Supercharge your VC round with founder-friendly venture debt

Head of Capital & Relationship Management

Hi there, I'm Jason Garcia and I joined Mercury to lead the Mercury Capital team. Today, I’m excited to reveal something we have been quietly building since June of last year: our first capital product, venture debt.

Building Mercury venture debt has been a labor of love. In the past, I’ve had a hand in providing hundreds of millions in venture debt as a lender at Silicon Valley Bank. I’ve also used venture debt myself as a CFO at multiple startups. Venture debt is an incredible tool for startups to preserve ownership, extend runway, and accelerate the timeline to reach their goals—but the current landscape of venture debt providers is stuck in the past.

With most providers, founders still have to work with old processes designed two decades ago. They have to take tedious phone calls, waste precious time going through manual diligence processes, and get charged high interest rates. That’s why we decided to build this product ourselves.

Mercury Venture Debt is built with founders in mind. A few months ago, I was manually underwriting loans in Excel on my own. Today, our venture debt program is supported by an entire team of people, including ex-founders and experienced venture debt lenders, along with tools that make our process efficient and transparent.

Here’s what you can expect from Mercury venture debt

We fund a wide range of companies, whether you're in fintech or flower delivery, pre-revenue or at a later stage. Over the past six months, we’ve already provided venture debt to startups that work across industries, including hardware, SaaS, and tech-enabled services. These startups are backed by some of the world's most recognizable venture capital firms, like Andreessen Horowitz, Founders’ Fund, and Floodgate, to name a few.

We're excited to offer:

- Competitive rates: Our loans come with minimal dilution, low interest rates, and founder-friendly payback plans.

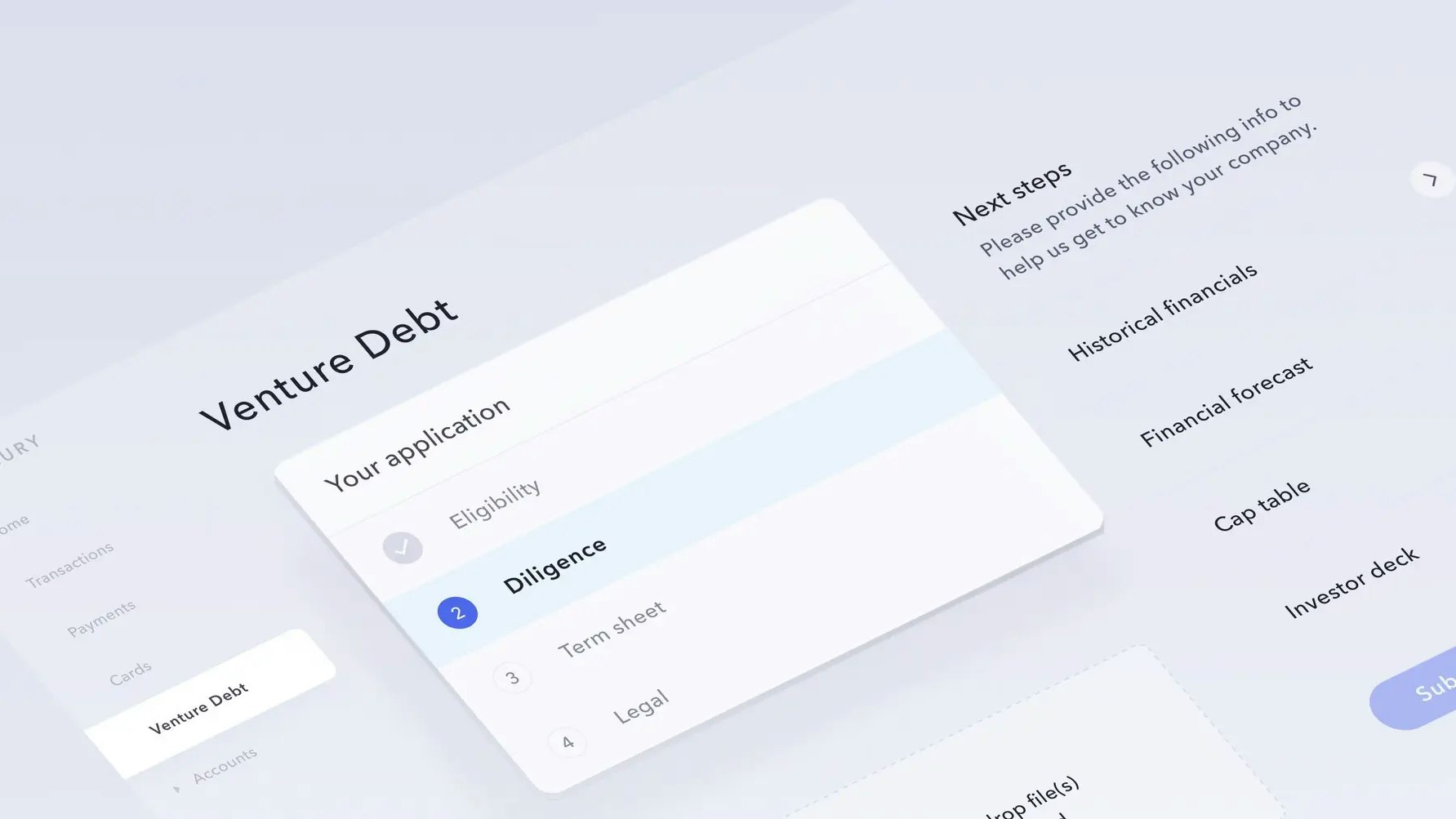

- Quick application: We’ve built a fully online application. Hear back from us within a few days and use documents you have on hand from your VC fundraise for diligence.

- Flexible financing: Use your loans to grow your business the way you think is best—whether that’s marketing, hiring, or otherwise.

It’s been immensely rewarding to build venture debt at Mercury and watch founders hit their goals. This year, we expect to provide over $200M in venture debt. Within the next two years, we expect that number to pass $1B.

Venture debt is our first capital product. It will lay the foundation for Mercury Capital, our growing program to connect founders with financing that supports their business’s goals.

If you're interested, get started with our eligibility questionnaire.

About the author

Head of Capital & Relationship Management