Tech-forward features for tech-forward companies

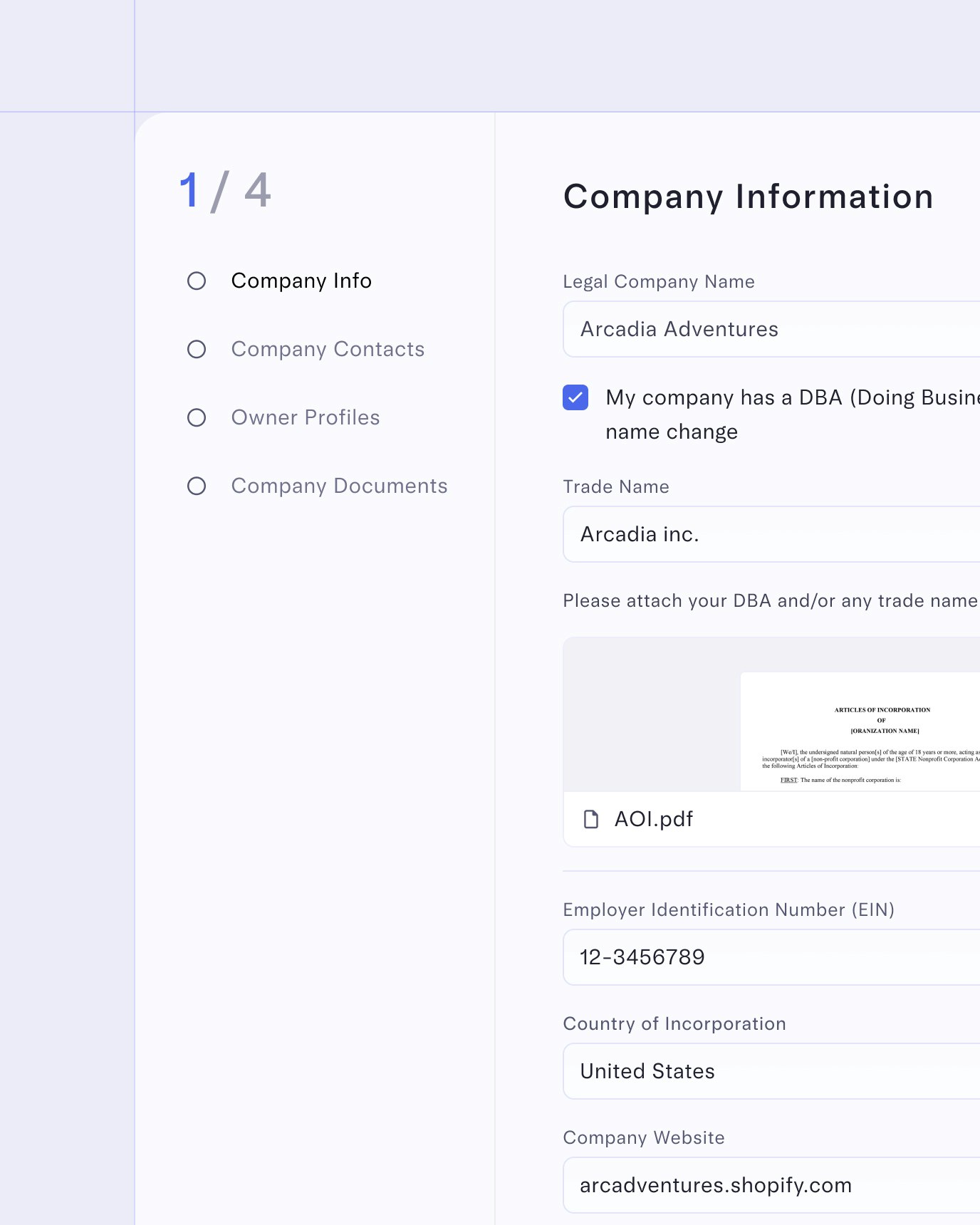

Onboard fast

We understand blockchain-based companies and only ask the right questions. Apply for an account online from just about anywhere.

Open Account

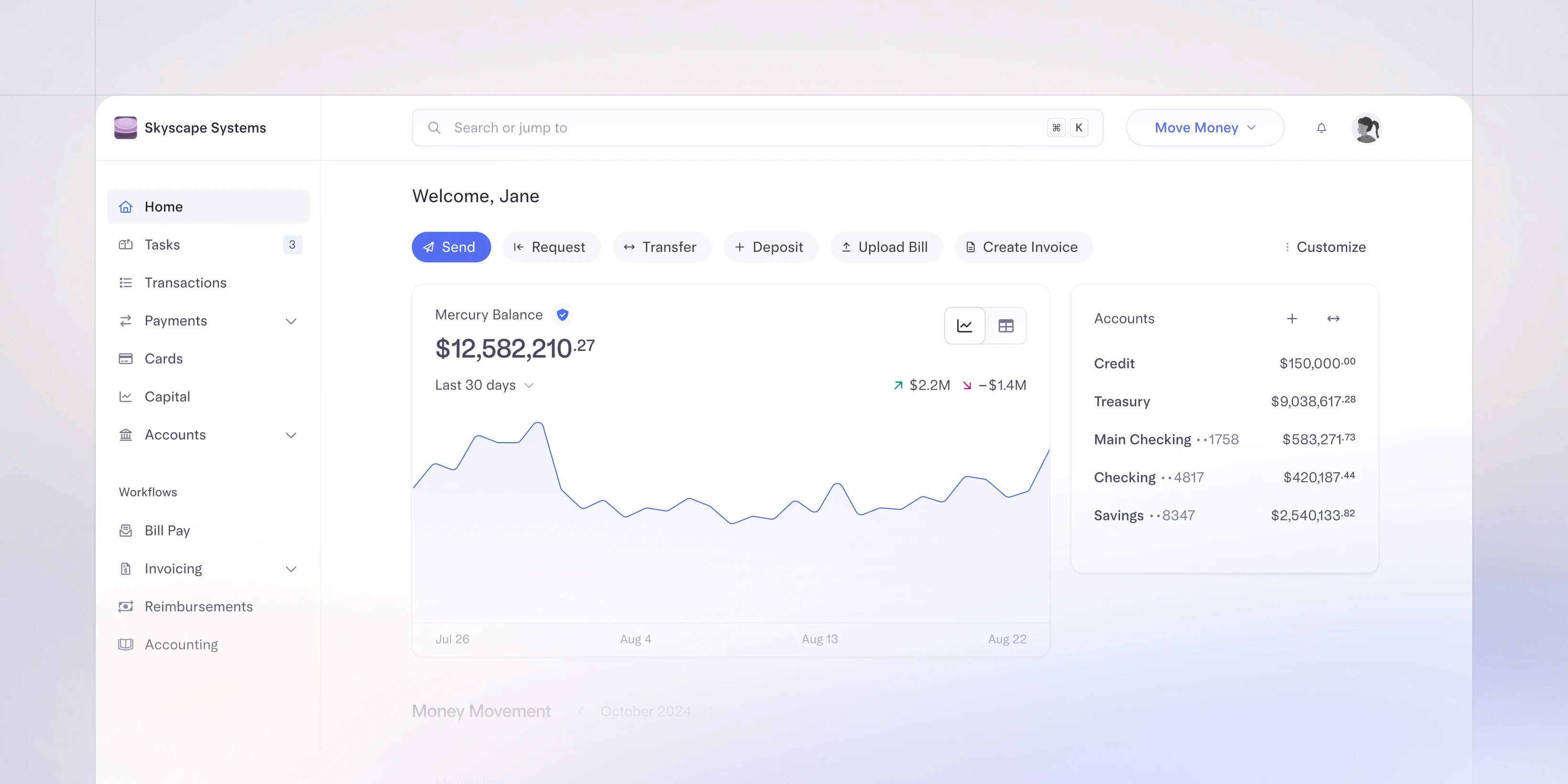

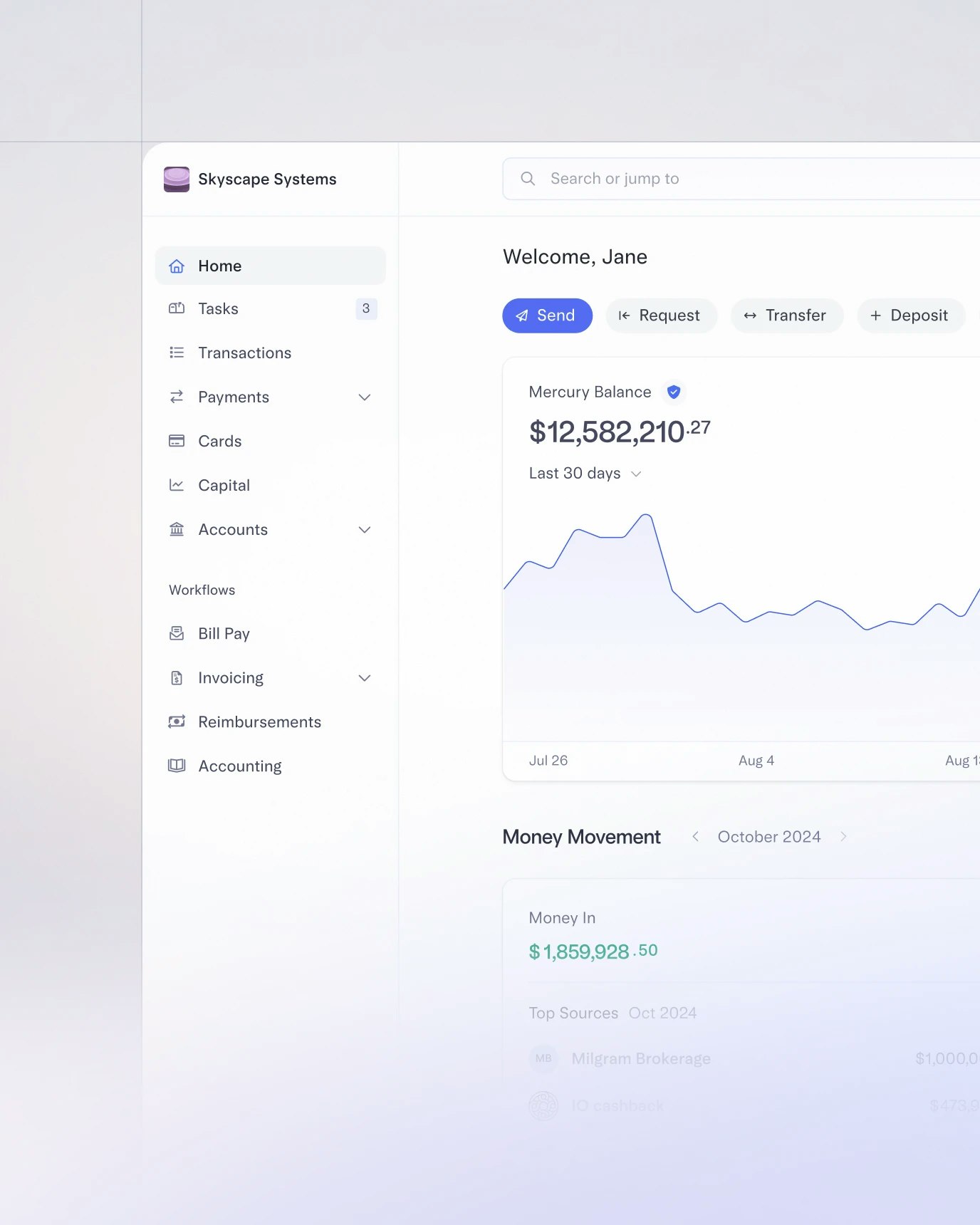

Move money seamlessly

Deposit money and pay vendors in three clicks — your choice of ACH, check, or wire. Send money to crypto exchanges, set up recurring payments, and share receipts.

Issue cards your way

Access credit cards with 1.5% cashback and issue cards in seconds — complete with custom limits, searchable transactions, and user permissions for teammates, bookkeepers, and contractors.

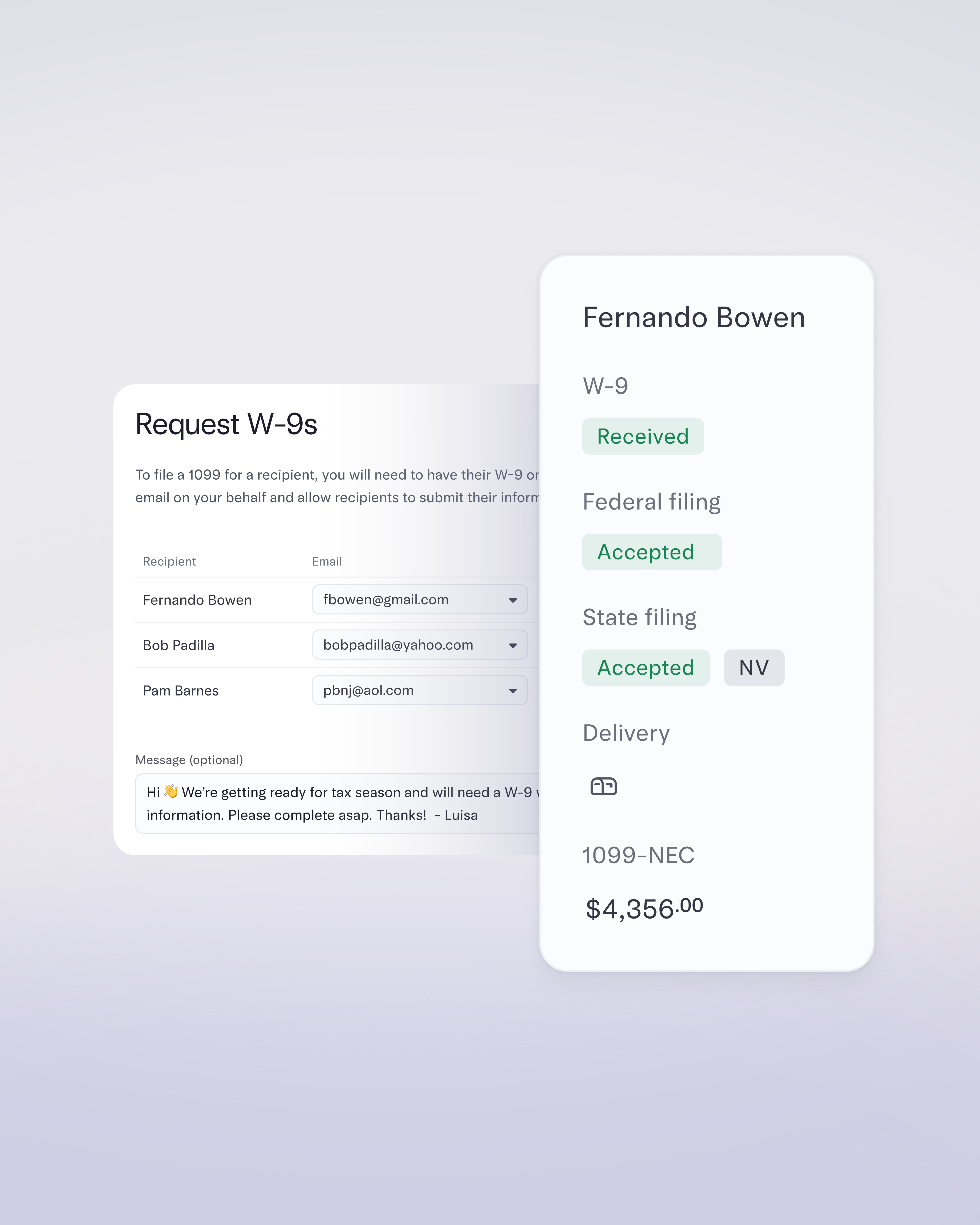

Explore CardsStay efficient and compliant

Track expenses, centralize records, and handle tax essentials like W-9 collection and 1099-NEC/MISC filings. Mercury helps crypto companies stay organized and audit-ready as they grow.

Explore Workflows

Mercury is the no-brainer banking product for every cryptocurrency startup.

Chandan Lodha

Co-founder, CoinTracker