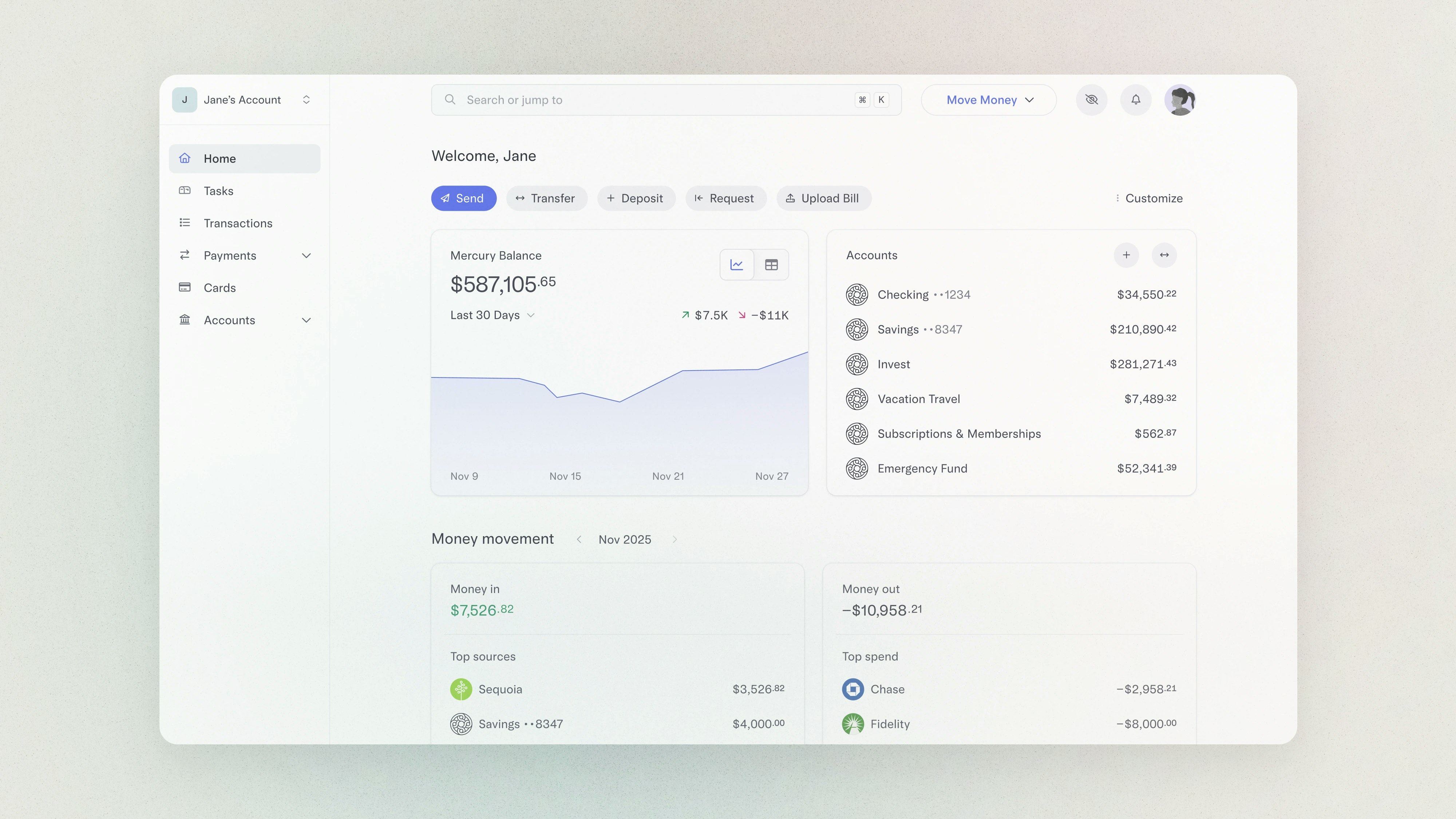

October 2024 — reimbursements, category-locked cards, and more

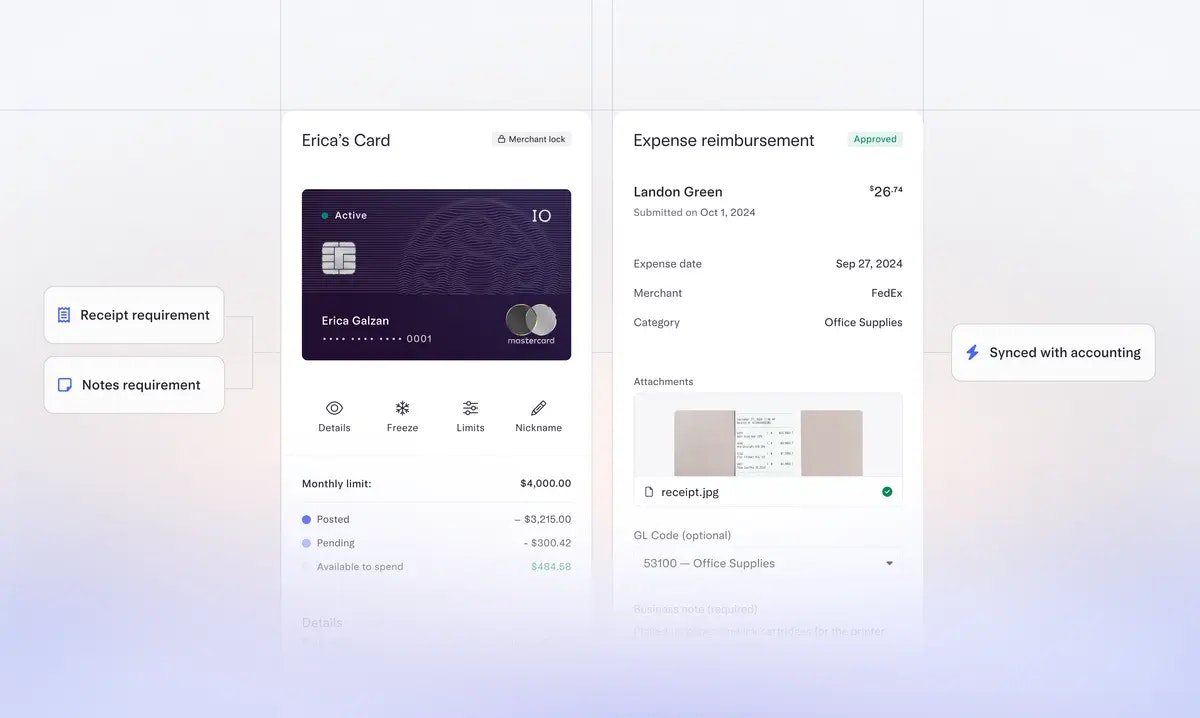

🧾 Say farewell to manual reimbursements

Are you manually reimbursing your employees for out-of-pocket costs like software and travel? With Mercury’s new expense reimbursements, you can effortlessly review, approve, and process reimbursements right from your bank account, putting an end to receipt chasing and frustrating follow-ups. Paired with custom permissions and spend policies, it’s a time-saver that keeps you in control.

With Mercury Expense Reimbursements, you can:

- Onboard your employees quickly and securely, and easily invite them to submit expenses without granting access to your bank account details.

- Save your team time with quick receipt uploading and auto-populated transaction details.

- Set policies upfront for receipts and notes, then approve and process reimbursements in two clicks, individually or in bulk.

- Maintain a clean end-of-month close by syncing expenses with GL codes to your accounting software.

- Manage expenses with reimbursements alongside Mercury's debit and credit cards for an even more cohesive experience.

Read more details in our announcement.

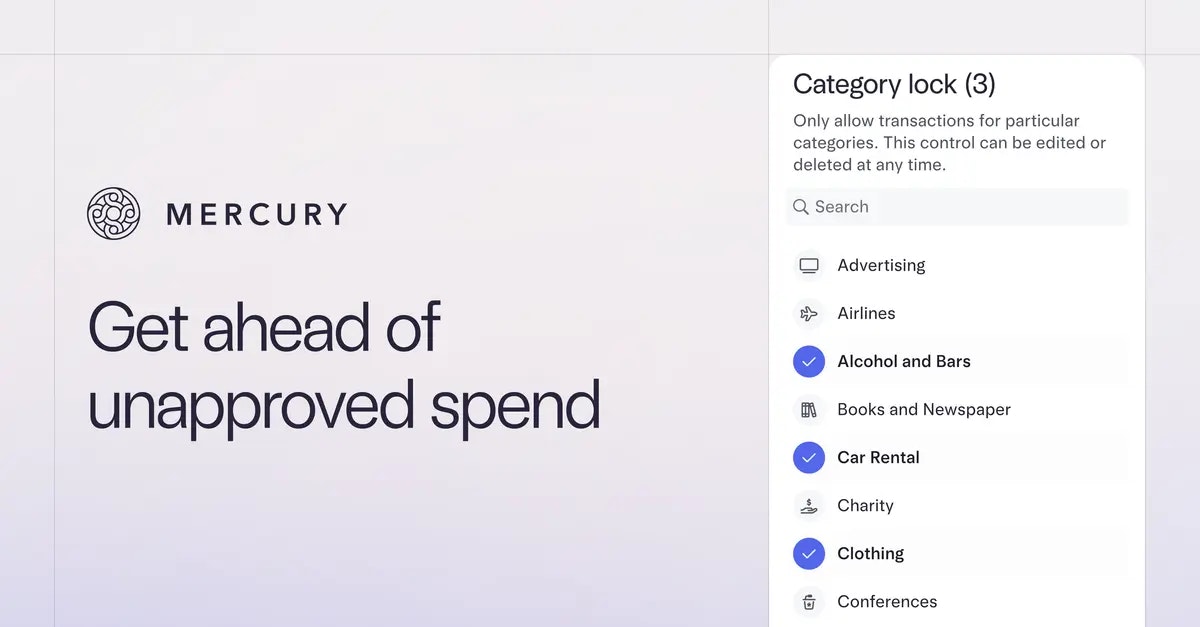

💳 Curb unapproved spend with category-locked cards

How do you make your spend controls even more powerful? With category-locked cards. To lock an existing card to one or more categories, navigate to your Cards page and open the card’s details — on mobile, you'll find "Category Lock" in the buttons up top, and on desktop, you’ll find it in the “More” menu. To allow or block categories for your entire org’s card spend, head to the Policies page and enable Merchant and Category Restrictions.

🚦Give employees access to what they need and nothing they don’t

As you build out roles and permissions for your team, Mercury’s new “Employee” role will be especially important. It allows team members to spend on cards, submit expenses (if your company has enabled expense reimbursements), and add context to their transactions — without exposing sensitive financial info like account numbers or balances.

👥 Invite your teammates in bulk

Onboarding a new group to Mercury — and don’t want the hassle of inviting team members one-by-one? Just copy and paste their emails so you can invite them and issue company cards in one flow. Once your teammates accept, they’ll be prompted to create a profile and be on their way to paying for travel and submitting expenses.

☑️ New in Mercury Invoicing: Upload attachments, customize templates, and CC more emails

Mercury Invoicing just got an upgrade. Need to attach a purchase order or timesheet to an invoice? Skip sending documents by email and just directly upload the files. To make sure your invoices are extra polished, you can also customize templates with emails and tax IDs. You'll also be able to cc your invoice to multiple email addresses so that relevant teams are informed.

Don't have a Mercury account yet? You can create professional, personalized invoices in minutes with our free Invoice Generator — no sign-up required.

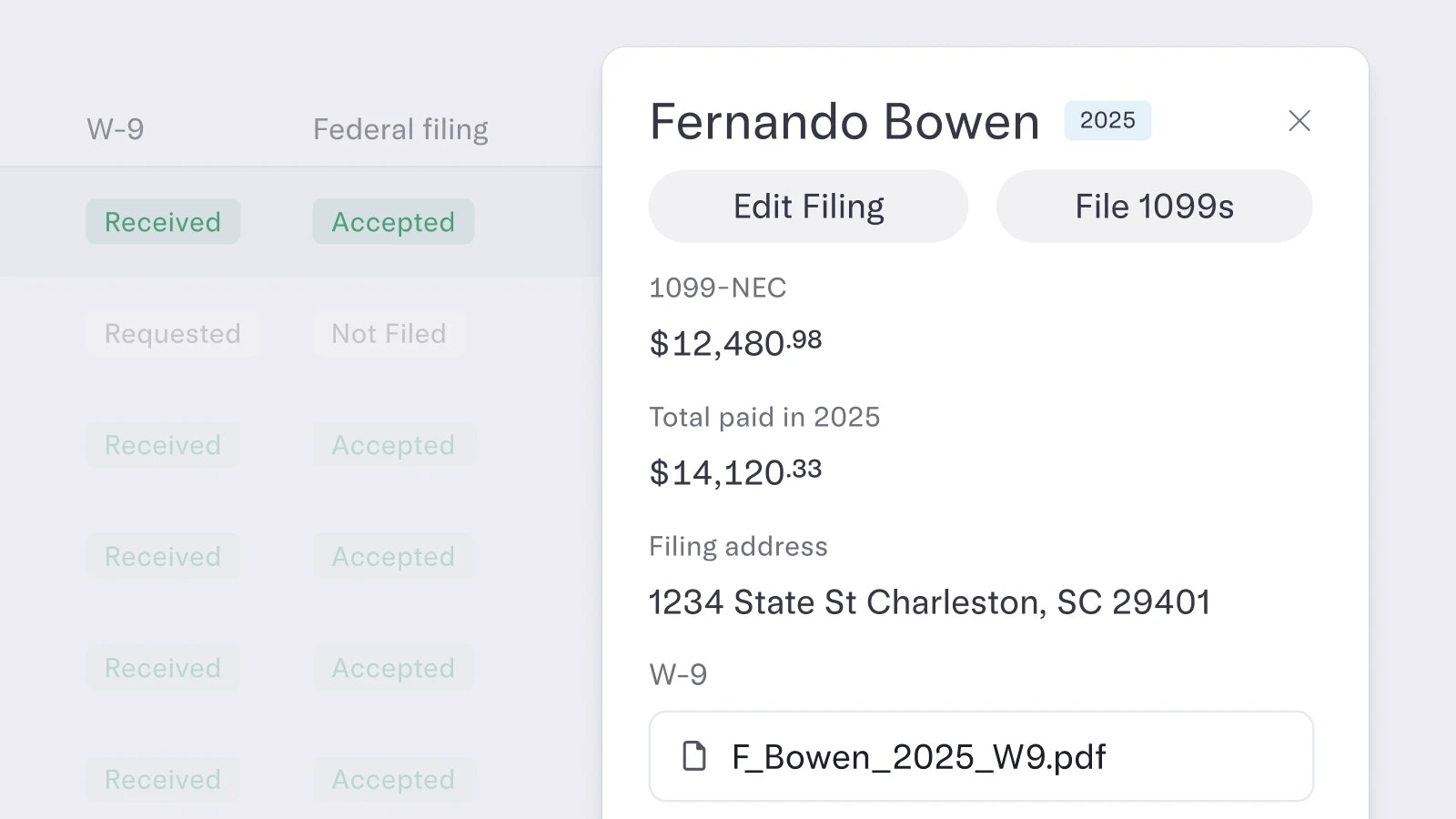

🧾 New in accounting automations: Take bulk actions, streamline GL code tagging, and more

You already know that transactions can be categorized from one place, letting founders, bookkeepers, and accountants manage accounting tasks more confidently and efficiently.

But you can now apply bulk actions from the accounting page, eliminating the need to manually review each uncategorized transaction. Categorize similar transactions with the same GL code in a few clicks and bulk mark transactions as ready to sync to help save time on categorization and syncing.

We’re also introducing more use cases for CSV uploads. Custom CSV-uploaded GL codes are now supported everywhere GL code tagging is available, and CSV exports include check numbers.

Bite-sized improvements:

- Ready to pay a bill or create an invoice? You can now do both from the Move Money menu in the top right corner of your dashboard, or from the homepage.

- If you’ve sent a payment that needs approval and later want to change it, now you can by hitting the “edit request” button.