What is variance analysis?

Startups are constantly seeking ways to improve their business's efficiency and profitability. Variance analysis is a powerful tool that can help you do just that.

Variance analysis is like a financial health check-up, allowing you to identify discrepancies, understand their causes, and take corrective action. That way, you can better understand your company's operations and make smarter business decisions.

In this guide, we’ll dive into what variance analysis is, why it's important for startups, and how you can implement it in your financial reporting process.

What is variance analysis?

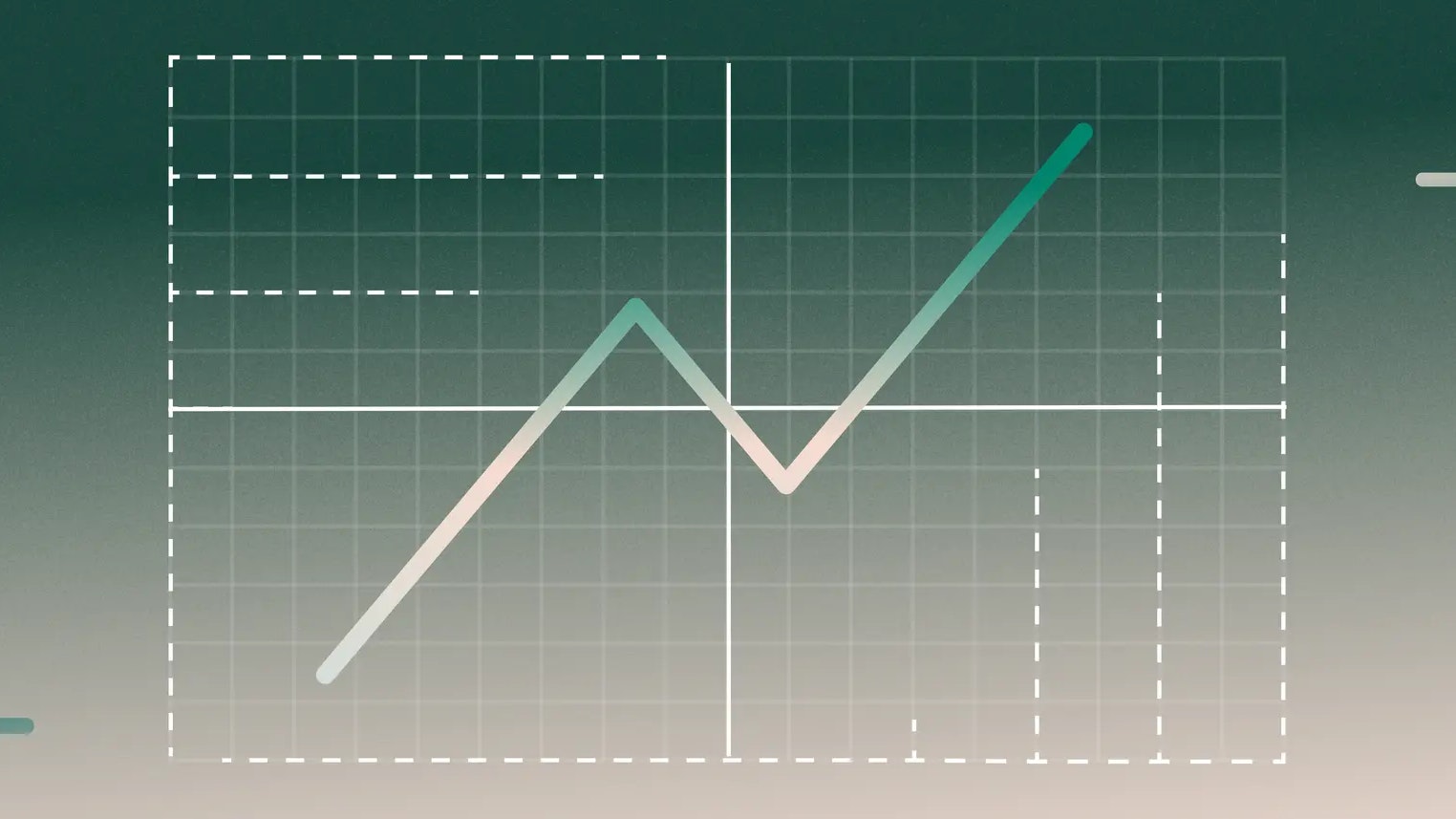

Variance analysis is a method of comparing actual financial results to budgeted or planned figures, to identify and understand significant differences (variances) between the two. Variances can be classified as favorable (when actual results are better than planned) or unfavorable (when actual results are worse than planned).

Variance analysis offers insights that can help improve financial planning, control costs, and optimize resource allocation. It can help you understand why your company’s performance differs from your expectations.

For startups, conducting regular variance analysis is essential for several reasons:

- It helps you monitor your financial performance and identify areas where you may be overspending or underperforming.

- It enables you to make data-driven decisions and adjust your strategies based on actual results.

- It promotes accountability and helps you communicate financial performance to stakeholders, such as investors and board members.

Types of variances

You may encounter several types of variances when conducting variance analysis. Let's explore the most common ones:

Revenue variances

Revenue variances occur when actual sales differ from budgeted sales. They can be broken down into two components:

- Sales volume variance: This represents the difference due to selling more or fewer units than planned. A positive volume variance means you sold more than expected, while a negative one indicates you sold less.

- Sales price variance: This shows the difference due to selling at a higher or lower price than planned. A positive price variance means you sold at higher prices, while a negative one indicates lower prices.

For example, suppose your startup budgeted to sell 1,000 units at $100 each but actually sold 1,200 units at $95 each.

- Sales volume variance: (1,200 - 1,000) × $100 = $20,000 favorable

- Sales price variance: (1,200 × $95) - (1,200 × $100) = $6,000 unfavorable

- Total revenue variance: $20,000 - $6,000 = $14,000 favorable

In this case, while you sold at a lower price than planned, the increased volume made up for it, resulting in a favorable overall revenue variance.

Cost variances

Cost variances occur when actual costs differ from budgeted costs. The two main types are variable cost variances and fixed cost variances.

Variable cost variances

These are differences in costs that change with production volume. They can be further broken down into:

- Price variance represents the difference due to paying a different price for inputs than planned.

- Efficiency variance highlights the difference between the amount of labor—or how long—it took to produce something compared to the forecast.

For example, let's say your startup budgeted to use two hours of labor at $20/hour to produce one unit but actually used 1.8 hours at $22/hour.

- Price variance: (1.8 × $22) - (1.8 × $20) = $3.60 unfavorable

- Efficiency variance: (1.8 - 2) × $20 = $4.00 favorable

- Total variable cost variance: $4.00 - $3.60 = $0.40 favorable

While you paid more per hour than planned, you used less labor time, resulting in a small favorable variance overall.

Fixed cost variances

These variances are typically simpler to calculate — comparing actual fixed costs to budgeted ones. For instance, if your startup budgeted $10,000 for monthly office rent but actually paid $9,500, you'd have a favorable fixed cost variance of $500.

Benefits of conducting variance analysis

Implementing variance analysis in your startup can yield several benefits:

- Improved financial control: Regularly monitoring variances can help you make more informed, data-driven decisions about resource allocation, pricing, and cost management.

- Early identification of potential issues: Variance analysis can help you spot potential problems before they escalate into bigger challenges that could threaten your startup's financial health.

- Enhanced communication between finance and other departments: Conducting variance analysis requires collaboration between finance and other teams, including sales, marketing, and operations. This can foster better alignment across your startup.

- Better resource allocation and cost management: By identifying areas where you're overspending or underperforming, you can optimize your resource allocation and find ways to reduce costs without compromising quality or growth.

How to conduct a variance analysis: Step-by-step guide

Now that you understand the types of variances let's walk through the process of conducting a variance analysis:

Establish your baseline

Before you can analyze variances, you need a point of comparison. This is typically your budget or forecast.

If you haven’t already, create a detailed budget for each business area. Set specific, measurable targets for revenue, costs, and other key metrics. Ensure your budget aligns with your overall business strategy and growth plans.

Try to be as realistic as possible. Overly optimistic or pessimistic budgets can lead to misleading variances. Strive for budgets that are challenging but achievable. One way to help achieve this is by involving team leads from different departments. Their insights can lead to more accurate projections and greater organizational buy-in.

Gather actual performance data

Next, collect data on your actual financial performance. This step is crucial for identifying where your results differ from your projections.

This involves compiling financial statements, including your income statement and balance sheet. You’ll also need to collect detailed data on sales, costs, and other relevant metrics.

One tip is to invest in robust financial software that can automatically collect and organize this data. This will save time and reduce the risk of errors.

Calculate variances

Now, it's time to compare your actual results with your budget and calculate the variances. The basic formula is: Variance = Actual Result - Budgeted Amount.

Identify which variances are favorable (better than budget) and unfavorable (worse than budget). Focus on material variances. While tracking all variances is important, those that significantly impact your bottom line deserve the most attention.

Analyze the variances

This is where you dig deeper to understand why variances occurred. This step is crucial for turning data into actionable insights.

Here, it's important to set a materiality threshold at which a variance is considered significant enough to warrant further investigation. You don’t want to get bogged down by small discrepancies. Ideally, you’ll concentrate on variances that significantly impact your business — and the materiality threshold can help determine that.

The materiality threshold will depend on factors such as the size of your startup, your risk tolerance, and the potential impact of the variance on your overall financial performance.

When analyzing your variances, consider factors such as:

- External market conditions: Did unexpected changes in the market affect your performance?

- Internal operational changes: Have you implemented new processes that impacted your results?

- One-time events or anomalies: Were any unusual occurrences skewed your numbers?

Investigate the root causes of significant variances and consider both internal factors (like operational changes) and external factors (like market conditions).

Single-period variances can be informative, but tracking variances over time can reveal important trends. Are certain variances persistent? Are they growing or shrinking over time? Sometimes, variances are caused by qualitative factors. Don't ignore the broader context of your business environment.

Don't just focus on unfavorable variances. Understanding why you outperformed in certain areas can help you replicate that success elsewhere.

Develop an action plan

Based on your analysis, create strategies to address unfavorable variances and capitalize on favorable ones.

Identify steps to bring performance in line with expectations or adjust expectations if needed. Possible actions might include:

- Adjusting pricing strategies

- Improving operational efficiency

- Revising budgets for future periods

- Reallocating resources to more profitable areas of the business

For example, if marketing expenses are consistently under budget but sales are lagging, consider reallocating some funds to more effective marketing channels.

Assign responsibility for implementing each action to specific team members. Set deadlines for implementation and follow-up. Prioritize actions that address the most significant variances or can be implemented quickly for immediate impact.

Implement and monitor

Variance analysis is not a one-time event but an ongoing process. Review your action plans regularly and track variances to see if your actions are having the desired effect. Be prepared to adjust your strategies if they're not producing the expected results.

Consider creating a dashboard that displays key variances and the status of related action plans. This can help keep the entire team aligned. This cycle of analysis and action will help you stay on top of your financial performance and make improvements over time.

Best practices for successful variance analysis

To get the most out of your variance analysis efforts, consider the following tips:

- Set up a regular variance analysis process: Integrate variance analysis into your monthly or quarterly financial reporting cycle, and establish clear roles and responsibilities for conducting the analysis.

- Train your team: Ensure that your finance team and other relevant stakeholders understand the concepts and techniques involved in variance analysis. Consider providing training or educational resources to build their skills in this area.

- Use the right tools: Invest in financial software that can help automate the variance analysis process and make identifying and investigating significant variances easier.

- Foster a culture of continuous improvement: Encourage your team to view variance analysis not just as a reporting exercise but as an opportunity to continuously improve your startup's financial performance and decision-making.

Remember, the goal of variance analysis isn't just to identify discrepancies but to understand why they occurred and take appropriate action. Use it as a springboard for asking important questions about your business operations and strategy.

As you implement variance analysis in your startup, start small and focus on the most critical areas of your business. Over time, you can expand your analysis and refine your approach based on what works best for your organization.

By making variance analysis a regular part of your financial management routine, you'll be better equipped to navigate the challenges of the startup world and drive your business toward sustainable growth. Your future self (and your investors) will thank you.

Related reads

Report: The new economics of modern love

The world is an array of edits

2025 Ecommerce Holiday Report: Headwinds, High Hopes, and AI Acceleration