Funding for what’s next?Add to cart.

Flat-fee pricing and competitive rates

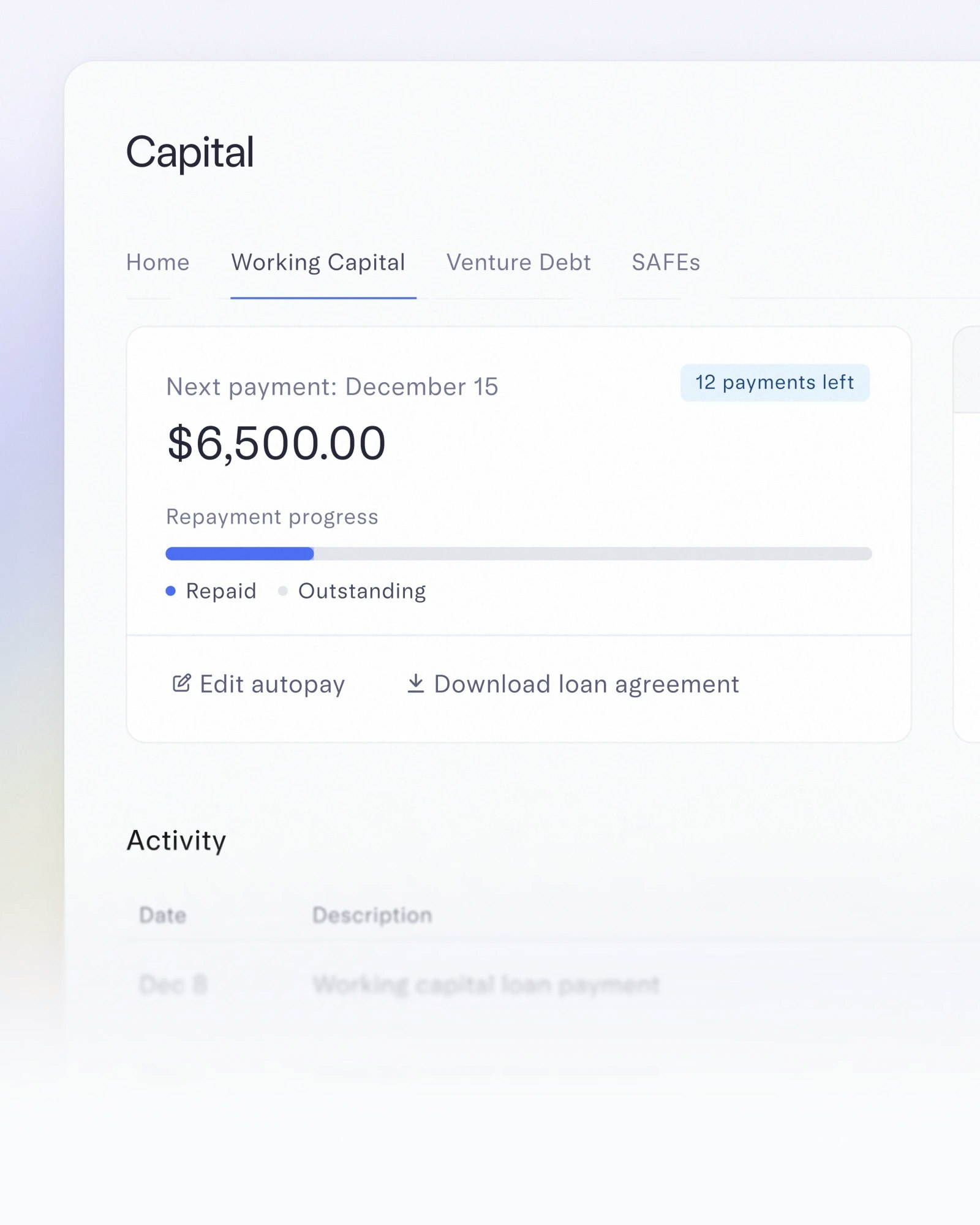

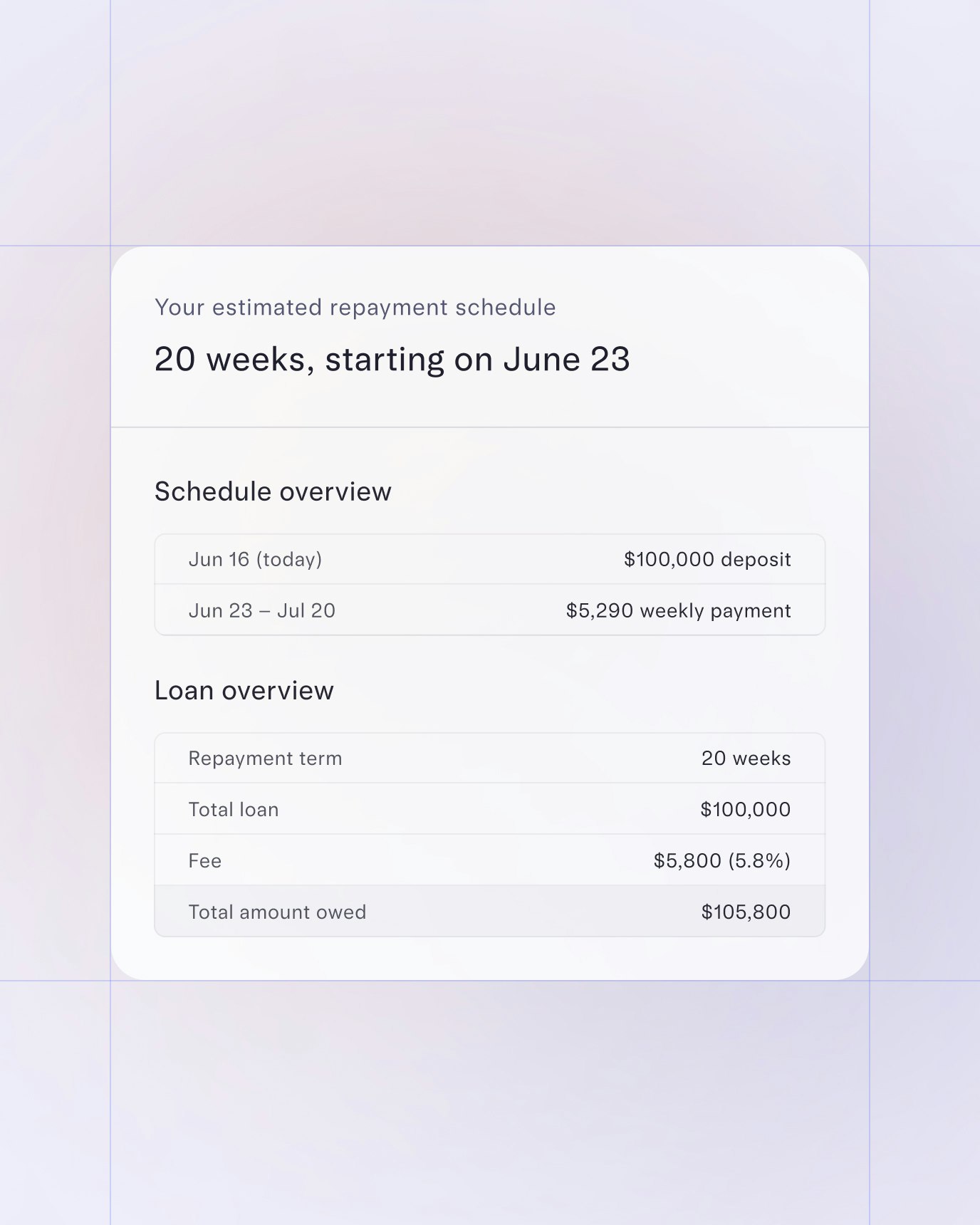

Fixed weekly repayment schedule

Long-term partnership

Transparent terms designed to help you grow

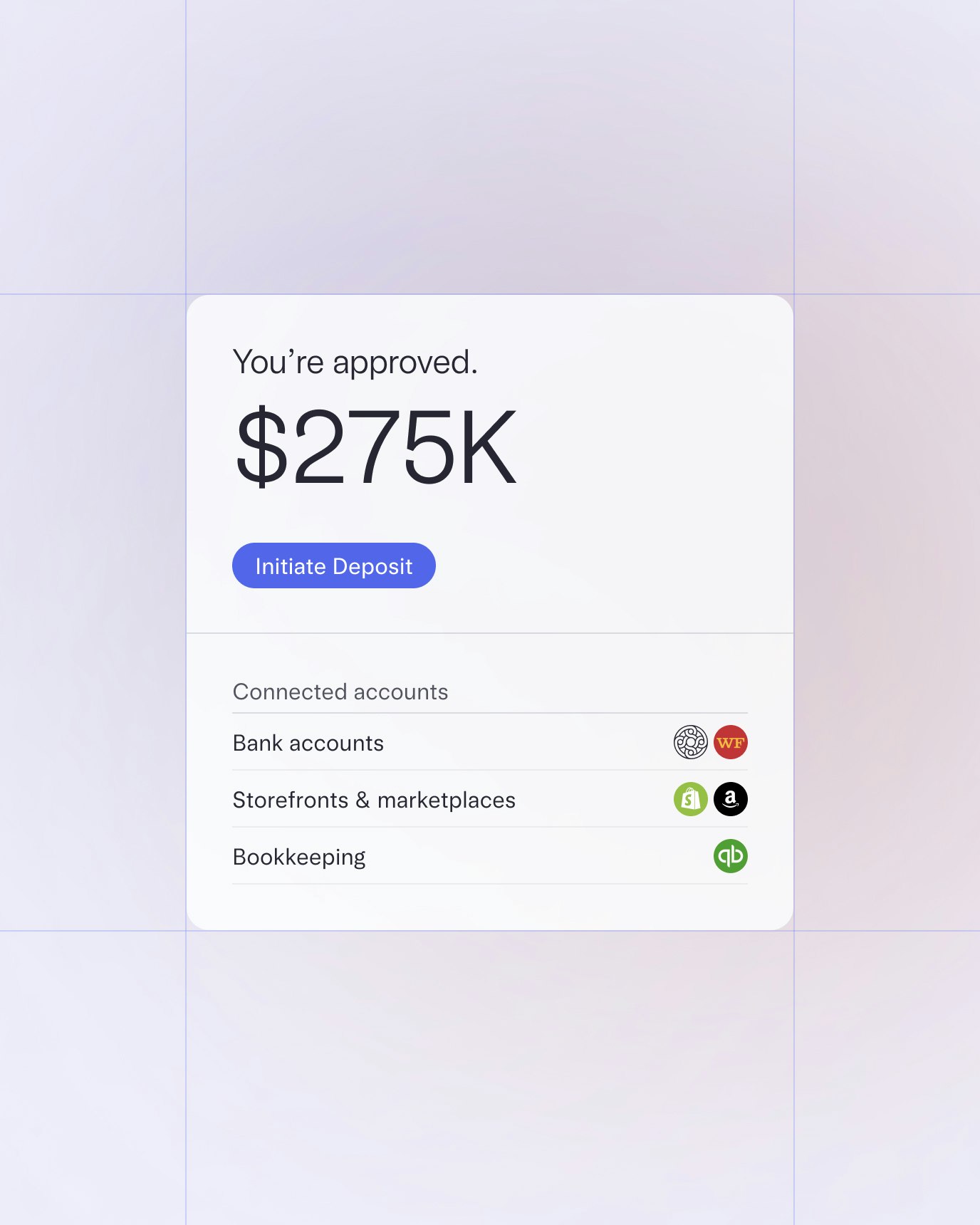

Get the most for your business

With our holistic underwriting process, we look at revenue from all your ecommerce sales platforms to ensure you get the best offer.

Unlock funding that doesn’t hold you back

Use funds for anything your business needs — we trust you to know what’s best.

No personal guarantee, so your personal assets aren’t on the line.

No prepayment fees because we don’t think you should be penalized for growth.

Forecast the road ahead

With fixed weekly payments on your working capital loan, you’ll know exactly how much you’re paying and leave the unpredictability of revenue-based repayment behind.

Simplified banking, lending, and financial workflows all in one place

We’ve had three working capital loans so far and I can say that working with the team at Mercury gives me complete peace of mind. My Ecom Specialist has my back, understands my business, and wants to help me grow.

Brandon Wang

Founder, Capnos