Is cash basis or accrual accounting better for my startup?

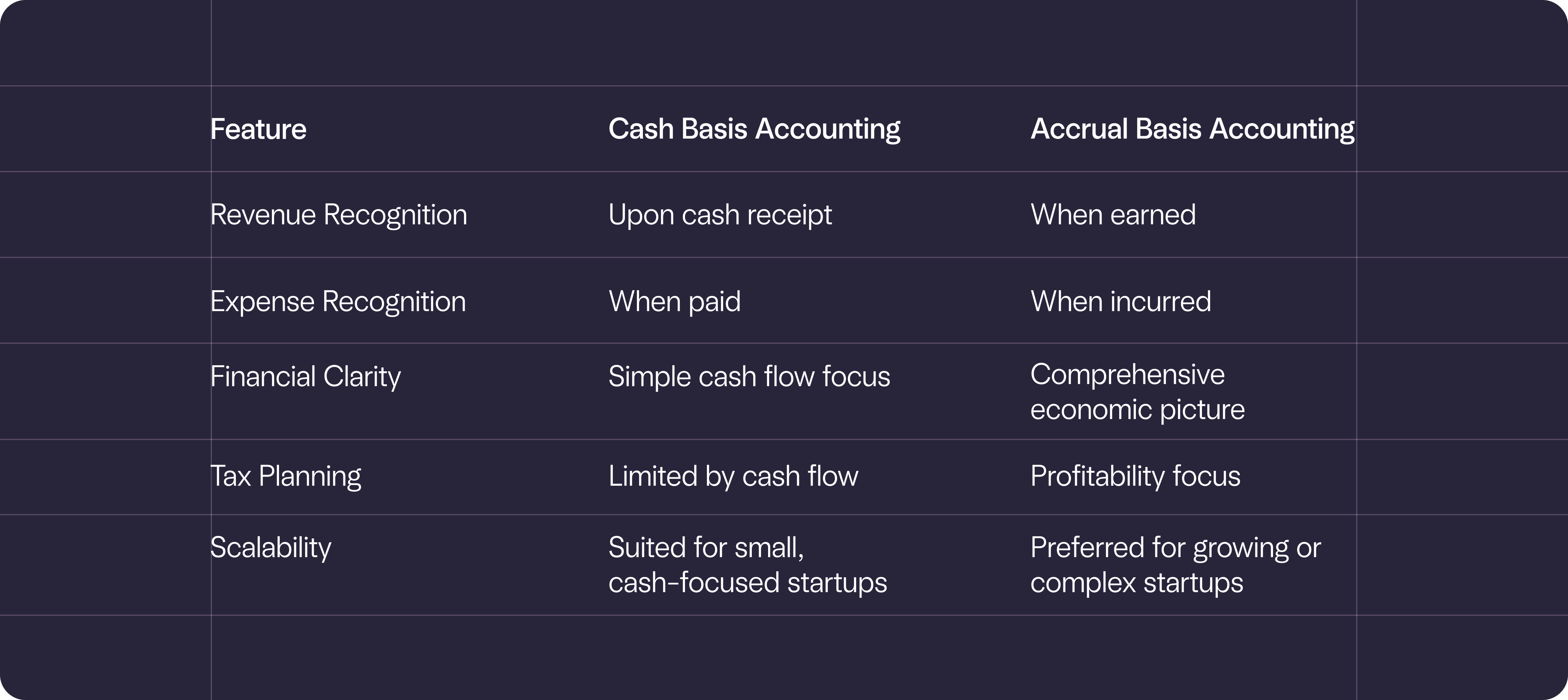

Starting a business involves many important decisions that often have long-term ramifications on how you operate and grow. Navigating the initial challenges of managing your company's finances, you'll encounter a crucial decision: selecting the right accounting method to accurately reflect your company's performance. The two main contenders in this area are cash accounting and accrual accounting. Each method has its own unique impact on how you report your finances, pay your taxes, and make big decisions as you scale your startup.

This guide will help you understand both accounting methods in detail, and help you align your accounting choice with your startup's vision and operational reality.

What is cash basis accounting?

Cash basis accounting captures transactions only when cash physically enters or exits your business, offering a straightforward mirror of your cash flow.

As an example, let’s say your startup brings on a big new software subscription customer in March, but the deal was negotiated and finalized in February. Under cash basis accounting, this revenue is recognized in March, the moment cash is received, not when the agreement was made. This immediacy provides a snapshot of your cash flow but may not fully reflect the operational efforts and economic realities of the period in question.

What are the benefits of cash basis accounting?

New companies can find cash basis accounting a less daunting approach, thanks to its blend of simplicity and strategic tax advantages:

Simplicity

Cash basis accounting is ideal for startups with straightforward financial transactions, making it easier to track cash flow without the need for complex accounting knowledge. If you are managing the day-to-day accounts yourself, this simplicity will save you time when it comes to compiling financial statements.

Tax flexibility

Potentially defer tax liabilities by recognizing revenue only upon receipt of payment, not when it is earned or invoiced. For example, if your startup earns revenue in December but doesn't receive the payment until January of the next year, you won't record this income in your books until January. This income will be taxed in the next tax year, not the current one. By timing the receipt of payments towards the end of the fiscal year, you can effectively shift income to the following year, thus deferring the tax liability associated with that income. This strategy can help to with managing cash flow better, investing in growth opportunities, or even in strategic financial planning to align with anticipated changes in tax rates or regulations. It's important to consider that while deferring tax liabilities can be advantageous, it requires careful planning and management. Startups need to balance the benefits of deferring taxes with the potential risks, as well as make sure they have a strong handle on their cash flow needs and tax obligations in the future.

What are the shortcomings of cash basis accounting

While cash basis accounting can simplify financial management, its inherent limitations, including the risk of financial misrepresentation and restricted growth scalability, mean it isn’t suitable for all startups. Here are some of the ways that cash basis accounting can fall short:

Financial misrepresentation

This method records transactions only when cash changes hands, which can lead to a skewed view of your startup's financial health. By ignoring receivables (money owed to the company) and payables (money the company owes), cash basis accounting can make a business appear more or less financially healthy than it truly is.

For example, if your startup has delivered products or services but hasn't yet received payment, these earnings won't be reflected in your financial statements under cash basis accounting. Similarly, expenses incurred but not yet paid for will also be omitted. This can be misleading for stakeholders, as it might not accurately represent the company's pending financial obligations or incoming revenue, leading to decisions based on incomplete financial information. All this can muddy the performance waters, and be perceived as being disingenuous when you are looking to raise your next round.

Limited growth scalability

As your startup scales, its financial needs and reporting requirements will become more complex. Cash basis accounting, while simpler, may not provide the comprehensive financial insight needed by investors, lenders, and regulatory agencies, who often prefer or require accrual-based financial statements. Accrual accounting offers a clearer picture of a company's financial health by including accounts receivable, accounts payable, and other accrued liabilities, which are critical for assessing a company's operational efficiency and financial stability. For growing startups seeking investment or loans, the transition to accrual accounting becomes almost inevitable. Investors and lenders rely on accrual-based financial statements to assess risk, profitability, and the overall financial health of a business. They need to know not just the current cash position but also how effectively the company manages its obligations and revenues over time. Regulatory compliance for larger enterprises often mandates accrual accounting, making it a necessary adjustment as startups scale.

What is accrual basis accounting?

Accrual basis accounting, or accrual accounting, offers a more nuanced view of your startup's financial activities by recording revenue and expenses at the moment when they're generated rather than at the point when cash is changing hands. This approach aligns your financial reporting with the economic reality of your operations, providing insights into not just where you stand, but also where you're headed.

Let’s say your startup delivers a project in February but doesn't receive payment until April. Accrual accounting records this revenue in February since that’s when the work started. This method highlights the economic activity in the actual time frame of goods delivered, offering insights into profitability and operational effectiveness that cash basis accounting might obscure.

What are the benefits of accrual basis accounting?

Accrual basis accounting can elevate your startup's financial strategy by offering a fuller, more accurate picture of current finances. This enhances strategic planning with its depth of insight into performance and obligations, paving the way for informed decision-making and future success. Benefits of accrual basis accounting include:

Complete financial picture

Accrual accounting includes accounts receivable (money owed to your company) and accounts payable (money your company owes), offering a more accurate reflection of your startup's financial status at any given time.

By incorporating owed or owing amounts, accrual accounting ensures that your company's financial statements are an accurate reflection of your financial activities, giving stakeholders a clearer and more complete picture of its financial situation. This is important for assessing the company's profitability, financial stability, and operational efficiency over time.

Accrual basis can lead to the recognition of income before cash is received, potentially advancing tax liabilities. However, it also allows for more strategic tax planning, offering opportunities to align expenses with the revenues they generate, possibly smoothing out taxable income fluctuations over time.

Enhanced strategic insight

The detailed financial insight provided by accrual accounting empowers better strategic decision-making. With a clearer understanding of your startup's financial performance and obligations, independent of cash flow, you can make informed choices about investments, cost management, and growth strategies. This method allows you to anticipate future cash needs, evaluate the profitability of different segments of your business, and understand the timing of income and expenses. Such strategic insight is invaluable for planning purposes, helping to navigate financial challenges and capitalize on opportunities with greater confidence.

What are the shortcomings of accrual basis accounting?

Accrual accounting's main challenges stem from its complexity, which demands advanced bookkeeping skills and often leads to higher operational costs for startups, and its potential to hide cash flow issues. Areas where cash basis accounting falls short include:

Increased complexity

The major downside of accrual accounting is its complexity. This method requires tracking receivables, payables, and other accrued items, demanding a more sophisticated approach to bookkeeping. For early-stage startups, this complexity often means the need for professional accounting services from day one, which can increase operational costs and shorten your runway.

By design, accrual accounting is more detailed compared to cash accounting, and therefore needs a more thorough understanding of accounting principles and practices. This complexity can be a significant hurdle for startups looking to maintain lean operations while ensuring accurate financial reporting.

Cash flow clarity

While accrual accounting offers a complete picture of a company's financial health, it can sometimes obscure cash flow issues. Since revenue is recognized at the time it is earned rather than when cash is received, a business might appear profitable on paper while facing cash shortages in reality. This situation needs diligent cash management and forecasting to ensure that the business can meet its short-term financial obligations. Startups must closely monitor their cash flow alongside their accrual-based financial statements to avoid liquidity problems. This dual focus can add an additional layer of financial management, as well as an additional cost. This is because businesses could have to make up the lack of cash flow in other ways, such as leveraging a credit card with a high interest rate. In other words, by failing to give a clear view of a company’s cash position, accrual accounting can leave a company stuck from time to time, forced to take a reactive approach to cash flow rather than a proactive (and more cost-effective) one.

How to choose the right accounting method for your startup

Deciding whether to use cash-basis or accrual-basis accounting can come down to a few main factors:

- Your startup's size and complexity of financial transactions: For smaller startups with simpler operations (generally <20 employees), cash basis accounting often suffices due to its straightforward nature, making it easier to manage with fewer transactions and less complexity. The choice between the two systems depends on the startup's ability to handle the accounting complexity versus the need for detailed financial insights to support strategic decisions.

- Cash flow management needs: Industries that operate on a straightforward cash-in, cash-out basis, such as retail or services that require payment upon delivery, often prefer cash basis accounting. This method offers them a clear, real-time view of cash availability, which is crucial for day-to-day operations, allowing these businesses to closely monitor their liquidity and make immediate financial decisions. Alternatively, industries engaged in long-term projects or those that experience significant delays between issuing invoices and receiving payments, such as construction, manufacturing, or companies involved in long-term service contracts, might opt for accrual accounting.

- Long-term strategic goals: The long-term ambitions of your startup are crucial in deciding whether cash basis or accrual accounting suits your journey better, as this choice touches on everything from financial forecasts to tax commitments, and how you communicate with investors. Take a tech startup setting its sights on quick expansion through venture capital. Such a startup may gravitate towards accrual accounting, which paints a more accurate financial position. This approach better matches the discerning eyes of investors and financiers, who look beyond simple cash flow to grasp the essence of your operational success.

Cash basis may appeal for its simplicity and tax deferral opportunities, especially for startups focused on immediate cash flow. Accrual accounting, despite its complexity, provides a robust framework for startups aiming for growth, requiring financing, or dealing with sophisticated transactions and business models.

It might not even be a matter of choice. Certain businesses are restricted from using cash basis accounting due to their size, structure, or the nature of their operations. Typically, these restrictions apply to:

- Public companies: Companies that are publicly traded are generally required to use accrual accounting to provide a more accurate and fair view of their financial position and operations to shareholders and regulators. Also, accrual accounting is a requirement under Generally Accepted Accounting Principles (GAAP).

- Large corporations: The IRS restricts corporations (including partnerships with a corporate partner) that have average annual gross receipts over a specified threshold (this threshold can change, so it's important to check the current IRS guidelines) from using cash basis accounting.

- Tax shelters: Entities classified as tax shelters are typically required to use accrual accounting to ensure transparency and fairness in financial reporting.

- Businesses with large amounts of inventory: Businesses that hold inventory as a significant part of their sales process are usually required to use accrual accounting. This requirement is because accrual accounting provides a more accurate picture of cost of goods sold and inventory levels, which are crucial for assessing the financial health of a business that relies on inventory sales.

- Financial institutions: Banks and other financial institutions (including fintechs like Mercury) are often required to use accrual accounting due to the nature of their business and the regulatory requirements imposed on them.

These restrictions are primarily aimed at ensuring that the financial statements of these businesses accurately reflect their financial status and operations. Again, because accrual accounting is focused on offering a more comprehensive look at a company’s finances, it’s a better fit for larger companies or those in specific sectors where the timing of cash flows does not necessarily align with the underlying economic activities.

Selecting the right accounting method is a strategic decision that is foundational to your startup's financial integrity and scale. By weighing the pros and cons of cash and accrual accounting in light of your startup's unique context, you can chart a course that not only aligns with your current realities but also positions you for future success. Working with a financial expert can provide personalized insights, ensuring your accounting strategy fully supports your startup’s journey.

Related reads

What to look for in business bill pay software — beyond basic payments

Tax season stress-test: How ready is your startup’s financial stack?

How to evaluate external bookkeeping partners