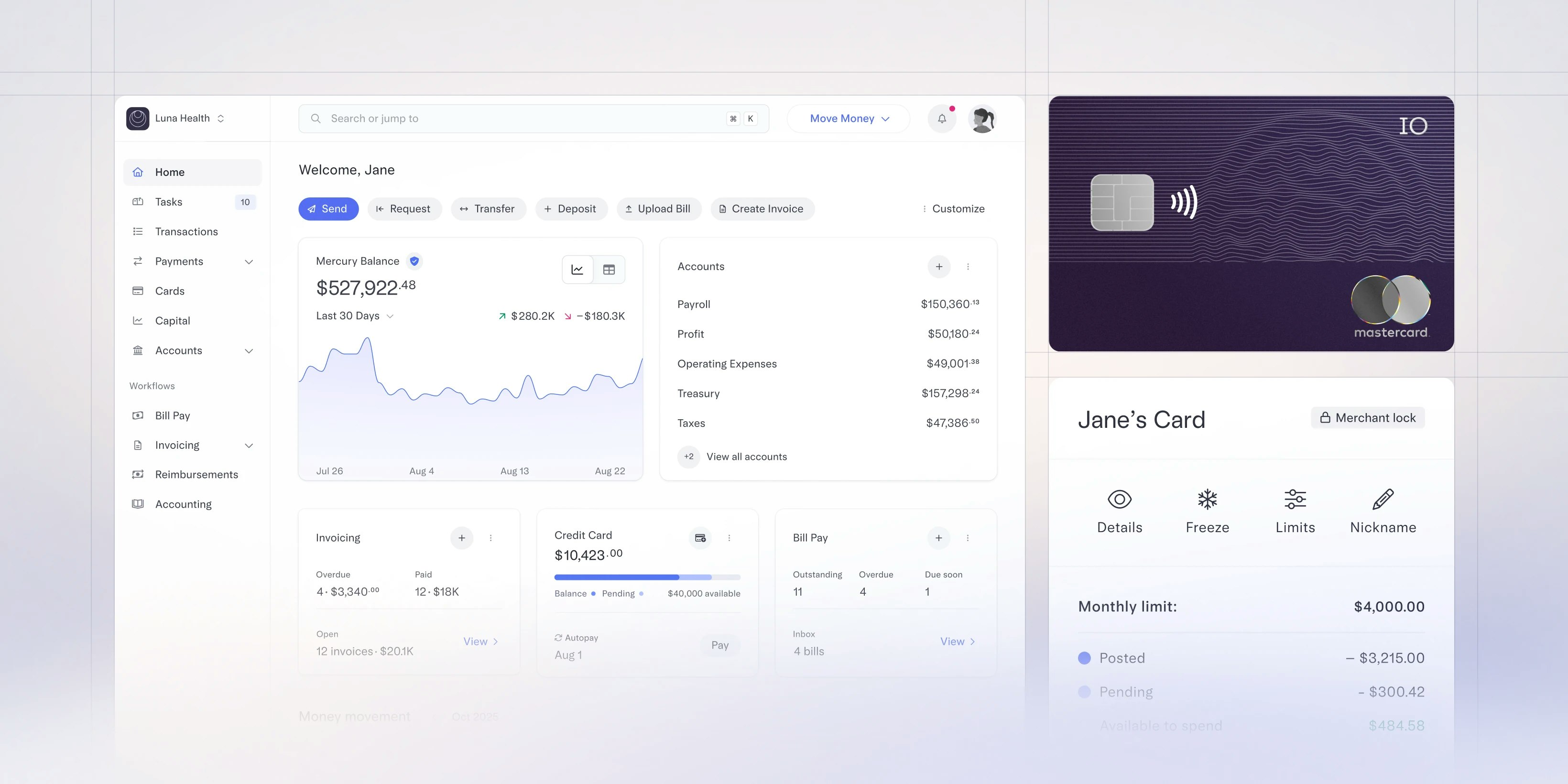

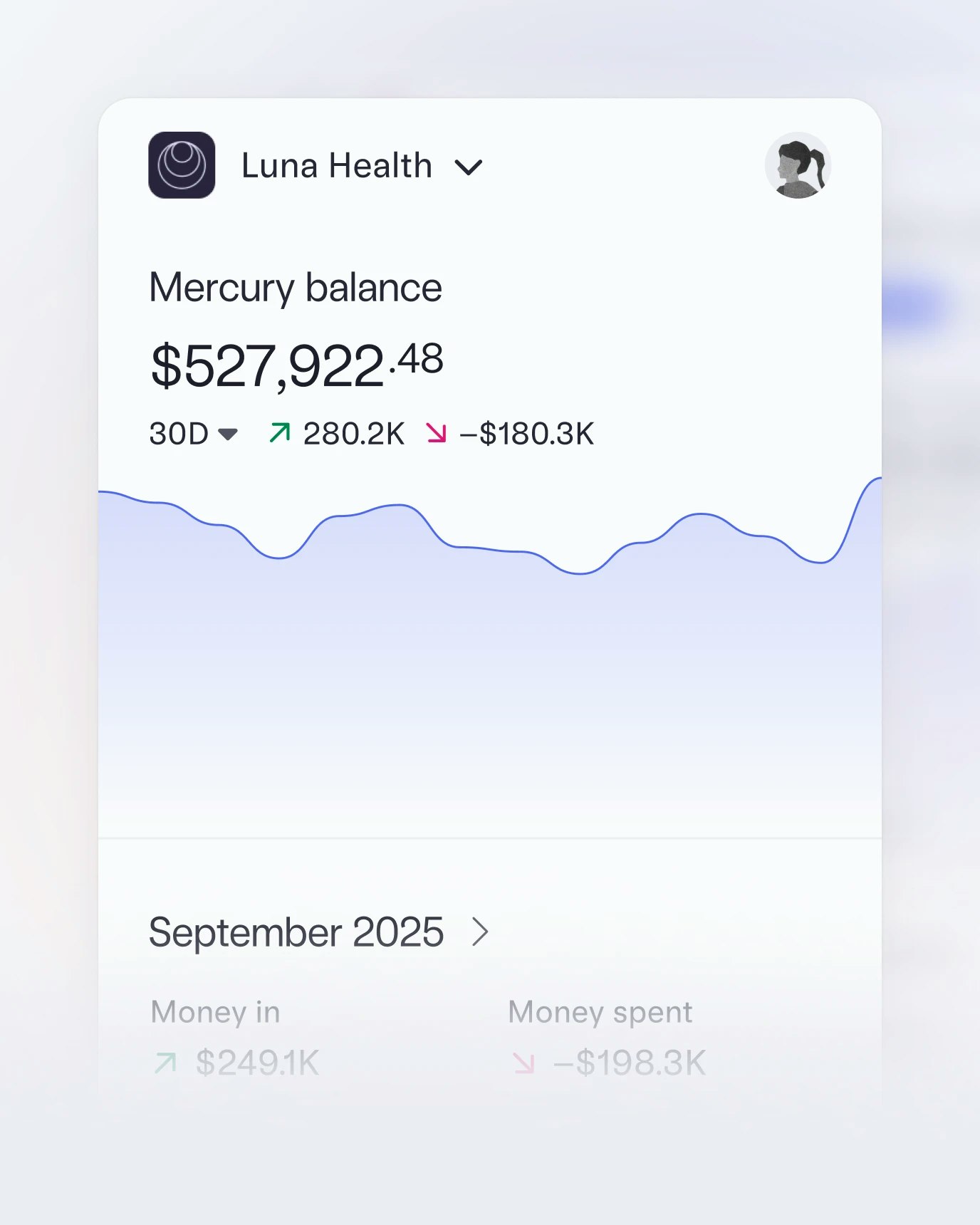

Get a holistic view of your finances from one easy-to-use dashboard

Access and manage your money from anywhere

Explore BankingApprove payments, issue cards, and check cashflow from your phone

Get real-time visibility into balances and transactions between sessions or visits

See large transactions, low balances, and approvals via our modern mobile app

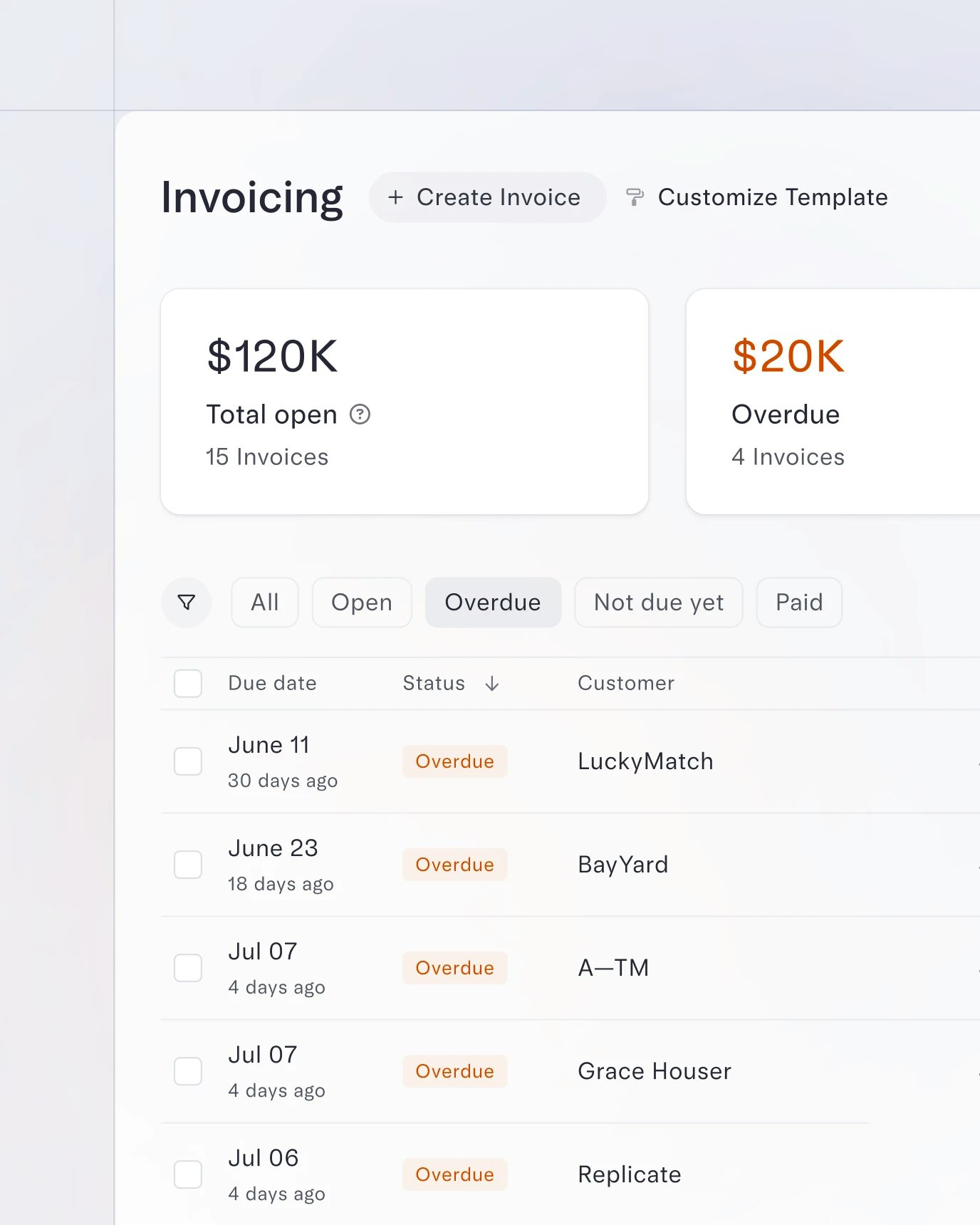

Invoice clients with ease

Explore InvoicingCreate and send polished, branded invoices right from your account

See payment status and send reminders for overdue payments in just a few clicks

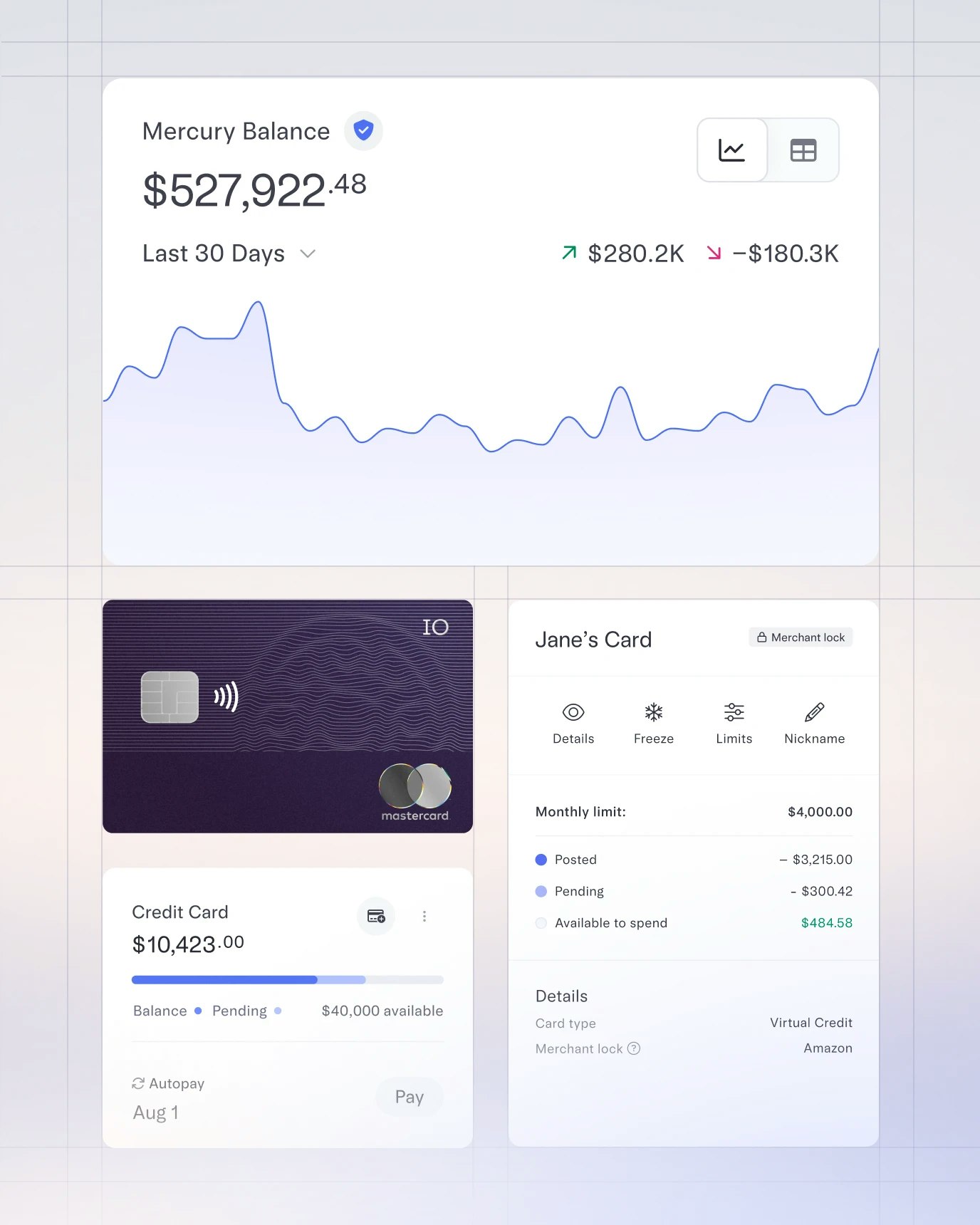

Build business credit and get 1.5% cashback on all credit spend

Explore CardsAccess corporate credit cards on day one for eligible customers

No personal guarantee or business credit history required

Create virtual cards for your team or certain merchants

Simplify operations so you can focus on client care

Explore Bill PaySeamlessly integrate with QuickBooks, Xero and NetSuite for easier accounting

Use Mercury Bill Pay for seamless management and record-keeping

Assign special access to office managers, bookkeepers, or business partners

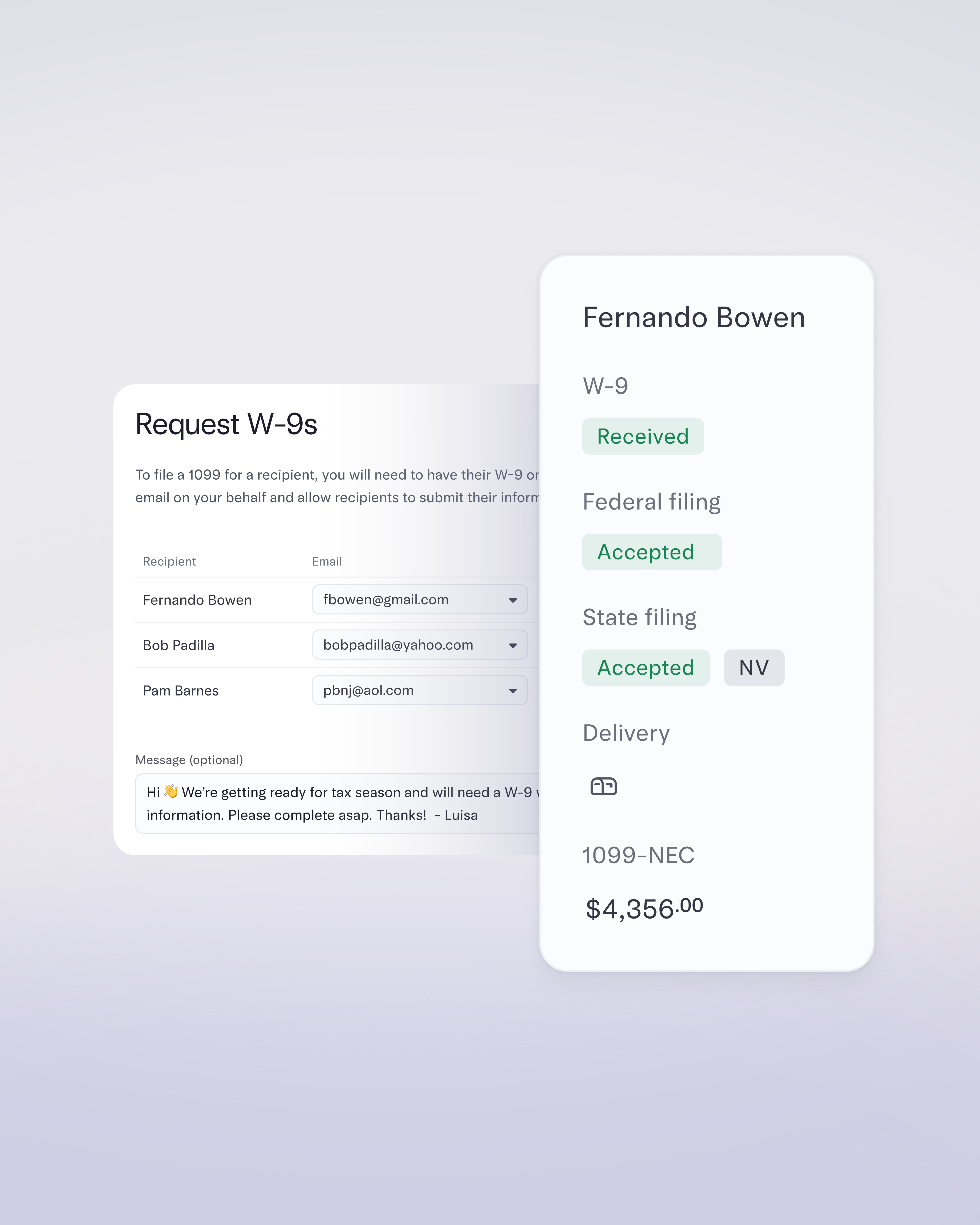

Collect W-9s and file federal and state 1099-NEC and MISCs — no exports or third-party tools required