Introducing SAFEs by Mercury, for fundraising integrated with your banking

When Carolynn Levy and her team at Y Combinator (YC) first launched the SAFE in 2014, the five-page document was intended to build on the popularity of convertible notes while fixing what didn’t quite work about them. The document would be a way for startups — particularly early-stage companies — to raise money quickly and with the utmost flexibility, but with a focus on equity over debt, and without the complexity around interest rates and maturity dates.

Today — nearly ten years later — SAFEs (or, a simple agreement for future equity) have become a vital tool in the startup ecosystem. SAFEs work by allowing founders to get venture capital money right when they need it while pushing the paperwork, cost, and time required of an equity round to a later date. This can be a valuable and time-saving tool for startups in many cases, particularly for pre-seed and seed companies where it can be difficult to price rounds so early. Among these companies that raised convertible financing in Q1 2023, 67% did so through SAFEs versus convertible notes, according to Carta.

But SAFEs are especially useful in the current fundraising climate, where capital is more constrained and startups are relying more on SAFE-powered bridge rounds to extend their runway between priced equity rounds. And this is true for startups across stages, with Carta reporting an 87% uptick YoY in post-Series A companies that opted to raise a SAFE or convertible note in Q3 2022.

Seeing the popularity and utility of SAFEs in recent years, and understanding the particular benefit that this fundraising tool has in the current environment, Mercury decided to integrate the document into our existing product to facilitate a more seamless SAFE process for startups banking with us.

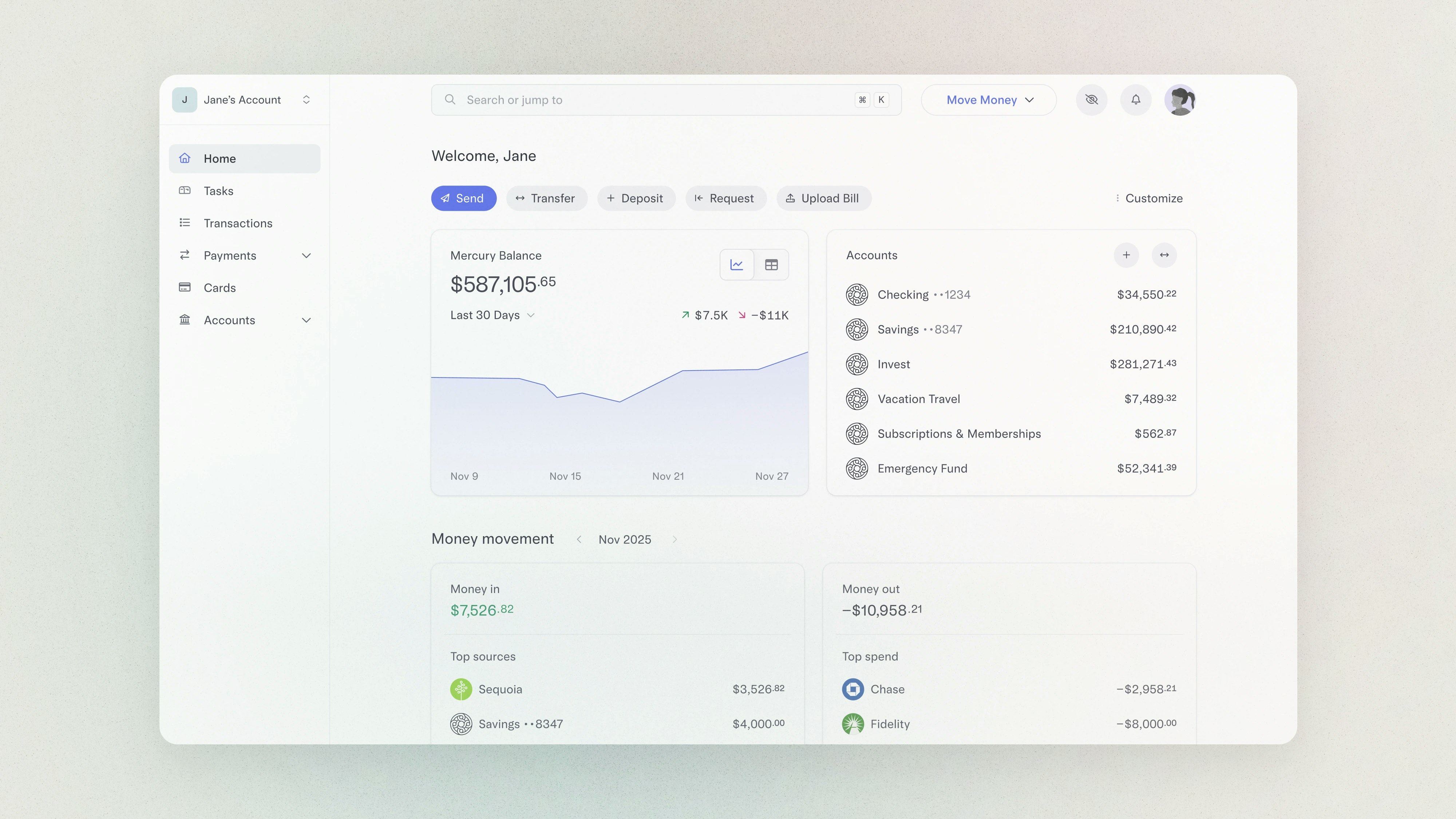

To that end, we’re proud to introduce SAFEs by Mercury, a new feature that will enable founders to manage the end-to-end SAFE process — from document creation and distribution to payment requests and tracking — straight from their Mercury dashboard.

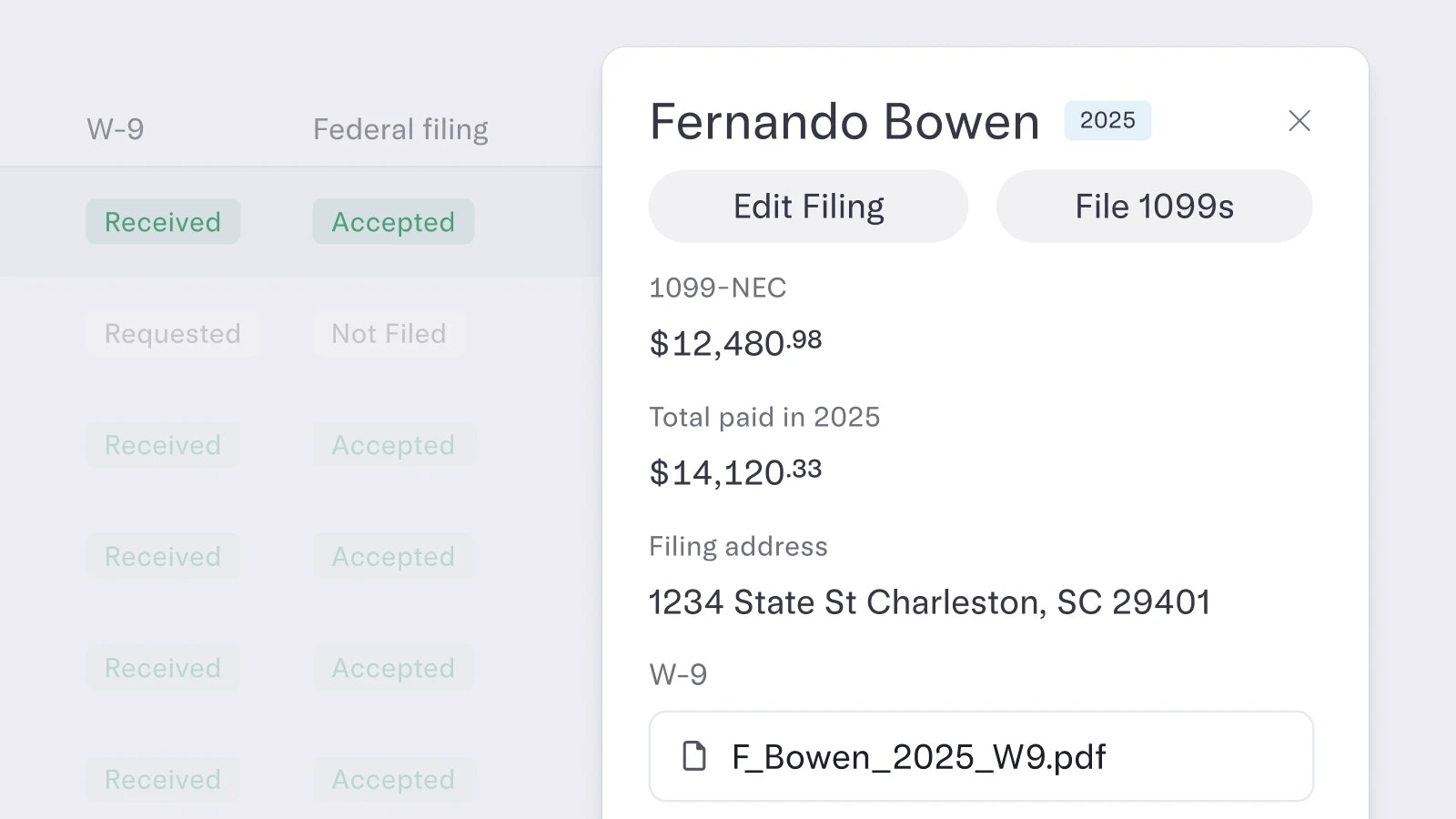

Here's how it works: Once a founder and investor reach an agreement on terms, the founder can generate a SAFE document within the Mercury platform. (SAFE documents created within the Mercury dashboard follow the YC template.) In a seamless workflow, both parties can sign the agreement directly within Mercury via ESign capabilities, eliminating the notoriously tedious back-and-forth exchanges and PDF email attachments that typically accompany the SAFE process.

From there, Mercury also allows for easy tracking of any payments linked to a specific SAFE, ensuring a hassle-free experience. Customers can effortlessly access and review all their past and present SAFEs through a dedicated SAFE dashboard that also provides an at-a-glance overview of investors, making it easy for founders to monitor progress.

“The integration of SAFEs by Mercury into founders’ existing Mercury accounts will help founders get venture capital money right where they need it, without messy tracking spreadsheets and awkward texts coordinating,” says Michael Ducker, VP of Product at Mercury. “Founders need every tool available to them in this stale fundraising environment. This launch is about giving founders the right tools integrated into existing workflows to create an added layer of efficiency that doesn’t exist with current SAFE offerings on the market.”

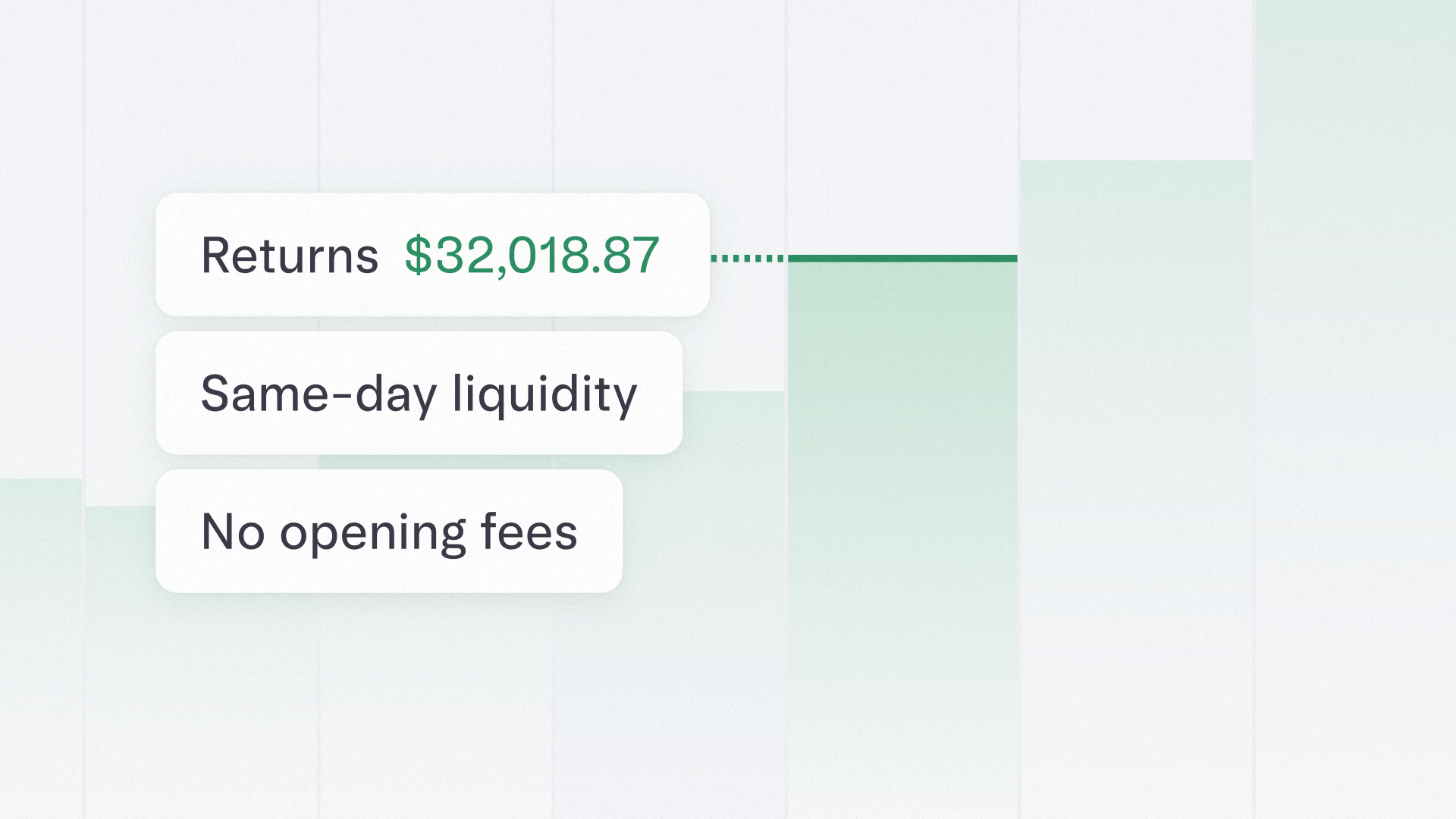

Mercury’s focus on building the future of banking for startups comes down to understanding that startups need so much more than the usual offerings of a traditional bank. Startups’ unique needs — particularly around cash flow, fundraising, money movement, and efficiency — demand bespoke tools created with them in mind. With the launch of SAFEs by Mercury, we’re continuing to unlock new possibilities for founders and startup teams in an effort to give them a stronger foundation as they build the next great companies.

Related reads