How to use multiple business checking accounts for better budgeting

One of the first steps founders take when launching a startup is setting up a dedicated business checking account.

But as the business grows, one account is often no longer enough.

In a world where 16% of startups fail because of financial problems, allocating income and expenses across multiple business checking accounts can give founders a birds-eye view of their startup’s financial situation, helping them make smarter decisions.

And thanks to online banking, organizing and managing a startup’s banking infrastructure is now easier than ever. Let’s explore how multiple business checking accounts can improve budgeting and how a founder might arrange their banking infrastructure for effective income and expense management.

What are the benefits of having multiple business checking accounts?

Maintaining multiple business checking accounts can support your business in a number of key ways:

- Financial organization. Maintaining multiple accounts with specified purposes clarifies a business’s financial status. With a glance, founders can see if they have enough to cover the next payroll cycle or if they can afford that new piece of equipment. If the business is short in one expense category, it can simply move cash from one account to another. Having its finances in order can also make it easier for the business to determine how much runway it has and when it needs to raise a new round of financing.

- Recordkeeping. Most startups create quarterly financial statements — but financial decisions happen a lot more frequently. A startup’s bank statements can provide detailed and timely insight into crucial income and expenses. Leveraging multiple checking accounts can help break those financials down further and give a clear look into category-specific cash flows.

- Tax prep. Having multiple checking accounts makes tax prep easier because it allows the business to automatically set aside cash to cover its quarterly or annual tax bill.

- Manage spend. For specific operating expenses, like software subscriptions and travel, having a designated checking account allows the business to create dedicated credit or debit cards, making it even easier to track these expenses.

- Security. Dividing funds across multiple accounts can safeguard your money from fraudulent activity or a breach in security.

Should you use multiple business checking accounts?

Using multiple business checking accounts can make budgeting clearer, but it isn’t the right solution for every business. The value depends on complexity, scale, and how disciplined your financial operations already are.

For very small businesses or early-stage startups with limited transactions, a single account may be sufficient. When cash flow is simple and expenses are predictable, adding more accounts can create unnecessary overhead.

Multiple accounts tend to become more useful as revenue stabilizes, teams grow, or expenses diversify. Businesses with payroll, recurring operating costs, taxes, and variable spend often benefit from separating funds to reduce the risk of overspending or misallocation.

Industry also matters. Ecommerce businesses with inventory cycles face different budgeting challenges than SaaS companies with recurring revenue. The key question isn’t how many accounts you can have, but whether separation improves clarity and control.

Account setups by industry

Different business models benefit from different account structures.

Tech startups and SaaS companies often separate accounts by function. A common setup includes an operating account for day-to-day expenses, a payroll account to ensure salaries are always funded, and a tax reserve account to avoid surprises at filing time. This structure works well for predictable, recurring revenue.

Agencies and professional services firms may organize accounts around cash flow timing. One account handles client payments, another covers operating expenses, and a third holds retained earnings or owner distributions. This separation helps smooth uneven inflows and avoid spending revenue that hasn’t fully “settled.”

Ecommerce businesses often benefit from more granular separation. Accounts may be designated for inventory purchases, operating expenses, taxes, and profits. Because inventory and ad spend can create large swings in cash flow, isolating these funds reduces the risk of liquidity gaps.

These configurations aren’t rules, but starting points. The best setup reflects how money actually moves through your business.

Downsides of using multiple business checking accounts

While multiple accounts can improve clarity, they also introduce friction.

Bookkeeping becomes more complex as the number of accounts grows. Each account adds reconciliation work and increases the chance of errors if processes aren’t well defined.

Minimum balance requirements and account fees can also add up. Some banks impose balance thresholds or charge fees that make maintaining multiple accounts costly, especially for smaller businesses.

Operationally, transfer timing matters. Moving money between accounts isn’t always instant, which can create short-term cash constraints if funds aren’t positioned correctly ahead of payroll or large payments.

Finally, managing multiple accounts requires discipline. Without clear rules for funding and usage, separation can create confusion rather than control.

Real-world examples by business size

A bootstrapped business earning under $500,000 annually with a small team may start with two accounts: one for operating expenses and one for taxes. This provides basic protection without overcomplicating operations.

A growing company with $1–5 million in annual revenue and multiple employees often benefits from adding a dedicated payroll account. This ensures salaries and benefits are always covered, even when operating expenses fluctuate.

At higher revenue levels or post-funding stages, businesses may introduce additional accounts for retained earnings, large vendor payments, or strategic reserves. At this point, the goal shifts from basic budgeting to risk management and planning.

These examples illustrate progression rather than prescription. The right structure evolves alongside the business.

How does having multiple business checking accounts improve budgeting?

The goal when maintaining multiple business checking accounts is to be able to allocate income across various expense categories automatically. This way, when an expense comes due, the company can tap the account needed to cover the cost — no mental math, no tricky accounting.

But creating dedicated checking accounts requires an understanding of what a business’s major expense categories are. While every business is unique, common startup expense categories include:

- Payroll

- Operations

- Taxes

- Contractors / vendors

Based on the size of each expense, the founder can determine what portion of income should be allocated to each account (e.g., 30% of revenue to payroll, 15% of revenue to taxes, etc.).

This approach allows the business to use its bank as a built-in budgeting tool. If the business were to keep all income in one checking account, it’d be harder to tell if it had the cash to cover expenses.

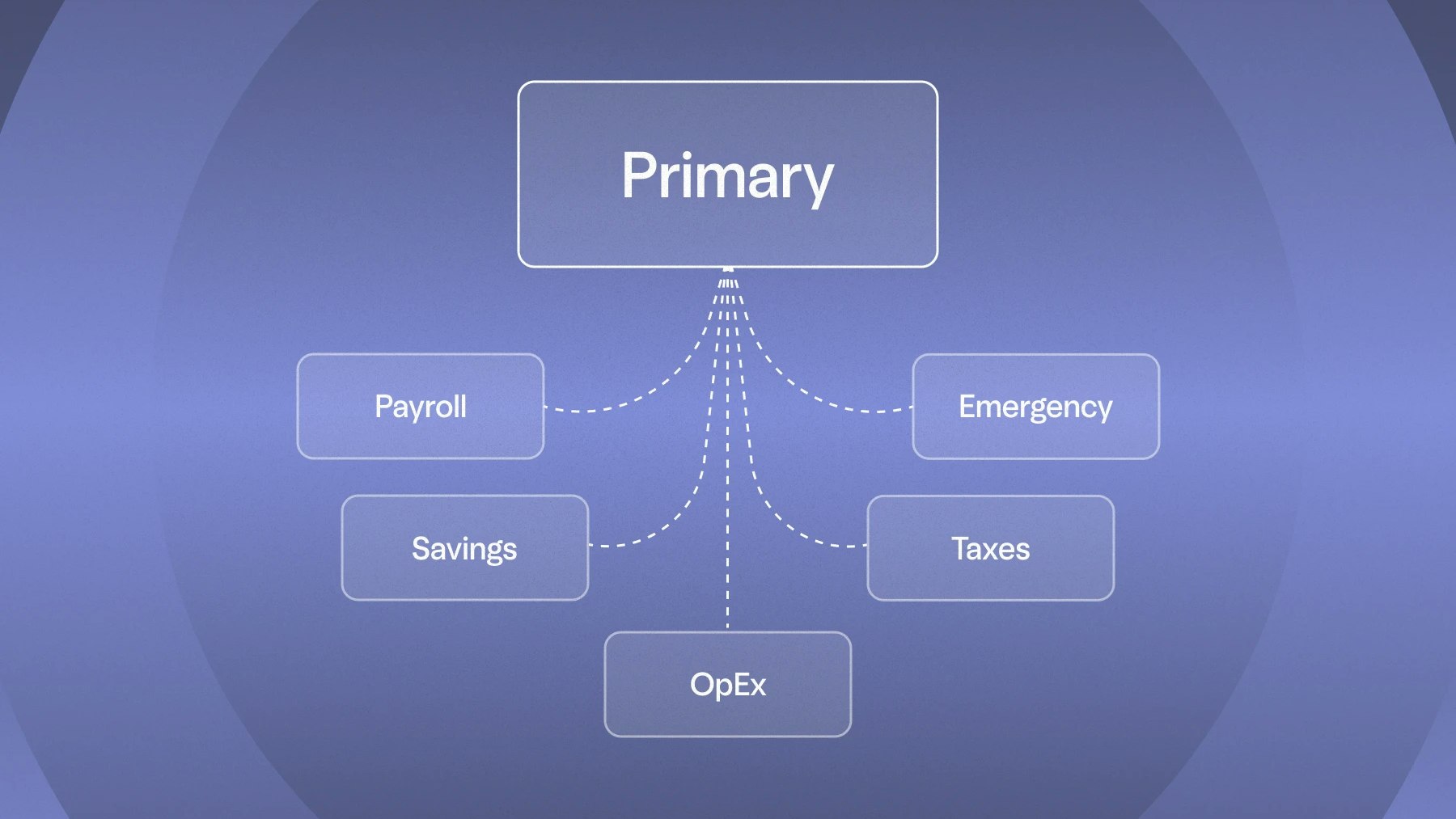

What are some examples of business checking accounts for bucketing your startup’s cash?

Again, the amount of checking accounts a startup may need should depend on the business’s major budget categories. Founders should consider where their business spends the most money and if it would be helpful to hone in on specific expense categories. Here are some examples of startup checking account categories that may be useful for budgeting:

Primary checking account

A primary checking account can be used to collect all business revenues before allocating that cash flow into respective expense accounts. This account should receive all direct deposits, wires, and invoices.

OpEx

An OpEx (operational expense) account should cover recurring monthly expenses related to running your business, such as rent, software subscriptions, third-party vendors, advertising/marketing, and utilities. Depending on the scale of the business and its specific operational costs, it may make sense to break out OpEx even further. For instance, a company that spends a lot on travel each month may consider a dedicated travel checking account. Meanwhile, a business that owns multiple brick-and-mortar stores may want to create separate OpEx accounts for each store.

Payroll

As a startup grows its team, managing payroll becomes increasingly complicated. Organizing a dedicated account for payroll and funding it regularly ensures the business never falls short of its payroll obligations.

Taxes

As mentioned earlier, setting aside cash to cover taxes can provide peace of mind come tax season. It’s a good practice to set aside a portion of all accounts receivable equal to the business’s tax rate and transfer that directly into the tax account every time the company receives a new payment.

Emergency expenses

Startups need to expect the unexpected. An emergency fund will put the business on better footing if and when unforeseen circumstances interrupt cash flow or threaten a company’s ability to carry on with business as usual. A small recurring allocation can prove invaluable when extra funds are needed to run payroll, pay off a debt, or cover a business-critical service.

Accounts receivable

If a business has multiple large revenue streams, it can make sense to divvy up this income into different checking accounts rather than collect them all in one primary checking account. This approach can provide better insight into a business’s revenue generators. For instance, a company with multiple brick-and-mortar stores may want to collect the revenues for each locale in separate accounts — such as they might do with OpEx — to see how their performance compares.

Savings

Aside from these business checking accounts, a startup should also aim to set aside cash in a savings account for significant future expenses. The savings account should ideally be interest-bearing so that idle cash can go to work for the business.

How to allocate money into multiple business checking accounts

How much you choose to allocate to each business checking account will largely depends on the startup’s unique financial situation. Generally speaking, startups allocate a lion's share of their income to covering payroll and operations. When determining how to allocate income, it’s helpful to focus on the total revenue the startup brings in every month, and how that cash should be distributed across various accounts based on the business’s largest expenses.

Consider a startup that generates $15K per month in revenue, where payroll comprises about 50% of expenses, operations comprises about 25–30%, and taxes comprise around 20% (the average federal tax rate for small businesses). Here’s how such a startup might consider distributing income into its various business checking accounts:

$15K monthly income | $7.5K to payroll account |

$5K to OpEx account | |

$2K to tax account | |

$250 to emergency account | |

$250 to savings account |

Risks of mismanaging multiple accounts

Poorly managed account separation can introduce real risk.

Underfunding tax or payroll accounts can lead to missed obligations, penalties, or compliance issues. Treating these accounts as flexible spending pools defeats their purpose.

Liquidity gaps are another concern. Spreading funds too thinly across accounts can make a business appear solvent on paper while lacking sufficient cash in the right place at the right time.

Clear rules for how and when money moves between accounts are essential. Without them, multiple accounts can create a false sense of security rather than genuine financial control.

Are multiple business checking accounts right for me?

Multiple business checking accounts can help growing businesses be more thoughtful about managing cash flow. However, it’s important not to complicate things too early. A small startup with limited revenue streams and expenses often only needs a single business checking account to manage money effectively.

In the early days of a business, it can also be distracting for the founders to manage the added obligations that come with maintaining multiple business checking accounts (e.g., maintaining minimum account balances, tracking transaction limits, etc.).

We recommend founders look into opening additional business checking accounts after seeing a large cash inflow, such as from a fundraising round.

Common business checking account types and when to use them

Account type | Primary purpose | When it helps most | Who benefits |

|---|---|---|---|

Operating account | Day-to-day expenses | Core spending management | All businesses |

Payroll account | Salaries and benefits | Regular payroll cycles | Growing teams |

Tax reserve account | Income and payroll taxes | Avoiding tax surprises | Profitable businesses |

Inventory account | Stock purchases | Managing inventory cycles | Ecommerce |

Profit or reserve account | Retained earnings | Long-term planning | Established businesses |

Scaling your business means being smart about how you manage money. Setting up multiple business checking accounts to handle major cash inflows and outflows is a great way to ensure you’re working within your budget and positioning your business for long-term success.

Mercury allows businesses to open and manage multiple checking accounts within a single platform, making it easier to separate funds by purpose without juggling multiple banking providers. This structure can support budgeting, payroll planning, and cash management while keeping visibility centralized.

- Open up to 100 checking accounts and 100 savings accounts with unique account numbers at no additional cost.

- Bank efficiently with automations that move funds between accounts based on custom rules you create.

- Manage spend with debit and business credit cards attached to individual accounts with custom limits.

- Simplify payments with infrastructure that facilitates ACH, checks, foreign exchange, and recurring payments.

- Improve bookkeeping with seamless integrations with QuickBooks and Stripe.

- Grow your business with tools that make it easy to connect with investors and manage your fundraise, including creating a SAFE (Simple Agreement for Future Equity).

- Make your money work for you with Treasury, which allows startups to earn competitive yield on idle cash annually.

With Mercury, founders can also manage all their accounts from one virtual dashboard. To see a Mercury account in action, try our product demo.

Related reads

Three-way matching: How to incorporate it into your accounts payable process

Deferred revenue explained: Why getting paid isn’t the same as earning revenue

Invoice coding best practices for startups