Easily manage employee expenses with reimbursements, cards, and expanded spend policies on Mercury

Today, Mercury introduces expense reimbursements and expanded spend policies — complementing our corporate debit and credit cards to offer a complete expense management solution.

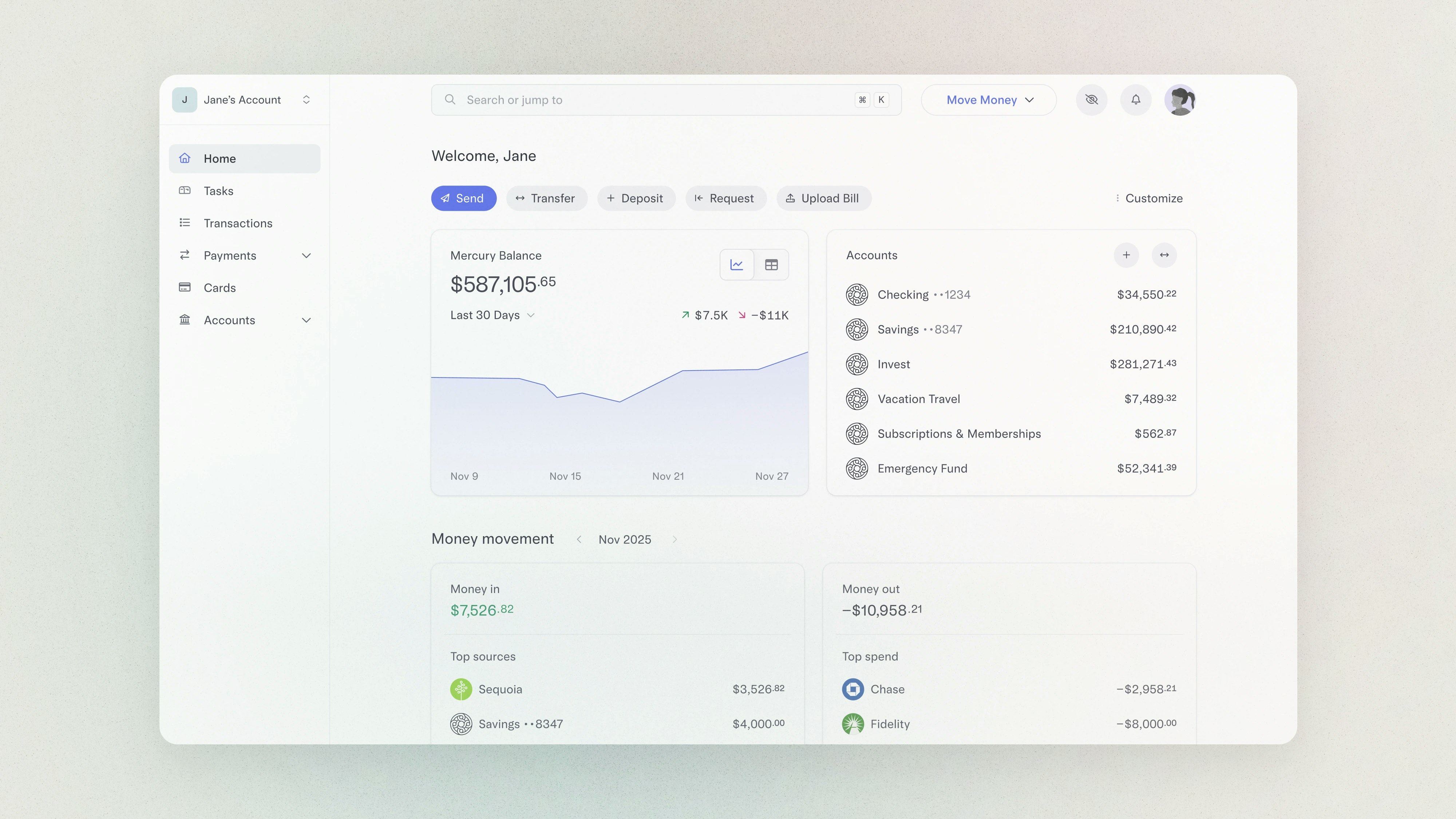

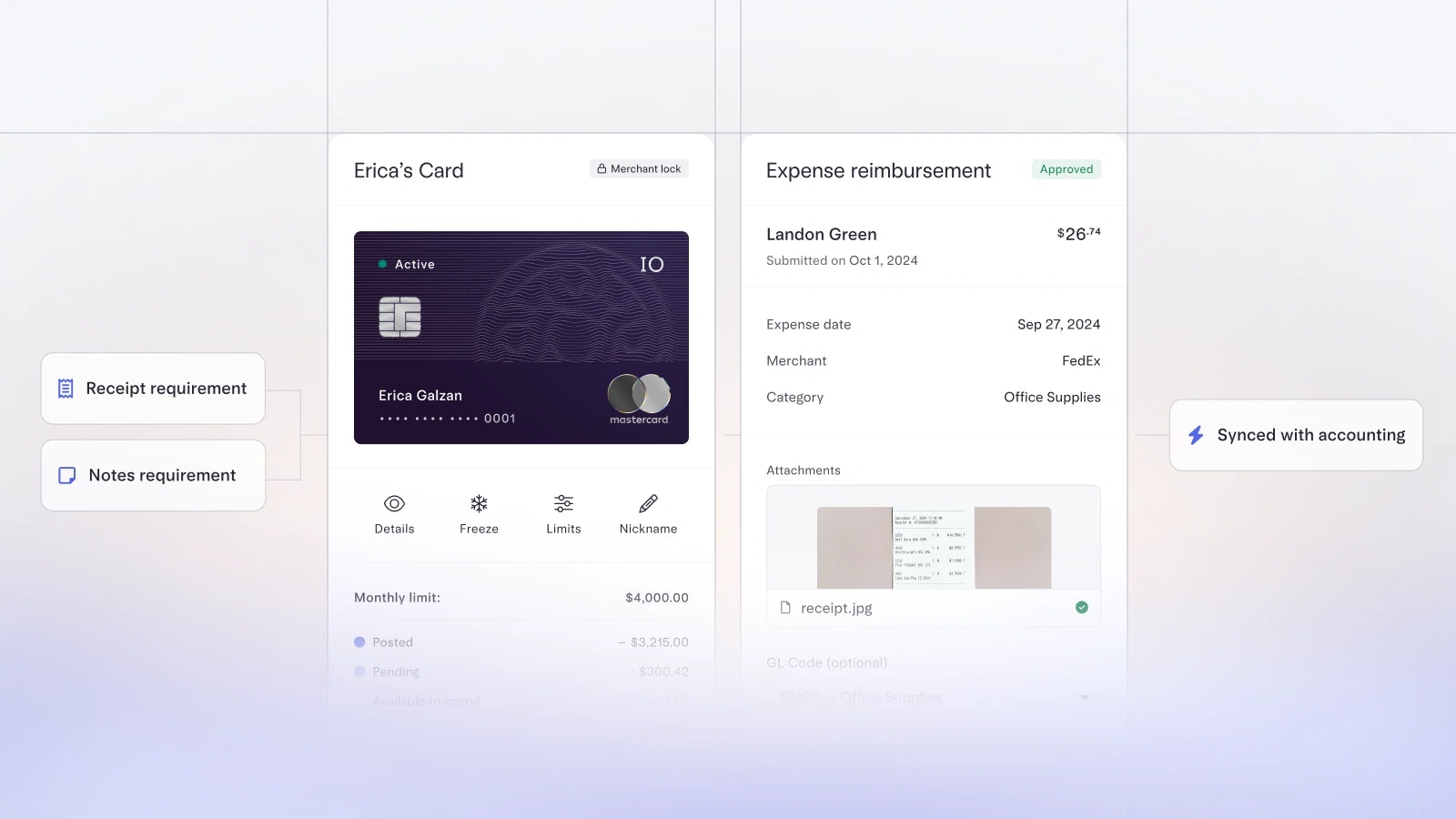

Now, you can easily review, approve, and process reimbursements for your team’s out-of-pocket expenses right from your Mercury dashboard. That means no more chasing receipts, frustrating back and forth with employees, or inefficiently toggling between accounting platforms and spreadsheets.

Assemble an expense management toolkit that works for your company’s needs by reimbursing out-of-pocket expenses, issuing corporate cards, or both. Plus, set policies for all the ways your employees spend from one centralized location to give you and your team more time and peace of mind as you control expenses on autopilot.

This is one more way that Mercury is simplifying financial workflows by powering them from the one thing every business needs: a bank account.

Manage employee expenses your way with cards and reimbursements together

Mercury’s debit and credit cards have laid the groundwork for our employee expense management program. Back in 2022, we launched the IO credit card, which at the time was the most requested product from our customers. Fast-forward two years, and IO has grown significantly, with total monthly spend increasing more than 3X in the last year alone.

We’ve continued to listen to our customers’ needs to build on that foundation, and that’s what brought us to launching expense reimbursements today. We talked to companies of various sizes and stages to learn what they’re looking for in their expense management tools. The answer? Efficiency, flexibility, and control.

Efficiently reimburse expenses

We know that when you’re a startup, time is money. Expense reimbursements built into your account make it quick and easy to reimburse your team for out-of-pocket expenses — rather than adding another new tool to your tech stack.

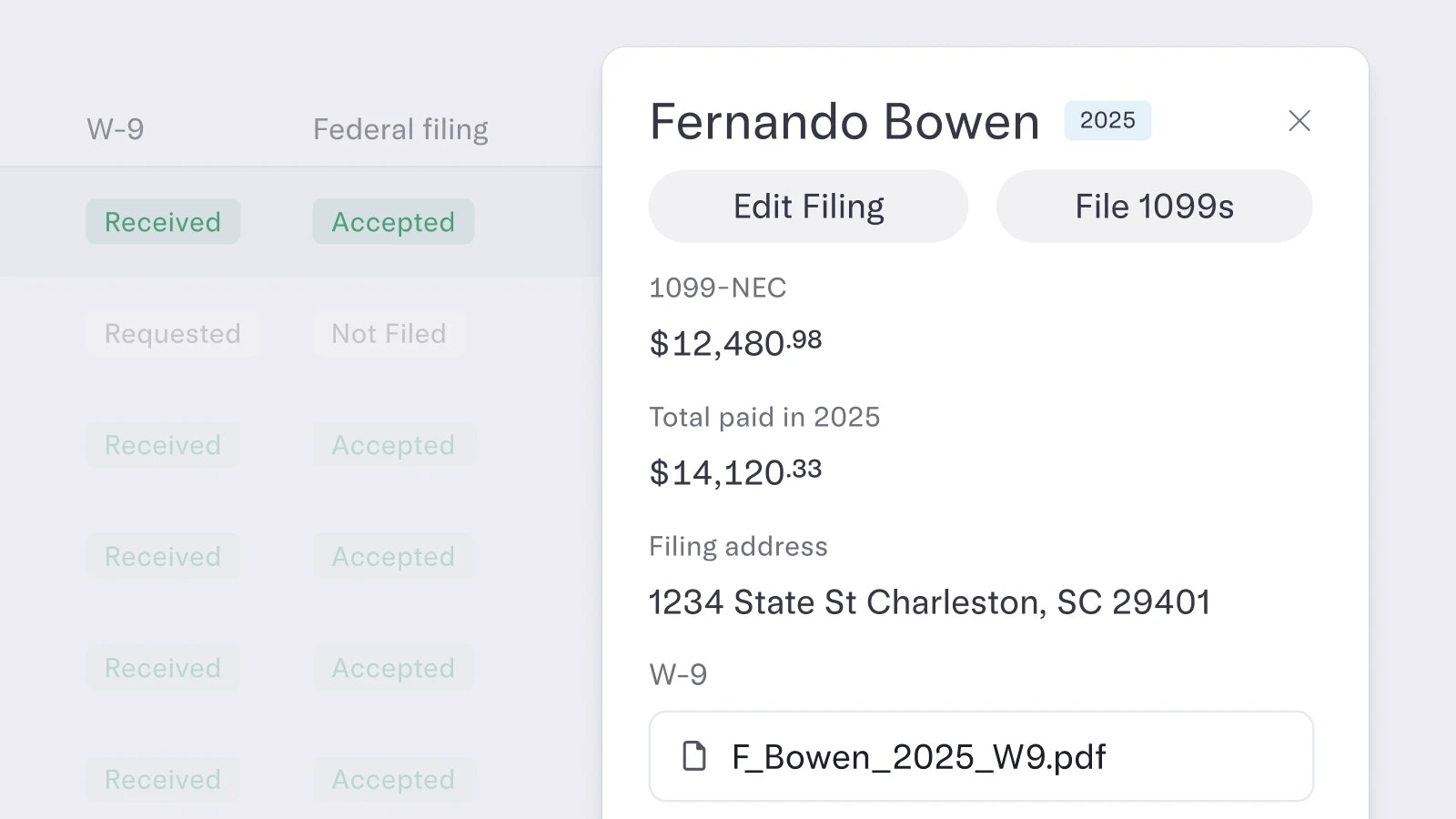

- Invite employees to submit expenses without granting access to your bank account details via bulk email invite or Google Workspace integration

- Employees can submit expenses and upload receipts in seconds, with transaction details automatically populating from receipts

- Set policies upfront for receipts and notes, and then approve and process reimbursements in two clicks, individually or in bulk

- Reimburse mileage at the standardized IRS rate and reimburse expenses incurred in foreign currencies

- Automatically sync expenses to your accounting software with categories and GL codes, for a simpler month-end close

It’s free to enable reimbursements for your whole company, for users to submit expenses, and to reimburse expenses for up to five active users per month. You can upgrade to one of our paid plans if you need to reimburse expenses for more than five users per month.

Try Reimbursements

Get the flexibility your business needs

Our new expense reimbursements complement our corporate debit and IO credit cards, and give operators the versatility growing businesses need. Cards enable you to establish guardrails from the get-go, effectively pre-approving spend and saving you the need to review transactions. Reimbursements, on the other hand, give you the opportunity to review and approve or deny spend with after-the-fact payouts.

There is no one-size-fits-all approach to employee expense management. What worked with just you and your co-founder may not work when you have upwards of twenty or two hundred employees. Now, you can reimburse expenses, issue corporate cards, or both. Depending on your preference, you might want to take one of the following approaches:

- Issue corporate cards to teams that spend regularly, and process reimbursements for employees with infrequent expenses.

- Use cards for specific recurring spend, like a merchant-locked card for advertising spend on Google, or a card with a monthly spend limit for software purchases.

- Issue cards for specific uses such as a temporary card for a week-long team onsite.

- Opt to use reimbursements exclusively, so that you can review all expenses before approving them.

With the addition of reimbursements, you now have a proverbial Swiss Army Knife of expense management tools to adapt to your unique needs.

New expanded company-wide spend policies

No matter how your employees spend, you need to stay in control. That’s why we’re also rolling out expanded spend policies that you can set and manage for card transactions and reimbursements, all from one central location in your Mercury dashboard.

Controlling spend is simple with spend policies

Companies often think of “policies” as only meaning travel policies and not being relevant until later in a startup’s lifecycle — but in reality, it’s best to implement spend policies as soon as your employees start making purchases. Preemptively setting company-wide policies is a win-win: you can set them once without spending time reviewing every single transaction and your team can move forward with essential purchases without being slowed down by approvals.

Example policies you may consider setting include:

- Receipt requirements. Require receipts for card transactions or expenses over $75. (You can choose any dollar threshold you like, but $75 is the IRS requirement.)

- Note requirements. Set a lower dollar threshold for requiring notes, making it easy to quickly review transactions.

- Expense submission timeframes. Set a maximum of 30 days from the purchase date for expense submissions.

- Category and merchant restrictions. Set restrictions at the card-specific or company-wide level. For example, you might want to create a card locked to a specific software provider; or you might want to block spend on “Alcohol & Bars” across your company.

What you can expect next

Our employee expense platform brings together corporate cards, reimbursements, policies and other spend controls, granular user permissions, and automatic syncing to accounting software – all directly integrated with your bank account for a single source of truth on employee spend.

We’re continuing to evolve our employee expense management platform and have more exciting updates in the works, including:

- Receipt matching. Email receipts and we’ll automatically match them to card transactions.

- Integrations with HR and payroll systems. Sync employee data to Mercury from HR and payroll systems so you only have to maintain one record of employees.

Managing employee expenses shouldn’t be a full-time job — both you and your team have those already. That’s why Mercury is continuing to build more flexible tools that operators and growing teams can implement to simplify their financial work, recoup their time, and ensure every dollar spent moves their business forward. Here’s to time and money well spent.