How to make hype cycles work for you as a startup founder

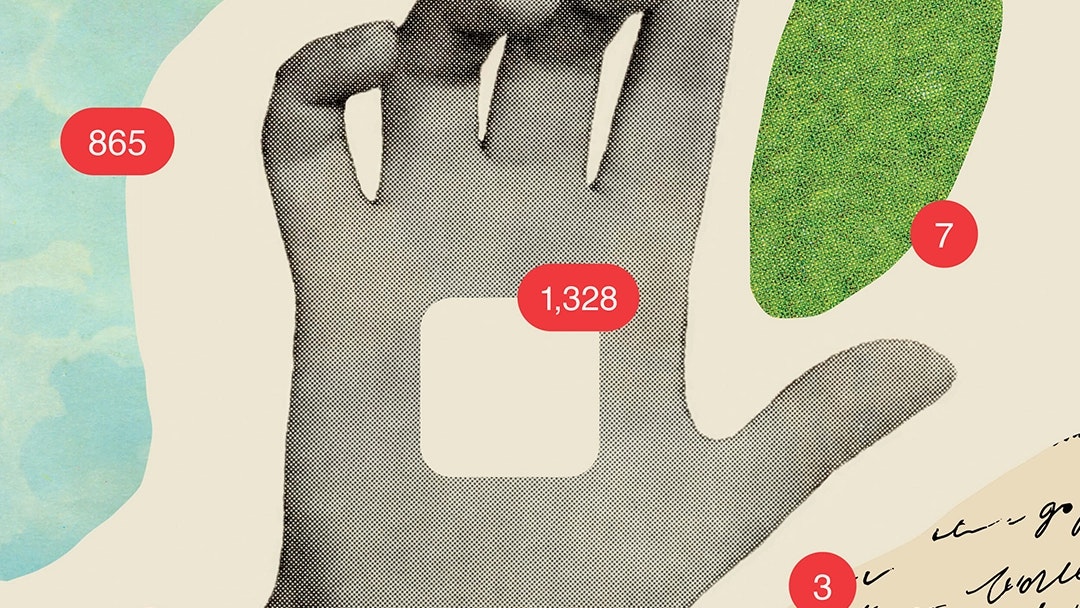

New technology that gives rise to seismic changes and momentous opportunities constantly orbits Silicon Valley — spinning up hype cycle after hype cycle in the process. You’ve likely watched trends like climate tech, augmented reality, web3 and blockchain, and now AI go through such cycles. Some cause tectonic shifts, forever changing the landscape and creating transformative businesses. Others are captivating yet short-lived phenomena — as swiftly fleeting as the weather. As a founder, you may wonder how important it is to study these patterns presented by hype cycles, and how you can leverage learnings or opportunities for your own startup when a new hype cycle moves through the technology space.

Mercury co-founder and CEO, Immad Akhund, recently invited prominent VCs for a candid virtual discussion about hype cycles as part of our quarterly series, Investors Unscripted. He was joined by Amit Kumar, partner at Accel, Elizabeth Yin, co-founder and general partner at Hustle Fund, and Peter Boyce II, co-founder and managing partner at Stellation Capital. The group discussed how they discern the merits of an emerging hype cycle, and whether founders should play into them or not. Here, we explore some of the key insights from their discussion.

Watch the recording here:

Develop your own point of view.

While in the thrall of a hype cycle, like the one currently surrounding AI, VCs have to become more judicious about the bets they make — and founders should be similarly discriminating amid the excitement. Amit takes a thesis-driven approach, inspired by the thinking behind seeking out opportunities with a “prepared mind,” as described by Sebastian Mallaby in his book, ‘The Power Law.’ Amit spends months carefully studying an emerging area, the burgeoning technology, and how the most driven people in that area are applying their unique perspectives to it. He explains, “your job as an entrepreneur and my job as an investor is to formulate your own point of view and your own opinion.”

Founders can adopt a similar practice to the thesis-driven approach utilized by VCs to get clear on their product and how best to position it to raise capital and bring it to market.

Be an authentic participant.

Once the opportunity in a certain category is inevitable, and it’s no longer a question of “why” or “when,” it becomes a matter of “who.” VCs like Amit, Elizabeth, and Peter are laser-focused on the founders and teams who can realize these often nascent opportunities, seeking out those who have a proven commitment to the space. Peter explains that this process becomes about “[assessing] other measures of authenticity, future vision, clarity of thought, and willingness to push the company independent of the hype. Those are the things that end up being really important in evaluating which are the founders who can go the distance.”

Authenticity and a demonstrated investment in a category is a true asset to VCs. According to Amit, “a lot of it comes down to the founder — and the question that resonates with me, is ‘is this person an authentic builder, or are they just chasing heat?’”

Just as a VC might exercise a healthy amount of skepticism in their investment in a category with outsized attention, founders should be wary of bandwagonism, too. Suddenly pivoting your roadmap to intersect with a hype cycle might be a vehicle for attracting attention and even raising capital in the short term, but it could nudge your once-focused plan off-course in the long term. As a founder, you have to evaluate whether something enticing, like AI currently, or crypto recently, is a valuable addition to your vision, or a fashionable — and possibly costly — distraction.

Let’s say amidst the crypto boom you raised money to pivot into web3 or add crypto to your feature set in some capacity, to attract investor money. “Be careful what you wish for,” says Amit. “Now you have crypto investors on your cap table, you’ve hired a bunch of crypto people on your team, and you’re living a crypto company lifestyle. Be really sure that’s what you want to do.” Watching the space for new opportunities is a smart move, just so long as founders are ready to build anew, or pivot wholeheartedly.

Some of the best enduring founders look like anthropologists in their excavations of founders and companies that came before them.

Peter Boyce II, co-founder and managing partner at Stellation Capital

Study your peers to stand out.

Watching the companies that came before you in a given space and developing a hypothesis about their successes and failures, can equip you with a stronger perspective on your own venture. “What’s really important to take away from the companies who don’t make it is to have a thesis on why they didn’t make it,” Elizabeth explains. “Perhaps A,B,C, or D weren’t ready in the category.” She gives the example of VR, where the technology and UX has to catch up before her firm will continue to look at companies in that space. Peter agrees that this kind of analysis can help you stand out in a sea of startups. He believes, “some of the best enduring founders look like anthropologists in their excavations of founders and companies that came before them.”

Follow your vision instead of chasing hype.

When watching a hype cycle unfold from the sidelines, it may feel like you’re missing out — especially if the category you’re building in isn’t currently caught up in its momentum. But remember, while these cycles seem to happen instantaneously, in reality, they take years to unfold. As Amit reminds us, “OpenAI is ironically one of the best examples of that. The company was founded eight or nine years ago and now we’re [discussing the hype around it]. It’s good to be early — it’s good to be right.”

As a founder on the outside of a hype cycle, you might also be concerned that your startup won’t attract the eyes of investors. Rest assured that while VCs are always watching emerging tech for opportunities, they’ll continue to build their portfolio according to their usual strategy. This, combined with the fact that press attention often overstates the prominence of a certain tech relative to VC interest, means building your startup according to your unique vision and seeking out VCs who invest in that category, is likely more advantageous than chasing hype.

Not being caught up in a hype cycle can have its advantages, too. Immad explains that at the start of Mercury, there weren’t many challenger business banks taking on the old guard, and this afforded the team the chance to stand out and define a category all their own. Peter discusses the belief that “the greatest outcomes for founders, companies, and investors is to be contrarian and right — the contrarian is that you birthed a company when there was no attention on it and then just over years you end up intersecting [with a hype cycle].”

Simply by focusing on your vision, what makes it unique, and how to reach your customers, you might be surprised to find yourself at the threshold of the next hype cycle — poised to incorporate new tech to propel you in the next leg of your business’s journey.

Fresh perspectives are what last.

As for whether founders or VCs can anticipate these hype cycles and which will stand the test of time, there are patterns, but as Elizabeth reminds us, only time will tell. This means that jumping in on a new wave of tech isn’t enough — VCs are still looking for promising opportunities across a diverse range of categories. These trends can come from all over — not simply by way of invention or a once imperfect tech finally maturing.

Take, for instance, the growth of telemedicine in healthcare over the course of the Covid-19 pandemic. This was a consequence of not just an opportunity in tech, but also macro, societal, and legislative factors conspiring to clear the way. To dive deeper into how these opportunities emerge and what to look out for, the group recommends, ‘Technological Revolutions in Financial Capital’ by Carlota Perez, which explores the dynamics between culture, tech, and financial trends. The key takeaway for founders? When the cultural climate is primed, and things are easy to build, the challenge becomes coming up with something compelling and new.

To attend the next Investors Unscripted live, simply sign up here to be notified and receive your invite.

Related reads

How I prep for interviews

What embracing everyday magic can teach us about design

A map of ambition: San Francisco