Unlock international capabilities

Easily send wire payments from your entities to your portfolio companies.

Expedite operational efficiencies

Connect with Plaid for ACH transfers and use foolproof instructions to send speedy wires to your portfolio companies. Plus, you can specify a designated approver for each transfer before syncing it to QuickBooks, Xero, or NetSuite.

One-on-one expert guidance

Your needs come first — and high-touch, white-glove service is part of the Mercury package for VC funds. Bank with confidence knowing your dedicated relationship manager is always one message away.

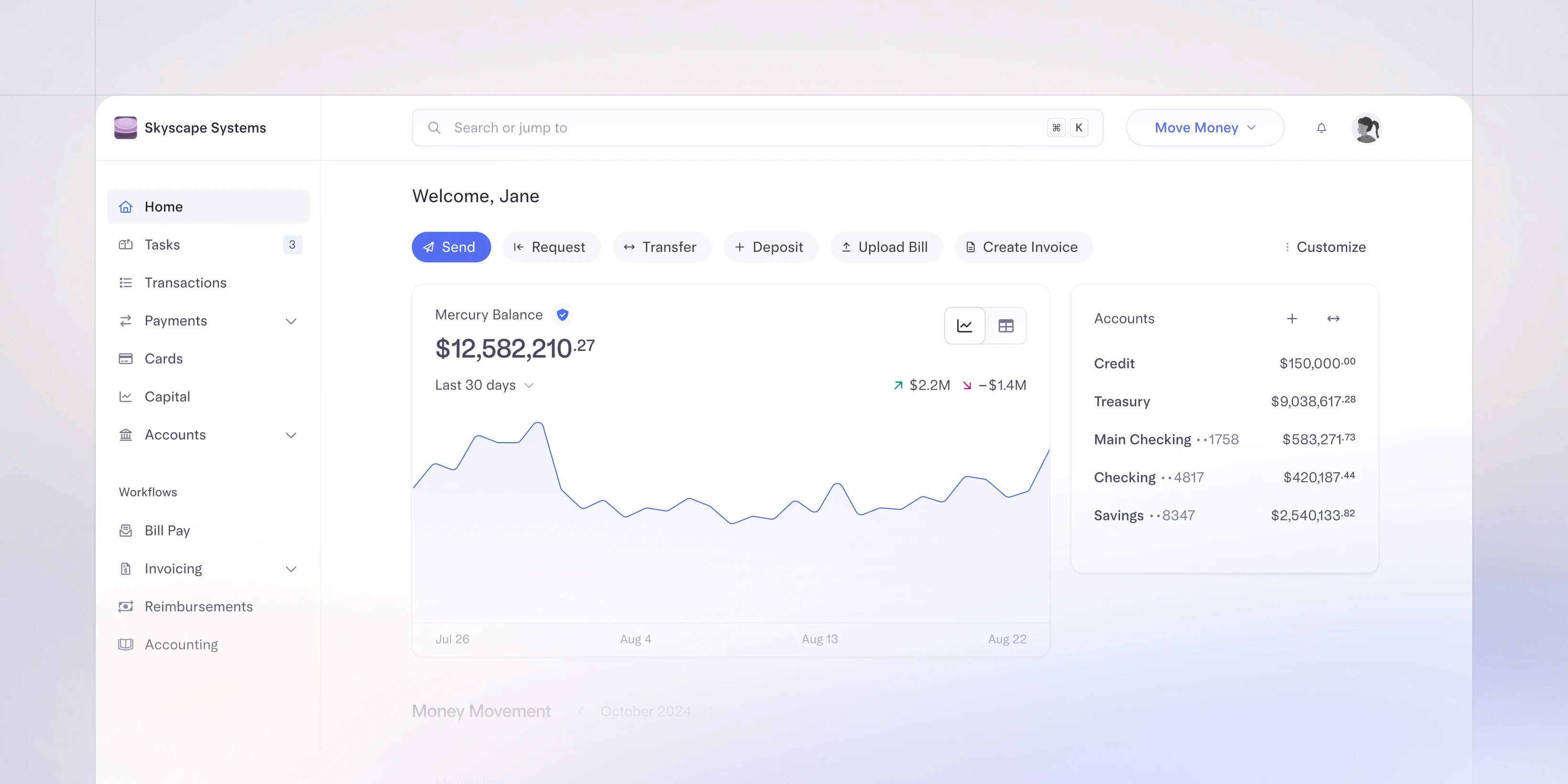

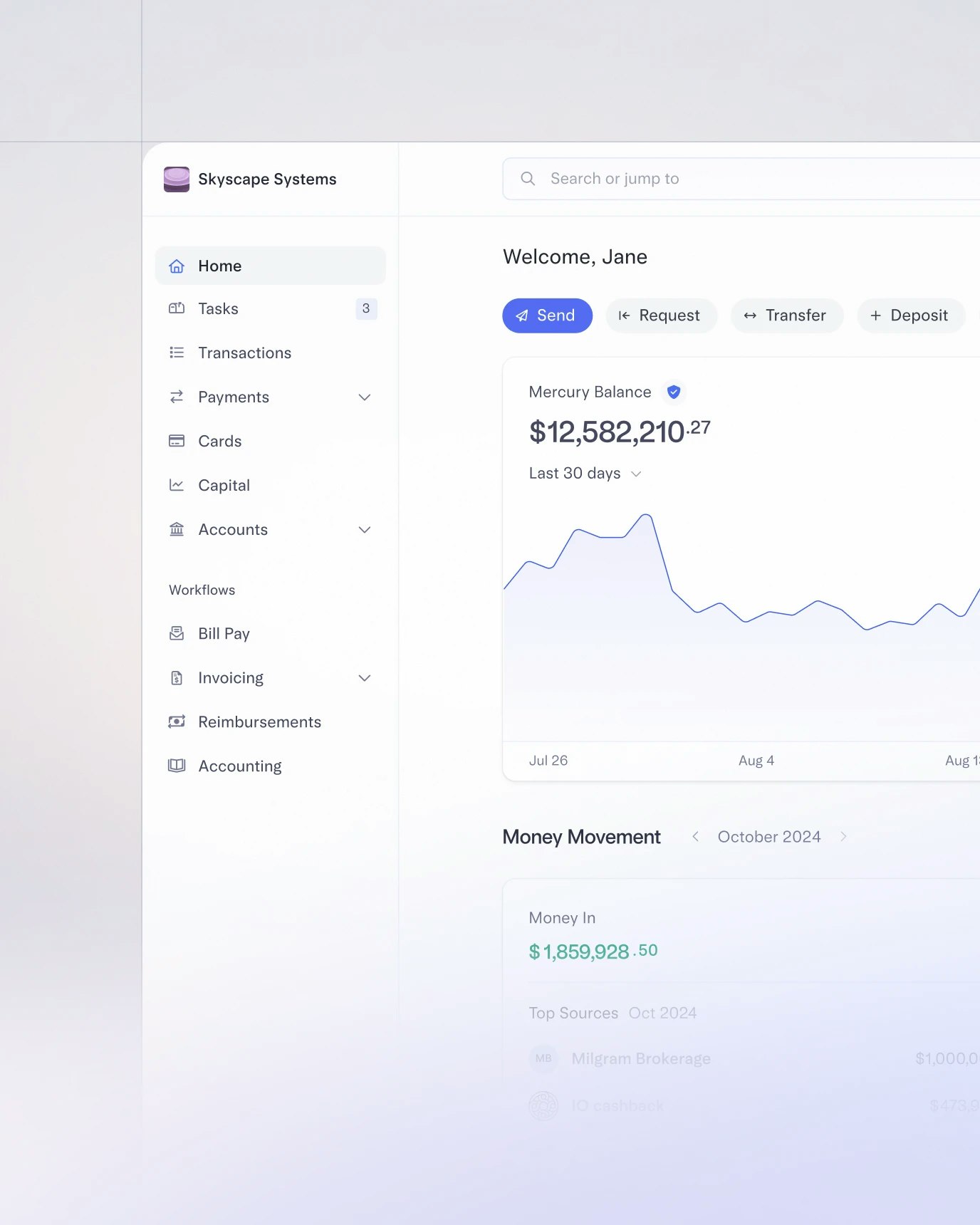

Manage all your accounts from one place

Create separate accounts for your fund, your SPVs, and your management company — and toggle between them with ease.

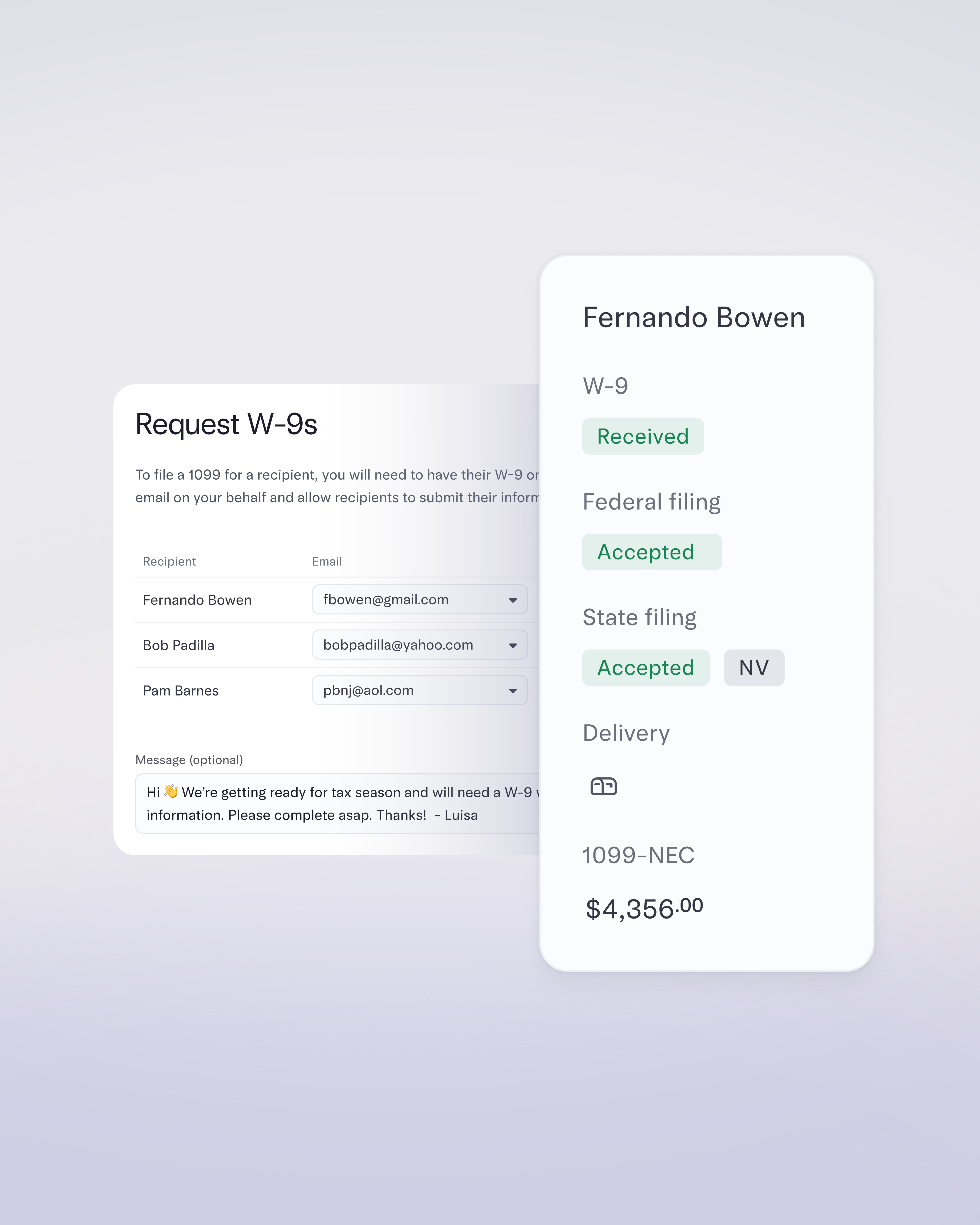

File 1099s right from Mercury

Collect W-9s and prefill forms with AI data extraction

File Federal and State 1099-NEC and MISCs for the 2025 tax season

Track progress and correct or void filings as needed

No exports or third-party tools required

Mercury has been a fantastic partner for us and our portcos. Their customer service is lightning speed, and they prioritize security, safety, and asset protection. Not to mention, the whole experience is modern and elegant.

Zann Ali

Partner, 2048 Ventures