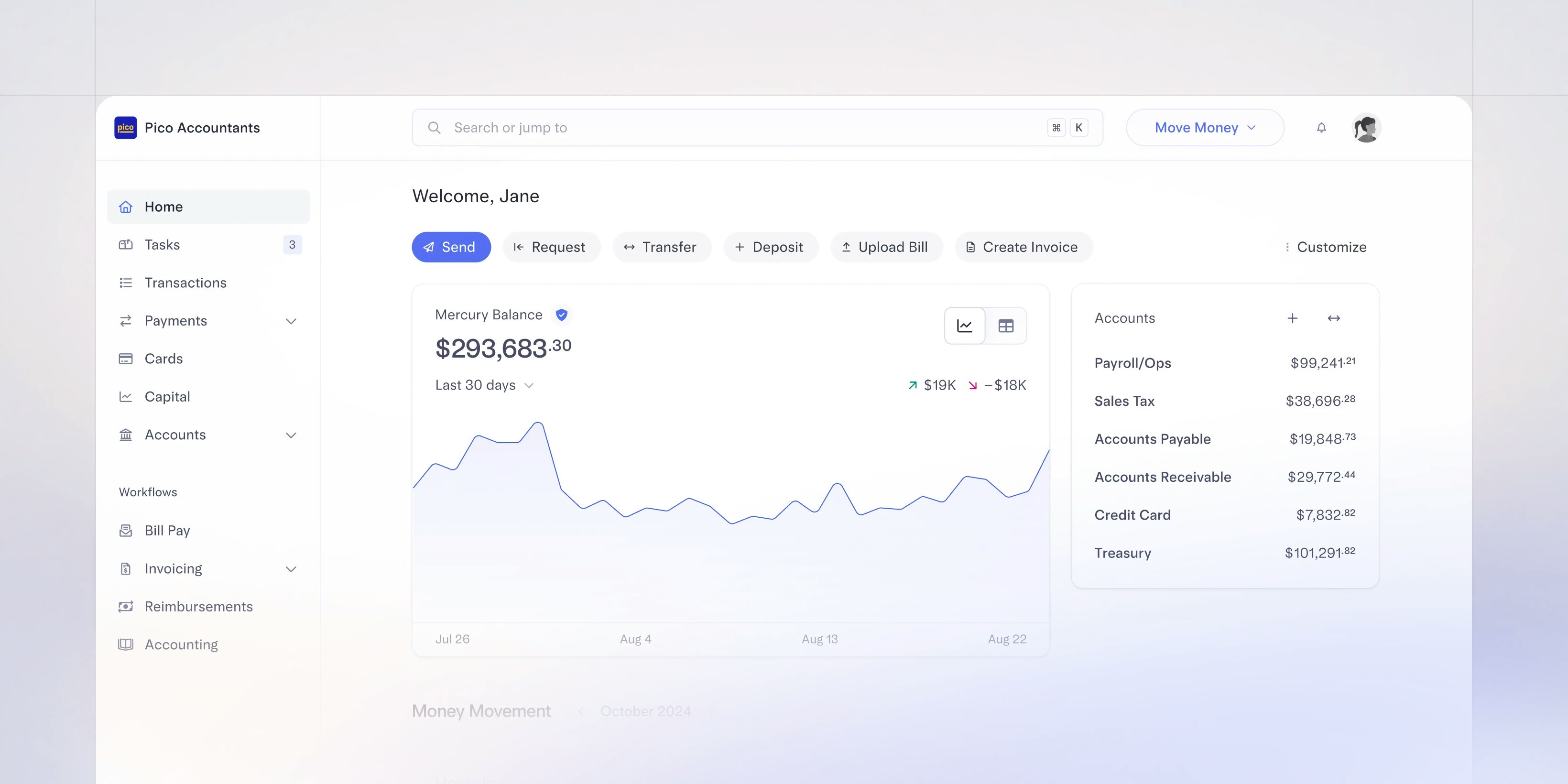

Everything you need to run your firm’s finances in the same place

Powerful banking that’s extraordinary to use

Explore BankingApply in 10 minutes and open an account with no minimum or maintenance fees

Free ACH debit and free domestic and international wires in USD

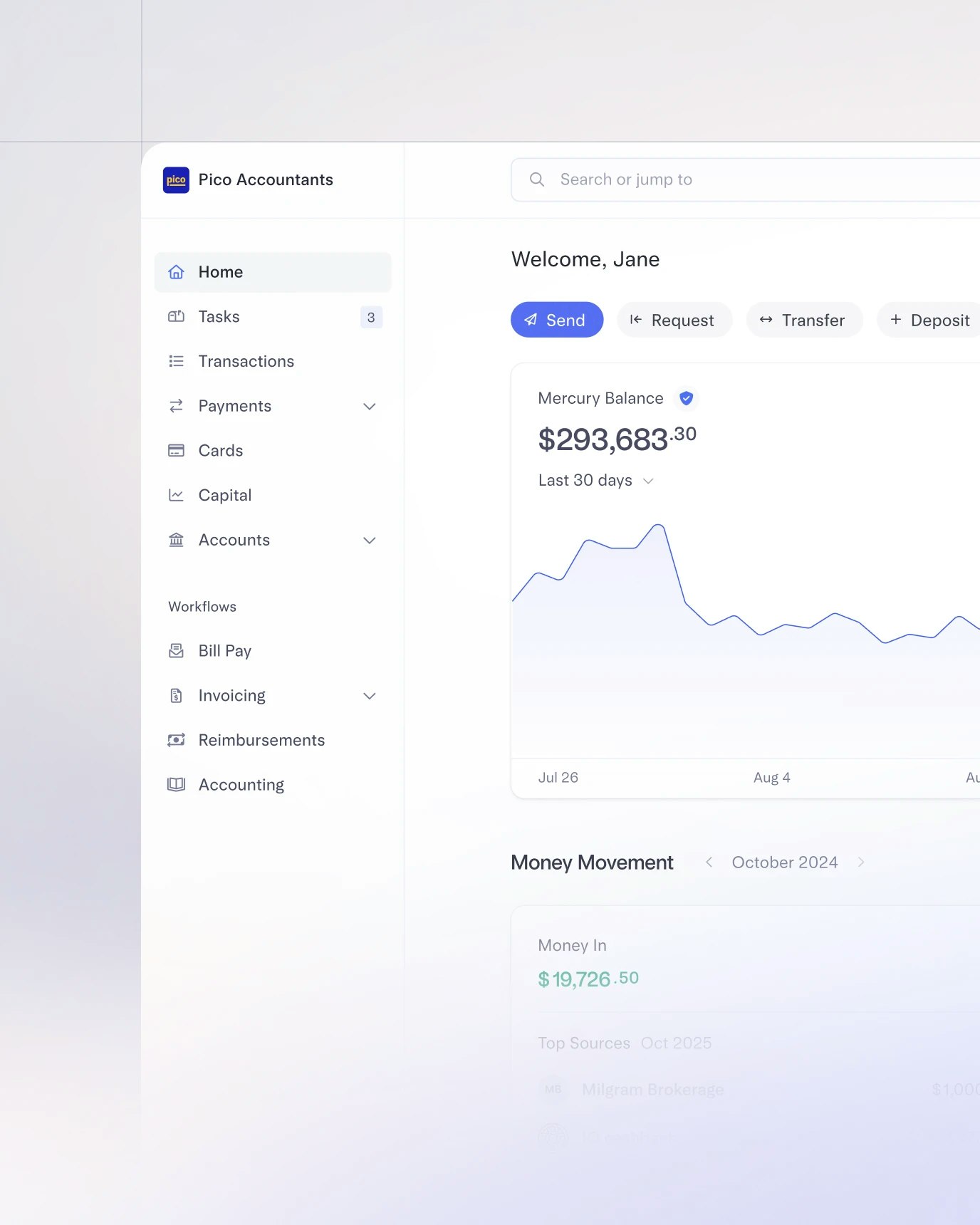

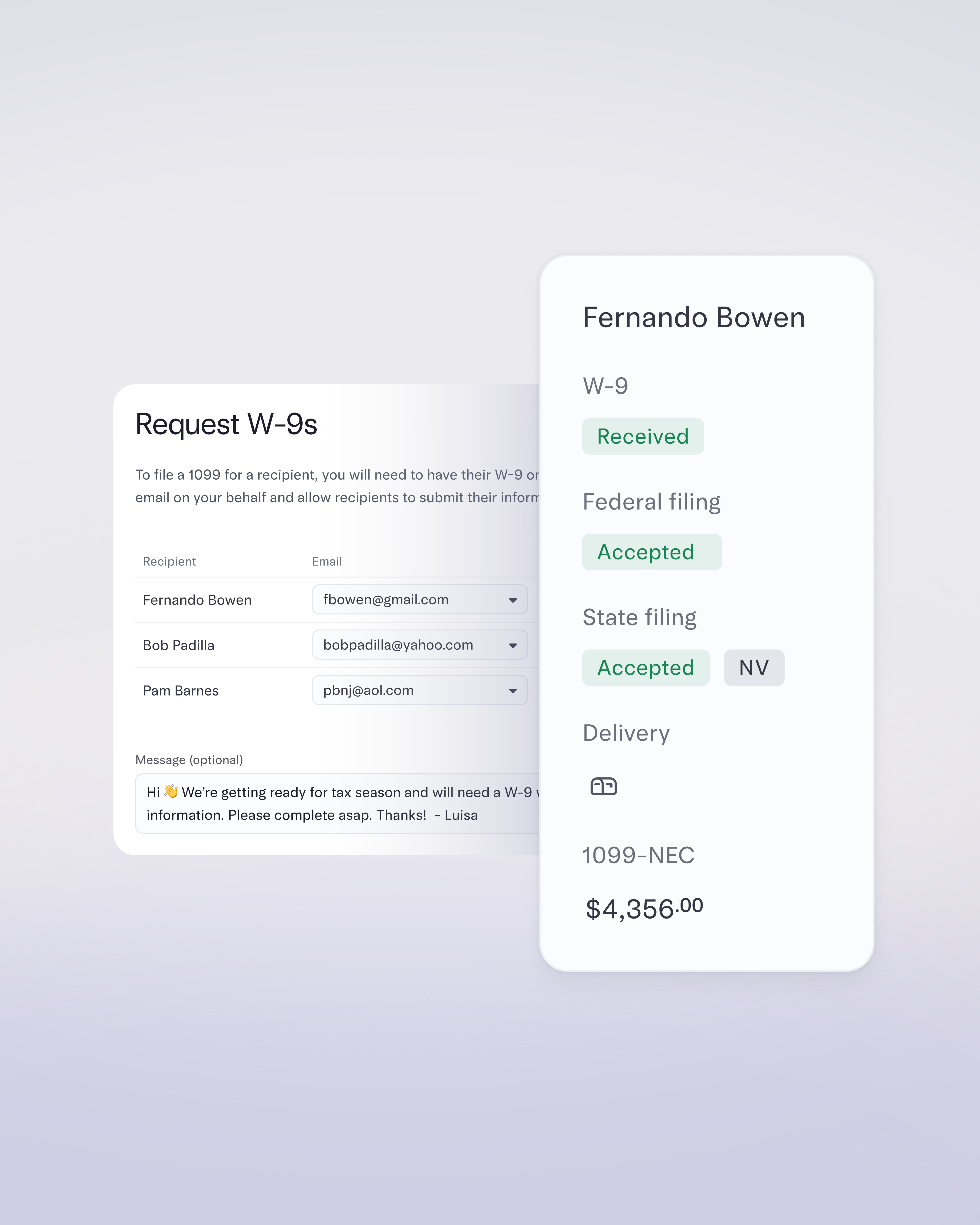

Minimize busy work and focus on high-value services

Explore Financial WorkflowStreamline invoicing to reduce reconciliation time with a better back office

Pay bills right from your bank account

Automate payroll with easy wire drawdowns

Categorize and sync your data in a click

1 / 3

Mercury for Accountants Partner

Working with clients’ banks used to slow accountants down. Being a partner with Mercury for Accountants changes everything. Its efficiencies make it a preferred choice for accountants and their clients.

Kenji Kuramoto

Founder, Acuity

Become a referral partner

Bring the power of Mercury to your clients and unlock special perks.

Perks and tools that put you ahead

Frequently asked questions

Join 300K+ startups and small businesses on Mercury

Apply in 10 minutes — no minimums required.