Save when you pay

Automate your accounting

Prioritize profit

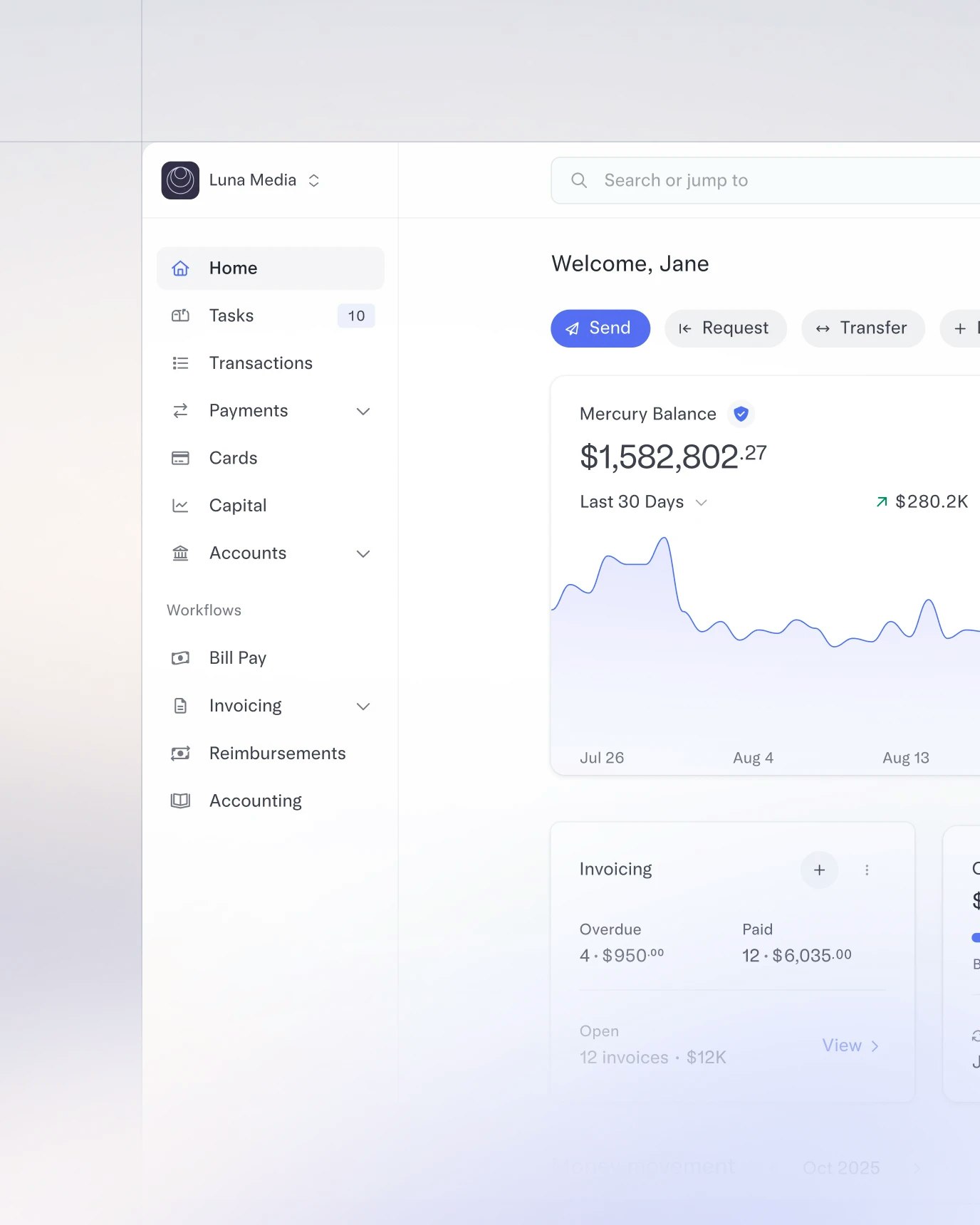

Run your finances from one dashboard

Powerful banking that feels extraordinary to use

Explore BankingStart spending with virtual cards as soon as you’re approved

Bank even when you’re on-the-go with a modern mobile app

Intuitive payment approval flows make it easier to stay on top of your cashflow

Access credit cards on day one for eligible customers

Explore CardsNo personal guarantee or business credit history required

Create virtual cards for your team with precise permissions and spend controls

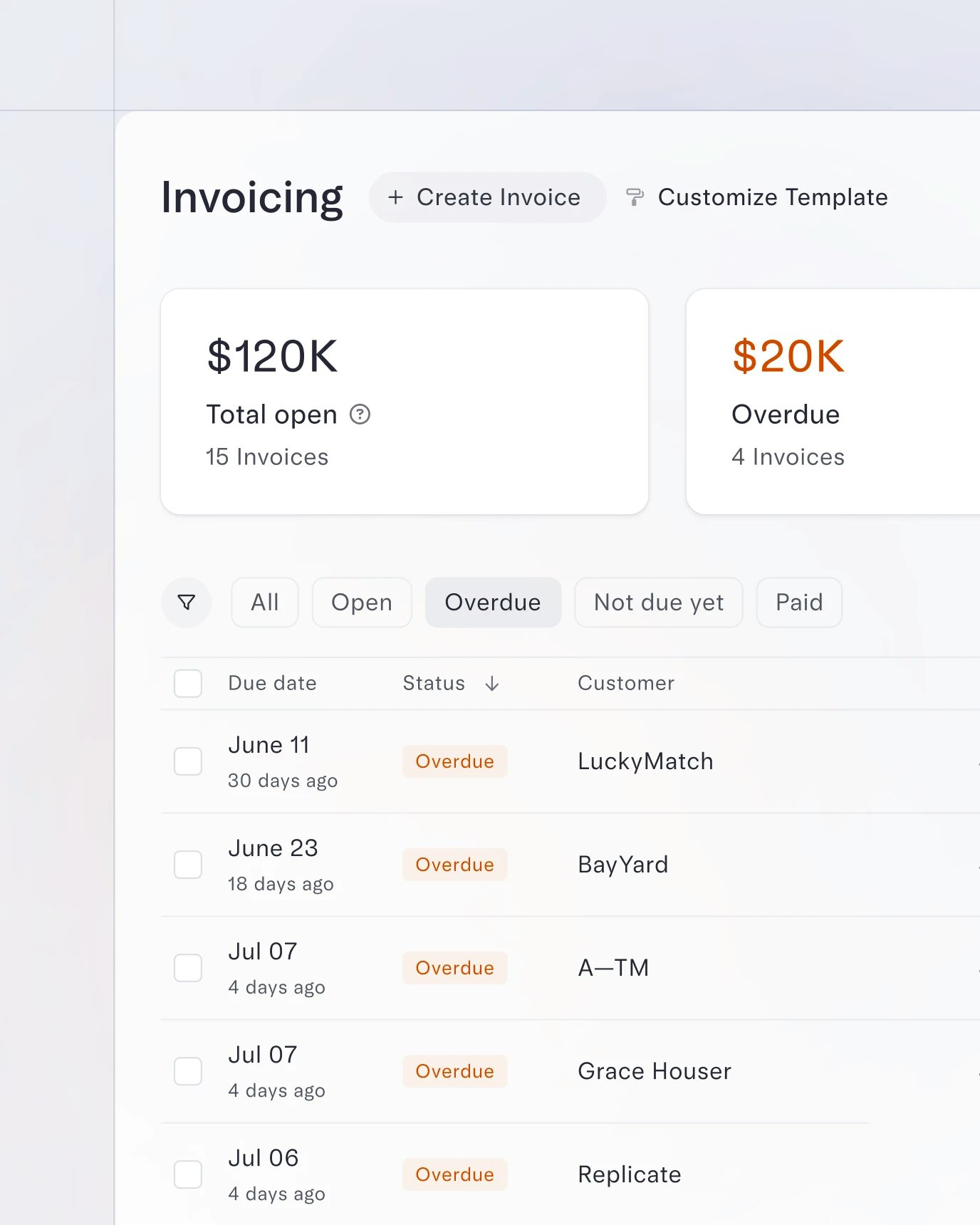

Seamless invoicing for you and your customers

Explore InvoicingGenerate polished invoices and payment reminders and easily send recurring invoices

Simplify reconciliation with automatically matched payments and invoices

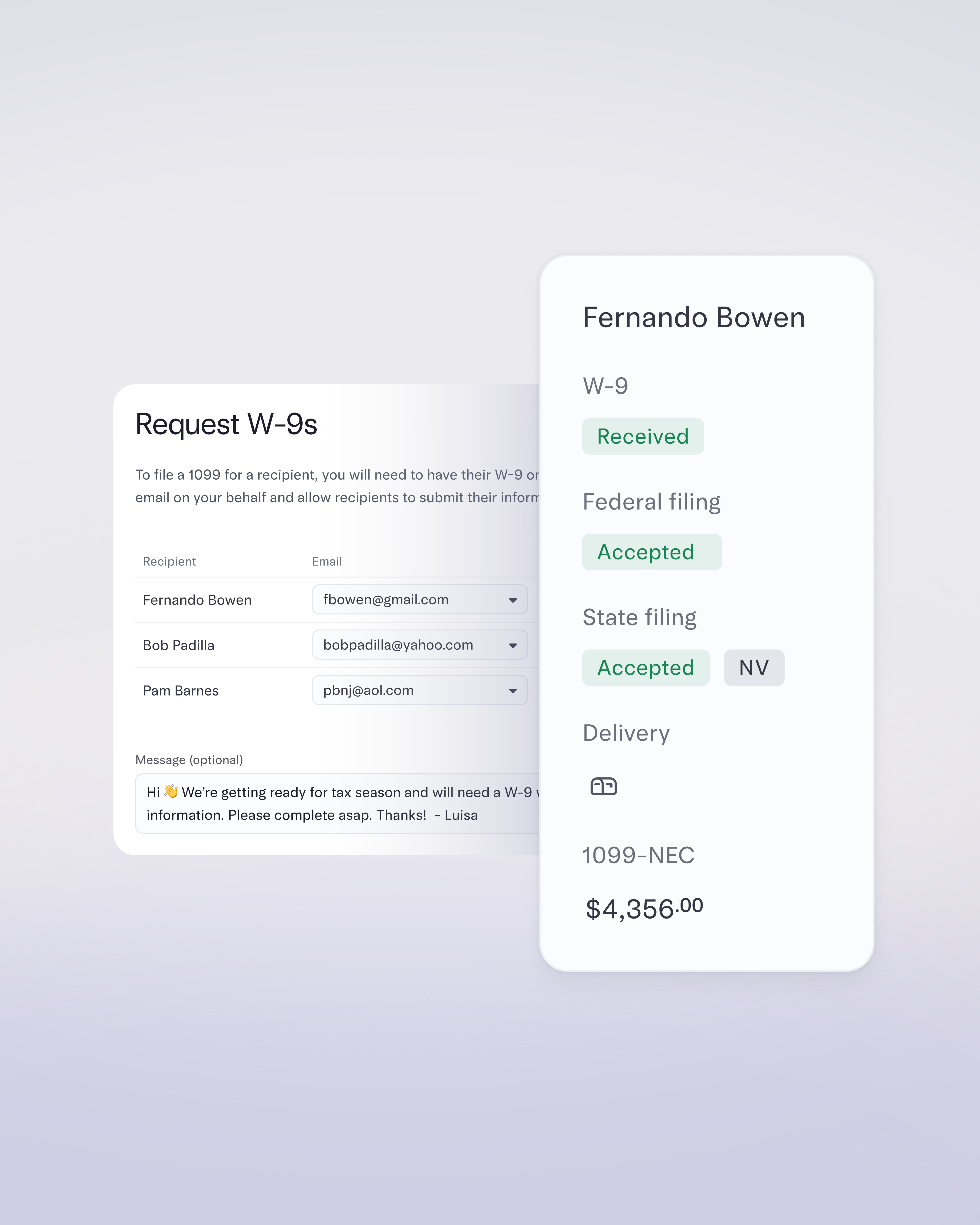

Streamline bill payments and 1099 filing

Explore Bill PayPopulate bill details automatically and detect duplicate payments and subscriptions

Set multi-layered approvals and approve payments instantly via Slack

Collect W-9s and file federal and state 1099-NEC and MISCs — no exports or third-party tools required

Why LLCs love Mercury

Banking with traditional banks is such a huge drain on time and energy. We didn’t want to get bogged down in paperwork and process, we just wanted to get to work. Setting up a Mercury account was a no-brainer.

Kelin Carolyn Zhang

Co-founder, Poetry Camera