Designed for scaling companies

First-class terms

We offer straightforward payback plans, minimal dilution, and competitive interest rates.

For the long run

We’re here through it all. We can chat about refreshing your loan with your next VC round.

Sector-agnostic

Lending for VC-funded companies across stages and industries.

See if you're eligible

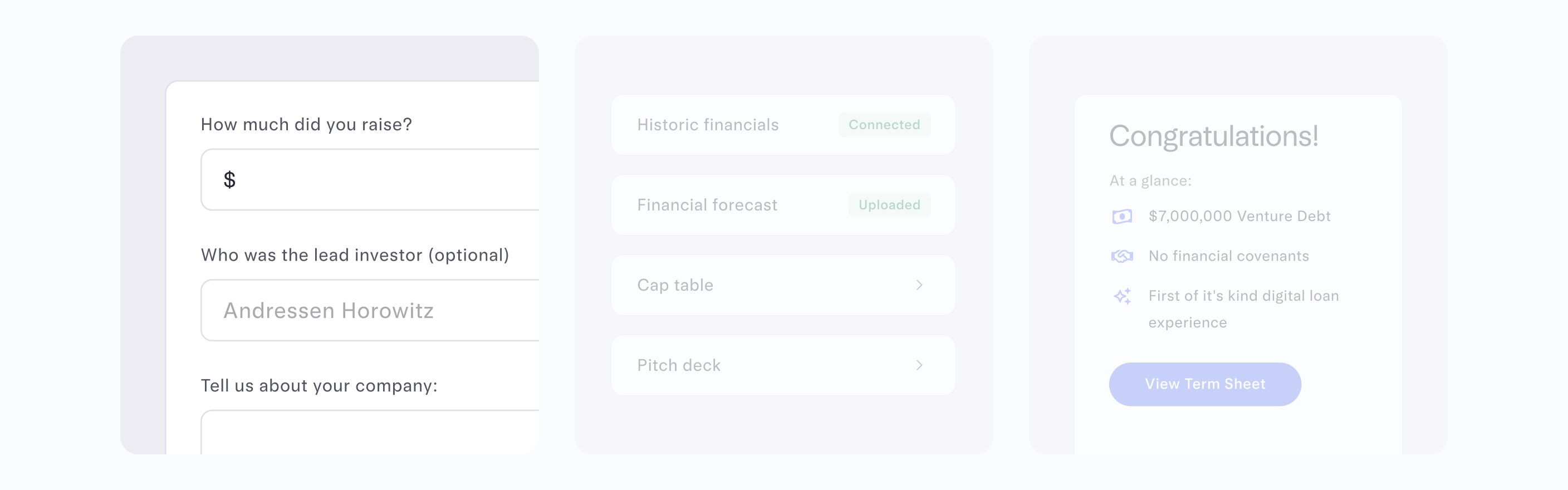

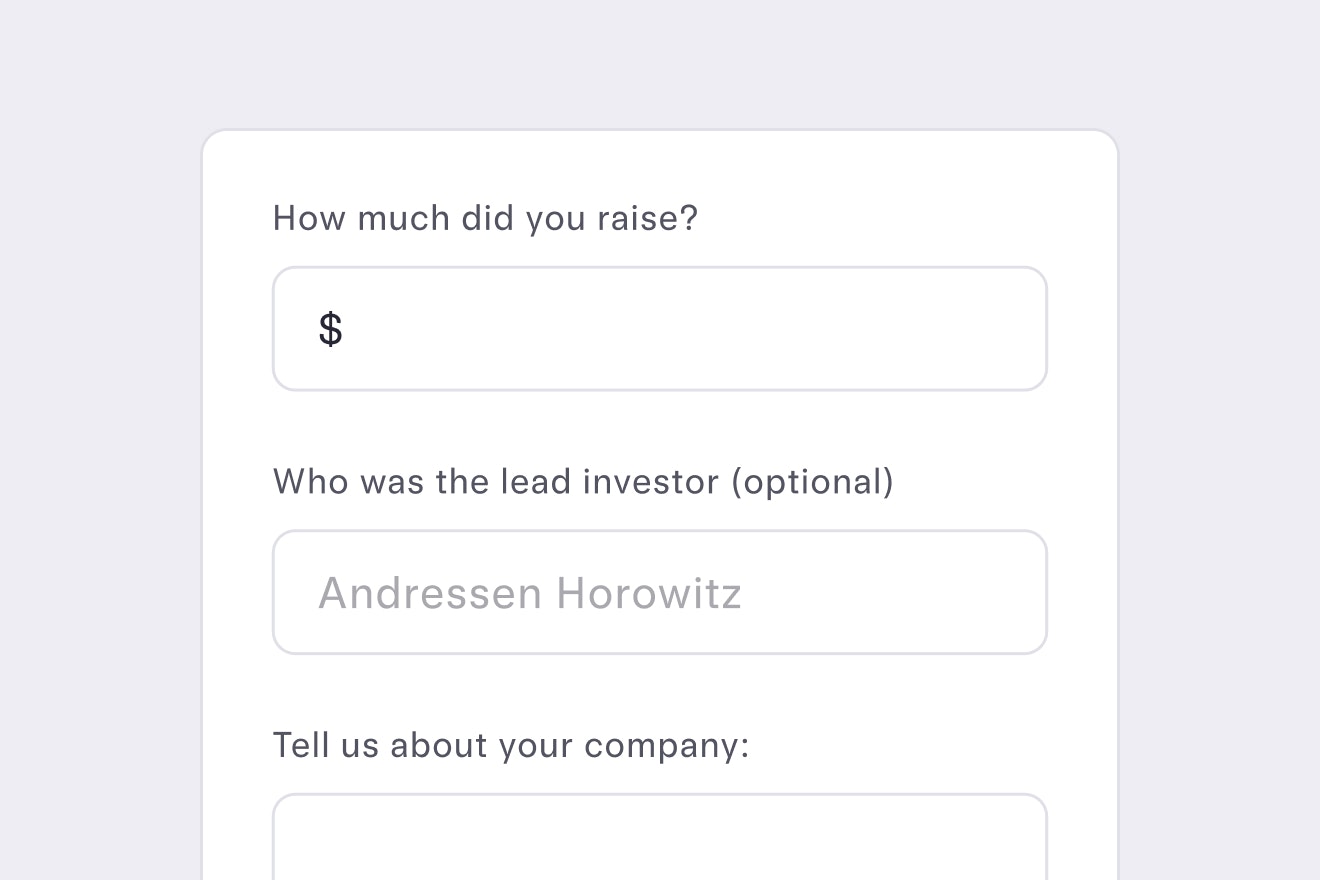

Complete our simple, confidential questionnaire to find out if your company is a good fit.

Check EligibilityVenture debt, reimagined

Our tech-enabled process is engineered to help you manage your capital with ease, all from a single dashboard.

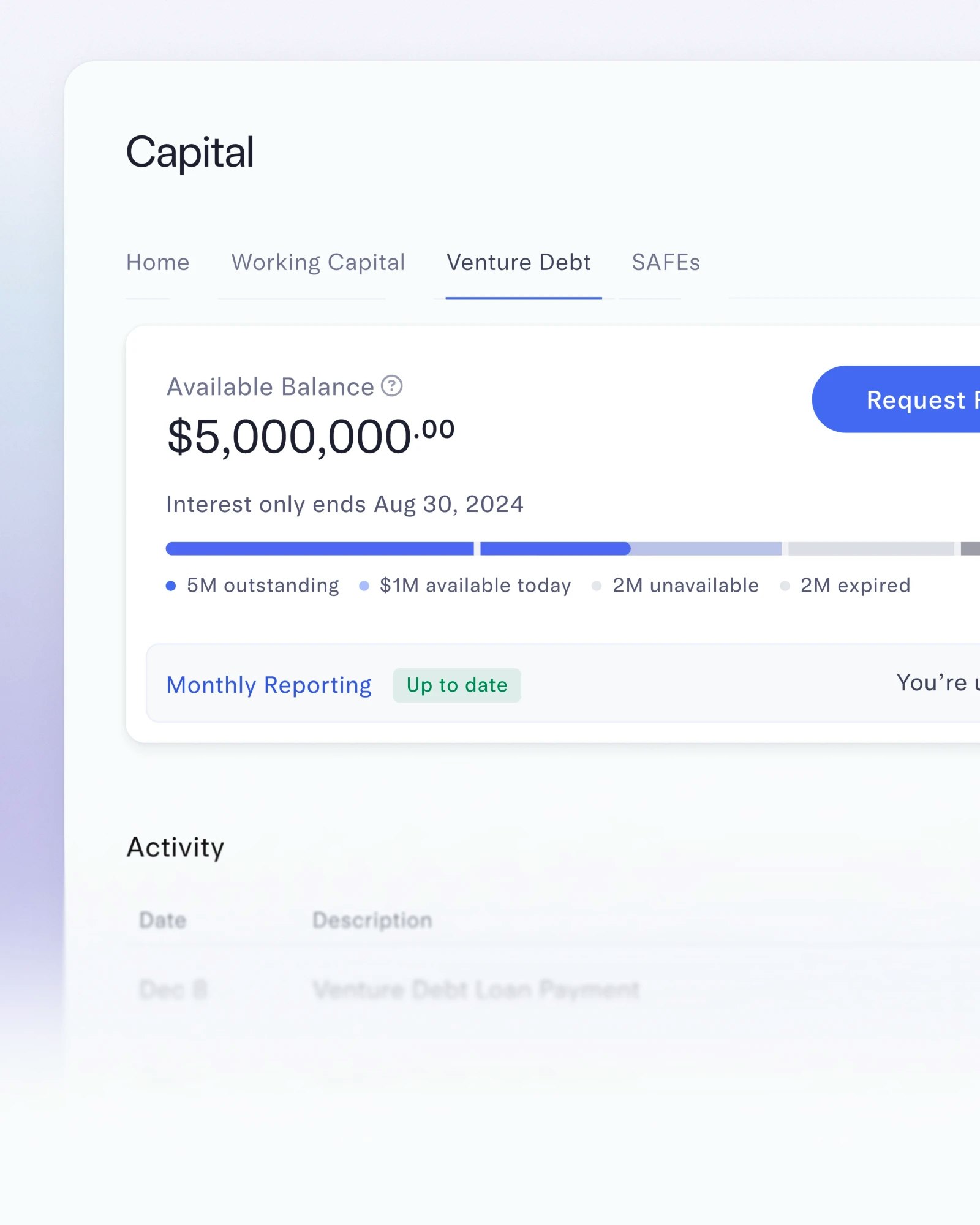

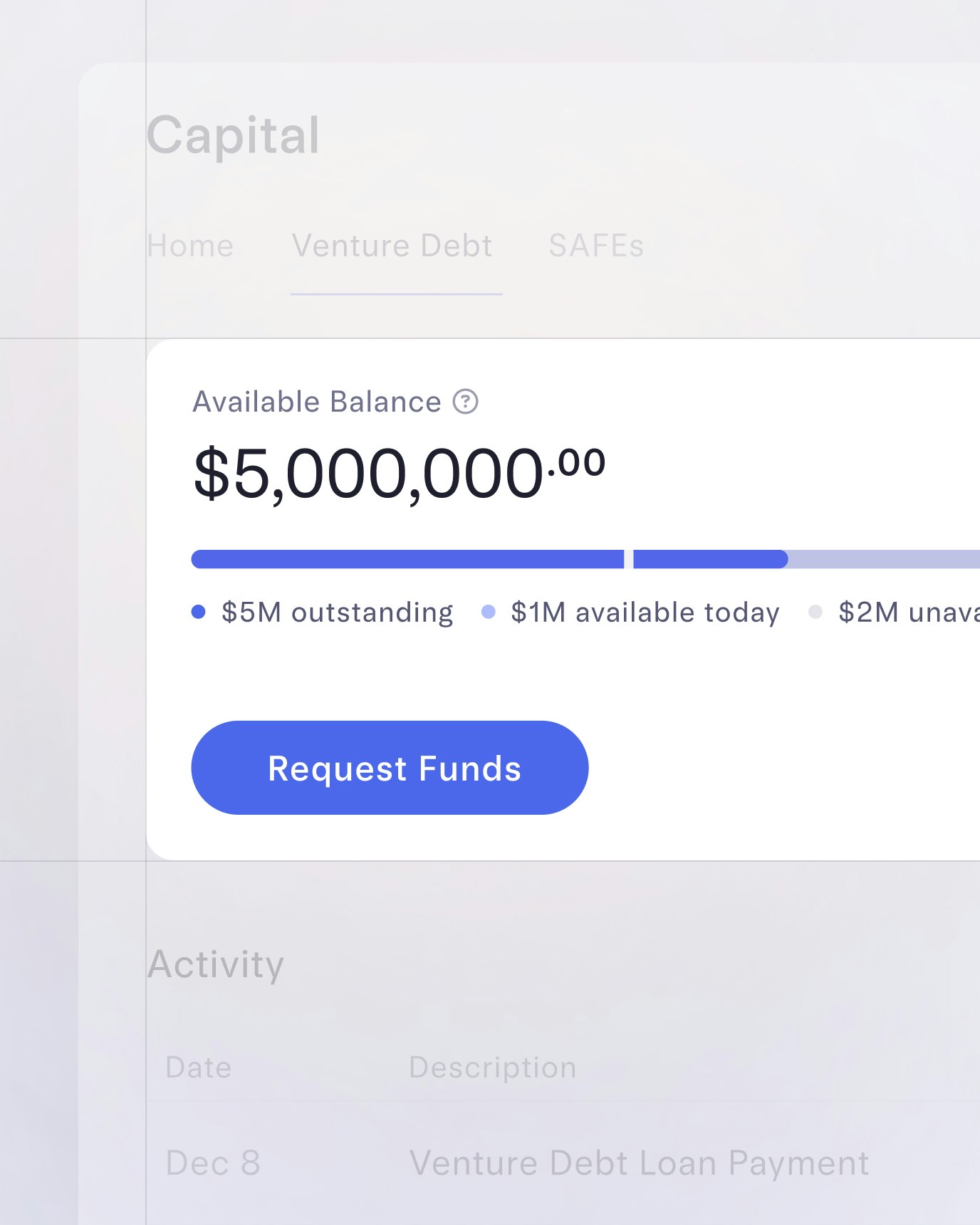

Easy access to your funds

Request withdrawals and see how much capital you have left in just a few clicks.

Dedicated team of advisors

Get 1:1 guidance from both a capital advisor and relationship manager, who leverage their banking expertise and deep network to provide solutions that make sense for your goals.

Proptech

Mercury Capital is beyond impressive. They are faster, easier to work with, and offer terms just as competitive — if not more — than the most established players. They’ve redefined the industry.

John Andrew Entwistle

Founder & CEO, Wander

Frequently asked questions

Open your account in 10 minutes or less

Scale smoothly and build to last on Mercury.