Everything you need for smooth banking

Free wires

Transparent pricing

Seamless payments

Custom approvals

Get back to building with streamlined banking and financial operations

Fast online application and onboarding

Start spending immediately with virtual cards

Complete any banking task in just a few clicks

Bank on-the-go with an intuitive mobile app

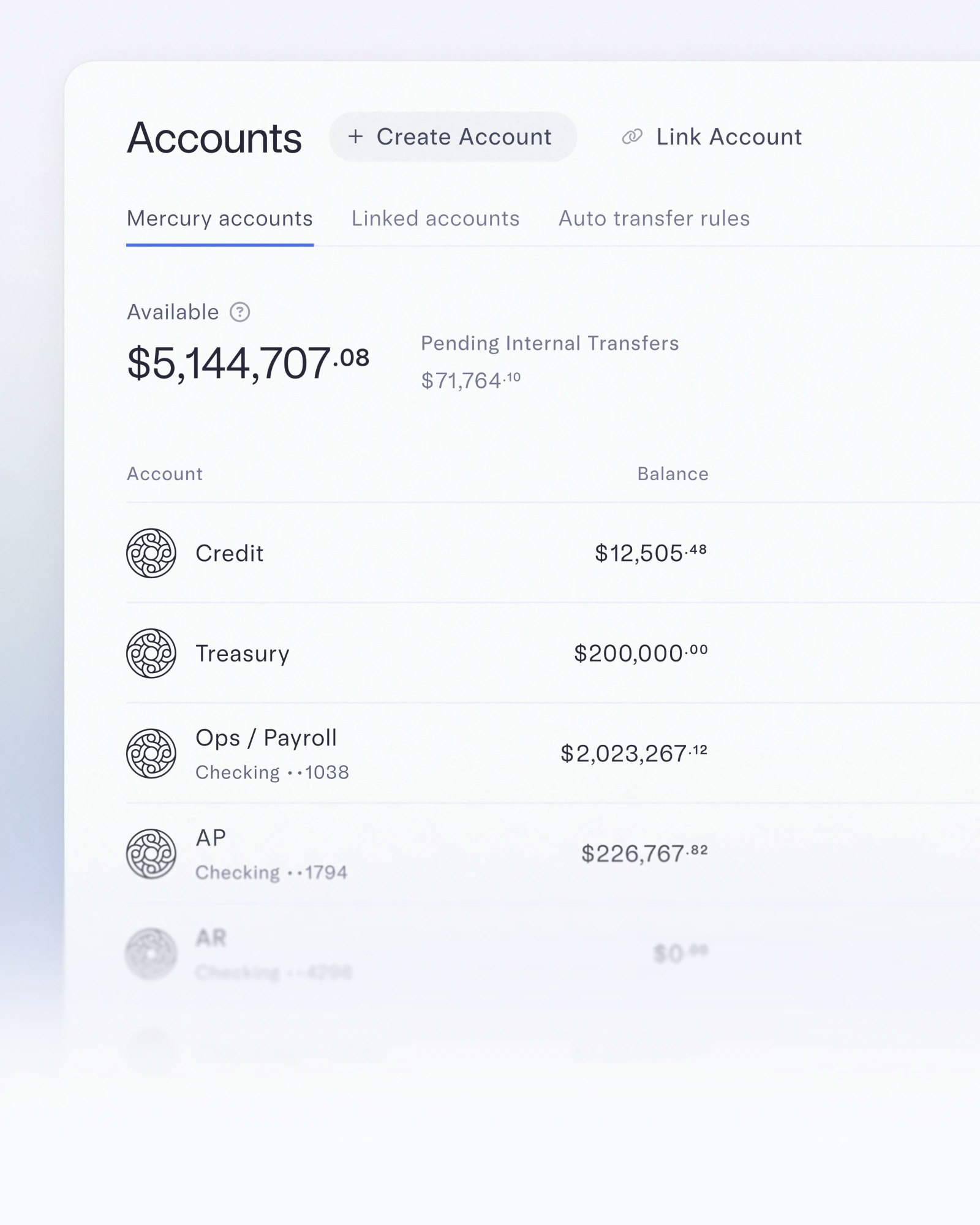

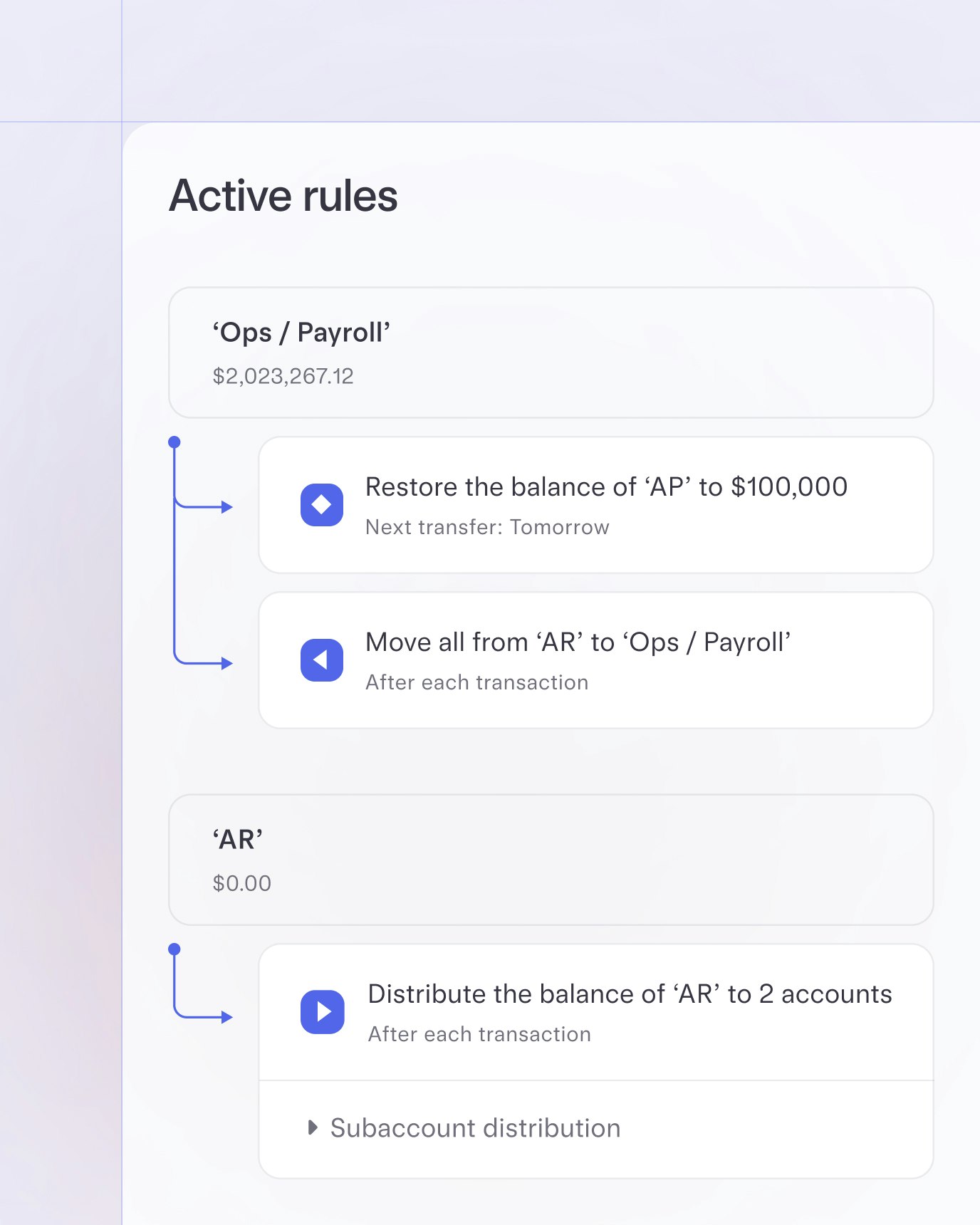

Set your finances on auto-pilot

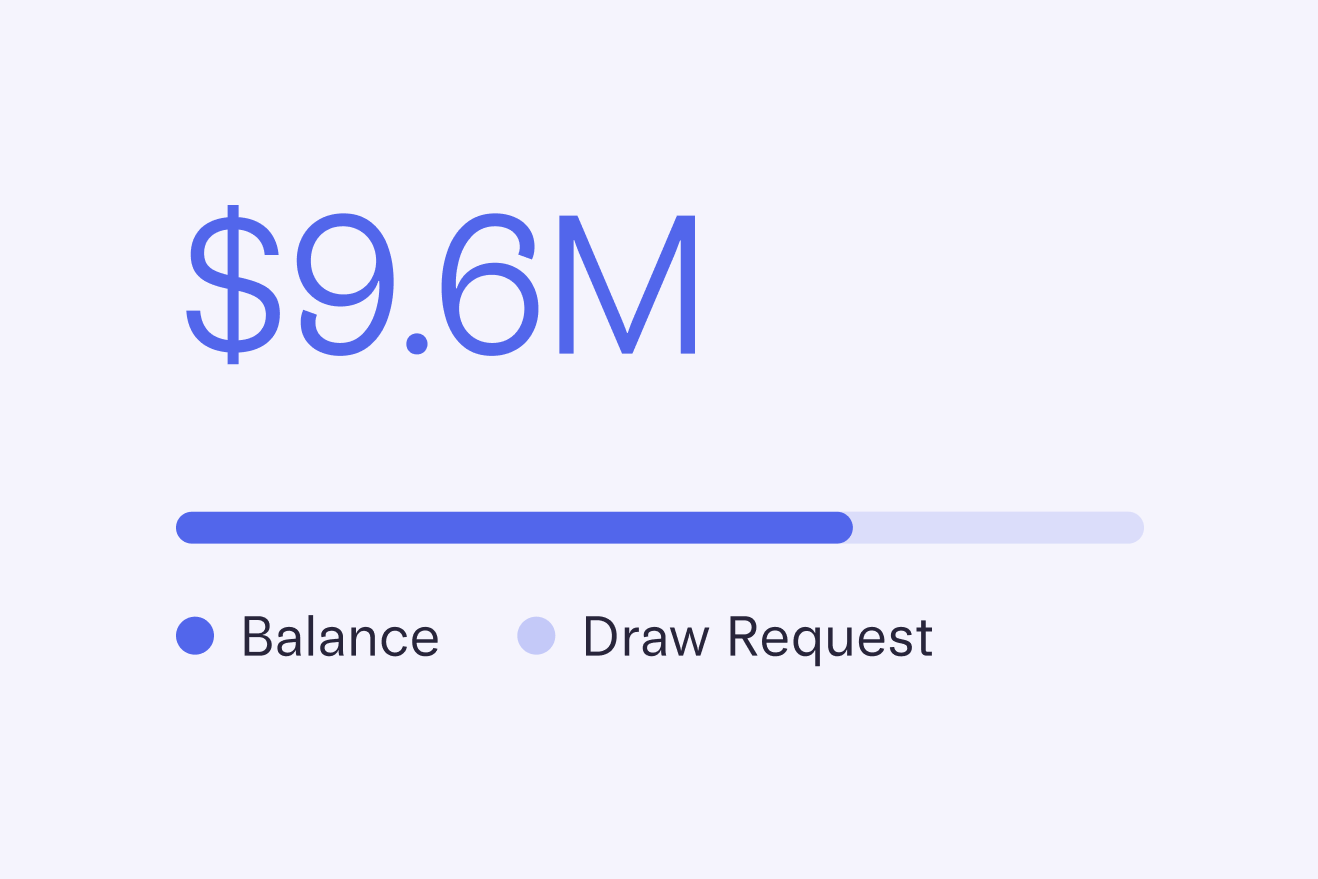

Create auto-transfer rules between your accounts

Approve payments instantly via Slack

Close the books quickly and accurately with Xero and QuickBooks integrations

Automate payroll with easy wire drawdowns

Control spend effortlessly with advanced rules

Create user-level permissions so that employees and bookkeepers only access the accounts they need

Set approval rules for large purchases and specify who can make payments without approval

Manage team spend with customizable & flexible card limits

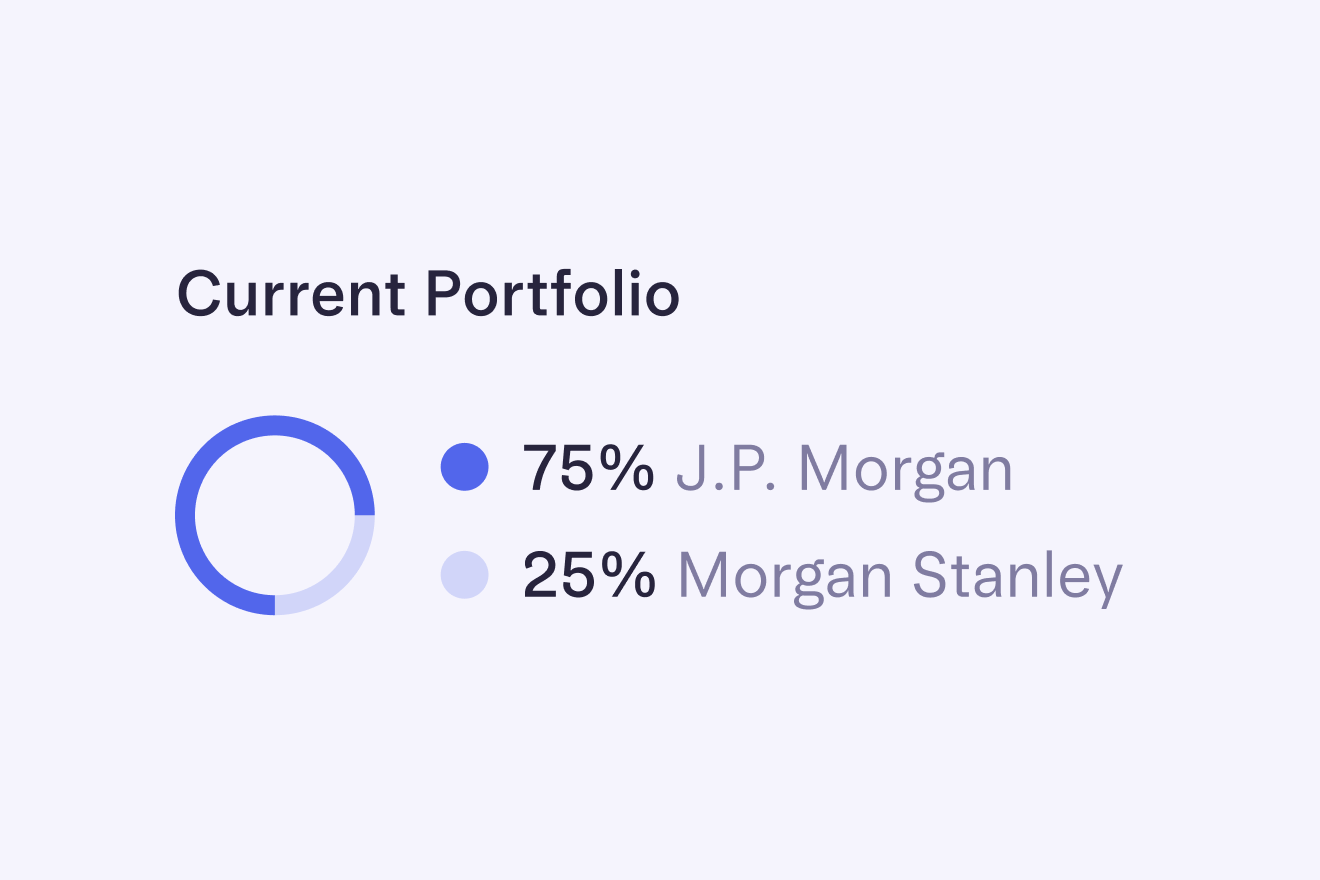

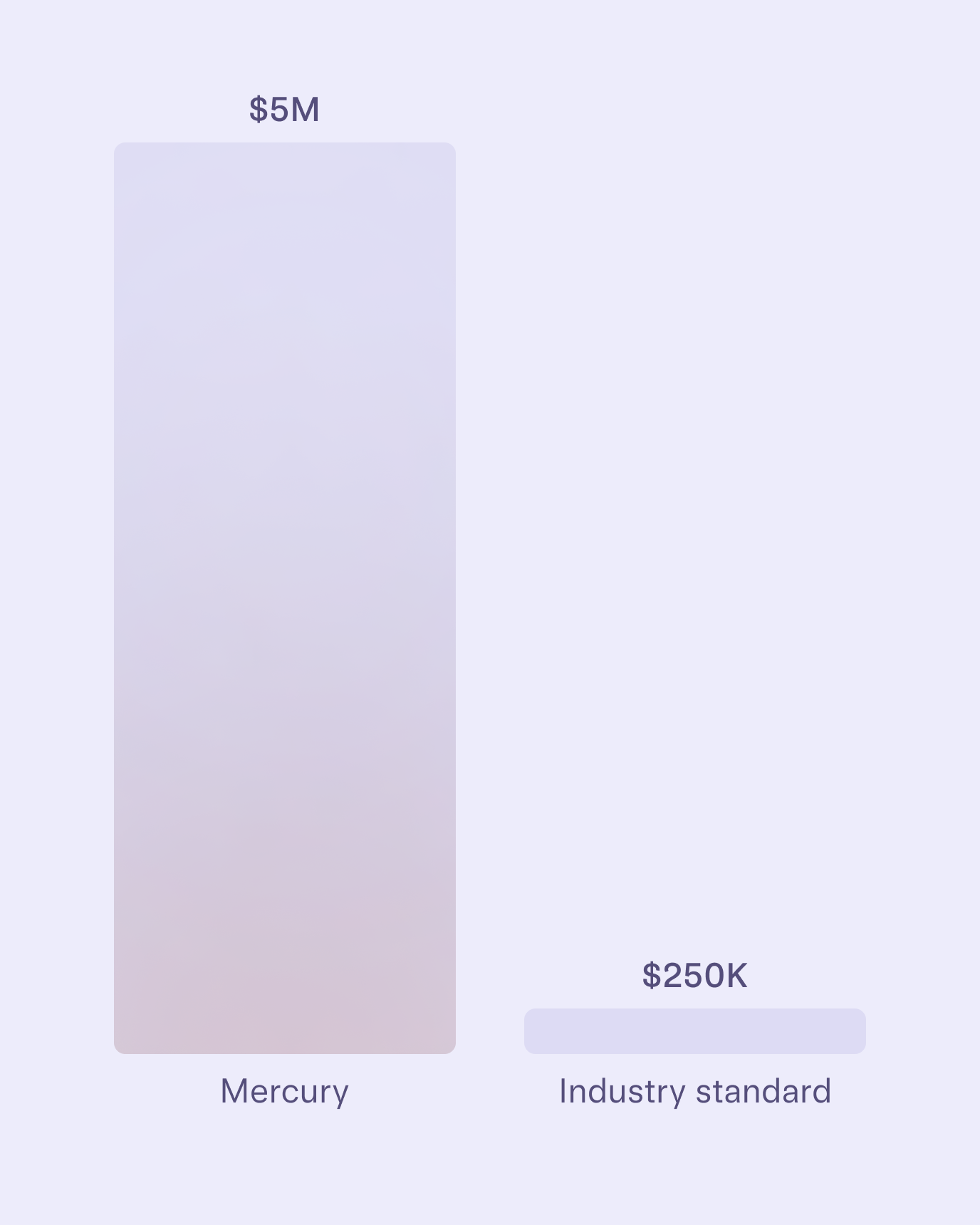

Store your funds with complete confidence

Learn More

Send and receive money seamlessly

Access an entire financial platform powered by your Mercury account

Transparent pricing

The [Mercury] application process was easy and fast. It felt straightforward and nonsense-free. I didn’t feel that I had to be on the lookout for sneaky fees.

Jake Stein

Co-founder & CEO, Common Paper