No in-person visit, just four easy steps

Apply online in 10 minutes

All you need is your EIN and personal ID — no need to visit a physical branch or office.

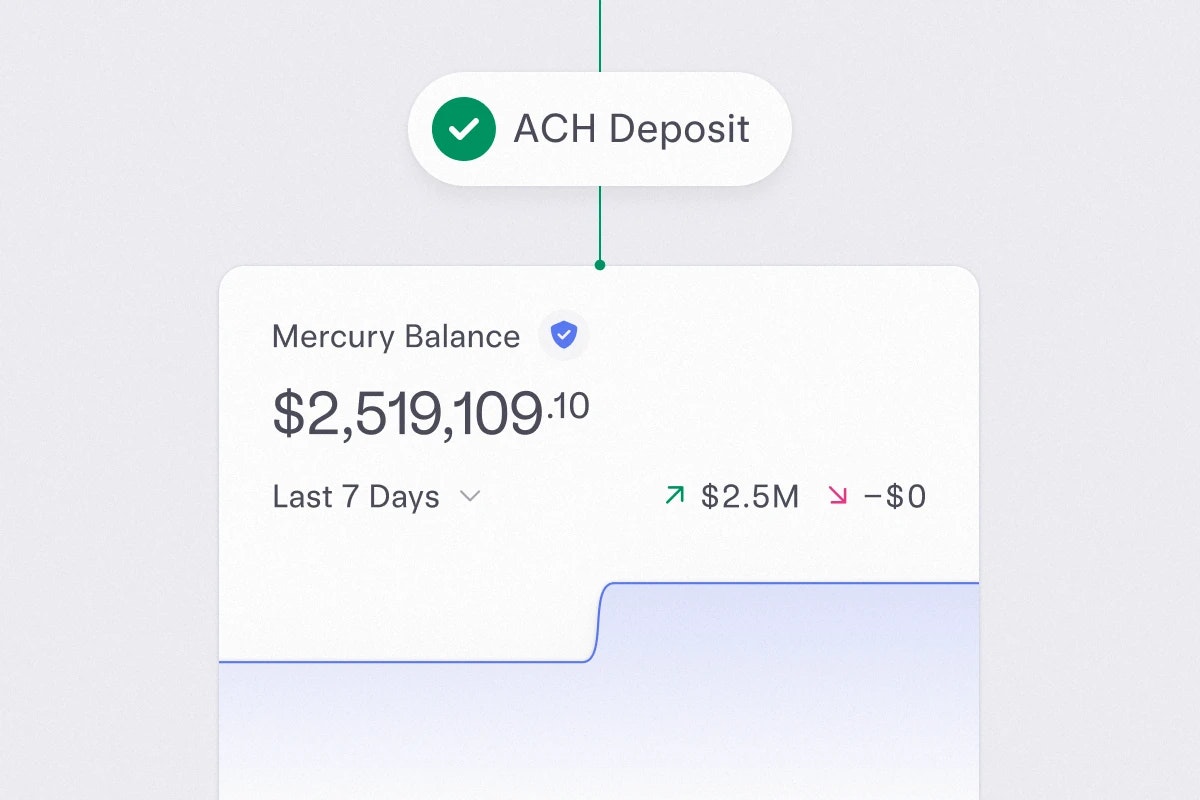

Transfer funds into your new account

Use ACH, wires, Stripe, or another bank account to move money fast and securely.

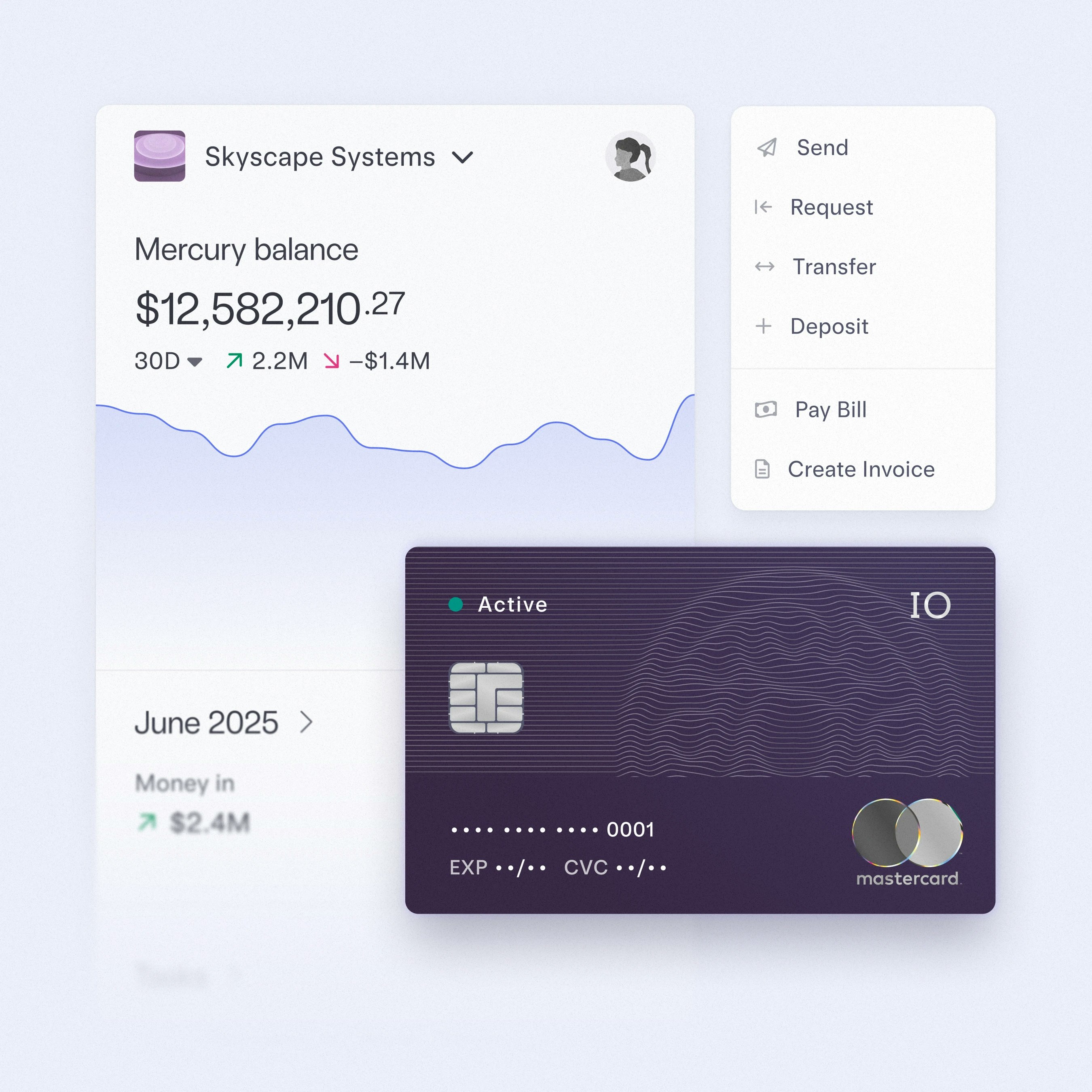

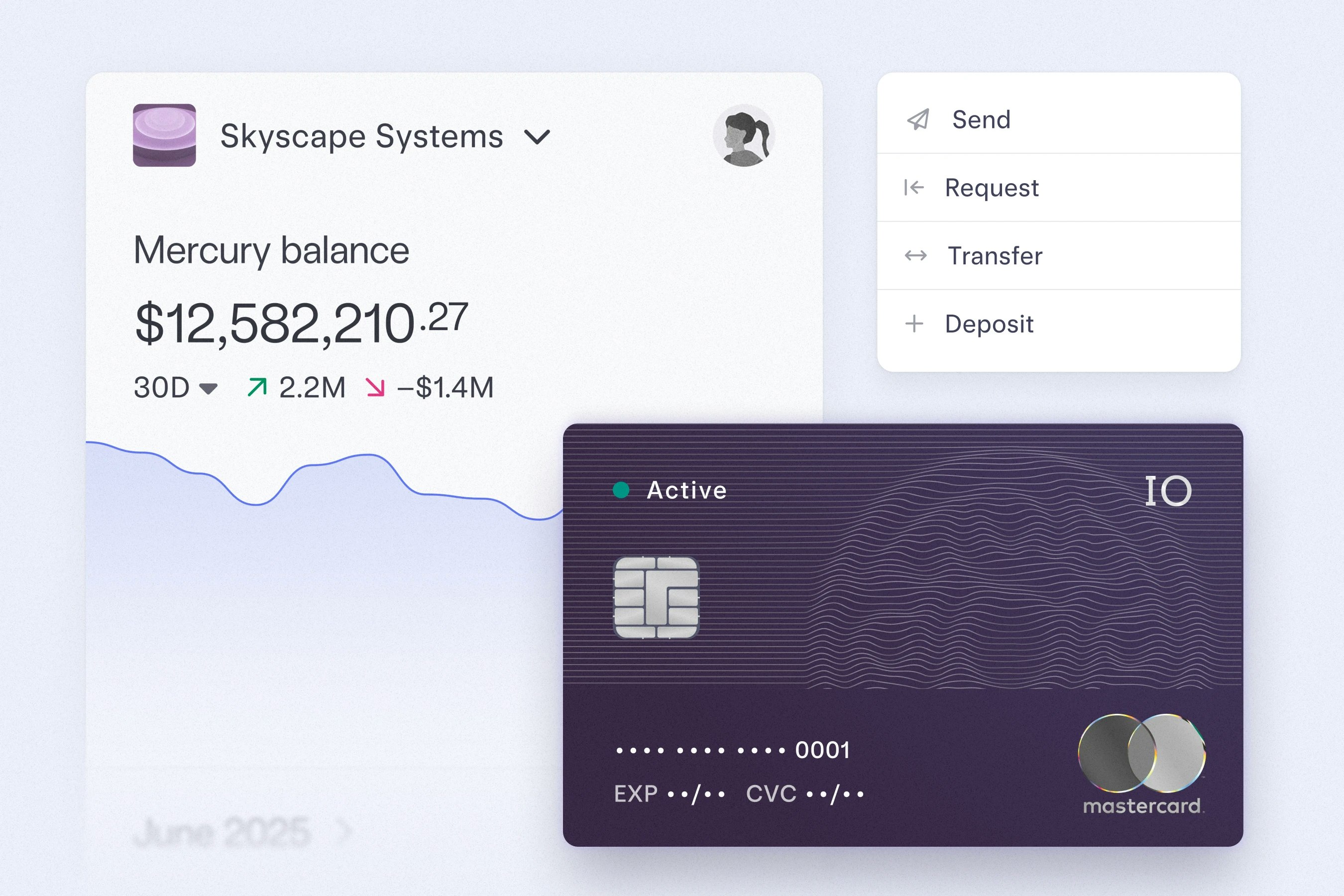

Set up your financial ops

Add users, issue cards, then set up controls, bill pay, reimbursements, and sync your accounting software.

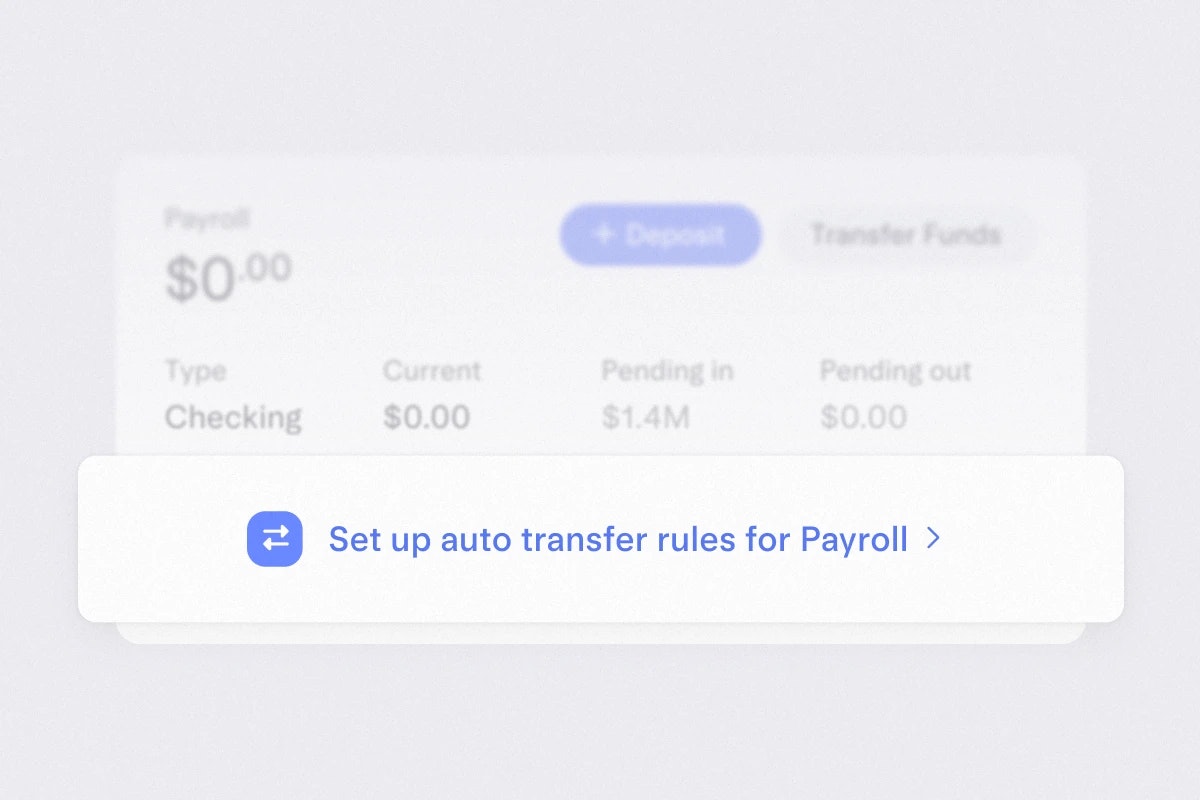

Update deposits and payment methods

Redirect payroll, Stripe, PayPal, and all your other vendor payments at your own pace.

There’s us. Then there’s others.

Mercury | Legacy banks | |

|---|---|---|

Business checking & savings | ||

Fast, online application | Limited | |

Monthly service fees, overdraft fees, and minimum balance fees | $0 | $5–$35 |

Up to $5M with partner banks’ sweep networks | $250K | |

Free same-day ACH, domestic wires, and USD international wires | ||

Business credit cards | Uncapped 1.5% cashback on all credit card spend | 1%–5% cashback on select purchases |

No annual fees | Fees vary | |

No credit checks or personal guarantees | Some credit checks and personal guarantees | |

Limited | ||

Built-in expense management, bill pay, and invoicing software | Limited | |

Accounting software integrations | Limited | |

Exclusive partner and software perks |

Save on fees and put it back into your business

We’ve prefilled some example transaction data. Adjust the inputs to reflect your business’s monthly activity.

$0

Legacy bank fees

$0/mo.

Mercury fees

$0/mo.

Mercury allows for sleek navigation, simple transfers without fees, quick note-taking to track expenses, and easy card distribution for your entire team. I'm so glad I made the switch to Mercury.

Andrew Leon Hanna

Founder, Mona

Frequently asked questions

Banking should do more

Say goodbye to bad design and hidden fees.