How to use the Profit First method to boost your startup or small business's profit

What if you could make your startup or small business profitable simply by changing the way you manage cash flow? This is the premise of the Profit First method of accounting — a technique for managing business finances popularized by Mike Michalowicz’s 2014 book, “Profit First.”

In a world where a majority of startups never achieve profitability and many small businesses end every month with nothing left over, the Profit First cash management method serves as a paradigm shift in how a business can operate. Read on to learn more about the Profit First accounting method for founders: what it is, how it works, and how you can use it to manage your startup or small business.

What is the Profit First method?

The Profit First method in accounting calls for directing a percentage of all sales directly to profit, before taking out expenses. This is in stark contrast to traditional accounting methods, which classify profit as income remaining after expenses have been paid.

Traditional accounting: Sales - Expenses = Profit

Profit first: Sales - Profit = Expenses

By taking profits off the top, the Profit First method aims to help founders scrutinize their spend to ensure they’re focusing on factors that drive profitability for the business. Michalowicz reasons that, if 10% of your sales each month go directly to profit, you’ll be forced to figure out how to manage your resources more efficiently. In other words, it encourages you to prioritize a healthy profit margin and build a more conscious budget around that, rather than leaving profit to the whims of adjustable expenses. Think of it like reverse engineering profitable growth.

Michalowicz often cites Parkinson’s Law — essentially the idea that whatever resources we have will be used up — as the reason it’s important not to rely on what’s left over to be the source of profits. The Profit First method ensures that business owners are paying themselves for their hard work — something they're often hesitant to do in the early days of the business.

How does the Profit First method work?

The Profit First method is relatively simple: take profit out of your cash deposits before paying expenses. To perform the Profit First method responsibly, Michalowicz recommends using multiple business checking accounts to distribute percentages of the business’s cash deposits.

The five foundational Profit First accounts are:

- Income: A general purpose account where all business revenue is deposited.

- Profit: The account that holds the predetermined percentage of revenue your business takes off the top as profit.

- Owner’s pay: The account that holds the percentage of income used for founder(s) to pay themselves a salary.

- Tax: The account that holds the portion of business revenue allocated to pay taxes.

- Operational expenses (OpEx): The account that holds remaining business revenue not allocated for profit, owner’s pay, or taxes. This will go towards covering business expenses.

If you’ve ever used an envelope system for your personal budget, this approach may feel familiar. These segmented accounts are the foundation of the Profit First cash management method, helping you maintain discipline and visibility across your finances, so you always know how much you have available in each category.

How much money should you put into each account?

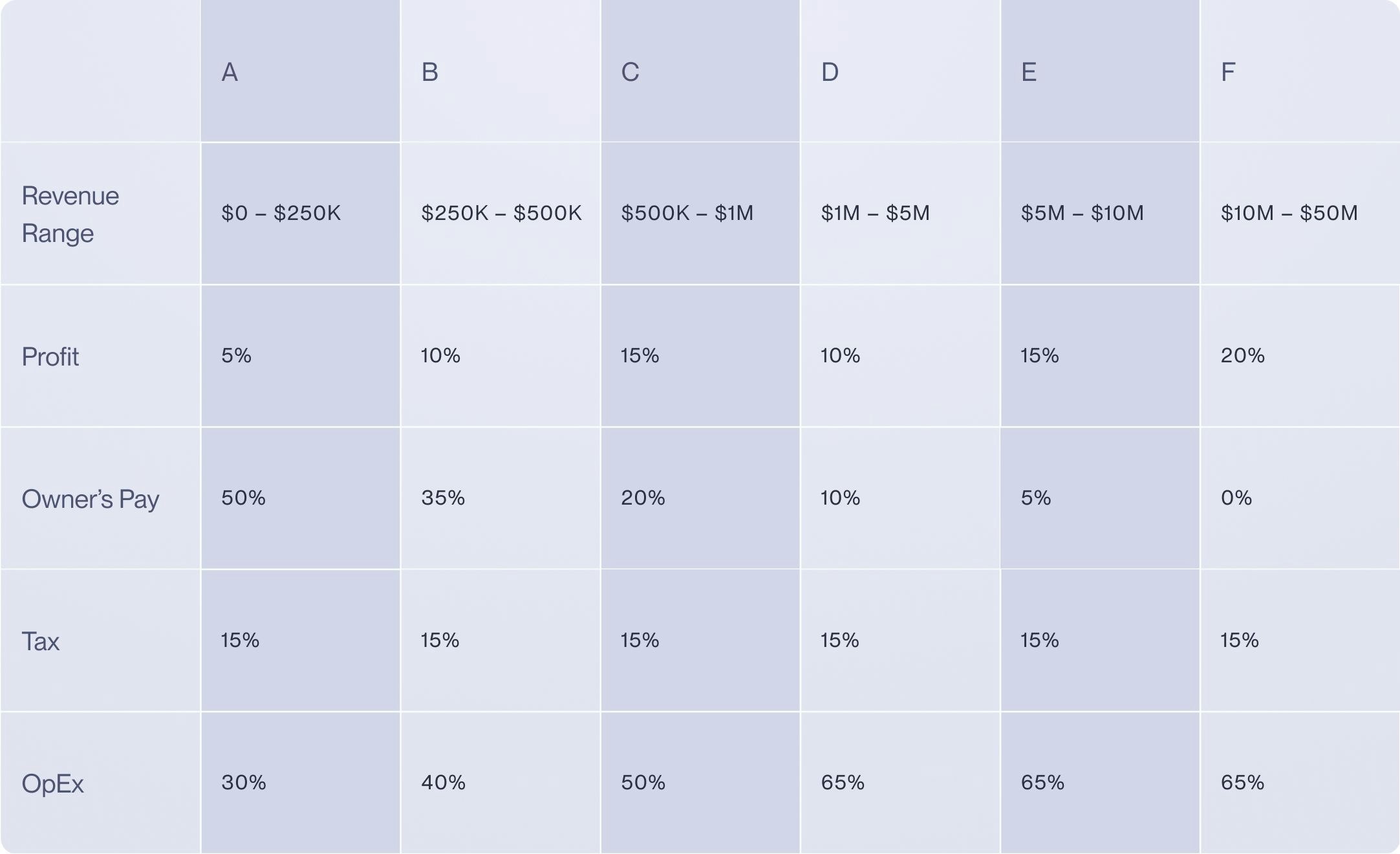

The trickiest aspect of the Profit First method is determining how much revenue you should allocate to profit vs. expenses. In his book, Michalowicz describes the amount you’re currently allocating to each account as your Current Allocation Percentages (CAPs), and the amount you want to allocate to each account as your Target Allocation Percentages (TAPs).

The goal of the Profit First method is to make your CAPs align with your TAPs by optimizing spend. To help business owners accomplish this, Michalowicz provides guidance on how to best organize Profit First percentages based on a company’s annual income:

How much money should you put into each account?

Michalowicz recommends allocating revenue from the income account to the other accounts in accordance with your TAPs twice per month on the 10th and 25th (though you can adjust the specific dates in a way that makes the most sense for your business).

To use the Profit First method effectively, make sure to pay your bills out of the appropriate account. It’s also advisable to revisit your TAPs periodically and adjust them as the business scales.

Benefits and Drawbacks of Using the Profit First Method

Benefits:

- Prioritizes profit early, helping startups and small businesses build healthier financial habits from the start.

- Creates budgeting discipline by limiting available funds for operating expenses.

- Supports owner compensation, ensuring founders and small business owners pay themselves consistently.

- Improves cash flow clarity by segmenting income into dedicated accounts.

- Builds financial resilience by setting aside profit and tax allocations regularly.

Drawbacks:

- May be difficult to implement for businesses with inconsistent revenue or thin margins.

- Requires ongoing management of multiple accounts and regular fund transfers.

- Less aligned with high-growth strategies that prioritize reinvestment over short-term profit.

- Initial setup can be complex, especially for teams unfamiliar with structured cash management systems.

While the Profit First method can offer visibility into your finances and help you see profit sooner, small businesses and startup founders should assess whether the system fits their cash flow needs, industry margins, and long-term growth goals.

Common Profit First Implementation Mistakes & How to Avoid Them

1. Skipping regular transfers:

Set calendar reminders or automate transfers to keep consistent.

2. Setting unrealistic TAPs too early:

Gradually shift toward your ideal allocations to avoid cash shortfalls.

3. Ignoring seasonal fluctuations:

Adjust your percentages during high- and low-revenue periods.

4. Paying expenses from the wrong account:

Maintain strict separation of account purposes to reinforce discipline.

5. Failing to revisit your TAPs:

Reassess your percentages quarterly as your business grows.

Frequently Asked Questions (FAQs)

What is the Profit First Method?

The Profit First Method is a cash management system that prioritizes profit by allocating a percentage of income to profit first—before paying expenses. It flips the traditional accounting formula to Sales - Profit = Expenses.

What percentage should I allocate to each Profit First account?

It depends on your business size and goals, but common starting points are 5% profit, 50% owner’s pay, 15% taxes, and 30% operating expenses. These are your Target Allocation Percentages (TAPs).

Is the Profit First Method suitable for startups?

The Profit First method works well for many bootstrapped startups looking for steady, profitable growth. However, it may not be the best fit for VC-funded or hyper-growth companies where profitability is a longer-term goal. It's important to evaluate whether the method aligns with your startup’s stage, goals, and financial model.

Is it suitable for larger enterprises?

Larger businesses can adapt the method, but they may need more nuanced systems. The core principles—prioritizing profit and creating financial structure—can still apply.

How often should I allocate funds in the Profit First system?

Most businesses allocate funds bi-monthly, on the 10th and 25th. The key is consistency.

Can I use Profit First with Mercury accounts?

Yes. Mercury allows up to 15 checking accounts, making it simple to set up, and you can set percentage-based transfer rules to automate your Profit First cash management strategy.

Related reads

Deferred revenue explained: Why getting paid isn’t the same as earning revenue

Invoice coding best practices for startups

Business loan default: What happens if you miss a payment?