A closer look at your SaaS magic number

What is the SaaS magic number?

Your SaaS magic number is a metric that measures how efficiently your SaaS company’s sales and marketing spend are driving revenue. It can help you gauge whether to continue on your current path or begin exploring new ways to accelerate growth.

Why It’s Important

Is your SaaS magic number on target?

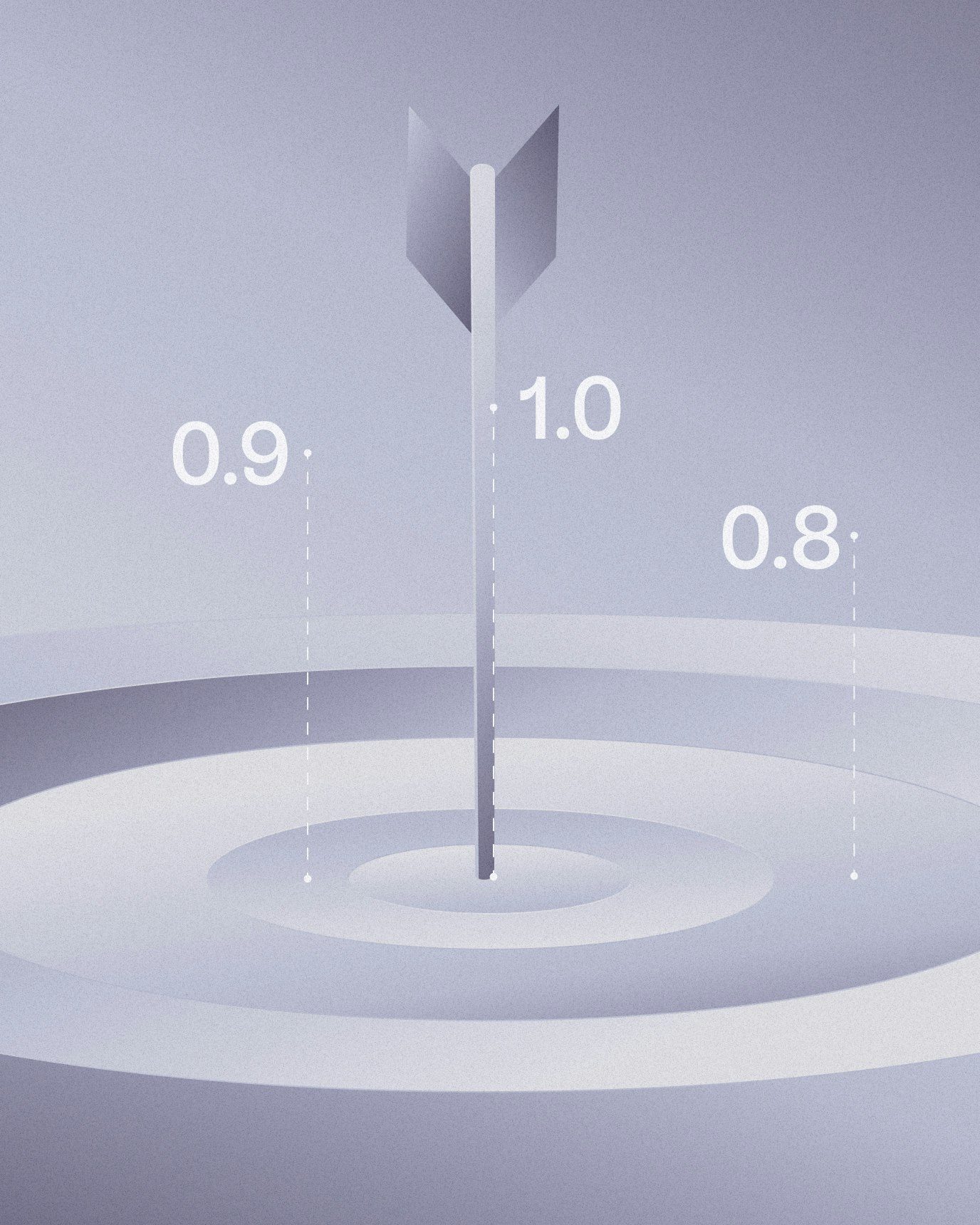

A magic number above 1.0 signals that your company’s marketing and sales efforts appear effective and sustainable for the long term. A number between 0.75 and 1.0 signals healthy growth, but there is room to improve. Below 0.75, and your company is likely not converting customers efficiently.

What Your Number Means

How to move the needle toward a stronger number

If you found that your SaaS magic number is less than magical, there are strategies you can adopt to improve it. Focus on optimizing your customer acquisition costs, upselling and cross-selling existing customers, minimizing churn, and look for new markets with high-growth potential.

Improve Your Number