The card for day one — and every day after that

Credit Card Underwriting Manager at Mercury.

Build business credit and earn cashback from day one of your business — no personal guarantee, no minimum balance — and get the controls and scalability to support your team as your company grows.

Getting a business credit card usually means jumping through hoops, like high balance requirements, personal credit checks, or waiting weeks for your application to be approved. With IO, eligible companies can now access a business credit card the moment they open a Mercury account.

This builds on everything our customers already love about IO, including:

- Unlimited 1.5% cashback

- No personal guarantee

- No minimum balance

- No separate application

- Spend management tools that scale with your business

Since launching IO in 2022, we’ve been steadily expanding access and rethinking business credit as something you build on, not wait for. With today’s updates, we’re ensuring that founders have the cards and spend management tools they need to build great things, from day one onward.

Business credit that works for you

More than 80,000 businesses have already integrated IO into their spending stack to build business credit, earn cashback, and manage team spending. And with our new early access model, IO will now be available to more businesses than ever. Limits are based on your total Mercury balance, with limits that evolve as your cash balance grows: New customers with lower balances pay off IO daily and can switch to 30-day terms once they reach $15K. It’s a simple, scalable way to start building business credit from your very first purchase and earning cashback on all your spend.

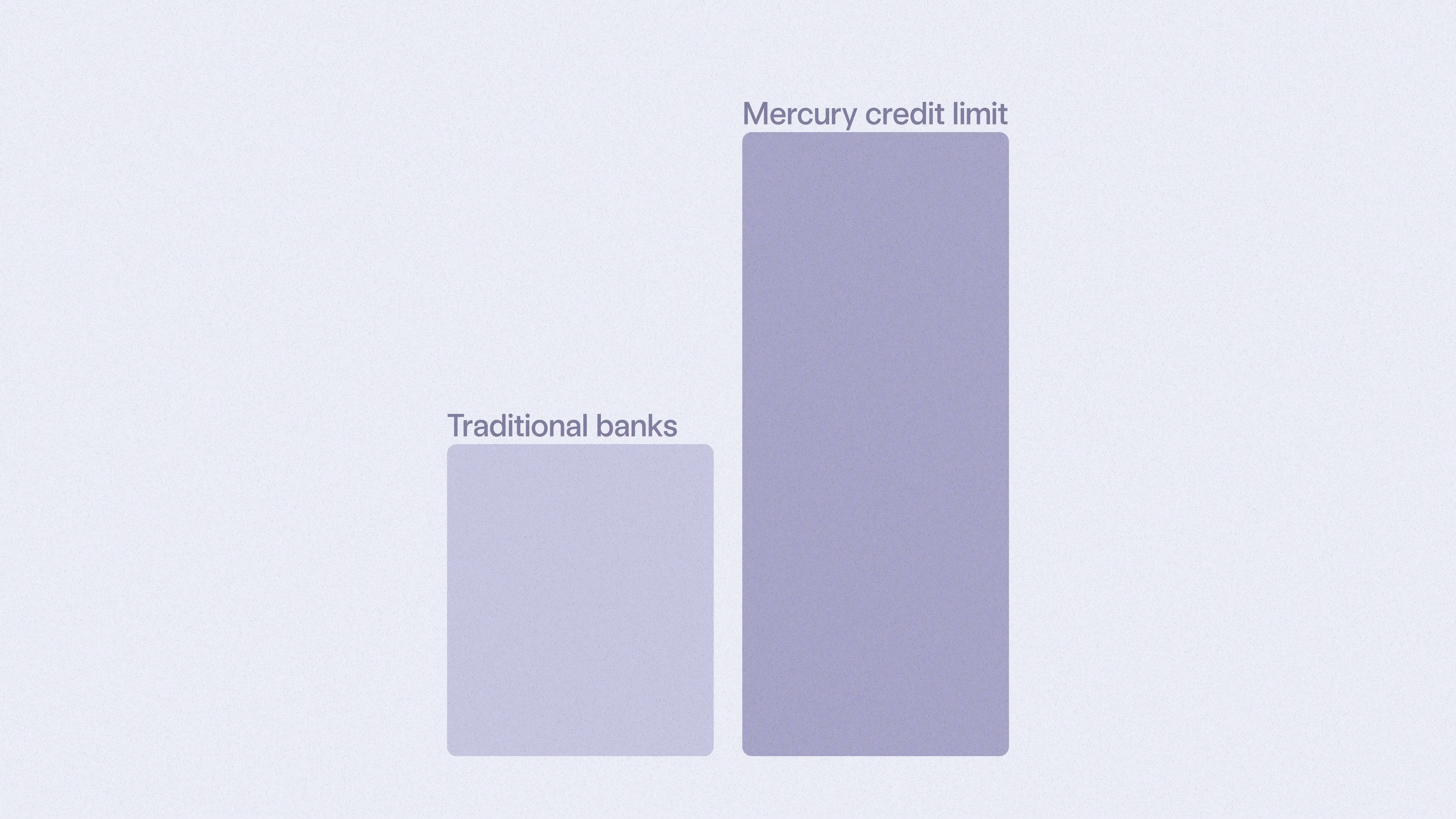

Even higher credit limits to fuel your ambition

IO consistently offers some of the highest limits of any cash-based business credit card — and now those limits go even further. In addition to expanding access to IO from day one, we’ve also improved our credit limit terms for companies with balances under $50K. That means newer businesses not only get IO earlier, but also qualify for more credit right away — helping you cover early expenses like software, contractors, and inventory without hesitation.

As of this month, you can also link external bank accounts and we'll factor those balances into your IO credit limit, giving you access to even more spending power. It’s flexible credit that meets you where you are.

A scalable card for day 1,000 — and beyond

IO doesn’t just get you started — it grows with you. As your team starts to grow, you can streamline team expense management by building on top of Mercury’s powerful card foundation.

Get everything you need to set up, manage, and scale team expenses. Mercury makes it easy to:

Enable team spend

- Safely invite your team as employees, but grant access to cards and reimbursements only

- Connect your HR and payroll system to automate onboarding and offboarding

- Issue your team cards with spending limits or merchant-locked cards for specific subscriptions

- Enable reimbursements for any out-of-pocket spend

Create receipt and spending policies

- Set spending policies for when receipts, memos, and categories are required

- Simplify receipt capture by emailing or uploading receipts to Mercury for automatic matching

Automate accounting

- Create employee-friendly categories to ensure accurate GL coding and simplify expense categorization

- Automate GL coding with rules based on merchant, card, category, and more

Analyze your team’s spending

- Create and save reports that break down transactions by GL code, merchant, spend type, and any other transaction data

- Review transactions that are missing receipts and notes, then remind teammates to add required information

What’s next: evolving Mercury to scale for larger teams

Over the past year we've focused on building the key features that early-stage startups need to set their teams up for success when it comes to team spend — but we also know the importance of ensuring these systems can scale effectively from seed funding through to Series A, B, and beyond.

That’s why we’re working on new features designed to help larger teams streamline expense management and financial operations as they grow with Mercury. These include:

- Automated receipt collection. Set up inbox rules to auto-forward receipts for matching — or let Mercury scan your inbox in the background to catch them for you.

- Employee budgets. Assign employees pre-set budgets for travel or ongoing spend programs to track expenses across cards and reimbursements.

- Advanced team management. Customize roles and permissions, analyze spend by department, and give managers visibility into their team’s expenses.

- Org chart approvals. Route approvals through your org chart to simplify bill payments and reimbursements.

- Continued accounting improvements. Leverage AI to automate GL coding, and enrich transactions with accounting class fields.

- New insights and reporting tab. Build interactive dashboards, spot trends, and use AI to dig into spend patterns and answer ad-hoc questions.

As these features roll out, they’ll appear in your Mercury dashboard — and we’ll let you know as soon as they’re live.

This is what business credit should look like

The latest IO updates aren’t just about faster access or higher limits, they’re about giving real companies the financial tools to move forward with confidence, from day one to day 1,000 — and beyond.

Whether you just incorporated your company or are scaling fast, you now have a credit card that moves at your speed, and backs the ambition that inspired you to start a company in the first place.

About the author

Credit Card Underwriting Manager at Mercury.

Related reads