Empirically better banking for biotech & life sciences

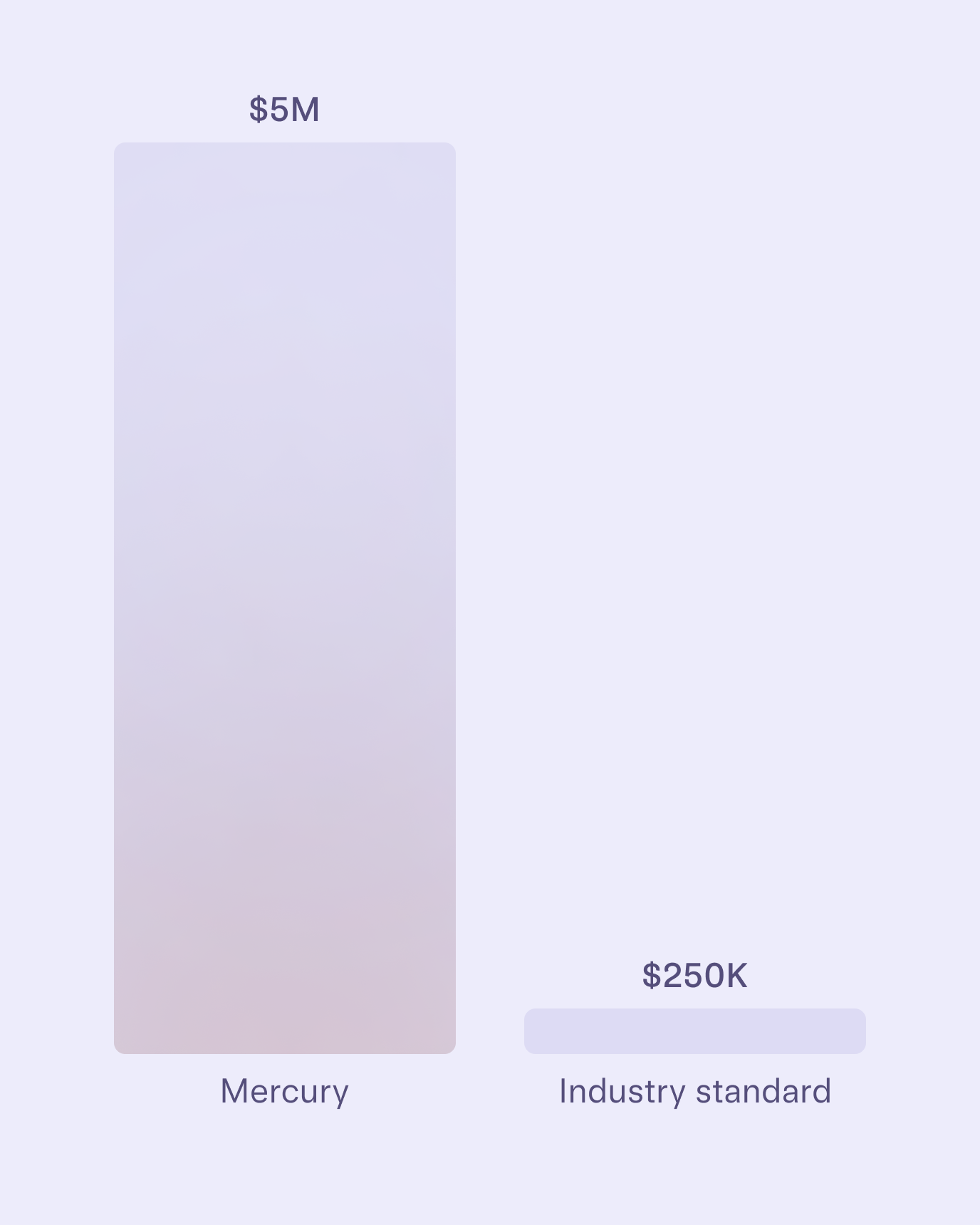

Deposit protection is in our DNA

Get up to $5M in FDIC insurance through our partner banks and sweep networks — plus access additional security through a money market fund.

Learn More

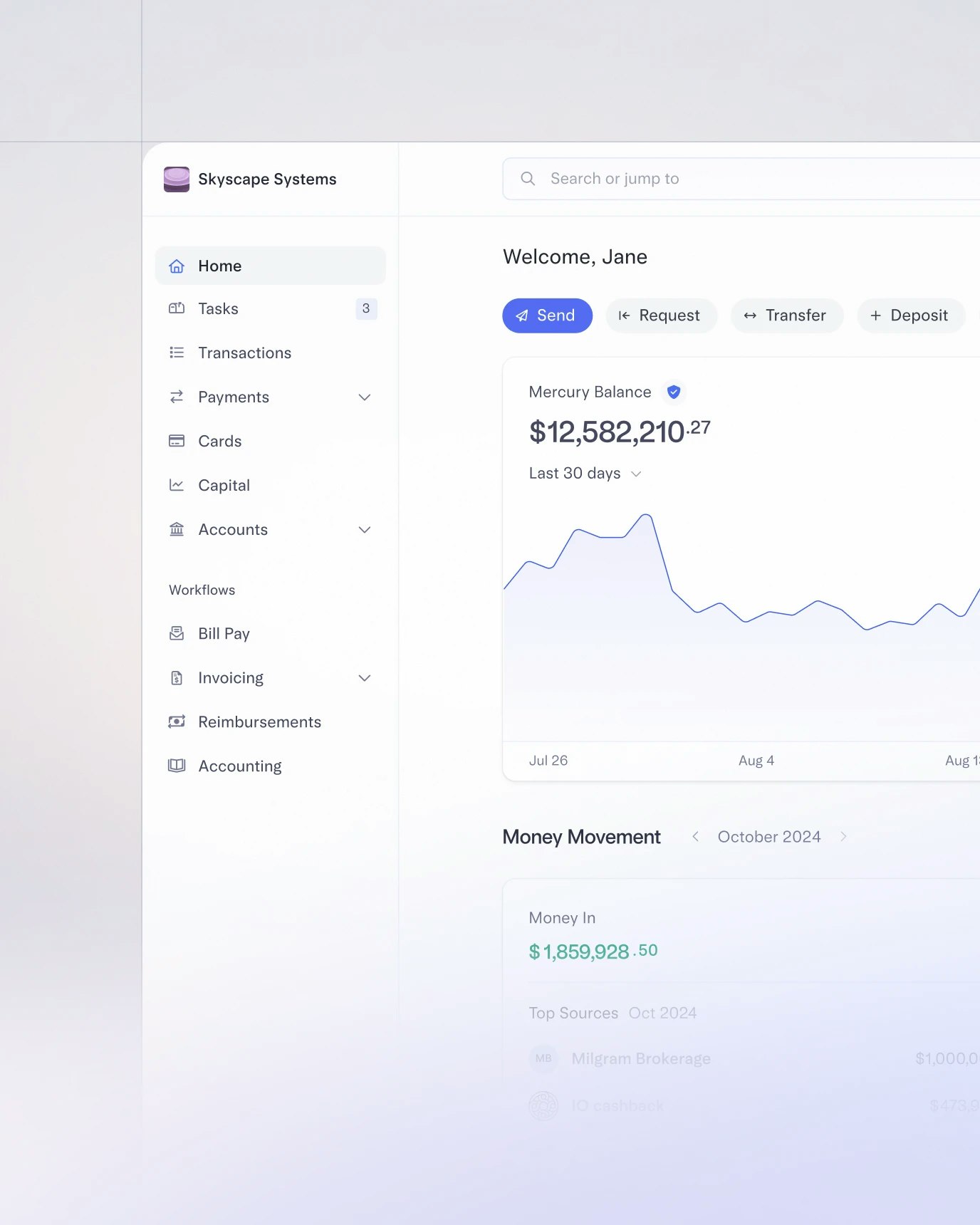

Put your company’s idle cash to work

Set rules to automatically move surplus funds from your operating account to your Mercury Treasury account and earn up to 3.71% yield with funds offered by J.P. Morgan Asset Management and Morgan Stanley.

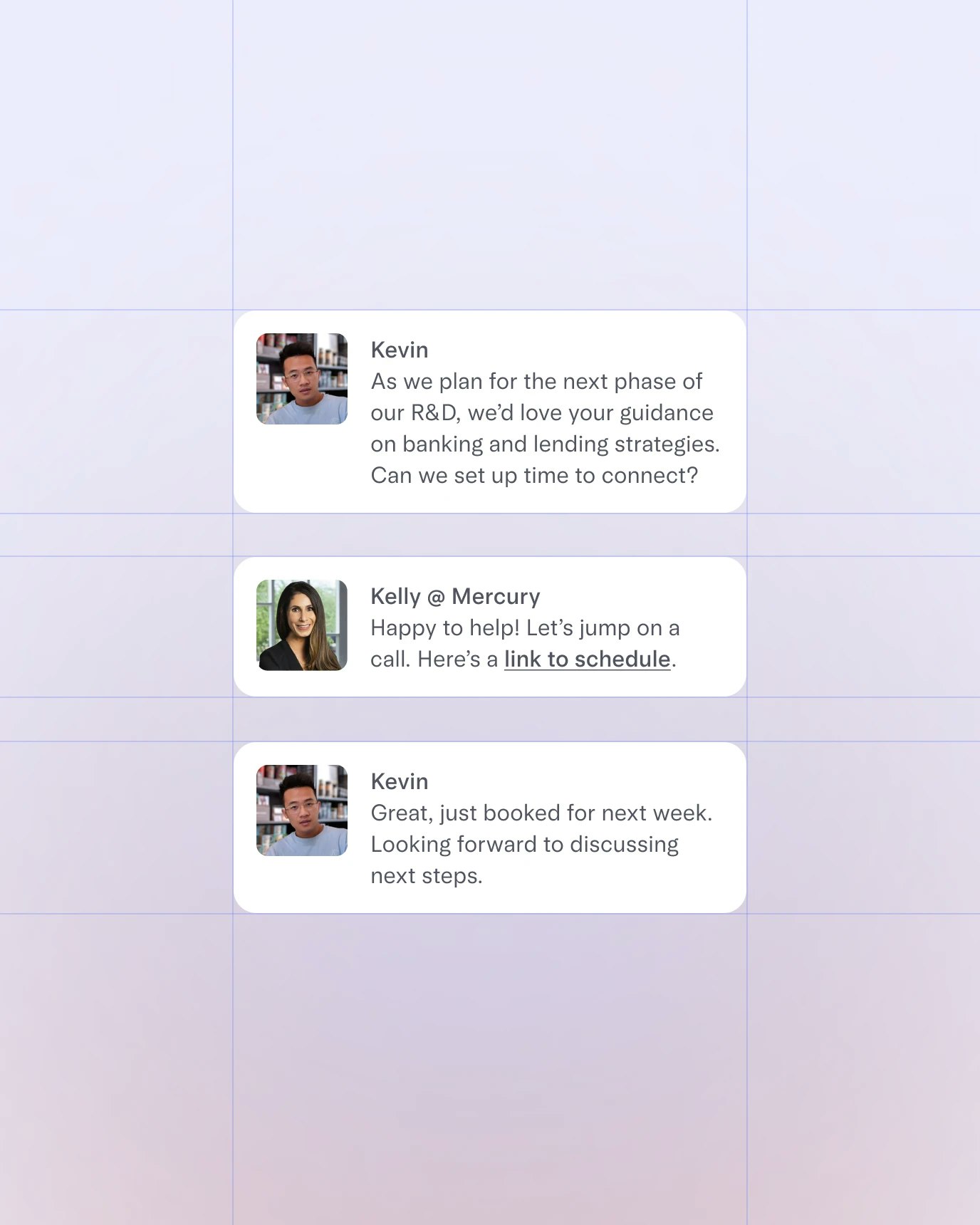

Discover TreasuryYour expanded health and life science support team

Get a dedicated Relationship Manager who is deeply ingrained in the industry to assist with your growth — guaranteed for all Mercury Pro customers and those with a $10M+ balance.

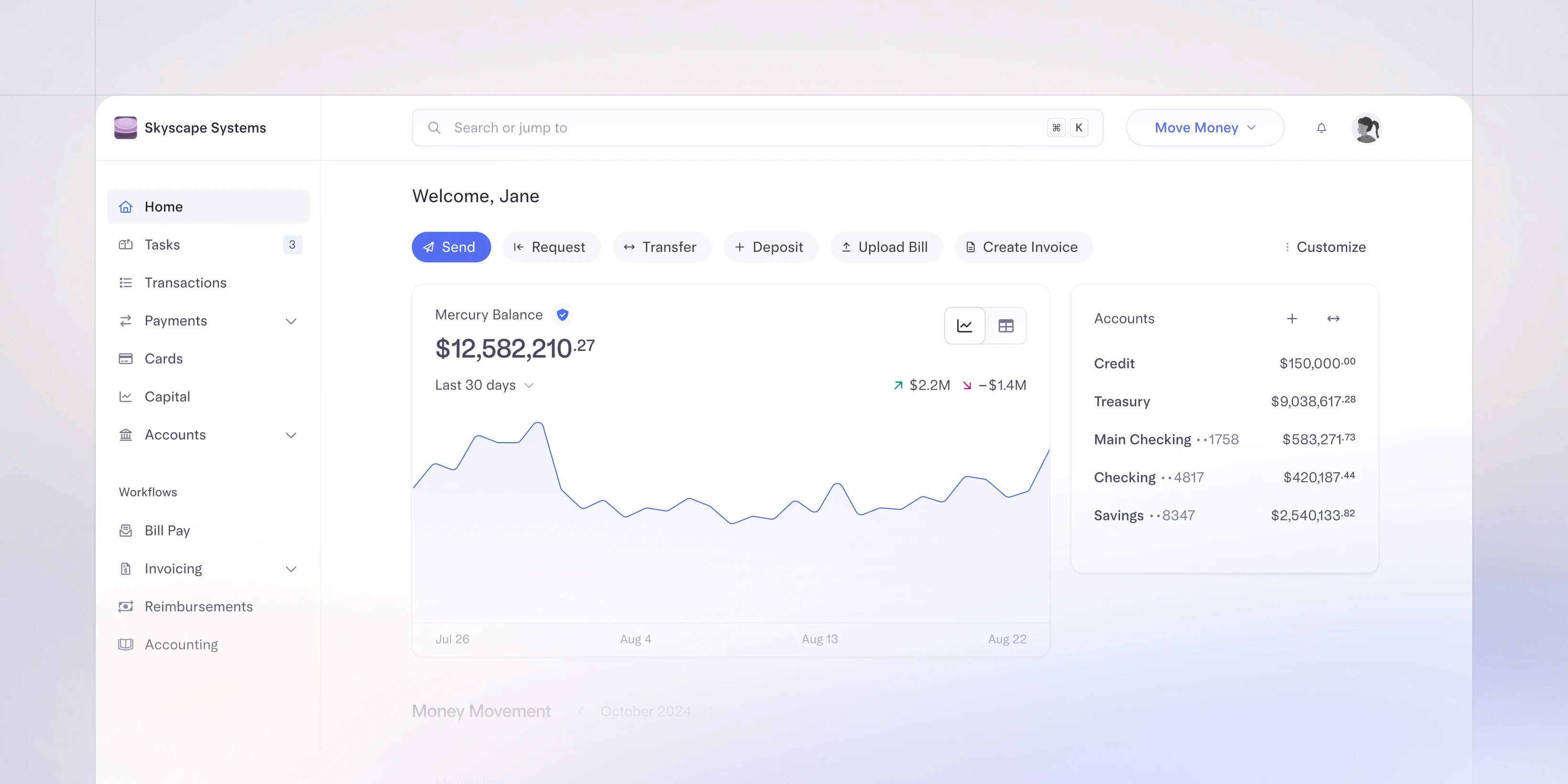

Banking should do more. Now it can.

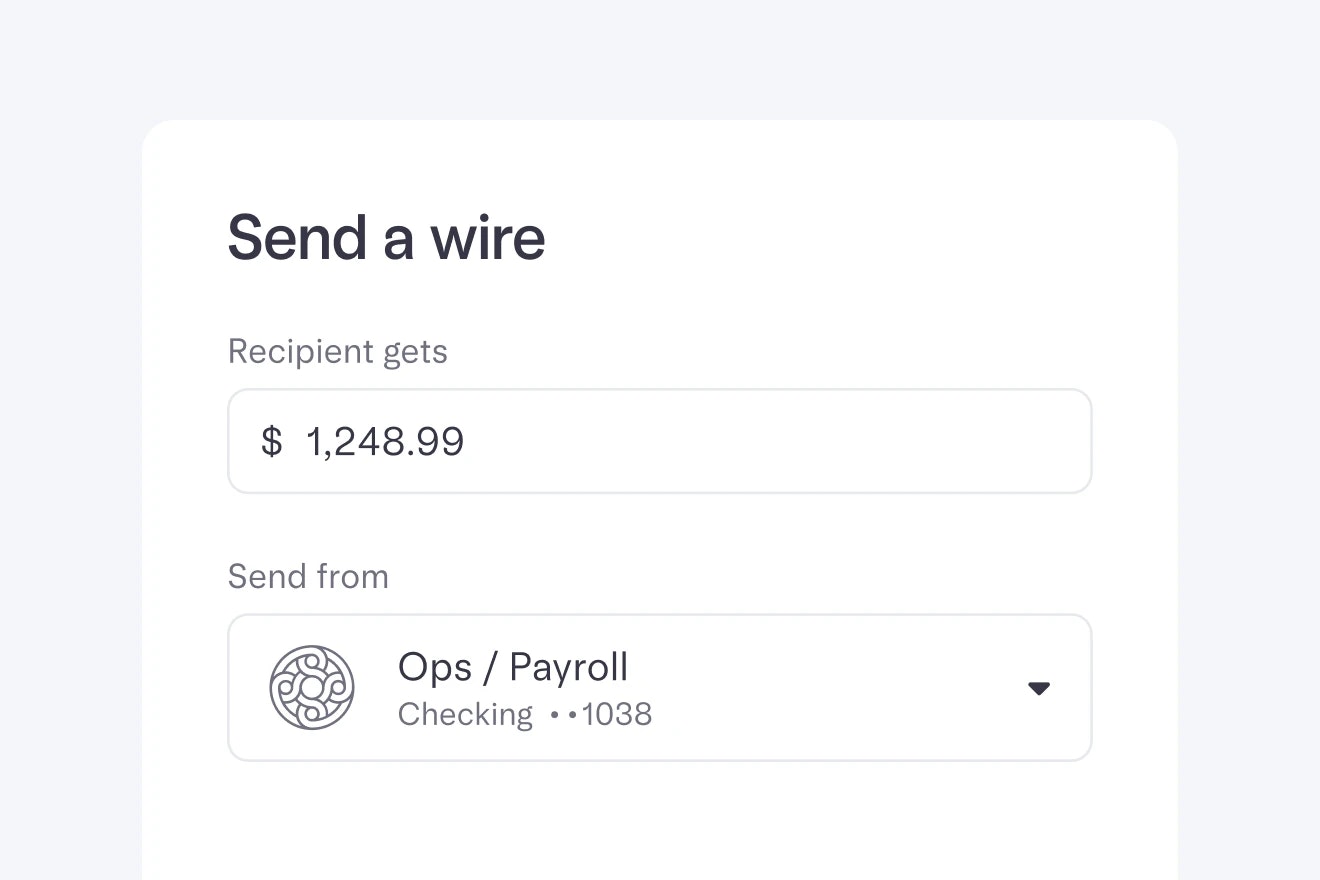

Send payments without the fees or phone calls

Extraordinary banking has its perks

Partnering with industry leaders

At Lactiga, we’re focused on R&D so we want to minimize time spent on banking. Mercury’s intuitive dashboard and long list of (free!) payment options has helped us quickly transfer funds by wire, ACH, and check – even internationally – and it all feels so easy.

Viraj Mane, PHD

Co-founder & CSO, Lactiga