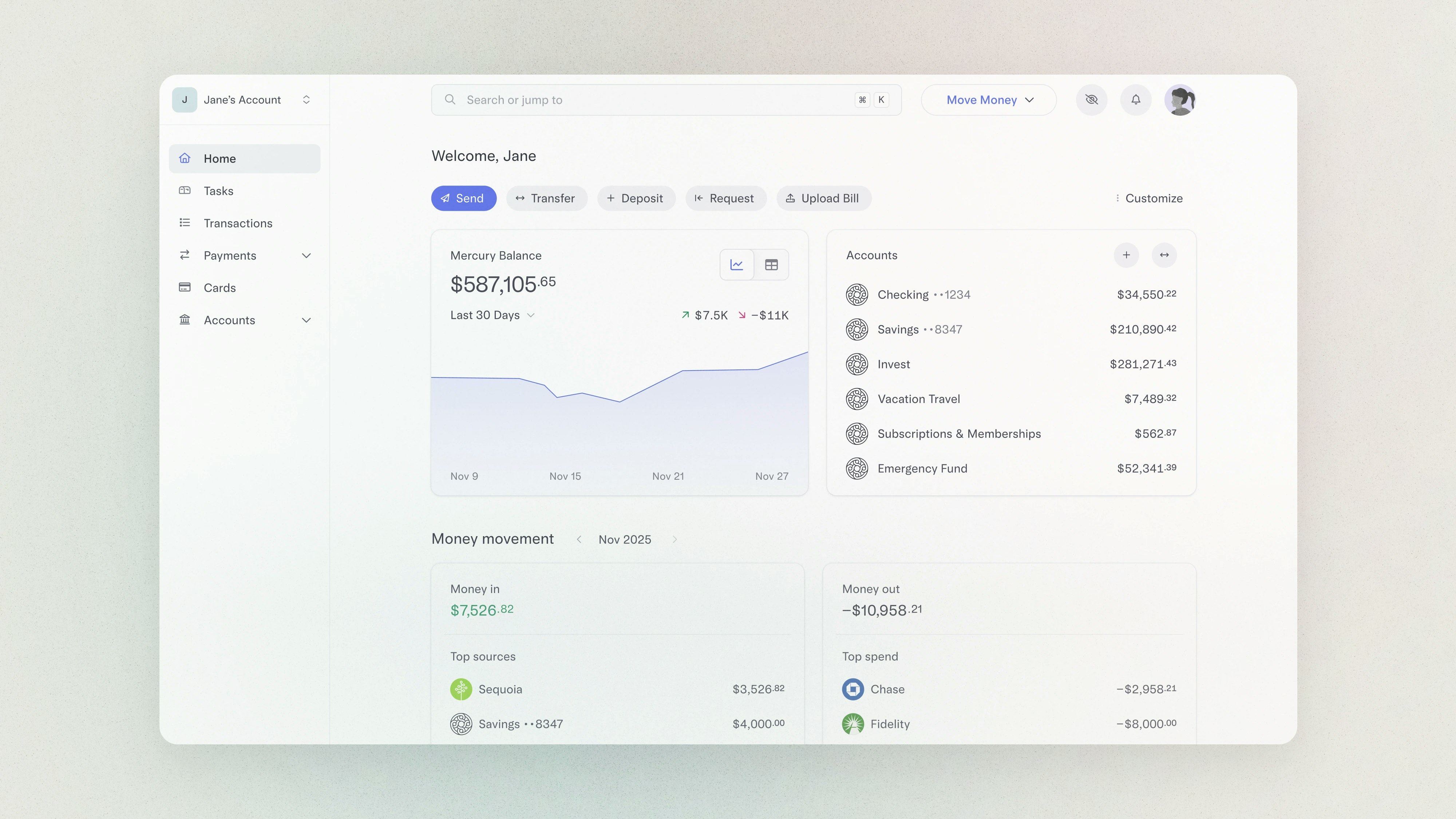

Introducing financial workflows to your Mercury business account

Co-founder and CEO of Mercury.

When I started fundraising for Mercury’s seed round in 2017, my pitch to investors was simple: Banking is a massive market, every business needs a bank account, and as a 4x founder, I’m deeply familiar with how painful it is for entrepreneurs to get and use their bank account.

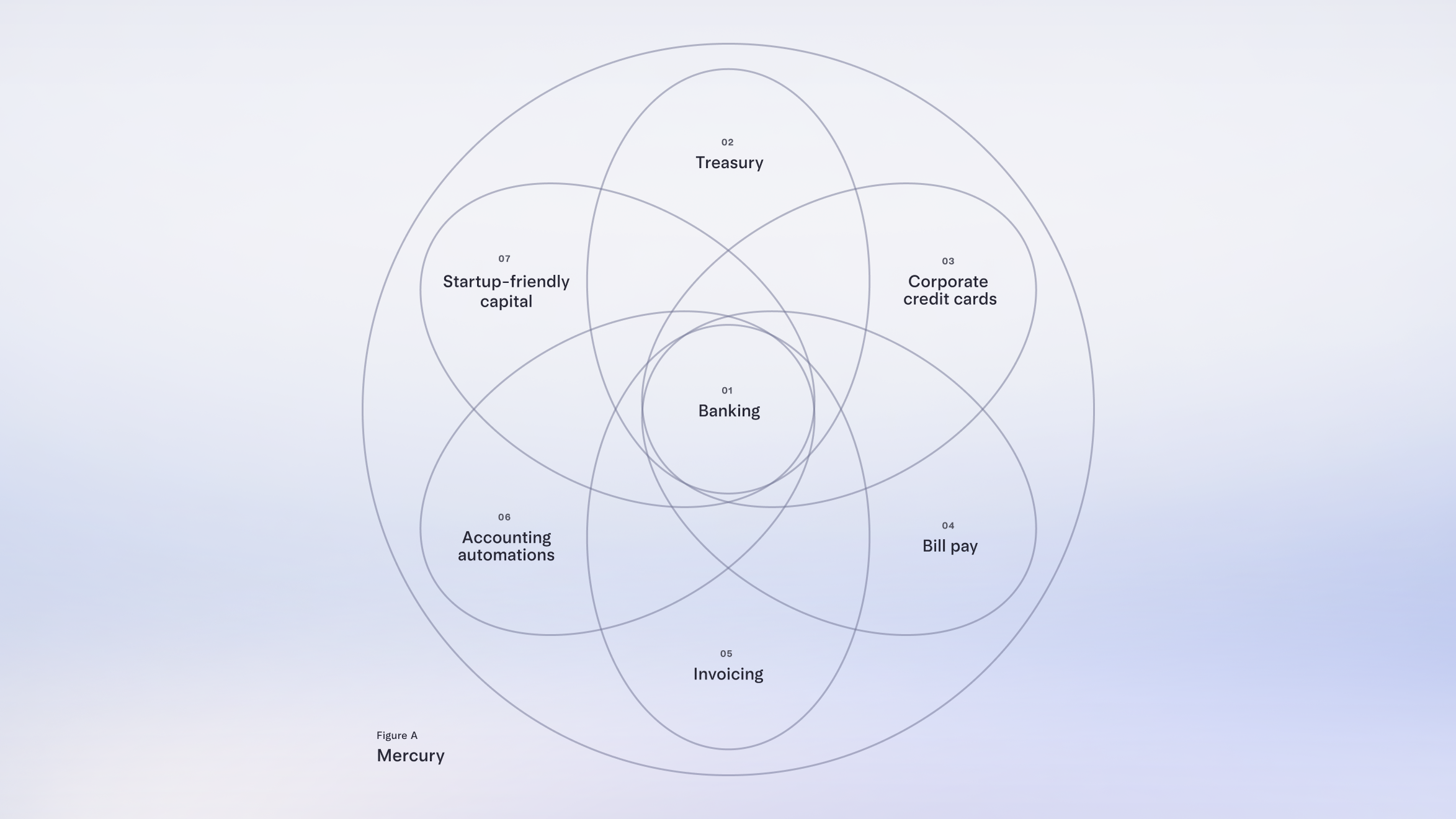

But what got me truly excited about building Mercury as my fourth startup was an idea bigger than just creating a better business bank account. The long-term vision for Mercury was always to create an essential product that could help businesses run all their company finances from one place.

Today, I’m announcing the next step toward realizing Mercury’s larger vision: new software to simplify your essential financial workflows by powering them directly from your Mercury account.

Starting today, customers can pay bills more accurately with Mercury Bill Pay. Close the books faster with new accounting automations, including a new NetSuite integration. And coming soon, collect customer payments on time with Mercury Invoicing and easily reimburse employees for their personal expenses.

Along with a bank account, every scaling company needs financial software to run their business. But today, the critical tools that help teams do seemingly simple tasks like pay bills, manage employee spend, and send invoices are needlessly complex. Founders and finance teams have to use multiple tools to run these workflows, and each tool needs to be carefully and separately connected to a bank account, but the tools aren’t then integrated with each other. And none are powered from the bank account, which is the source of truth for exactly how much money you have.

We believe your bank account should do more than hold your money.

Since the beginning, we’ve always understood that the bank account is not just a repository for funds but the heart of a business’s operations. With over 200,000 customers sending $4B in outgoing payments every month on Mercury, the ability to run financial operations from your Mercury account isn’t only convenient — it's essential. With banking and software to run financial workflows in one, Mercury enables a new level of visibility, speed, and control.

- Rather than monitoring multiple tools, simply check your bank account for a real-time and detailed view of every outgoing payment and incoming invoice.

- Control precisely how and when money moves in and out of your business. With Mercury, there’s no need to route your payments through third-party processors. You can pay your bills directly from your bank account the moment you need to, maximizing your cash flow by cutting out the middleman.

- Our new features help you close your books faster. By categorizing bills at the moment of payment and syncing these details directly with your accounting software, we reduce manual data entry and minimize errors, speeding up your financial reporting and reconciliation processes.

The result is simplified financial workflows that will make you more precise, give you more control, and help your finance team work faster than ever before.

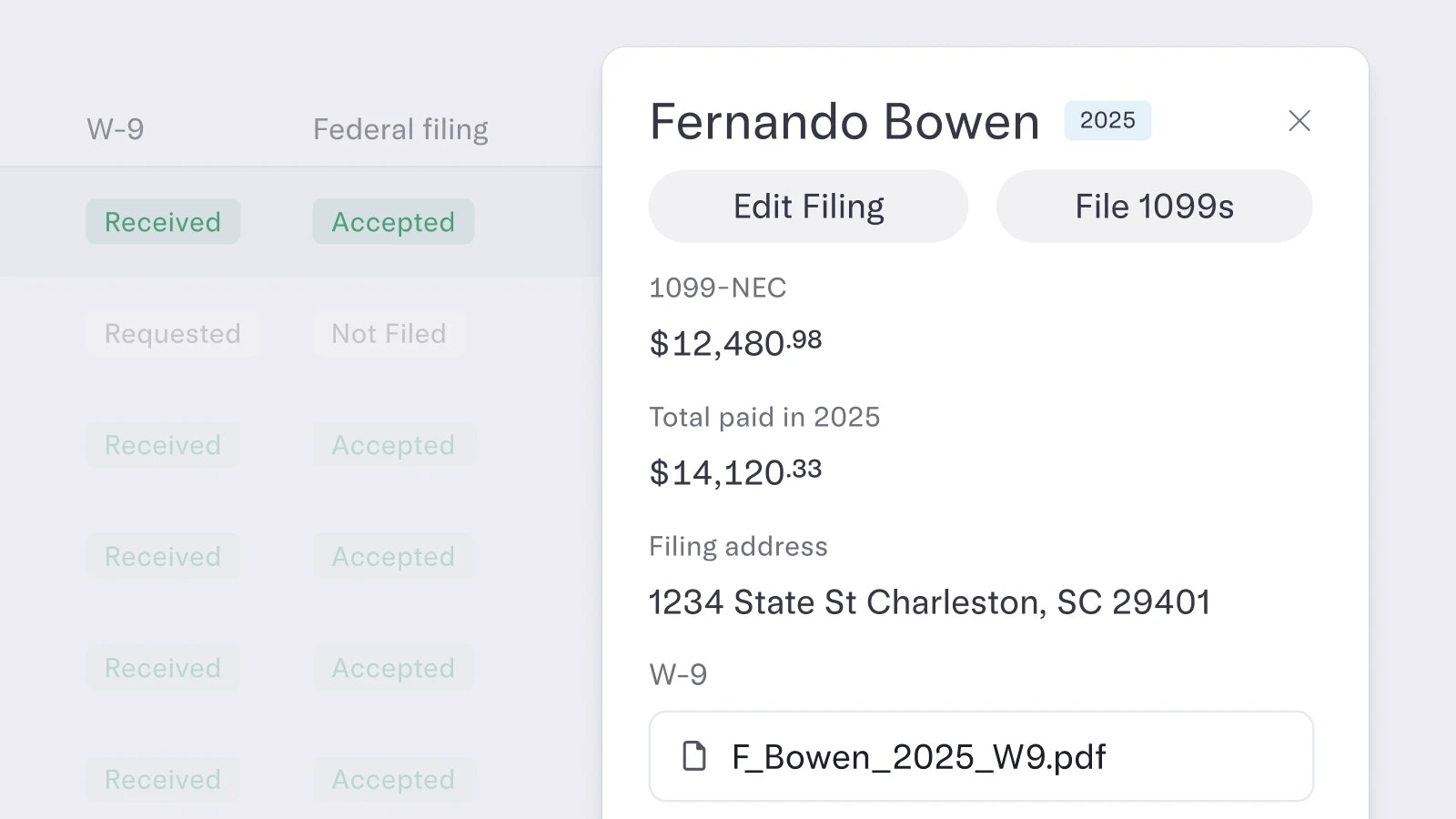

Manage and pay bills right from your bank account

Mercury Bill Pay allows you to process bills with more precision, stay in control of bill payments, and close your books faster.

With Mercury Bill Pay, you can now:

- Pay bills directly from your bank account – giving you more visibility into your cash flow and allowing you to pay vendors directly and keep cash in your account for longer

- Harness AI to populate your bill details for you

- Avoid paying a bill twice with duplicate bill detection

- Set multi-layered approvals and approve instantly on mobile and via Slack

Close your books faster by creating, coding, and syncing transactions without leaving Mercury

Mercury's accounting workflows enable customers to categorize bill and expense transactions directly within their bank account, saving time and reducing errors.

With Mercury’s new accounting automations, you can now:

- Categorize and sync bills and expenses right as you initiate them, directly within your bank account, saving you the hassle of having to do this later in your accounting software

- Streamline employee expense tracking with custom rules that automatically categorize card transactions

- Set and enforce policies for employee expenses, require receipts for transactions that meet custom criteria, and automatically nudge employees to upload missing receipts

- Sync to NetSuite, Xero, or QuickBooks across bills, payments, and card spend

- See all your bills, cards, and transactions in one place, allowing for easy cross-referencing

- Allow your whole team to operate using the same real-time information with custom user permissions and easy bank statement forwarding

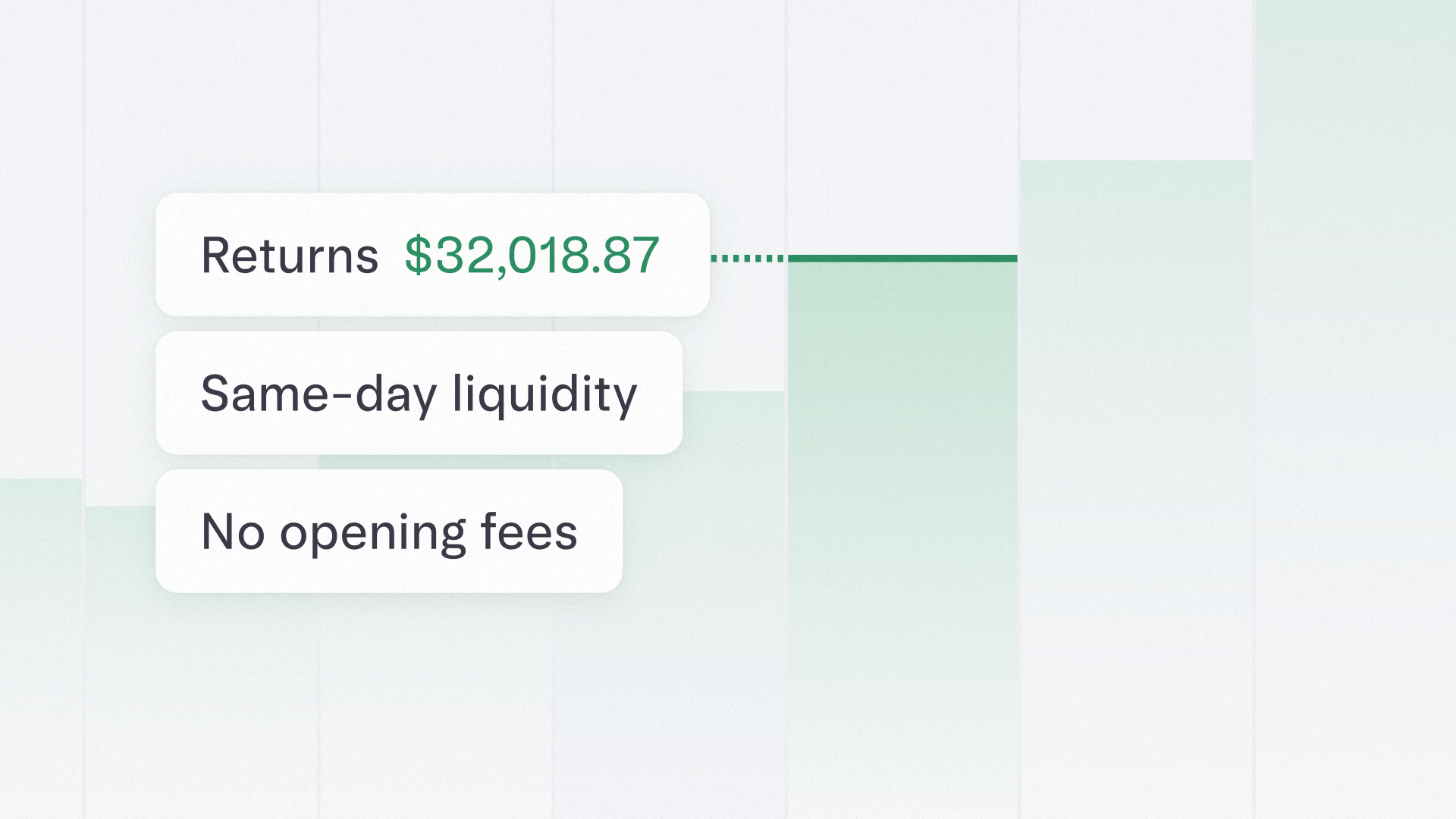

Coming soon: Invoicing and employee expense reimbursements

In the coming months, we’ll introduce more ways to simplify your financial workflows. These additional features include invoicing and employee expense reimbursements — all within your Mercury account.

With Mercury Invoicing, you’ll be able to:

- Build professional invoices, and get a full view of your invoices, including how much money is owed to you, and when, right inside Mercury

- Allow your customers to pay with credit cards or directly from their bank (via ACH) to get your funds faster

- Send automated invoice reminders, so payments aren’t overdue

- Bypass manual reconciliation and switching between endless tabs — incoming payments will be matched to the right invoices automatically

With employee expense reimbursements, you will be able to:

- Set up reimbursement policies — including submission timeframes, receipt and note requirements, and out-of-policy warnings‚ in minutes

- Easily search and filter expenses so you can monitor spend and make better business decisions

Pricing

Starting today, Mercury customers can access these financial workflows for free until August 1. The idea is to give our customers a chance to familiarize themselves with all the new workflows powered by the Mercury account. After August 1, customers will have the option to select a paid plan (starting at $35/month) with accounting automations, and (soon!) premium invoicing features and reimbursements for your team. If you don't need these advanced financial workflows quite yet, don't worry. The Mercury business account will remain free to use for everyone and when you're ready, you can upgrade to access the advanced features at the price point that makes sense for your company and volume of business.

See our pricing for more information.

We hope this new software will help you simplify your finances and operate with excellence. Give it a try and let us know what you think.

About the author

Co-founder and CEO of Mercury.

Related reads