Strategies to increase the AOV for your ecommerce company

Running a successful ecommerce business is like being the captain of a ship navigating through ever-changing waters. You're constantly balancing customer acquisition, retention, and revenue growth — all while keeping a close eye on the compass that guides your decisions. One of the key metrics that often flies under the radar but plays a significant role in steering your business toward profitability is average order value (AOV).

Think of this key performance indicator as the wind in your sails — it might not be as flashy as your conversion rate or as obvious as your sales numbers, but it's a powerful force that can accelerate your journey to success.

What is average order value, and why is it important?

Average order value (AOV) is like a snapshot of your customers' spending habits. It tells you how much, on average, each customer spends per order, offering a deeper understanding of your revenue. Think of it as a quick way to gauge how much money you’re making per transaction.

As your AOV increases, it’s a signal that your revenue is optimized — earning you more per transaction without increasing your customer acquisition costs. Keeping an eye on your AOV will also provide insights about:

- Upselling and cross-selling efforts. Tracking AOV helps you assess the effectiveness of upselling and cross-selling strategies, ensuring you're maximizing the value of each sale by recommending the right products or purchase options at opportune moments in a buyer’s journey.

- Pricing and product strategy. A healthy AOV can indicate that your pricing is attractive and your product mix aligns well with customer needs.

- Data that can support healthier growth. By monitoring AOV, you can make data-driven decisions that enhance customer experience, optimize marketing efforts, and ultimately grow your business.

The long and short of it is that understanding and improving your AOV ultimately allows you to make the most out of every customer interaction, ensuring that your ecommerce business thrives.

AOV versus modal value

Modal value is another method that can be used to analyze customer buying behavior. Modal value is the dollar amount that occurs most often.

AOV can be skewed by outliers, such as a few very large orders placed within the specific time period. In reality, most orders are much smaller. By contrast, the modal value looks at the most frequent order value within that time period.

With modal value, you get insights into the most common orders placed, which can help you apply strategies to increase the amount of each order (which we’ll discuss below).

How to calculate average order value

The formula for calculating AOV is straightforward:

Average Order Value (AOV) = Total Revenue / Number of Orders

Here, total revenue is the total amount of money generated from all sales during a specific time period, such as a day, week, or month. The number of orders is the total number of individual orders placed during that time period.

For example, imagine you’re running an online store and want to see what your AOV was over the past month. In that period, you generated $60,000 in total revenue from a total of 1,500 orders. Using the AOV formula: $60,000 / 1,500 = $40

This tells you that the average value of an order for the month is $40.

The importance of time period in the AOV equation

It's important to choose a consistent time period when calculating AOV. Whether you're looking at daily, weekly, or monthly AOV, sticking to the same period allows you to track changes over time and compare performance across different periods. For instance, comparing your AOV from one month to the next can help you see the impact of any new marketing strategies or promotions you’ve implemented.

Variations in AOV

AOV can vary significantly based on factors like seasonality, product promotions, or changes in customer behavior. For example, during a holiday season, you might see a spike in AOV as customers buy more expensive items or larger quantities. Keeping an eye on these fluctuations — and understanding the different trends that can predictably impact AOV from one period to the next — provides valuable insights into your business trends.

Using AOV in combination with other metrics

While AOV is a valuable metric on its own, it’s even more powerful when used alongside other KPIs like conversion rate, customer lifetime value (CLV), and customer acquisition cost (CAC). Together, these metrics give you a more comprehensive view of your business’s financial health and customer behavior.

Strategies to increase your ecommerce company’s average order value

Before we dig into ways that you can boost AOV over time, it’s important to focus on the right priorities in your approach. Persuading your customers to spend more per transaction should focus on offering additional value, rather than adopting short-term tactics that prioritize maximizing sales at all costs. Any feelings of buyer’s remorse may mean your customers cut back on future spending, or even choose a competitor, so it’s important to think about AOV optimization tactics with the long term in mind.

With that in mind, the following strategies can increase basket size without jeopardizing customer satisfaction:

Strategy Type | Description | Benefits | Risks |

|---|---|---|---|

Product bundling | Offer complementary products at a discounted price | Simplifies buying decisions and increases perceived value | Requires careful management of complementary products and inventory |

Personalized upselling and cross-selling | Suggested complementary or upgraded products based on the customer’s selection | Relies on customer data for better targeting and enhances the customer shopping experience | Poor suggestions can annoy customers and reduce trust |

Loyalty programs | Reward customers with points or perks to encourage repeat business | Boosts retention, incentivizes larger purchases, and builds brand loyalty | Can be costly to maintain and there’s potential for program abuse |

Tims-sensitive offers | Create urgency with limited-time deals | Drives quick decision-making, which increases short-term AOV | May lead to buyer’s remorse or increased returns |

Free shipping and flexible returns | Encourages bigger orders with free shipping over a minimum and encourages hesitant buyers | Reduces cart abandonment and eases purchase anxiety | Can increase operational costs and may increase returns |

First-time offers | Incentivize new customers to spend more with a discount on their first order | Boosts first-order value and creates a positive first impression | May attract discount shoppers who don’t turn into repeat buyers |

Trending products | Feature popular or in-demand products | Creates urgency and leverages social proof | Can create short-lived demand or inventory issues |

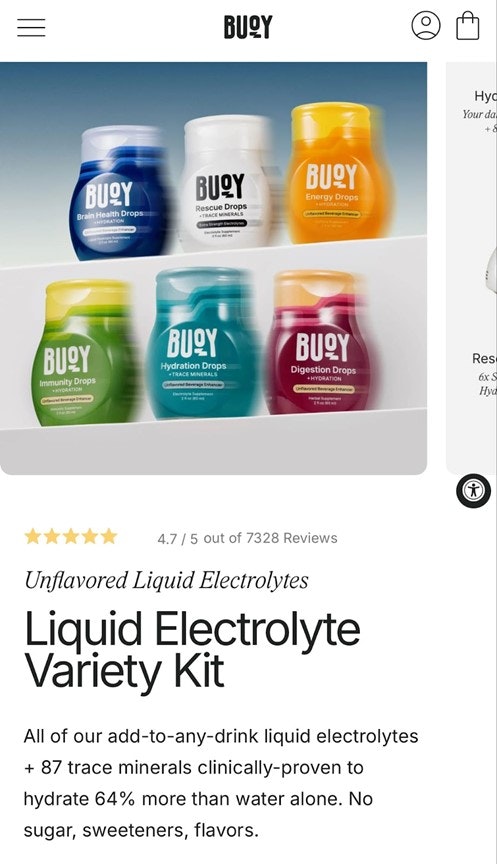

Product bundling

Customers are encouraged to spend more by offering multiple products commonly sold together as a discounted package. Product bundling offers several benefits, including providing customers with perceived added value, simplifying their purchasing decision by offering complementary items together, and promoting the sale of higher-margin products alongside popular ones. Using bundled options helps companies boost sales volume, enhance customer satisfaction, and optimize inventory management, all contributing to increased revenue and profitability.

Example: Liquid electrolyte company Buoy offers a bundle of its different hydration drops at a discount. Customers can also create their own bundles.

Personalized cross-selling and upselling

Cross-selling works by suggesting complementary products based on a customer's current selection, enhancing the shopping experience and encouraging additional purchases. For example, the “Often bought with…” feature on an ecommerce clothing site helps create some outfit inspiration, like a belt or shoes to go with the pants a customer picked. Alternatively, upselling promotes higher-ticket or more expensive versions of a product, increasing the overall transaction value. Both work more effectively when suggestions are intuitive, informed by sales data, and realistic.

Example: Amazon is, of course, the master at personalized recommendations, offering suggestions based on browsing history, saved items, and past purchases.

Loyalty programs

Loyalty programs incentivize repeat purchases and encourage customers to spend more to earn rewards. By offering redeemable points for every dollar spent, customers unlock discounts, free products, or exclusive offers that motivate them to reach higher spending levels. Additionally, loyalty programs can create a sense of exclusivity and appreciation, building stronger emotional connections with the brand and driving long-term profitability.

Example: Beauty brand Kiehl’s offers points for every $1 spent, which customers can redeem for future rewards. The loyalty program also includes a birthday perk.

Time-sensitive offers

Time-sensitive offers increase AOV by creating a sense of urgency, encouraging customers to make larger purchases quickly. These promotions, such as flash sales or limited-time discounts, prompt customers to buy more items to take full advantage of the temporary deal. This strategy not only boosts AOV but also improves inventory turnover (in the case of startups working with physical goods) and cash flow. However, there is a potential downside: if customers feel their purchase has been impulsive, it might lead to dissatisfaction, a spike in customer support tickets/refund requests, or poor retention.

Example: Clothing retailer UNIQLO offers customers limited-time offers for holidays.

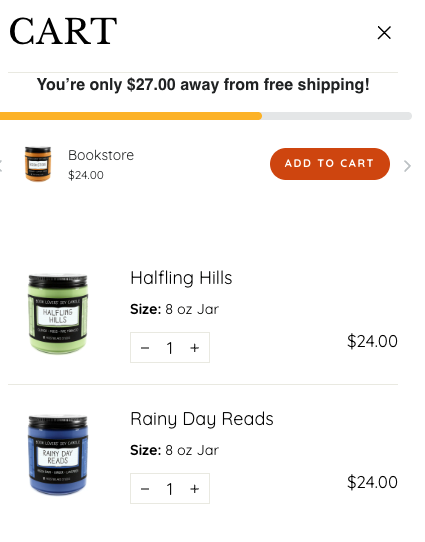

Free shipping thresholds & flexible returns

Offering low free shipping thresholds can nudge customers into adding more items to their cart, just to dodge delivery fees. Not only does it boost your AOV, but it also cut down on cart abandonment and drive up your conversion rates, translating to bigger sales and better profits.

On the flip side, flexible return policies work wonders by easing the anxiety around larger purchases. When customers know they have a window of time during which they can return items or request a refund without a headache, they’re more inclined to splurge on higher-value goods or buy in bulk. This approach doesn’t just sweeten the shopping experience, it can also encourage repeat business and fuel long-term growth.

Example: Candle company Frostbeard Studio offers free shipping on orders over $75 and shows customers how much they need to add to their order to qualify.

First-time offers

First-time offers — e.g., 15% off a first purchase when a customer signs up for the newsletter — incentivize new customers to make larger initial purchases to maximize their savings. This strategy not only boosts AOV but can also help convert visitors into loyal customers through providing a positive first impression. First-time offers can increase conversion rates, drive higher initial sales, and lay the foundation for long-term customer relationships and repeat business.

Example: Sock company BombasOpens in new tab greets visitors with a pop-up offering 20% off on their first order.

Trending products

Highlighting in-demand products creates a sense of urgency and excitement. It taps into a sort of “bandwagon effect,” where people are more inclined to purchase certain items because others want those items — they’re essentially buying not just the item, but its popularity as well. Additionally, bundling trending products with other items can further boost AOV by enticing customers to explore and purchase complementary goods.

Example: Beauty brand Sephora has a specific page on its site for “Trending on Social.”

Challenges to increasing AOV

While increasing AOV is a goal for most ecommerce companies, finding the right strategy (or combination of strategies) can be tricky.

Some customers are resistant to upselling and cross-selling — they might perceive your efforts as pushy or irrelevant. You also need the right tools to provide truly personal recommendations.

Other customers might be turned off by free shipping minimum thresholds and instead opt not to make a purchase at all. Bundling can also be ineffective if the bundles aren’t appealing to customers.

You can overcome some of these challenges with a data-driven approach: trying different strategies to see which customers respond to the most.

Tools to increase your online store’s AOV

In many cases, you’ll need to add tools to your tech stack in order to effectively implement a customer’s AOV. Here are a few types of tools to consider:

- AI-powered personalization to recommend products to customers (Bloomreach, parcelLab)

- Plugins to offer tiered discounts or free shipping thresholds (Shopify)

- Conversational texting with offers (Attentive, TxtCart)

- Tools to manage inventory (Sellercloud, a Mercury Perks partner)

- Email marketing to send personalized offers or discounts (Klaviyo, Omnisend)

Other ecommerce metrics that can improve revenue and profitability

Although extremely valuable, fixating solely on AOV can be misleading because it doesn't account for other crucial aspects of ongoing business health and revenue generation, such as customer retention, loyalty, and lifetime value. Ignoring these metrics can lead to short-term gains at the expense of long-term growth and customer satisfaction. Balancing AOV with other performance indicators, though, sets your ecommerce store up for longer-term success.

Here are a few of the other metrics to keep an eye on alongside AOV:

Churn rate

Churn rate measures the percentage of customers who stop using your product over a specific period. This metric is especially important if your ecommerce store relies on subscriptions, for example a vitamin company or personal care product that needs to be replenished at regular intervals. Keeping churn rate low is crucial for sustaining revenue growth and customer retention, particularly since acquiring a new customer typically incurs higher marketing costs compared to retaining an existing one.

Net promoter score

Net promoter score (NPS) gauges customer loyalty and satisfaction by asking how likely customers are to recommend your business to others. A high NPS indicates strong customer advocacy, leading to positive word-of-mouth and repeat purchases, which in turn reduce acquisition costs and increase customer lifetime value. By identifying promoters and detractors, companies can customize their experiences to address these pain points and foster loyalty, which lasts longer — and proves a higher long-term ROI — than improving AOV numbers alone.

Conversion rate

Conversion rate is the percentage of visitors who complete a desired action, like buying a product or signing up for a weekly newsletter. By optimizing conversion rates, companies can turn more website visitors into paying customers, effectively maximizing the return on marketing investments. Improved conversion rates lead to increased sales without necessarily increasing traffic, making marketing efforts more efficient. Also, a higher conversion rate signifies a better user experience, which can increase customer satisfaction and encourage repeat purchases. A/B testing different landing pages, purchase flows, and homepage designs could be a few ways to optimize your conversion rates over time.

Customer acquisition cost and customer lifetime value

Customer acquisition cost (CAC) measures the cost of acquiring a new customer, while customer lifetime value (CLTV) estimates the total revenue a customer will generate over their lifetime. Unit economics analysis considers both of these metrics, serving as a critical component in determining whether or not you have a sustainable business model, and can provide unrivaled insights into your company’s successes and shortcomings — regardless of its size or stage.

Impacts of increasing your AOV

Finding the right mix of strategies to increase the AOV for your ecommerce company will boost revenue, profitability, and free up cash to reinvest in other growth initiatives, like new product lines. Combining this metric with other performance indicators, such as NPS, will ensure a healthy balance is struck between short-term sales and long-term customer satisfaction.

Want to hear directly from an ecommerce founder? Watch our video with Mango Puzzles co-founders Kemal Didić and Svet Lovoukhin on their approach to logistics and margins:

FAQs

What is average order value (AOV) and why is it important?

Average Order Value (AOV) is the average amount a customer spends per transaction. It’s important because increasing AOV will boost an ecommerce company’s revenue without increased customer acquisition costs.

How can offering free shipping thresholds boost AOV?

A free shipping threshold encourages customers to add more items to their cart to qualify for free delivery, which will increase the total value of their purchase.

What role do product bundling and upselling play in increasing AOV?

Product bundling and upselling encourage customers to spend more in a single transaction. With bundling, customers may perceive a higher value because they’re receiving a discount. Upselling promotes products that customers may not have otherwise considered.

How can personalized product recommendations enhance AOV?

When you provide tailored recommendations based on a customer’s behavior or purchase history, customers are more likely to make additional purchases.

What are volume discounts and how do they affect AOV?

Volume discounts are price reductions when customers purchase a larger quantity of a product. Customers may buy more in a single transaction to take advantage of the savings.

How do limited-time offers and promotions influence AOV?

Limited time offers and promotions create urgency so customers may make purchasing decisions more quickly to take advantage of the deal. This can increase short-term AOV.

In what ways can loyalty programs contribute to higher AOV?

Loyalty programs reward customers for spending more. Through loyalty programs, customers can earn points, perks, or exclusive offers. This incentivizes repeat purchases and builds brand loyalty.

How does providing installment payment options impact AOV?

Payment installment options can increase AOV by making higher-priced items more affordable. Customers may make a purchasing decision based on their ability to make payments over time, rather than pay the entire amount up front.

What is the effect of exit-intent popups on AOV?

Exit-intent pop-ups offer last-minute incentives — like a discount — to encourage shoppers to complete checkout or add more items to their cart before leaving the site.

How can seasonal and holiday promotions be leveraged to increase AOV?

With limited-time offers, themed products, and special discounts, seasonal and holiday promotions create a lot of urgency, because customers know that the offer is only available for a specific period of time.

Related reads

Should you launch on eBay? A viability checklist by product category

Shopify Balance review: Pros, cons, and alternatives for ecommerce companies

Turning real-time financial insight into an ecommerce advantage