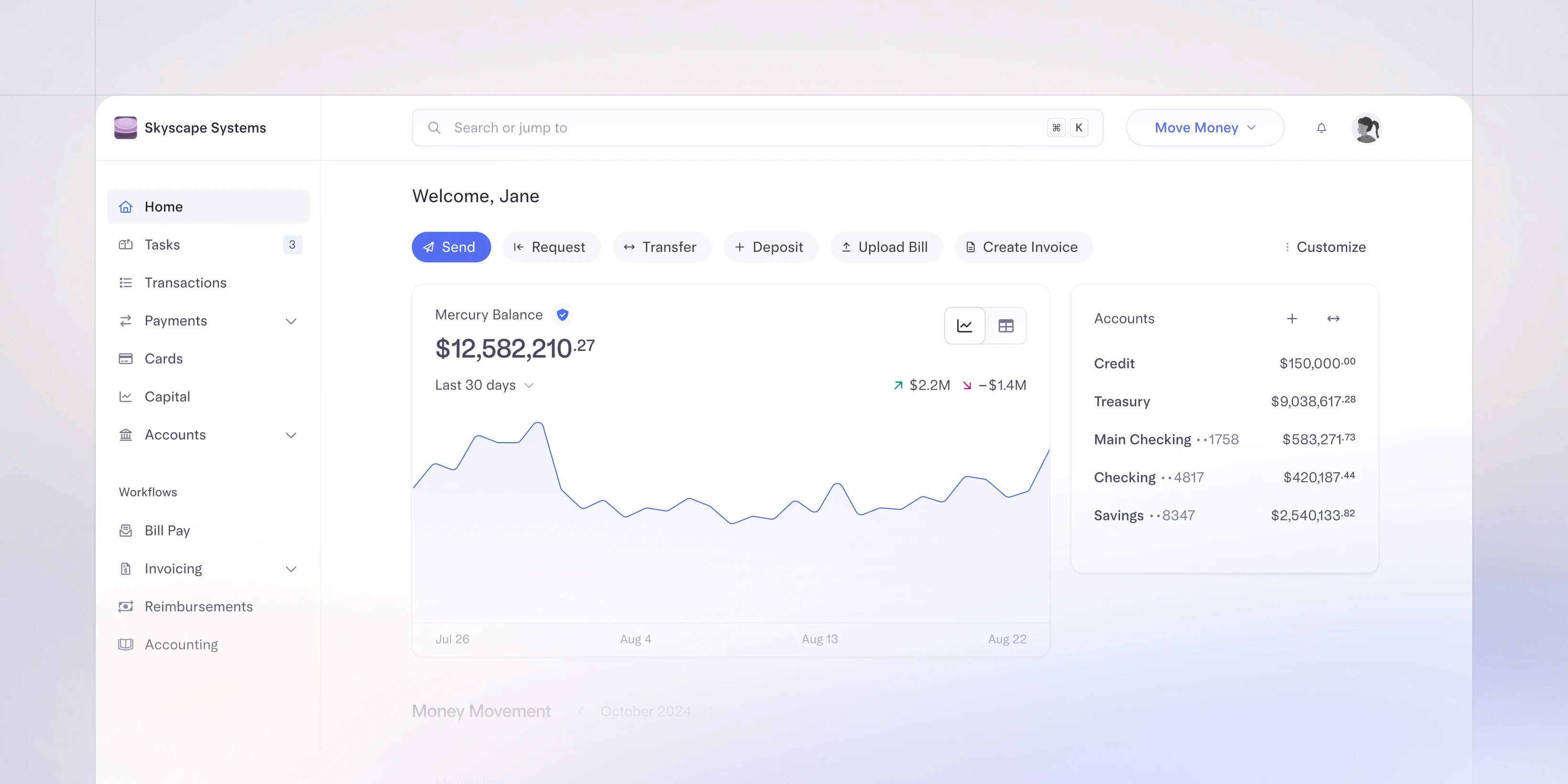

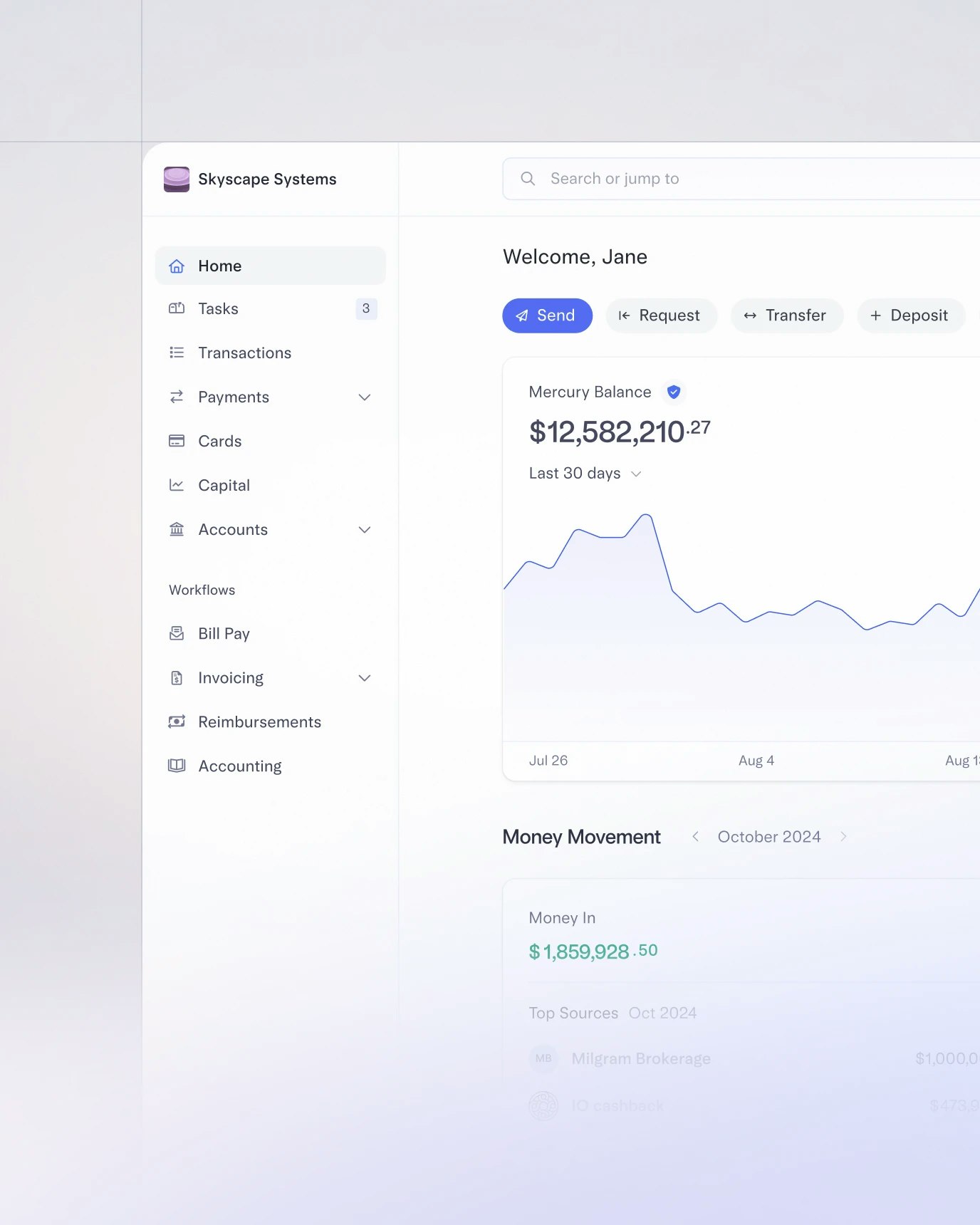

Features made for software companies

Send funds however you want, wherever you want

Pay employees and contractors your way. Schedule free USD wires, ACH payments, and checks on a one-time basis — or automate them at a cadence of your choosing.

Enhance your stack with best-in-class tools

Tee up handy integrations to sync Mercury with your favorite apps, including Xero, QuickBooks, and Zapier. Plus, get additional deals on platforms like AWS and Slack.

Innovation that doesn’t sacrifice security

Security you can count on

Authenticate securely with Touch ID while fraud monitoring and encryption measures keep attackers at bay.

Learn MoreWe’ve been with Mercury since the beginning, and while we’ve grown quickly, Mercury has grown with us. They’re just as useful with $90 million raised as they were at seed.

Ryan Glasgow

CEO, Sprig