Get clarity from your cash burn

What cash burn can tell you

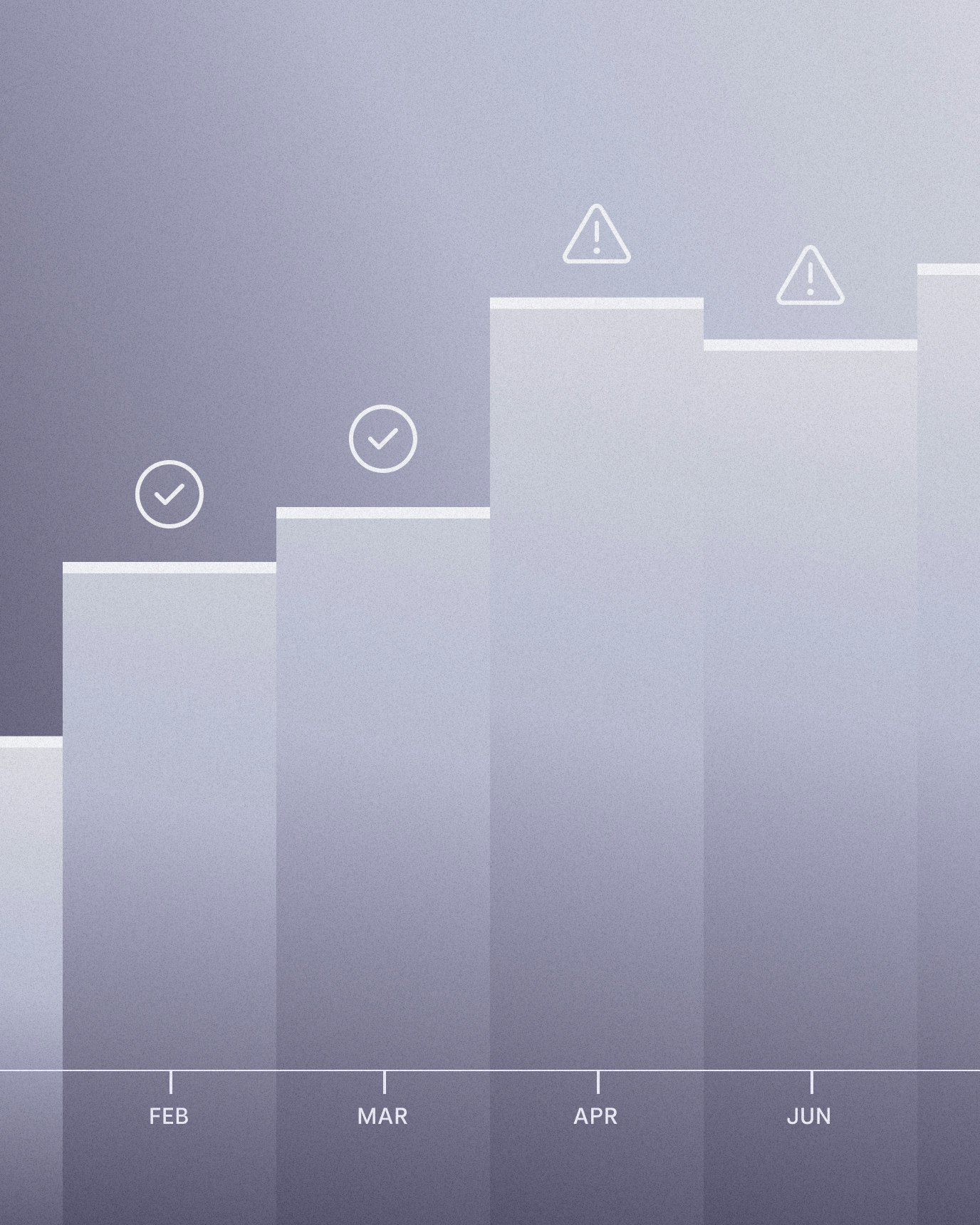

Your cash burn rate measures how quickly your business is spending its capital and how many months it has left at its current rate. Monitoring it is crucial for survival, budgeting, and forecasting. Investors will often assess a business’s cash burn rate to gauge its financial health and sustainability.

Dive Into Cash Burn

How to interpret your cash burn rate

While no universal metric exists for all businesses, a cash burn that offers a minimum of one year of runway is generally recommended. If your current cash burn positions you to run out of runway in less than six months, it may be a sign to course correct.

Learn More

How to improve your cash burn rate

As your business scales, you’ll want to see a decreasing trend in your cash burn. Some strategies for improving your cash burn are to audit your expenses, increase revenue through various strategies, and to look for flexible sources of funding.

Improve Your Burn Rate