Introducing our new CFO and CCO

Co-founder and CEO of Mercury.

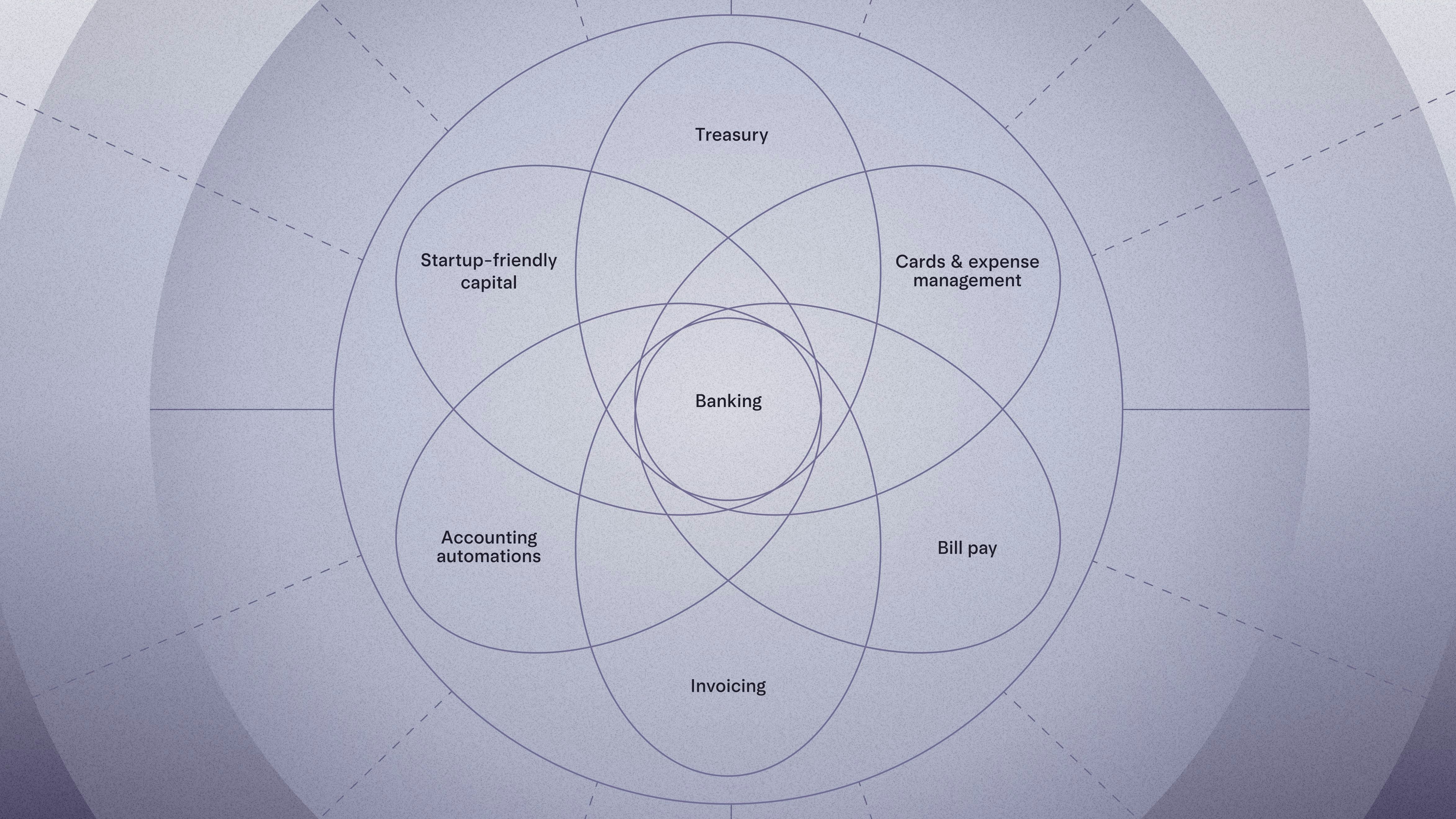

When Mercury announced our Series C funding in March 2025, I wrote about how it was a milestone on our path toward our vision that banking should do more than just hold your money — it should bring all the ways people and businesses use money into a single product that feels extraordinary to use.

Our next milestone in that journey is expanding our C-suite to match the scale, complexity, and ambition of where Mercury is headed and to help guide us through our next phase of growth.

Steve Pearlman joins as Chief Compliance Officer

Steve Pearlman brings deep regulatory and operational expertise to Mercury from his roles across high-growth fintechs and traditional banking. He has served as CCO for Varo Bank, Revolut US, and E*TRADE Bank, where he helped scale and strengthen compliance functions. During the 2008 financial crisis and recovery, Steve was a key compliance leader at Freddie Mac for nearly a decade, where he oversaw enterprise-wide compliance programs for the government-sponsored enterprise. His experience spans mission-driven organizations like Capital Area Asset Builders, large-scale institutions like Capital One, and more, giving him a broad perspective on how to build responsible, resilient financial systems.

Steve has earned trust across the financial industry, and his expertise will help bring added structure and rigor to the team as Mercury’s compliance needs grow in scale and complexity.

He now oversees Mercury’s compliance program, including managing consumer compliance, AML risk, and enterprise risk management. And he’ll help our compliance programs stay a step ahead of our products and keep pace with our bank partners and regulators’ expectations. That includes continuing to balance innovation with the structure and accountability that Mercury, regulators, and customers expect.

“Mercury is thinking about the future of finance in a way no other fintech or bank is. By reimagining traditional banking and financial services from the needs of entrepreneurs such that it becomes the singular product for all the ways a business uses money, Mercury is creating a smarter, more seamless experience that unlocks real value. What Mercury’s launched so far is just the tip of the iceberg and I’m eager to leverage my experience to help realize the full potential of the vision,” Steve shares.

Dan Kang promoted to Chief Financial Officer

Dan Kang was Mercury’s first finance hire back in 2022. Since then, Dan has built our finance function from scratch, scaled a high-performing team, and helped define how we grow with financial discipline and long-term vision. Before Mercury, he spent over eight years at fintech companies like Digit and Square, where he saw both companies through exit stages. His career also includes stints in investment banking and private equity.

As CFO, Dan is responsible for all of Mercury’s financial and accounting operations and partners closely with leaders across the organization to ensure Mercury’s financial practices support long-term growth. He also leads Mercury's credit underwriting team that focuses on enabling further access to credit and capital for growing businesses.

Under Dan’s leadership, Mercury has delivered 11 consecutive quarters of profitability, a strong balance sheet, and helped ensure our long-term financial flexibility. He’s proven to be a true partner in shaping our strategy and driving the success of our business.

Beyond the numbers, Dan plays an active role in shaping our product as CFO. He acts as “customer zero” for Mercury’s financial workflow software, bringing a first principles mindset into what founders and finance leaders need.

“I joined Mercury because there’s a massive opportunity for innovation at the intersection of banking and financial software. I’ve spent my career on finance teams, so I know how frustrating it is when financial tools get in the way — and how powerful it is when they just work. I also know how much our customers trust our products to run their businesses, and part of my job is making sure Mercury is a stable, lasting company they can count on. I’m fortunate to be in a CFO role where my scope goes beyond the traditional finance team, and I can have an impact on the strategic direction, product development, and so much more at Mercury,” says Dan.

New board members

To create a generational company with lasting impact, we need strong governance and experienced leaders outside of the company in place. As I shared in our Series C announcement, we recently appointed four new members to Mercury’s board. They include:

- Tim Mayopoulos — When the FDIC took over SVB, they needed a seasoned leader to stabilize operations and appointed Tim as President and CEO of the bridge bank until they sold most of the bank’s assets. His selection was unsurprising given his decades of experience leading major financial institutions, including as President and CEO of Fannie Mae during its recovery from the financial crisis.

- Tom Brown — An advisor to Mercury and me since the early days of the company, with over 15 years of experience at the intersection between financial services and technology, including Visa, PayPal, Upstart, and Chime.

- Sonya Huang — A partner at Sequoia Capital who led our Series C round. She brings rich experience from partnering with companies like Cribl, dbt Labs, Fireworks, Gong, LangChain, and OpenAI, and a keen interest in taking the long view and reinventing legacy financial services.

- Jason Zhang — As co-founder and Chief Operating Officer at Mercury, Jason has been pivotal in shaping the company from day one. His product vision, passion for quality, and uniquely thoughtful leadership help make us what we are.

The new members join Saar Gur of CRV and me, as well as board observers Alex Rampell of Andreessen Horowitz and Dan Rose of Coatue, in helping guide Mercury through its next phase of growth and beyond.

To learn more about the past year and the journey ahead, read our 2024 Annual Letter.

About the author

Co-founder and CEO of Mercury.

Related reads