One subscription.Endless ways to optimize.

Build your tomorrow with the best of today’s technology

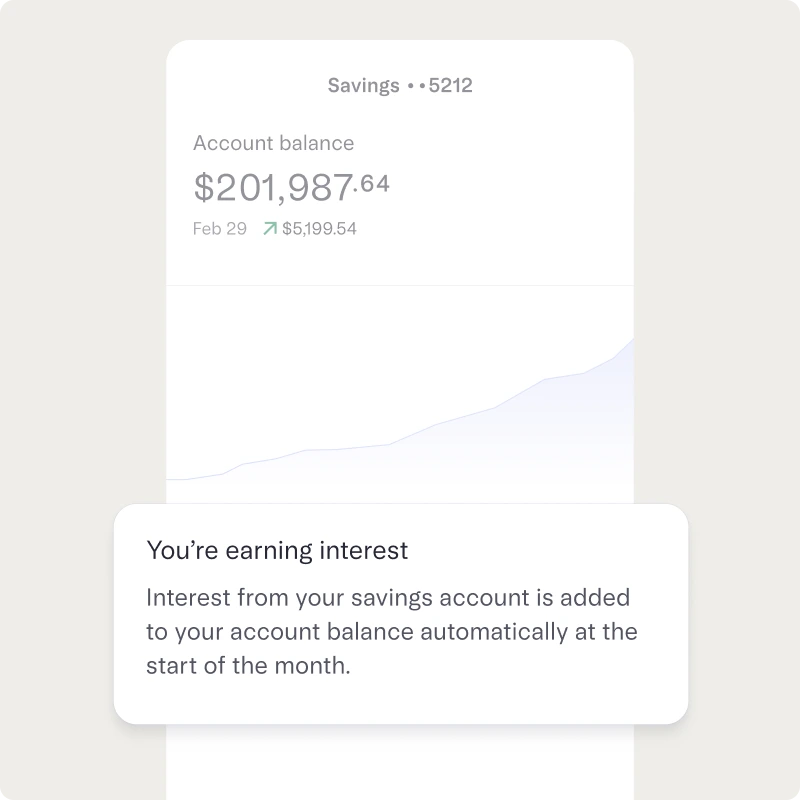

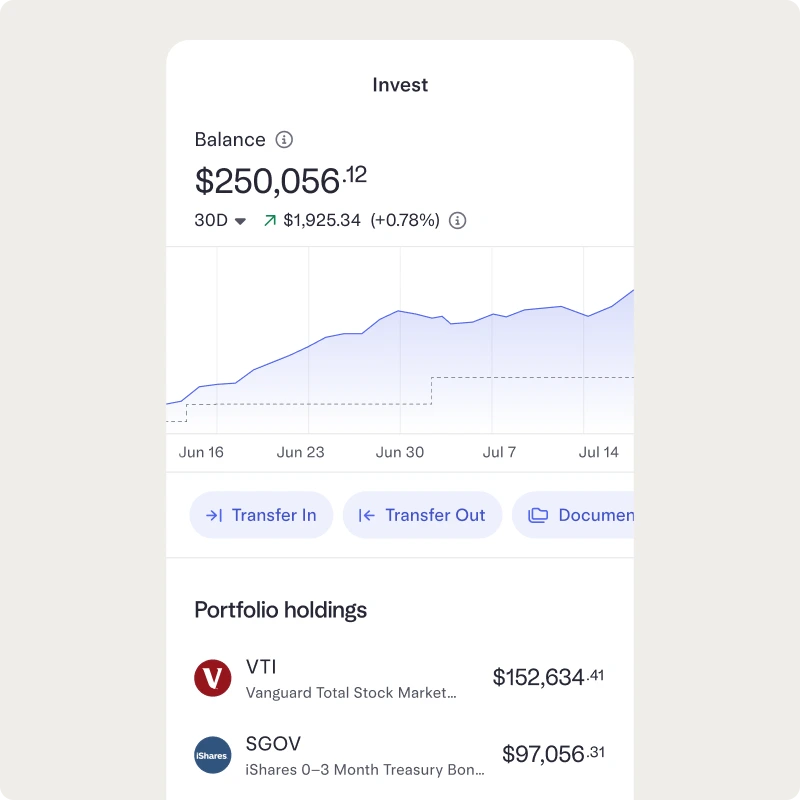

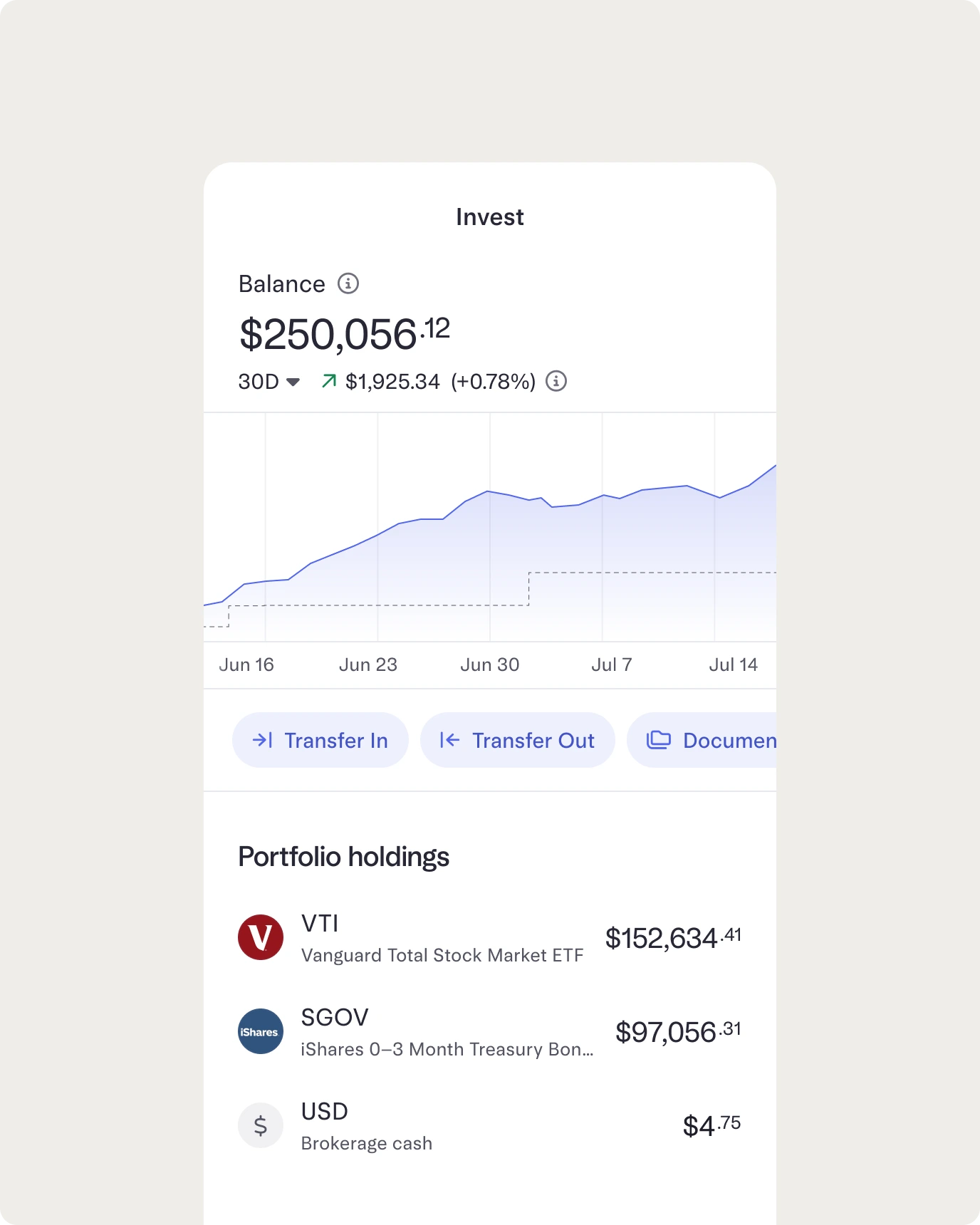

Invest confidently with a diversified portfolio for a low advisory fee of 0.1%

Choose from your preferred mix of low-cost ETFs comprised of U.S. stocks and Treasury bills based on your goals and risk tolerance

Keep more of what you earn with a Treasury bill ETF, typically exempt from state and local tax

Your funds are always liquid so you can access your money when you need it

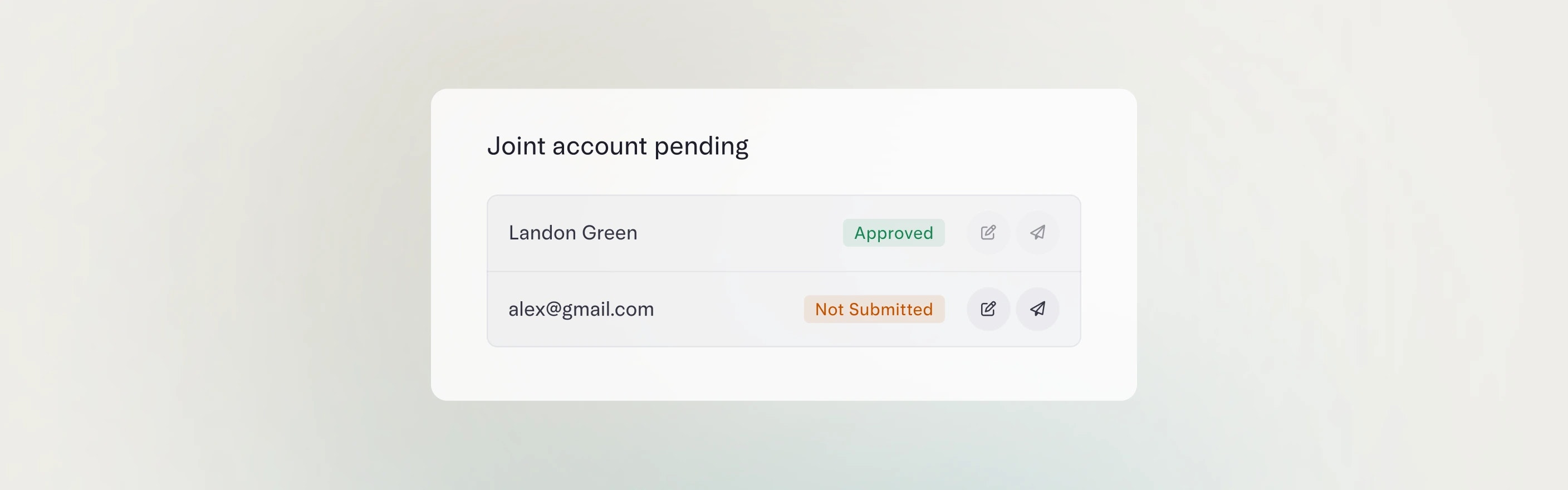

Room for everyone in your life

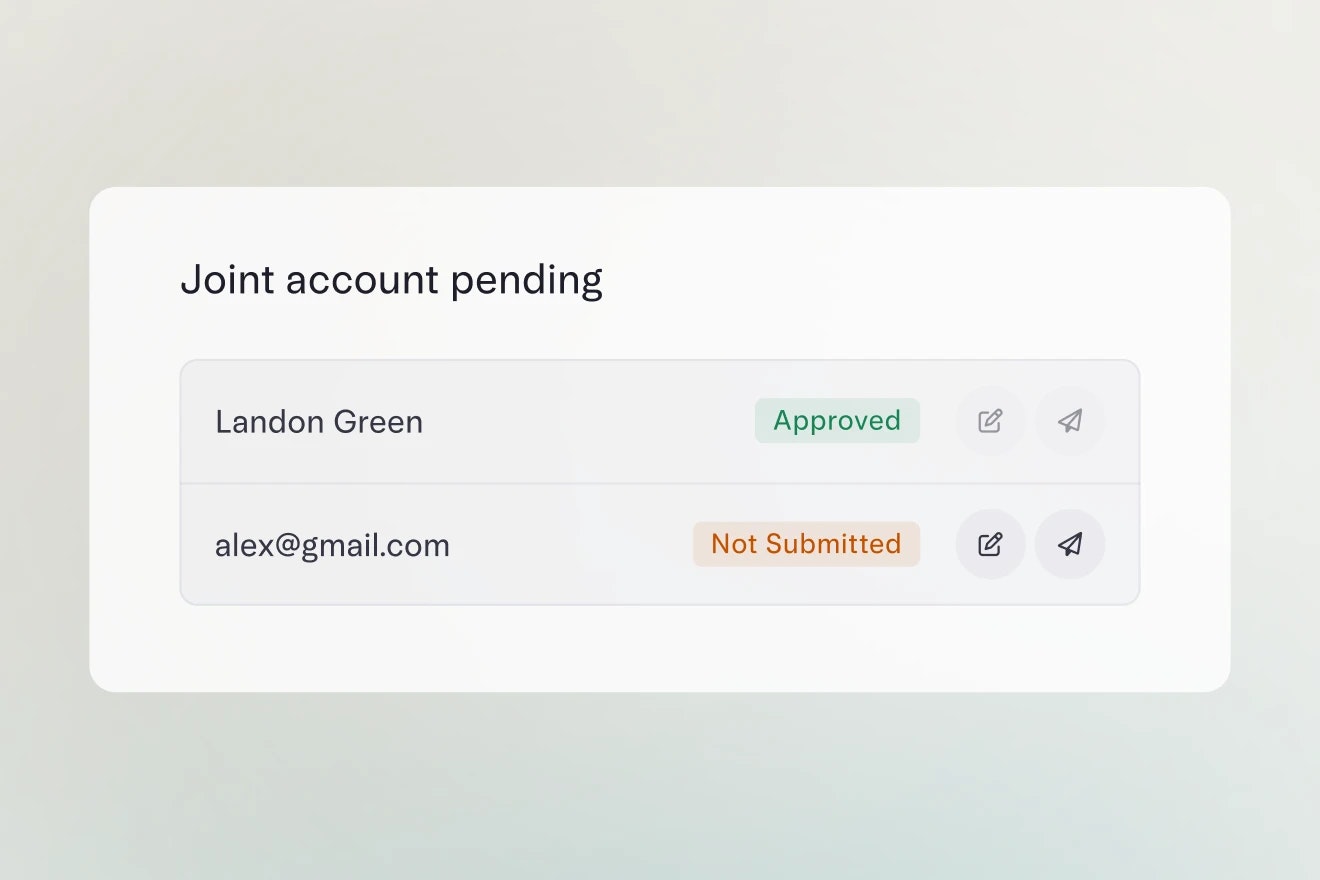

Create a joint account for your shared finances

One joint account for up to four account owners is included with your annual subscription.

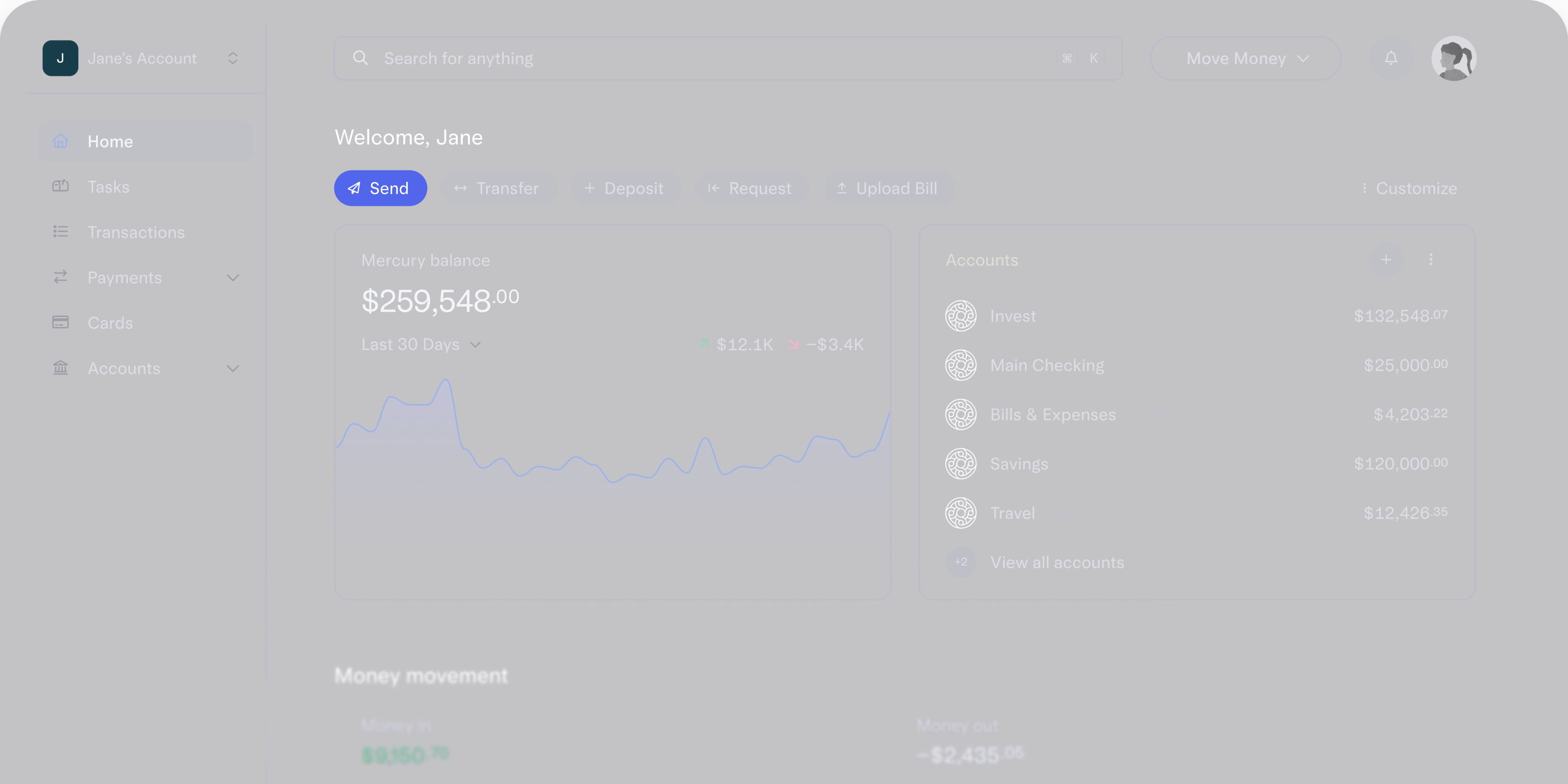

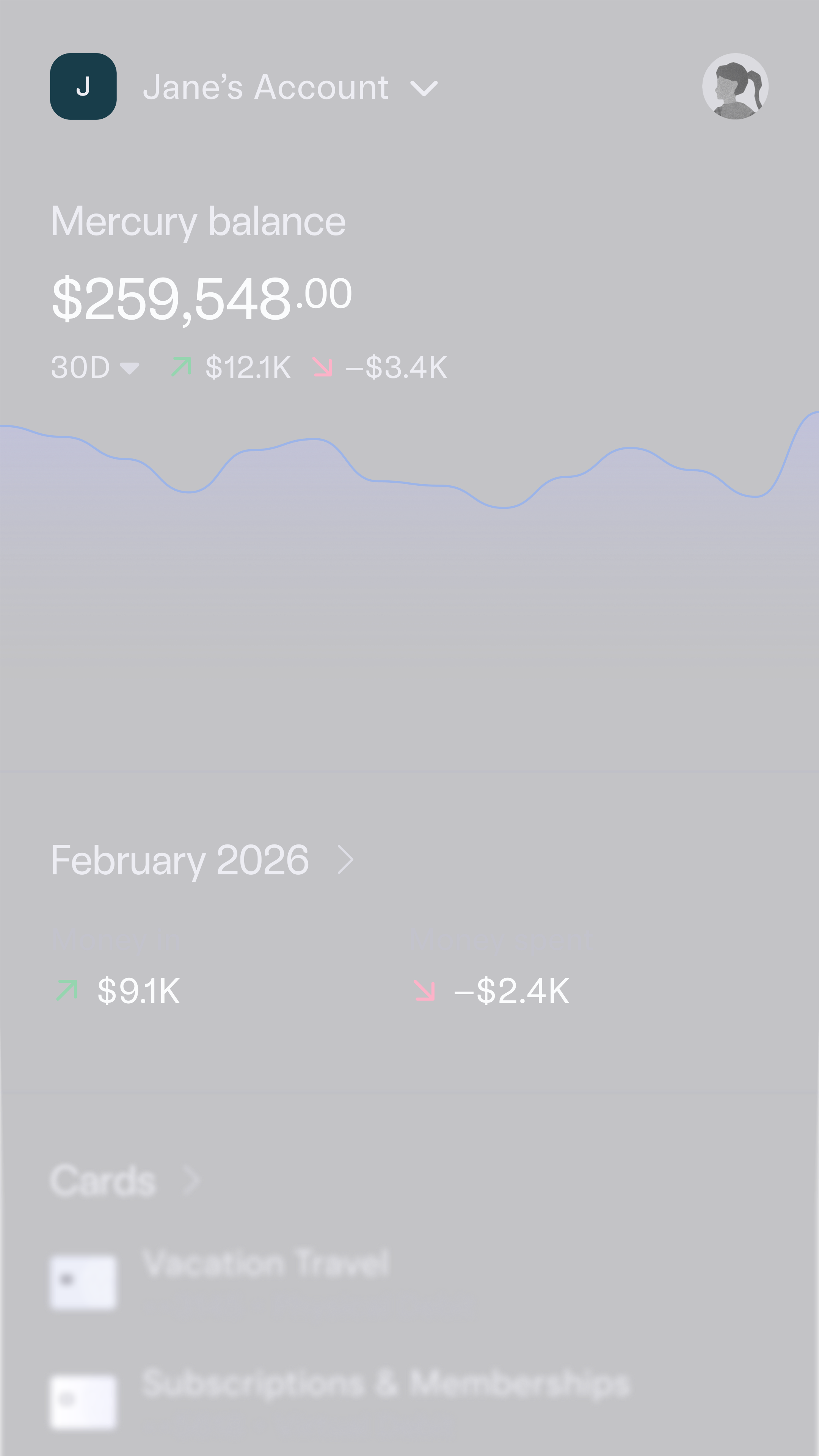

- IncludedUnlimited no-fee domestic wires, ACH, and check payments

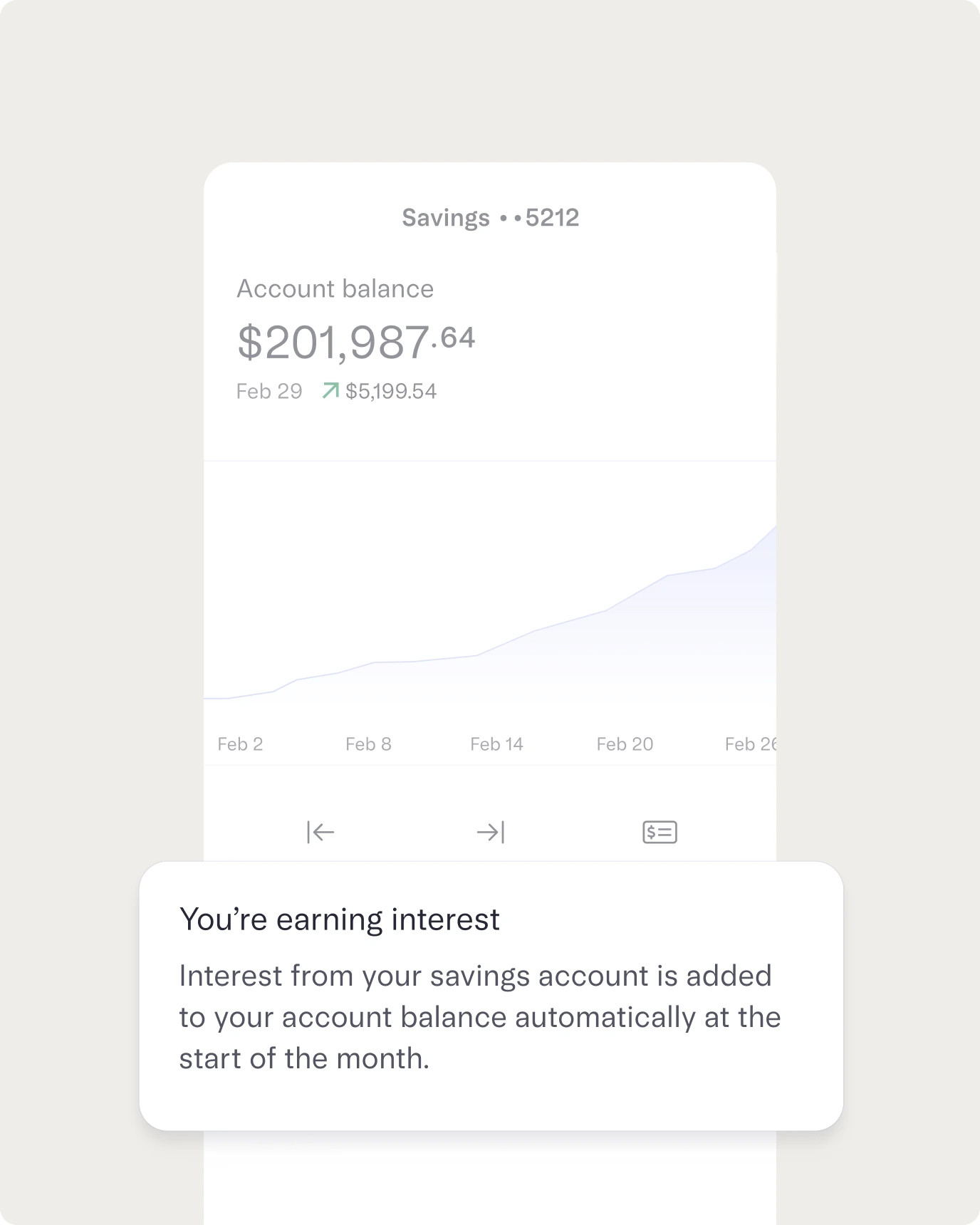

- IncludedMultiple checking and savings accounts

- IncludedOne joint account

- IncludedInternational wires in USD