Climate tech has big goals. This is banking that helps you get there.

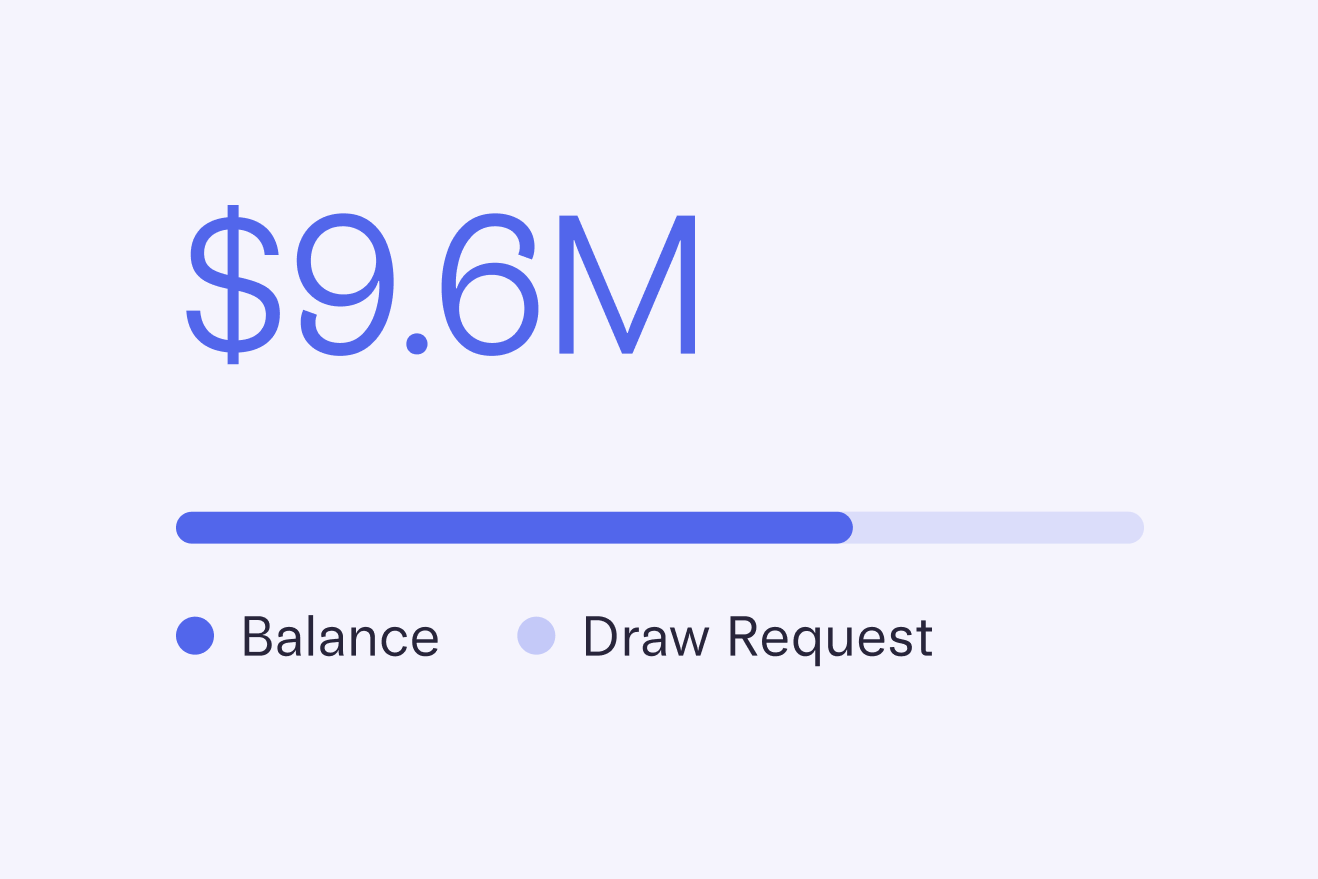

Boost your runway

Climate-specific perks

Support from experts

Expand your knowledge

A built-in climate ecosystem

Everything you need for smooth banking

Bank at your speed

Apply NowFast online application and onboarding

Start spending immediately with virtual cards

Complete any banking task in just a few clicks

Bank anywhere with an intuitive mobile app

Simple money transfers

Learn MoreDeposit money and pay vendors in three clicks

Pay via ACH, check, or wire

Create auto-transfer rules between accounts

Set up recurring payments

Easily share receipts with your team

Physical and virtual cards

Issue corporate cards in seconds — complete with custom limits, searchable transactions, and user permissions for teammates, bookkeepers, and contractors.

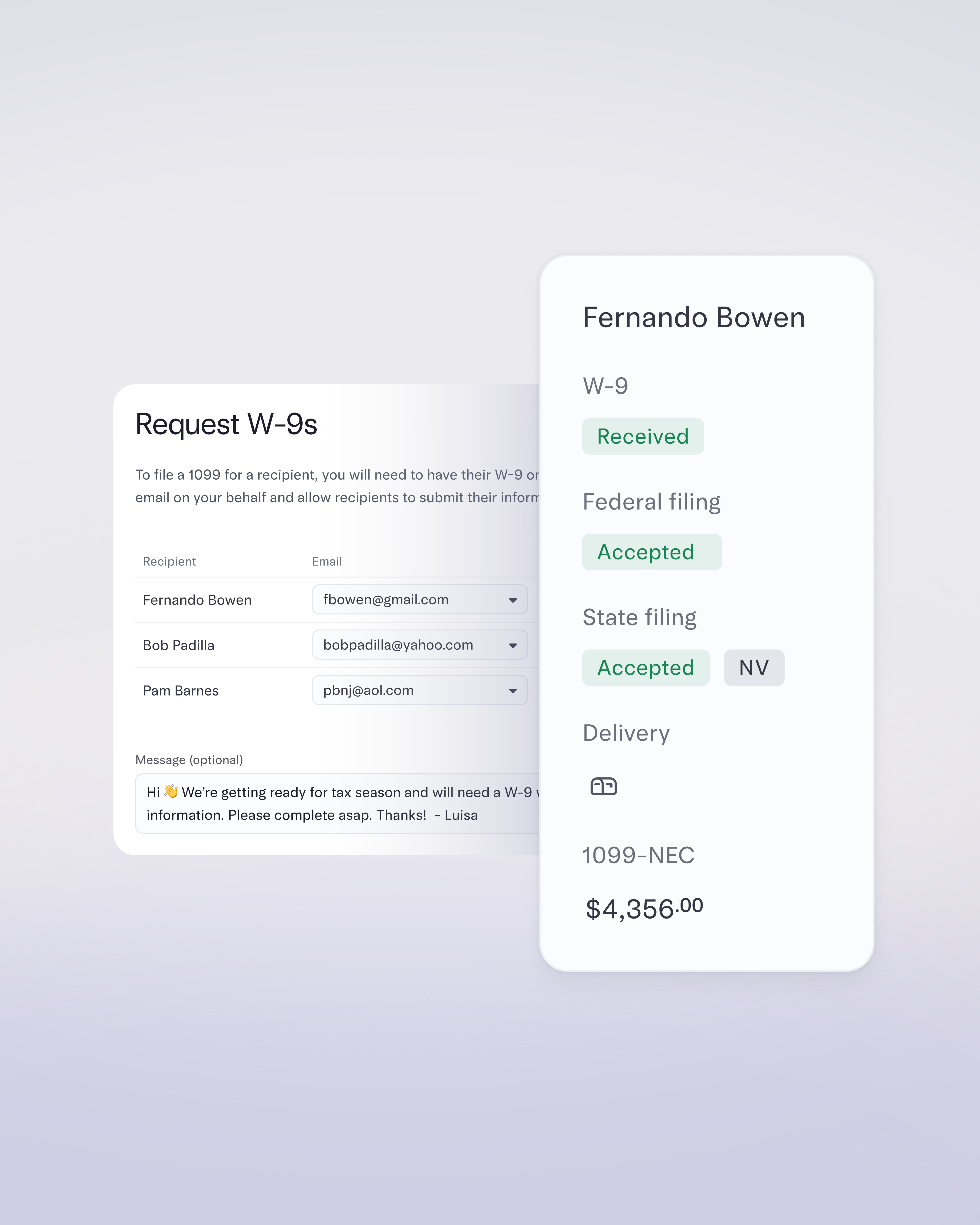

Learn MoreFile 1099s right from Mercury

Collect W-9s and prefill forms with AI data extraction

File Federal and State 1099-NEC and MISCs for the 2025 tax season

Track progress and correct or void filings as needed

No exports or third-party tools required

Your needs are our priority

Access an entire financial platform powered by your Mercury account

Mercury is built by entrepreneurs, for entrepreneurs. With their unrivaled venture debt and all-in-one financial platform, they’re the ideal partner for us to build and scale our business long-term.

Jonathan Segal

Co-founder & COO, Zeno Power