What is a sweep network and how does it work?

An effective business bank account is one that ensures your money is safe while balancing that security with readily available cash funds and a smooth banking experience. In the case of Mercury, we’ve built our products to offer you the stability you’d expect from traditional banks, while sparing you from the familiar pain of unwieldy interfaces and hidden fees.

Naturally, there’s a lot of work that has to happen behind the scenes in order for a checking account to check all the right boxes. A sweep network is just one example of this system at play.

TL;DR: Sweep networks, explained

A sweep network spreads your deposits across multiple FDIC-insured banks to increase how much of your money is protected. Instead of being limited to $250K of insurance at one bank, your balance can be distributed across several program banks—each with its own FDIC coverage.

Key benefits

- Higher FDIC insurance coverage for large balances

- One primary account instead of managing many

- Automated, behind-the-scenes operation

Typical coverage range

From the standard $250K up to several million dollars, depending on the number of partner banks in the network.

What is a sweep network?

Sweep networks are a way for customer deposits to be spread across a network of banks. Sweep networks aren’t investment funds — funds held across the network are treated similarly to money in a typical bank account.

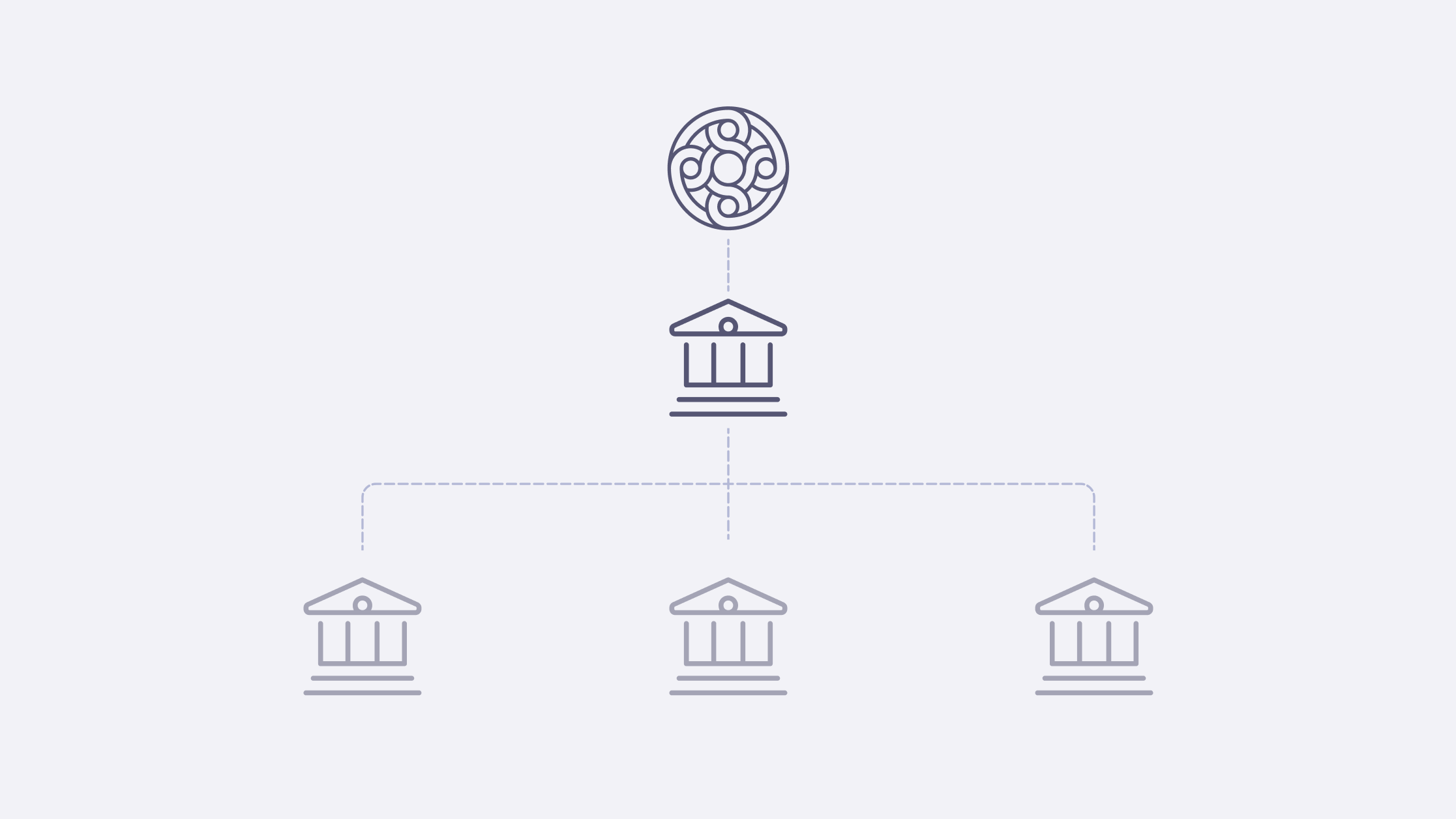

At Mercury, rather than holding deposits with a single banking partner, our partner banks’ sweep programs spread your deposits across a network of established FDIC-insured program banks.

Why do banks set up sweep networks?

Sweep networks are an effective way for banks to create additional value to their customers through increased FDIC insurance on deposits, while simultaneously solving for their own operational needs.

Essentially, sweep networks help balance cash flow between banks. Some banks have more deposits than they want to hold, while others want more to support lending, so the sweep network helps ensure that each institution has the cash it needs on hand at any given time.

At the same time, because the sweep network holds customer funds across different program bank accounts, it allows them to tap into additional FDIC insurance benefits beyond each account’s individual maximum coverage.

How does the sweep network increase insurance coverage on deposits?

One of the biggest benefits of a sweep network is that it can provide more FDIC insurance. The standard FDIC offering covers up to $250K in deposits for each client at a bank, regardless of the amount of money held in that account. However, startups deserve to have peace of mind that their operational cash and payroll funds are secured — and $250K insurance is simply not enough to guarantee that protection.

In order to get more insurance, you need to open more bank accounts. Sweep networks allow your bank to open those additional accounts on your behalf, so you can get that additional coverage without the headache of balancing multiple accounts yourself. Your bank will also do the legwork of negotiating with partner banks to increase the maximum coverage that you’re eligible for through relationships with program banks across the sweep network — the more program bank accounts you have access to through your bank’s agreement with a partner bank, the greater your maximum coverage will be.

For example, if you have $1M in deposits sitting in a single FDIC-insured account, that sum will generally only be insured up to the FDIC insurance maximum of $250K, which is only a quarter of your funds. However, a sweep network would allow your primary bank to spread that $1M across four accounts with different program banks — each of which insures your money up to $250K, raising your total insured cash amount to $1M, or 100% of your deposit.

How Mercury extends FDIC coverage

In the case of Mercury, we currently offer up to $5M in FDIC insurance through our partners Column N.A. and Choice Financial Group and their respective sweep networks. This works by spreading your deposits across multiple FDIC-insured partner banks, without requiring you to open or manage separate accounts yourself.

We are actively working to help customers maximize the protection of their funds through Mercury Vault.

For balances beyond sweep network coverage limits, businesses may also consider treasury solutions that focus on both protection and yield. While sweep networks are designed to maximize FDIC insurance on operational cash, treasury products can help larger balances earn interest while maintaining strong liquidity and risk controls.

Approach | Effort Complexity | LiquidityFDIC protection | Risk of errors |

|---|---|---|---|

Sweep network |

|

| Low |

Manual multi-bank strategy |

|

| High (manual mistakes possible) |

What are other benefits of a sweep network?

While accessing more insurance coverage is the primary advantage of using a sweep network, a subsequent benefit is that founders don’t have to juggle a handful of different banking relationships. Instead, you’re reaping the insurance benefits of multiple accounts while continuing to deal directly with a banking provider that you know and trust.

For example, to get $10M of insurance on deposits, you’d need to open and manage 40 bank accounts, and likely pay fees to transfer funds between those various accounts. A sweep program, however, takes that operational burden off your plate and saves your company time and money, while still getting the insurance benefit.

The sweep network also bakes redundancy into your business through account diversification. Because your funds are held across a network of trusted, FDIC-insured banks, you never have to worry about a single point of failure should an issue arise. You also continue to have access to all of your funds, even though they are held at multiple institutions.

How do you know that your bank uses a sweep network?

Before participating in a sweep network, your bank or banking provider will have you sign a disclosure agreement confirming your decision to opt into the network with your designated partner bank.

You will also see a list of the banks where your funds were FDIC insured on your monthly account statement. You can review Mercury’s sweep disclosure and our list of sweep partners at mercury.com/legal.

How does opting into a sweep network change the way you bank?

Rest assured — you can reap the rewards of a sweep network without making changes to your regular banking routine. Your primary bank or banking provider will remain your main point of contact, and you’ll still be able to conduct business as usual with every dollar in your account, regardless of where those dollars are held. The sweep network also doesn’t impact how quickly you can transact or withdraw money from your account.

Sweeps typically occur automatically on a regular schedule, often daily, based on your account balance. Excess funds above a certain threshold are allocated across partner banks in the network, while your primary account continues to show a single balance.

From your perspective, you still see and use one account. Payments, transfers, and withdrawals work the same way because your primary bank manages the movement of funds behind the scenes. Liquidity is maintained by keeping enough funds readily available for normal activity, while the rest are distributed across partner banks for insurance coverage.

In the case of Mercury, regardless of whether you opt in or out of the sweep program, your account functionality, features, and fees will remain the same, and your funds will continue to be held at FDIC-insured partner banks. The main difference will be the maximum insurance that your funds are eligible for.

Are there risks associated with the sweep network?

For the most part, the role of the sweep network is to help alleviate risk for businesses rather than create more of it. By allowing customers to increase the FDIC insurance on large deposits, the sweep program model helps ensure that as much of your funds are protected as possible.

Even in the event of a bank failure, a sweep network can further protect customers’ funds by spreading their funds across multiple FDIC-insured banks. Ultimately, the failure of a single bank wouldn’t impact the funds held at those other banks across the network, so customers would be able to recover most if not all of their funds. Though there could be some delay due to FDIC intervention in such an event, customers would be able to recover all of their funds from the banks that haven’t failed, even in excess of FDIC insurance limits.

In rare cases, temporary delays can occur due to processing issues, technology outages, or regulatory intervention during a bank failure. While sweep networks are designed to reduce overall risk by diversifying deposits, these edge cases may slow access to a portion of funds until systems or regulators complete their work. For most customers, this trade-off is offset by significantly greater insurance protection and reduced exposure to any single institution.

Sweep network FAQs

How much money can be insured through a sweep network?

Coverage depends on how many partner banks participate in the network. Each bank provides up to $250K in FDIC insurance, so total coverage increases as funds are spread across more institutions.

Do I need to manage multiple bank accounts in a sweep network?

No. Your primary bank manages the distribution for you. You interact with one account and one interface.

What happens if a partner bank in a sweep network fails?

Funds held at that bank are protected by FDIC insurance up to the applicable limit. Deposits held at other partner banks remain unaffected.

How quickly can I access funds in a sweep network during emergencies?

In normal conditions, access is immediate. During rare disruptions or regulatory actions, a portion of funds may be temporarily unavailable while processing or insurance claims are completed.

Can I opt out of a sweep network with Mercury?

Yes. Customers can choose whether to participate in the sweep program, subject to Mercury’s product terms.

Is Mercury’s sweep network the same as a money market fund?

No. Sweep networks keep funds in FDIC-insured bank accounts. Money market funds are investment products and are not FDIC insured.

What’s the difference between a sweep network and CDARS?

Both distribute deposits across multiple banks to increase FDIC coverage. CDARS is typically offered directly by traditional banks, while sweep networks are often used by fintechs and partner-bank platforms to achieve similar protection through automated programs.

At Mercury, our goal is always to provide a trusted banking experience that exceeds customer expectations — and that includes doing everything we can behind the scenes to protect your funds, engage with trusted partners, and pass on meaningful benefits for your business through those partnerships.

Not sure if Mercury is right for your business? Give our demo a spin to see it in action.