$0 monthly fees. $0 minimums. $0 USD wires. So your business can do more.

Businesses like yours love Mercury

We love Mercury’s interface. Built-in permissions means our accountant can easily make payments — literally one click and it’s done.

Karen Halstead

Founder, Ways & Means

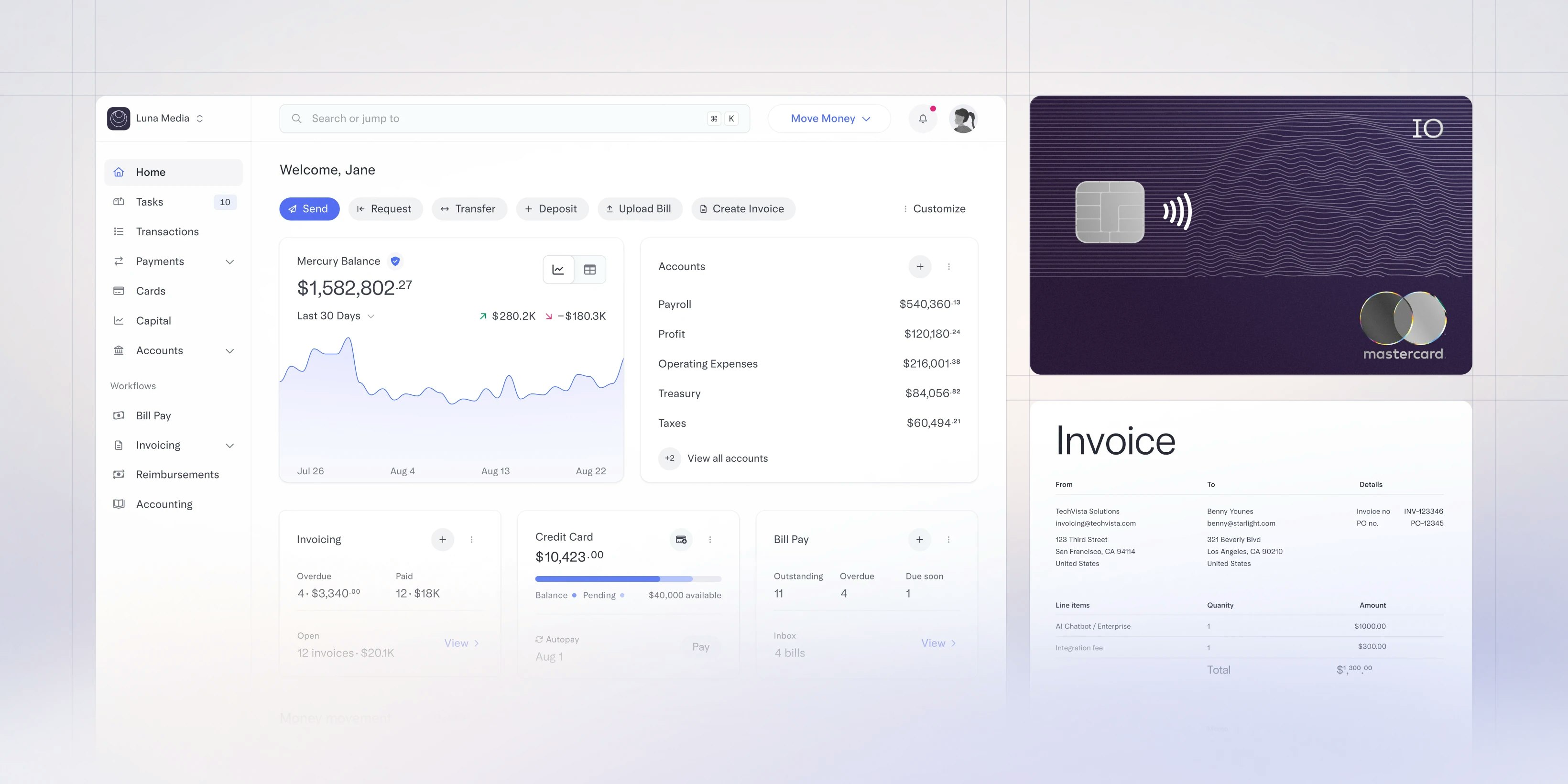

One powerful, intuitive account

Access and automate your finances from anywhere

Explore BankingSeamlessly integrate with QuickBooks, Xero and NetSuite

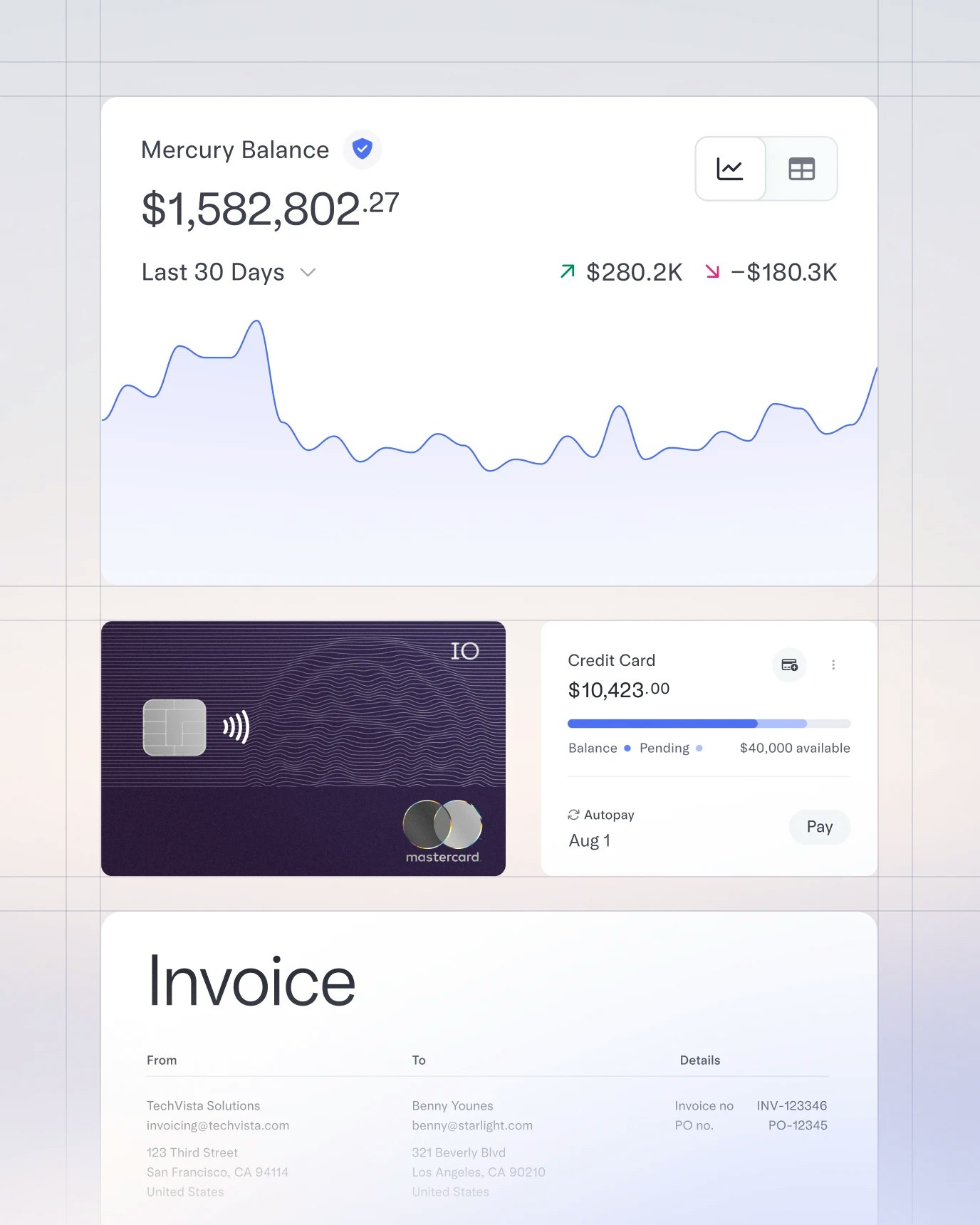

Prioritize profit by using multiple accounts to split income and allocate funds

Monitor and move your money on the go with a modern mobile app

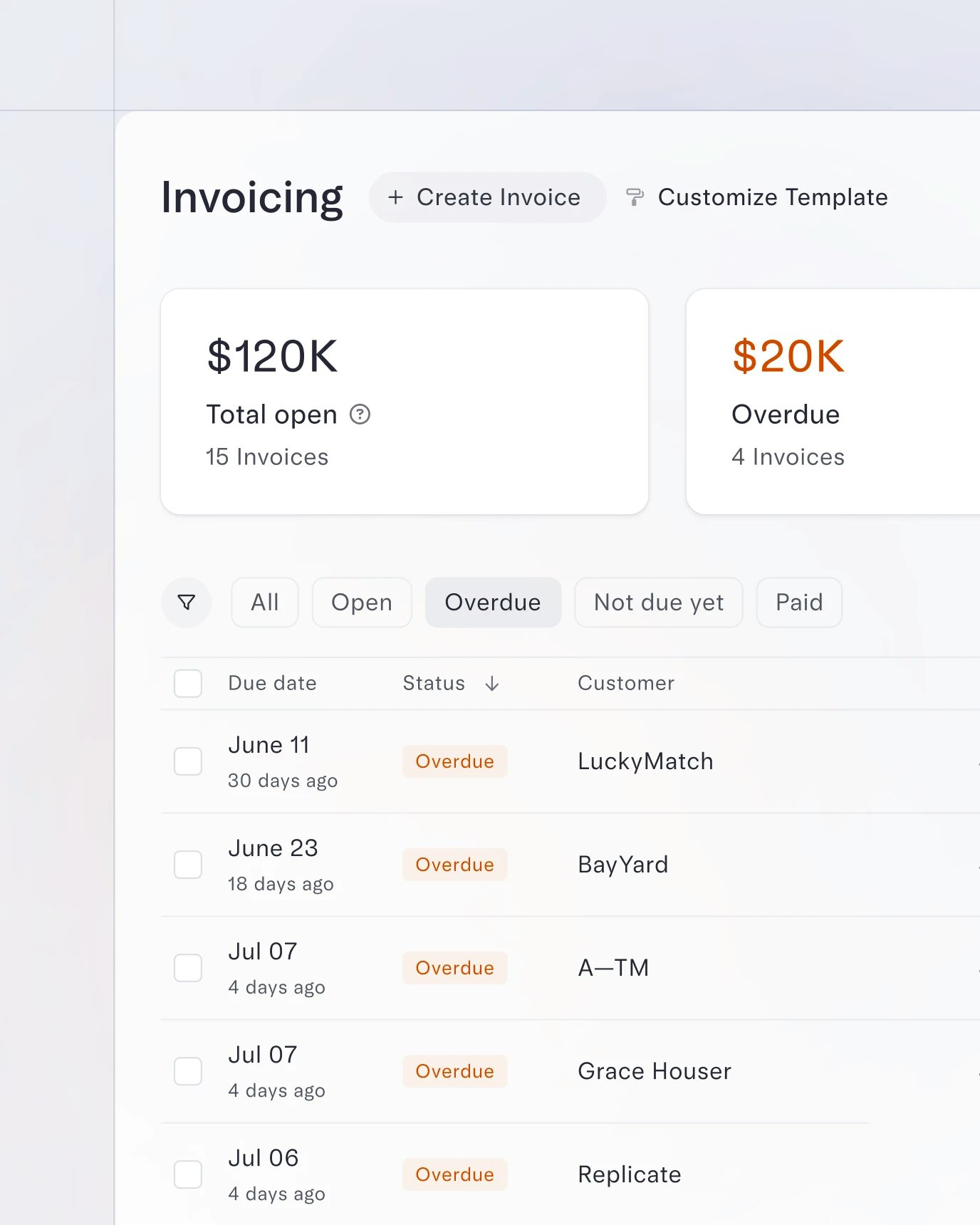

Invoice your customers the way you want

Explore InvoicingSimplify reconciliation with automatically matched payments and invoices

Build business credit and get 1.5% cashback on all credit spend

Explore CardsAccess corporate credit cards on day one for eligible customers

No personal guarantee or business credit history required

Create virtual cards for your team or certain merchants

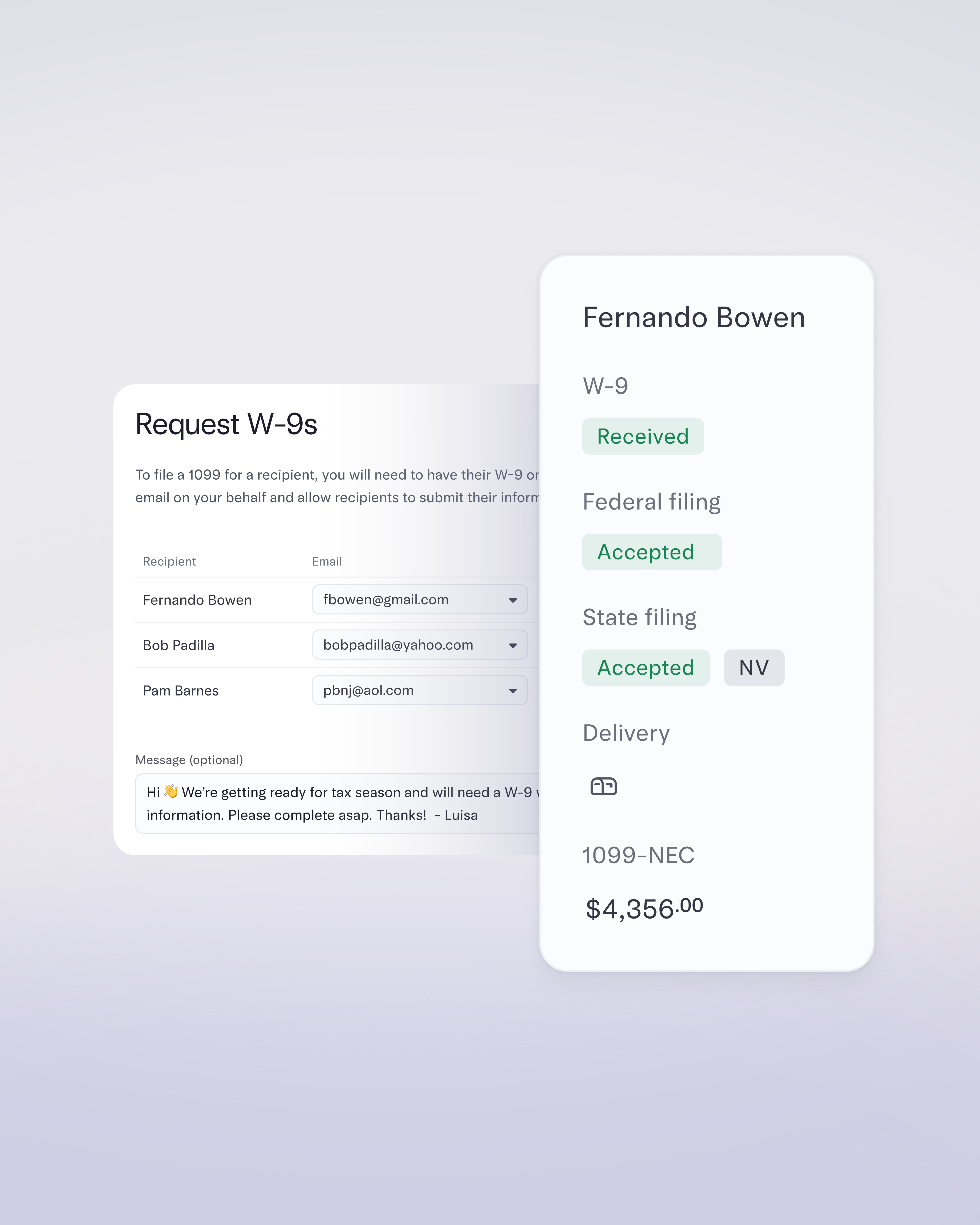

Simplify contractor payments and 1099 filing

Explore Bill PayManage all your bills with Mercury Bill Pay for seamless management and record-keeping

Collect W-9s and prefill forms with AI data extraction

File federal and state 1099-NEC and MISCs for 2025 tax season

Grant your bookkeeper or accountant special access