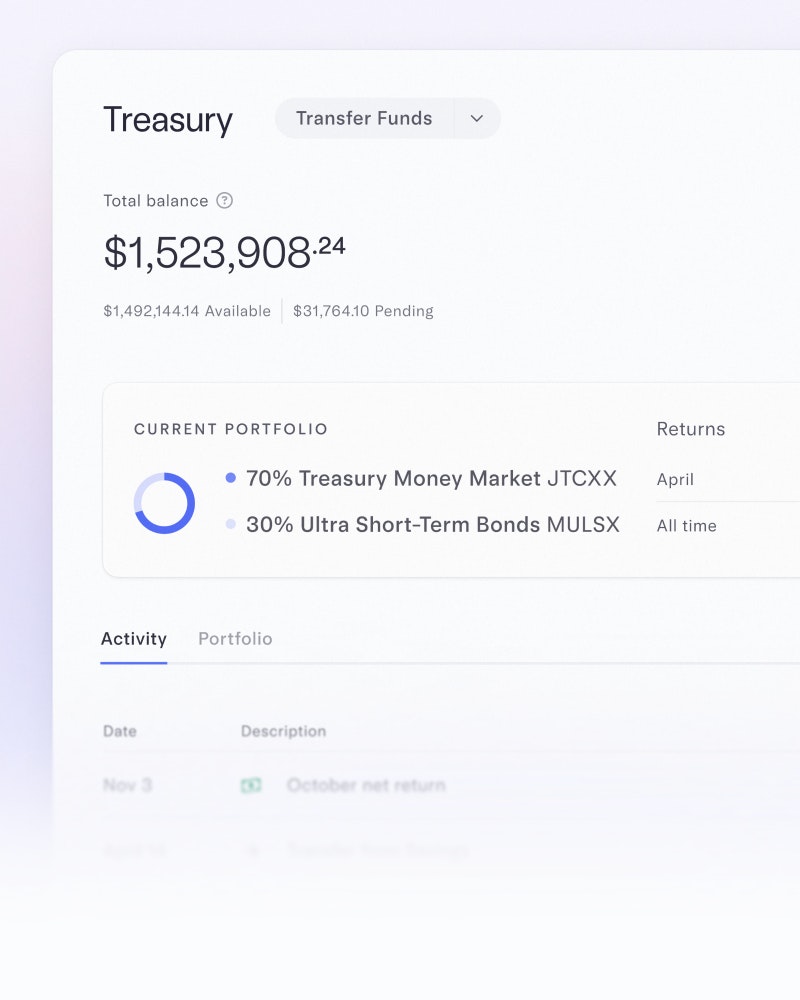

Strategic cash management

made simple

Automate your cash management

Secure your runway

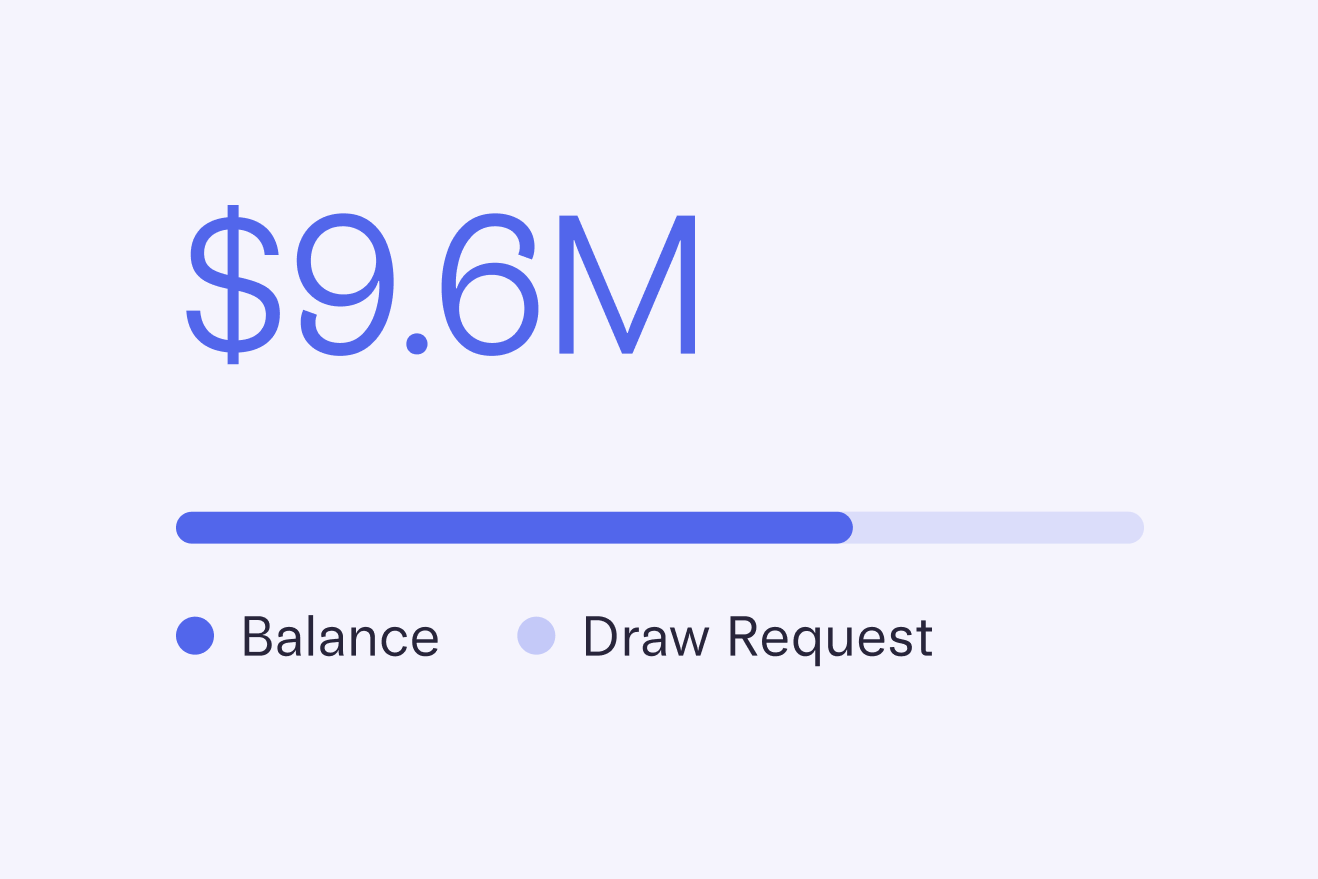

Growth for the long term, flexibility in the short term

Customize your portfolio allocation across top-tier funds

The J.P. Morgan U.S. Treasury Plus Money Market Fund invests in U.S. Treasury bills, notes, and other obligations issued or guaranteed by the U.S. Treasury

The Morgan Stanley Ultra-Short Income Portfolio invests in commercial paper and certificates of deposit and carries the highest Fitch rating

Personalized portfolio management services are available for customers with $25M in Mercury balances

Upgrade to personalized portfolios for a premium experience

Invest on a whole new level with Mercury Treasury Solutions by Morgan Stanley

Contact UsQualify with a $25M balance across Mercury accounts

Maximize yield through a wide range of short-term securities

Get dedicated, white-glove service from Morgan Stanley’s experienced portfolio management team