2025 Ecommerce Holiday Report: Headwinds, High Hopes, and AI Acceleration

It hasn’t exactly been an easy year for ecommerce companies. Rising costs, algorithm whiplash, and cautious consumer spending have created plenty of headwinds. So, as Black Friday and Cyber Monday loom, how are they approaching the 2025 holiday sales season?

We asked 750 leaders building ecommerce businesses, and their answers revealed more than seasonal tactics — they surfaced how the industry is adapting to both economic pressure and technological change in real time.

The headline? Most are profitable and optimistic, and AI has become embedded infrastructure across operations. But look closer and the holiday season is exposing divergence in how — and how quickly — companies are investing in what comes next.

Methodology: Data is based on a Mercury-commissioned survey of 750 U.S.-based ecommerce business leaders in Oct/Nov 2025. The sample was provided by Sago, a research panel company. Data points are rounded up or down to the nearest single digit, which means some things won’t add up to 100%.

Profitability is mostly… up

Sure, the market’s been unpredictable, costs are rising, and the public narrative about ecommerce has often emphasized contraction (and even distress). But 73% of respondents said profitability increased significantly or moderately in the past 12 months, a figure that jumps to 87% among companies with 500+ employees.

Businesses under 10 years old were more likely to say profits rose (78%) compared with older businesses (61%); 17% of the latter group reported declines.

To look through another lens, profitability increases were more likely amongst AI users: those using AI extensively were more than 2x as likely as those using AI a little or not at all to report an increase in profitability over the last year. (Drilling down, 50% of heavy AI users also reported significant profitability increases compared with only 11% of non-users.) These figures show correlation rather than causation — but they do highlight a clear divide.

There are still plenty of positive signals here. And maybe that has something to do with why respondents are optimistic about their business prospects in 2026: 88% were somewhat or strongly optimistic, versus just 4% who had a more negative outlook. Though similar to what we saw in our New Economics of Starting Up report earlier this year, there was a notable split between AI users and non-AI users. 92% of ecommerce leaders that use AI said they’re optimistic about the growth of their business in 2026; that rises to 96% if they use AI extensively. 69% of non-AI users said the same — a substantial number still, but also significantly less than those AI users.

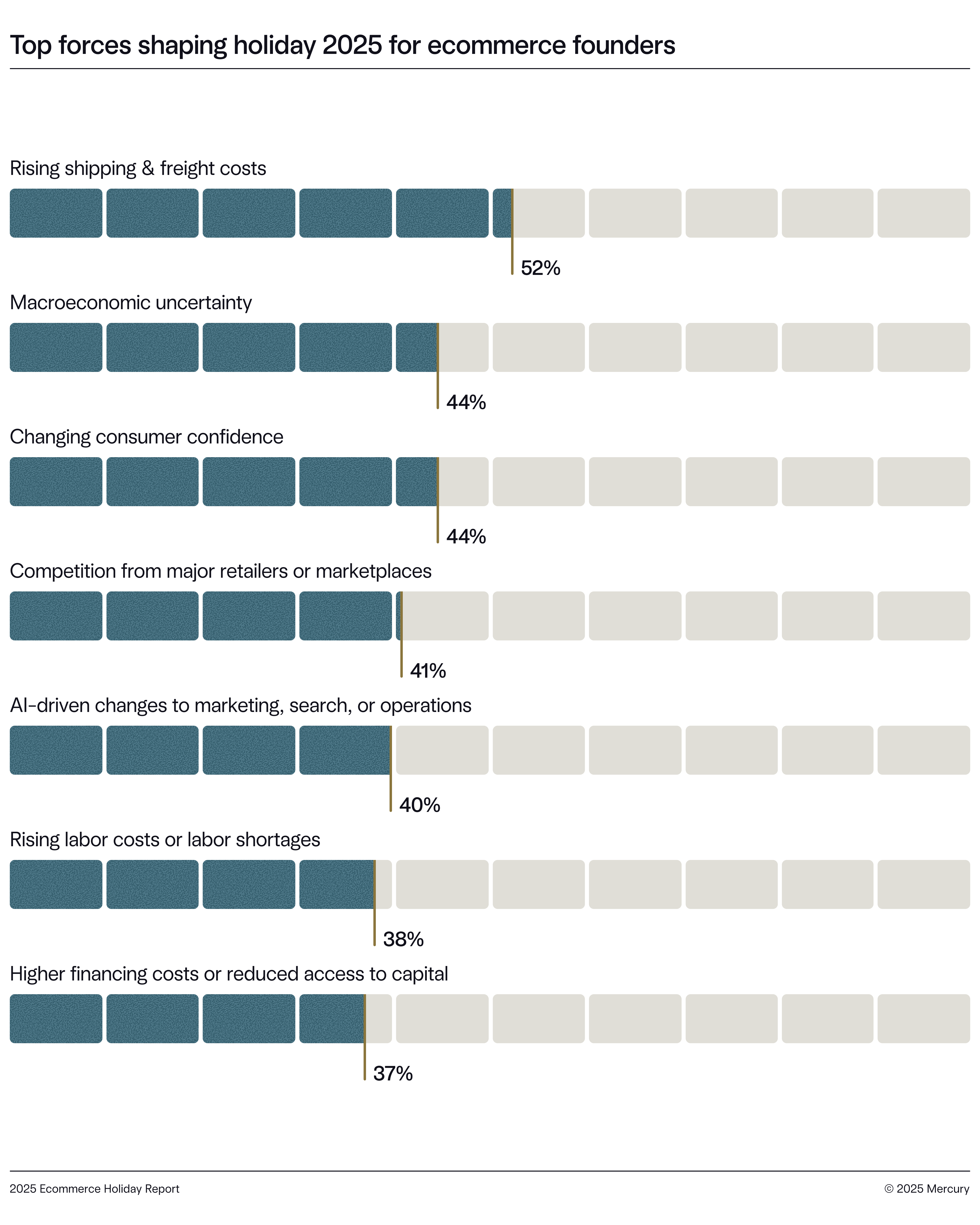

Ecommerce businesses face pressures from the economy to the algorithm

When asked what forces are having the biggest impact on this year’s holiday planning, the top overall were rising shipping and freight costs (52%), changing consumer confidence/spending patterns (44%), and macroeconomic factors (44%). Those shipping and freight aspects were most intensified for smaller, albeit not micro, companies (58% for companies 11-49 people, and 56% for companies with 50-99 people).

More granularly, larger companies (500+ employees) were most likely to feel the impact of AI-driven changes to marketing, search, or operations (53%) on their holiday planning — an influence coming in about 20-30 points higher than for companies under 100 people.

Moreover, 54% of ecommerce leaders expect to be more reliant on financing and credit this season than past years. The macro elements are fairly unsurprising here: in the New Economics of Starting Up, we found that ecommerce founders were 2–3x more likely than other founders to be tightening their budgets, and overall, highly concerned about the macro environment (even if they felt less concerned about their own business prospects).

AI is becoming ecommerce infrastructure

Regardless of how significantly they felt it was specifically impacting holiday planning, nearly 9 in 10 respondents (86%) said they rely on AI extensively or somewhat in their business operations. Larger companies (500+ employees) were more than 5x as likely as smaller companies (10 employees or fewer) to be in the heavy usage category. (47% vs. 9% )

Overall, AI adoption is broad but somewhat stratified for these ecommerce companies. Here is the percentage of ecommerce companies using AI somewhat or significantly, by team size:

64%

1–10 employees

84%

11–49 employees

93%

50–499 employees

96%

500+ employees

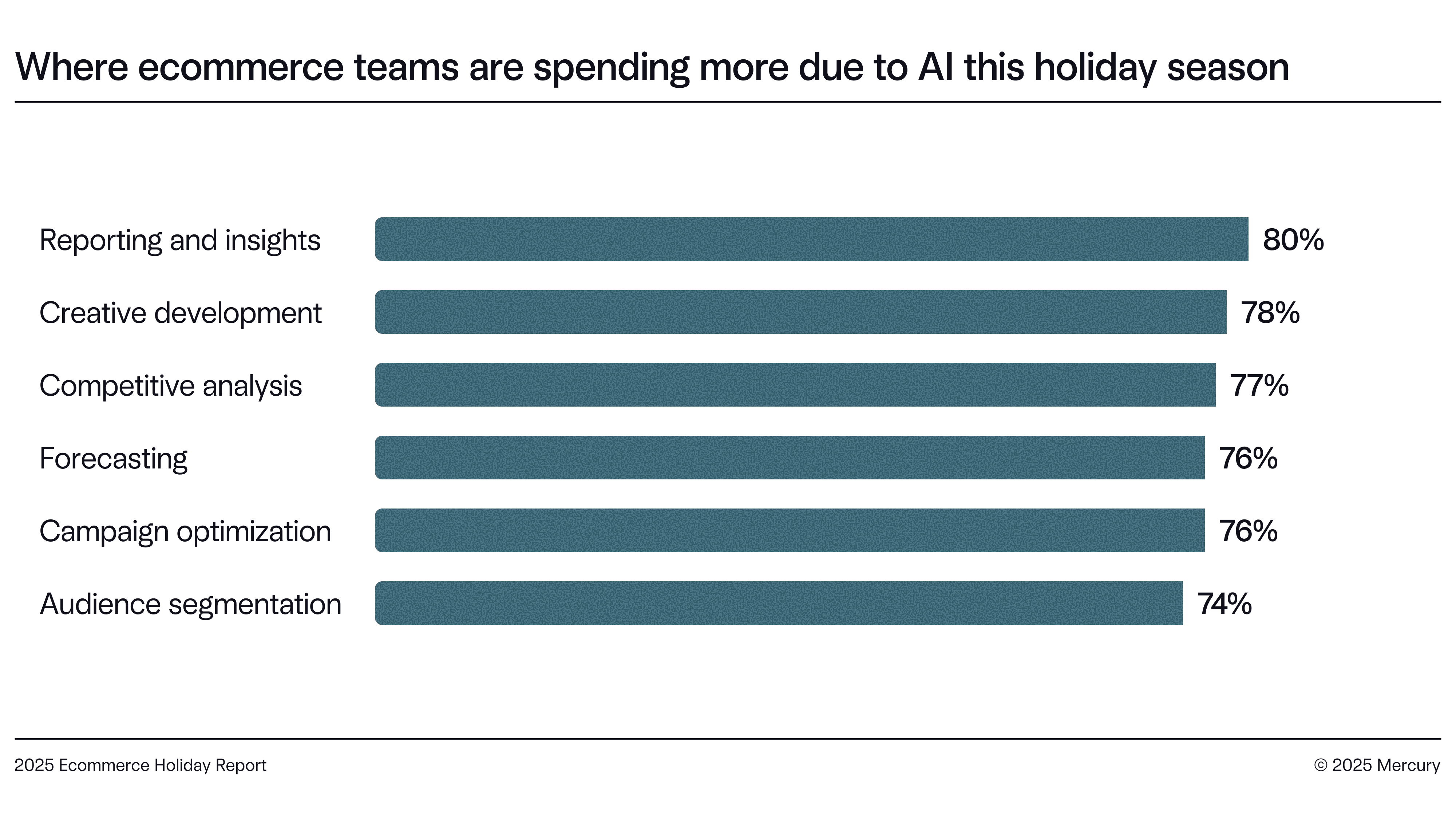

Interestingly, AI usage is also leading ecommerce businesses to spend more money on marketing this holiday season. Across all surveyed vectors respondents said they’re spending more because of their use of AI. Only 4% noted a decrease in these marketing costs due to their AI use.

Moreover, 91% of heavy AI users plan to increase digital ad spend itself this season versus 40% of those using AI sparingly or not at all. Here is the percentage of companies using AI to plan or optimize holiday ad spend, by team size:

48%

1–10 employees

72%

11–49 employees

80%

50–99 employees

83%

100–499 employees

86%

500+ employees

Discovery is being rewritten in real time — and scale influences who is investing ahead of the curve

As the critical holiday sales season gets underway, ecommerce leaders we surveyed shared their predictions for what distribution channels are going to deliver. They’re betting on paid social (70%) and marketplaces like Amazon and Walmart (55%) to drive the most revenue this holiday season.

Moreover, 83% said AI tools will help small businesses compete with major retailers.

And AI search is on their minds. Ecommerce leaders are thinking a lot about how this is reshaping discovery, and have some (pretty optimistic) predictions about where it’s heading:

- 74% said AI-generated search results would lower their marketing costs by making customer acquisition at least somewhat more efficient.

- 86% think AI-generated search will help them reach new customers.

- 90% said it will positively impact sales this season.

But there’s nuance and conflicting feelings beneath that enthusiasm. Even as ecomm leaders see upsides, 43% worry it could make it harder for new customers to find their products, and others (65%) worry that it could increase their CAC (even if it makes marketing cheaper). Perhaps that tension is driving action: 77% are rethinking their marketing strategy in response to AI’s impact on search and discovery — and they’re making investments to keep pace. In an effort to appear more consistently in AI-generated search results, 74% of companies are doing more content marketing, 68% have purchased tools to help, and 33% have hired external agencies.

Overall, a majority of ecommerce companies are planning to invest at least somewhat in their ability to show up in AI-generated search results this holiday sales season:

85%

of companies are investing in appearing in AI-generated search results

Scale also mattered here: 51% of larger companies are investing significantly to ensure they appear in AI-generated results, compared to just 19% of companies with 10 people or fewer. (10% of all companies noted that they plan to invest in this generally, but won’t be doing it for this holiday season.)

Ecommerce leaders are navigating a shifting landscape as they prepare for this holiday sales season and beyond

The headwinds that defined ecommerce the past year haven’t disappeared — if anything, that pressure can feel even stronger during the busiest sales season of the year. But the ecommerce leaders we surveyed are largely optimistic, with profitability on the upswing as they actively invest in new opportunities and tech.

We see these ecommerce companies adapting, building, and setting themselves up for success as the rules of discovery and commerce get rewritten. Not just for this holiday season, but for 2026 and beyond.

Thank you to Stephanie Baumann, Adam Berg, Celeste Carswell, Nic Corpora, Megan Duffy, Jordan Horsman, Heather MacKinnon, Tamara Rahoumi, Andrew Shen, June Shin, and Milena Wall for contributing to this report.

Related reads