Mercury received $20m in series A funding led by CRV

We announced our $20 million in Series A funding today. While we knew this endeavor would take some capital, we didn’t count on raising so quickly after our launch in April, and were able to do so largely because of the genuine enthusiasm and groundswell of support from the community. So before going into detail on what’s frankly a pretty wild roster of investors joining us this round, we wanted to give genuine thanks to the companies and founders that are building their businesses with Mercury. You’ve helped us figure out what features to build, tweeted witticisms, raved to friends running companies, and generally been the best possible customers to work with. We’ll be putting the money into making a product that will foundationally make it easier for your company to succeed.

The round was led by CRV, and we’re very excited to have Saar Gur from CRV joining our board. Andreessen Horowitz, which led our seed round, was also a major participant, and other investors joining include Will Smith’s Dreamers Fund, Kevin Durant’s Thirty Five Ventures, Serena Ventures, The Cultural Leadership Fund, Nick Jonas & Phil McIntyre, Clocktower Ventures, Brad Flora (Y Combinator Visiting Partner), Allison Barr (Head of Money, Uber), Ryan Shea (co-founder, Blockstack), Ayo Omojola (Product Lead, Square Cash), Jonathan Swanson (co-founder, Thumbtack), Peggy Mangot (SVP Innovation, Wells Fargo), Julia and Kevin Hartz (co-founders, Eventbrite), Scott Belsky (co-founder, Behance), Rajat Suri (co-founder, Presto, Lyft), 500 Fintech, Andre Iguodala (angel investor), Ryan Petersen (CEO, Flexport), Rahul Vohra (founder, Superhuman), Anjula Acharia (angel investor), Larry Fitzgerald (angel investor), Suhail Doshi (co-founder, Mixpanel), and Melo7 Tech Partners.

Raising this Series A will help us push deeper into the vision we have for what the first tech banking stack in the US should look like. When we started Mercury, a big part of what excited us was just how many features it seemed like a financial service could have if it were created from the ground up as a tech product. It turns out there definitely are ample features to build, and even rounding out what we think of as baseline banking features has taken some hard work in the past few months since launch. New features we’ve gotten out recently:

Integrations with Xero, Quickbooks, Plaid, and Finicity

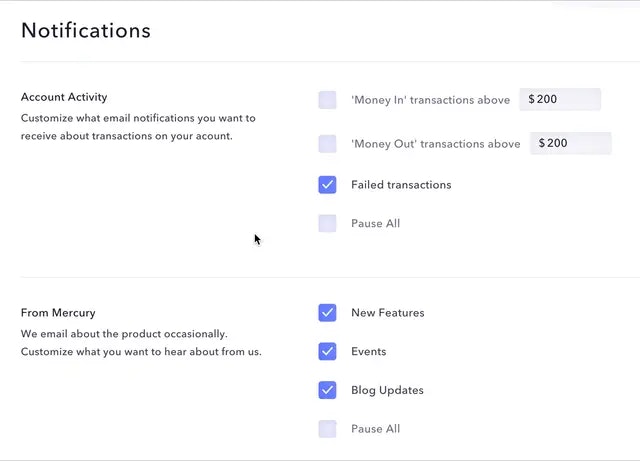

Notifications on incoming and outgoing transactions

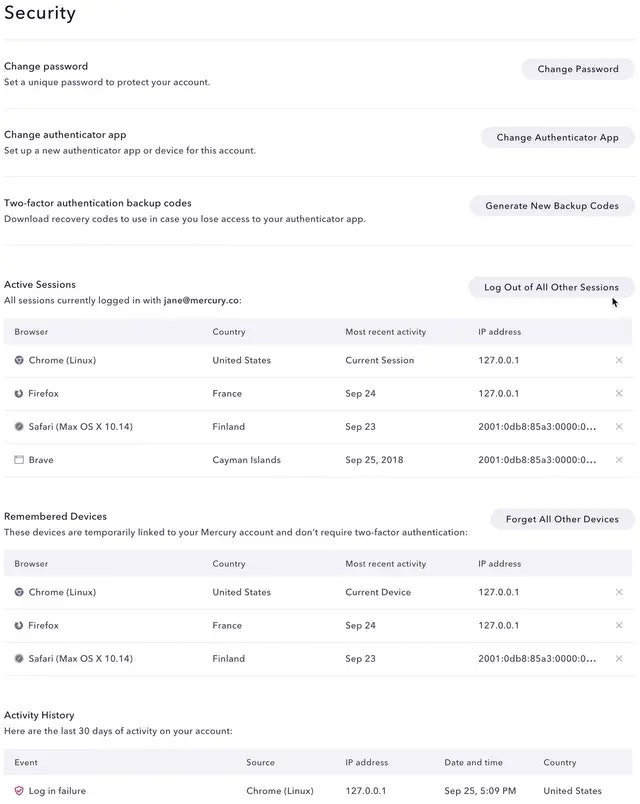

A security page to monitor and audit account activity

We also took the first version of our API live today, which is something we’ve wanted to create since we first had the idea of starting Mercury. At my previous startup, which included an ad network, we had to reconcile transactions and make dozens of payouts by hand to publishers at month end. Doing so would often take days of manual work, stress, and frustration.

Our API will let you access your Mercury account programmatically to automate tasks you’d previously have to do by hand. We put together a page that explains a little bit more about it here, and you can check out the API documentation here. My hope is that no founder ever has to experience what I did again.

This initial version of the API is just a small step towards building a financial product that helps startups succeed. We’re working on features that will change how you think of your financial stack, like streamlining payments or maximizing the value of your treasury. We’re proud of what we’ve built so far and can’t wait to show you what else we’ve been working on.