Report: The new economics of modern love

Love, but make it logistical

“Will you be my joint account holder?”

It’s not exactly a rom-com line — but for many couples, love isn’t just about chemistry or commitment. It’s also the mish-mash of money that tends to come with building a life together. That means navigating what’s yours, what’s ours, and how we make sense of it all.

Even in an age where people post their whole lives online, money talk is often still kept a bit close to the chest — but we wanted to know more.

To understand how people are actually navigating the financial side of life together, we surveyed 1,400 U.S. adults in committed relationships — spanning generations, income levels, and financial arrangements. Here, we uncover more about their choices, feelings, and behaviors around money — including who’s got the account passwords.

Methodology: This report is based on a January 2026 online survey of 1,400 U.S. adults in committed relationships, including 1,200 respondents who share or coordinate finances and 200 who do not. The sample was provided by Sago, a research panel company. Numbers are rounded to the next whole digit; percentages may not add up to 100%.

What is love? Baby, it’s money…

How people actually think about money — before it ever becomes “ours.”

Before we get into the dollars and cents, let’s talk about money itself.

Across the survey, respondents most often describe money as:

- A source of security (48%)

- A tool to build the life I want (47%)

- Something I need to manage carefully (43%)

While the first two tended to become more true as people had more money, that last one held pretty evenly, regardless of income, gender, and generation — though people with the most money (annual household incomes over $200K) or time on Earth (for our survey, folks in the Baby Boomer generation) were least likely to be concerned with careful cash management.

As income rose, we also saw pragmatic views begin to give way to expansive ones — money as a source of freedom or a way to create flexibility and optionality.

And, of course, managing money as a couple starts with how each person thinks about and approaches it individually. So where are people getting their financial intel? According to respondents, the top three sources are:

- Through personal trial and error (47%)

- From their parents or caregivers (39%)

- Via online resources (36%) — a number that dipped heavily for Boomers (22%) and soared for Millennials and Gen Z (44 and 46%, respectively), and spiked for men (42%) over women (29%)

Nearly a quarter of respondents (23%) also learned from a current or past romantic partner.

Feels like cold, hard cash

On financial confidence, alignment, and confidence in your alignment

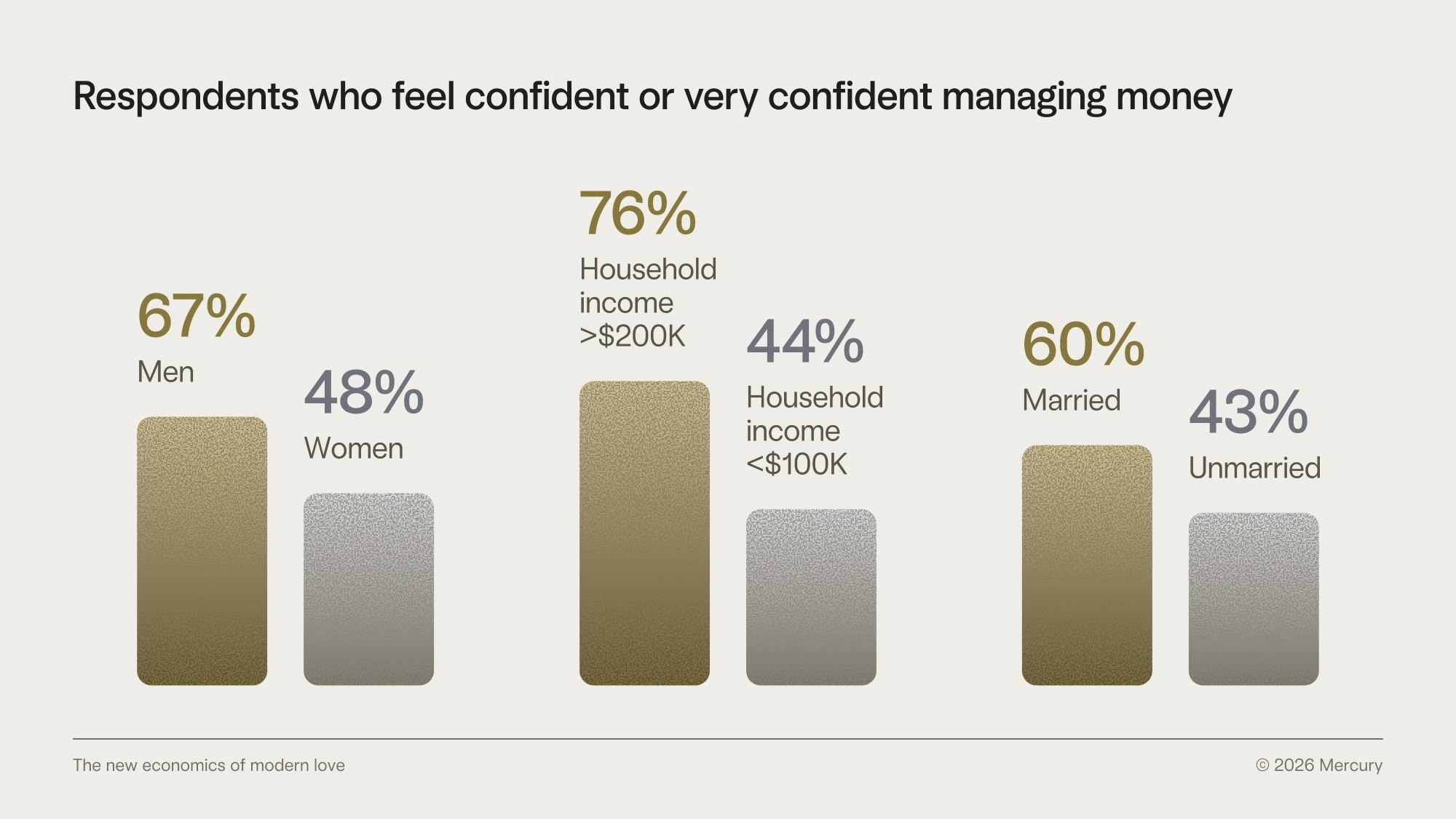

Now, let’s discuss the money feels. 57% of respondents say they feel confident or very confident managing money in their day-to-day lives. But that confidence is a bit unevenly distributed:

- Men (67%) report higher financial confidence than women (48%).

- Confidence increases substantially with household income (44% for couples with HHI under $100K versus 76% for those with HHI over $200K).

- Married respondents (60%) are more likely to report high confidence than unmarried ones (43%).

Gen Z (59%), Millennials (61%), and Baby Boomers (58%) had a lead on Gen X (50%) in feeling financially confident or very confident. (This wasn’t too anomalous; Gen X was often the least cheery of the lot.)

Notably, across the board, respondents were more likely to feel confident navigating money with a partner (73%) than managing it alone.

73%

of respondents are confident in managing money with their partner.

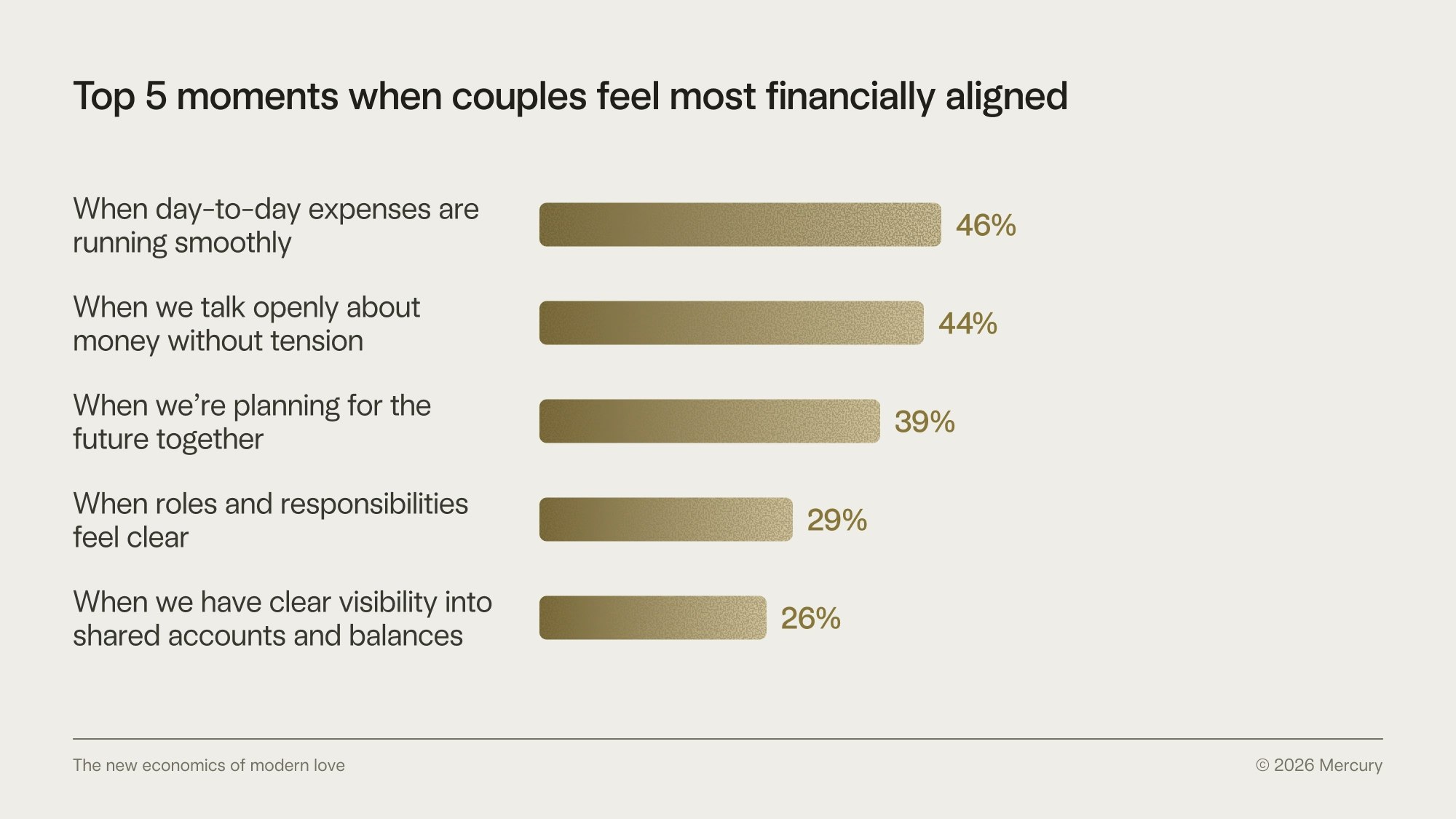

Contributing to that is a somewhat variable sense of financial alignment. Only around a quarter of respondents (27%) reported they rarely feel financially misaligned with their partner. But when do things work out best?

Of note, older generations seemed to have a different joint relationship with financial future planning: Gen X and Boomer respondents (both 35%) highlighted this less often than Millennials (43%) and Gen Z (46%). Alignment on responsibilities also seemed to have decreasing impact by age, with it being a key alignment area for Gen Z (38%) and gradually declining to 23% for Boomers.

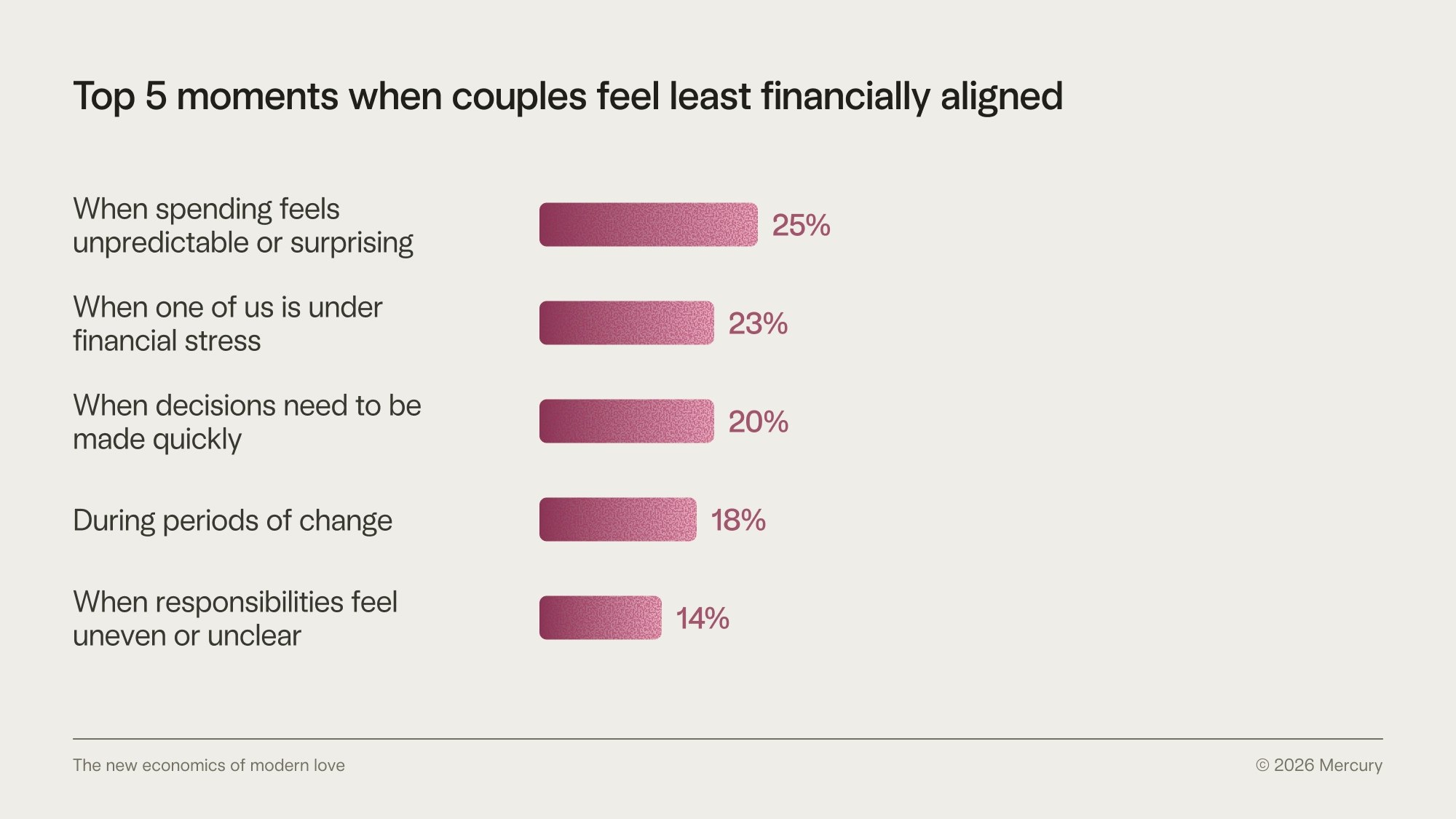

On the other hand, the top factors that came through around misalignment were all versions of situational rockiness.

In the write-ins, we also talked about compromise. While respondents highlighted significant financial compromises around all kinds of things — from the cars they buy to their investment strategies to whether or not they’re buying Prada — housing-related costs were the most common. 1 in 7 respondents noted compromises around things like the cost of a down payment or mortgage, home renovations or improvements, HELOCs, and deciding on housing location, price, and size.

Is sharing caring?

Why couples share, coordinate, or keep things separate — and how those choices take shape

When we screened respondents for this survey, we found that married couples were far more likely to say they were financially involved with their partner than others — they made up a majority (84%) of respondents. 52% of married folks said they combined most or all finances; 21% of folks in other committed relationships said the same. Rather than combining everything, unmarried folks were more likely to focus on coordination — e.g., sharing goals and planning, but keeping money in separate accounts. (About 24% of married couples opt for an arrangement like this over fully merging their finances, too.)

How did they get to those setups? Unmarried couples and married couples were almost equally likely (30% and 32%, respectively) say they planned them intentionally. But more married couples (37% vs. 28%) said they emerged organically. (In other scenarios, setups resulted from moments of necessity or convenience, among other things.)

Age also played a bit of a role here. Gen Z (39%) and Millennials (35%) were more likely to plan their financial arrangement deliberately with their partners — a small but meaningful lead on Gen X (28%) and Baby Boomers (29%). At 48%, Baby Boomers were by far the largest group to say that their setup just happened without any kind of plan.

There was also no single moment when money flipped from “mine” to “ours.” (And for 3% of couples who coordinate or share money, it still doesn’t feel shared, regardless!) But two main points of transition did stand out as frontrunners:

- 45% say money began to feel shared when they got married

- 28% say it happened when they moved in together (and this spikes to 52% for unmarried couples)

Gen Z (11%) were the most likely among respondents to say money felt shared before they moved in with a partner. They were also more likely than other generations (42%) to pin the shift on when they moved in together, whether or not they were married now. Gen X (47%) and Baby Boomers (63%) were much more likely to point to marriage as the defining moment, while Millennials were fairly split between moving in together (32%) and marriage (38%).

Taken together, these numbers point to our shared relationship with money coinciding with moments when coordination becomes more consequential — legally, logistically, or practically. And that doesn’t mean there was a reluctance to share prior. It might just be that the circumstances didn’t really call for it yet. Fair enough.

What’s yours is mine, and what’s mine is mine

The practical reality of shared accounts, shared bills, and other shared-money-things

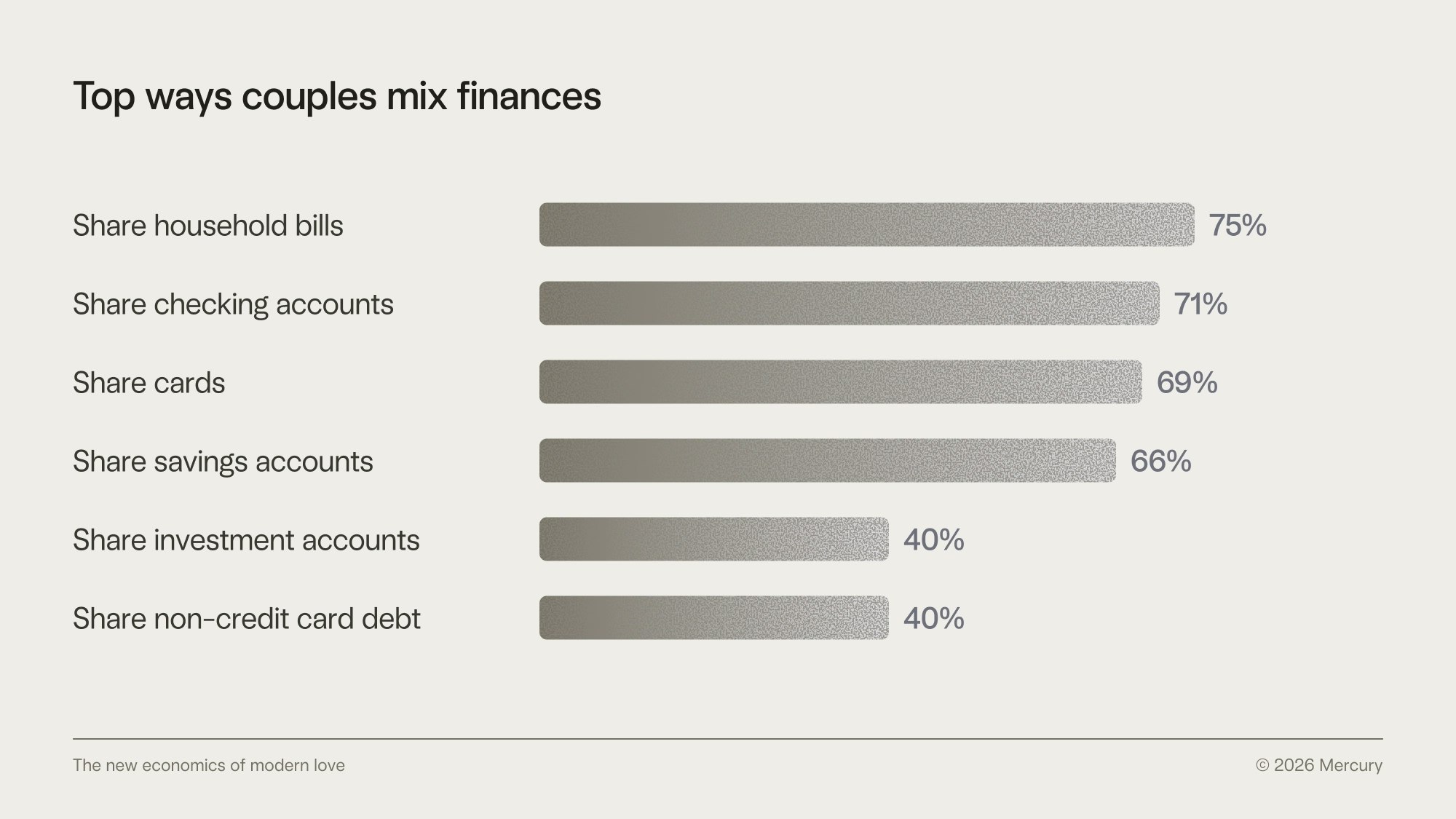

By the time couples are coordinating finances, regardless of relationship status, sharing across basic accounts and expenses is pretty widespread:

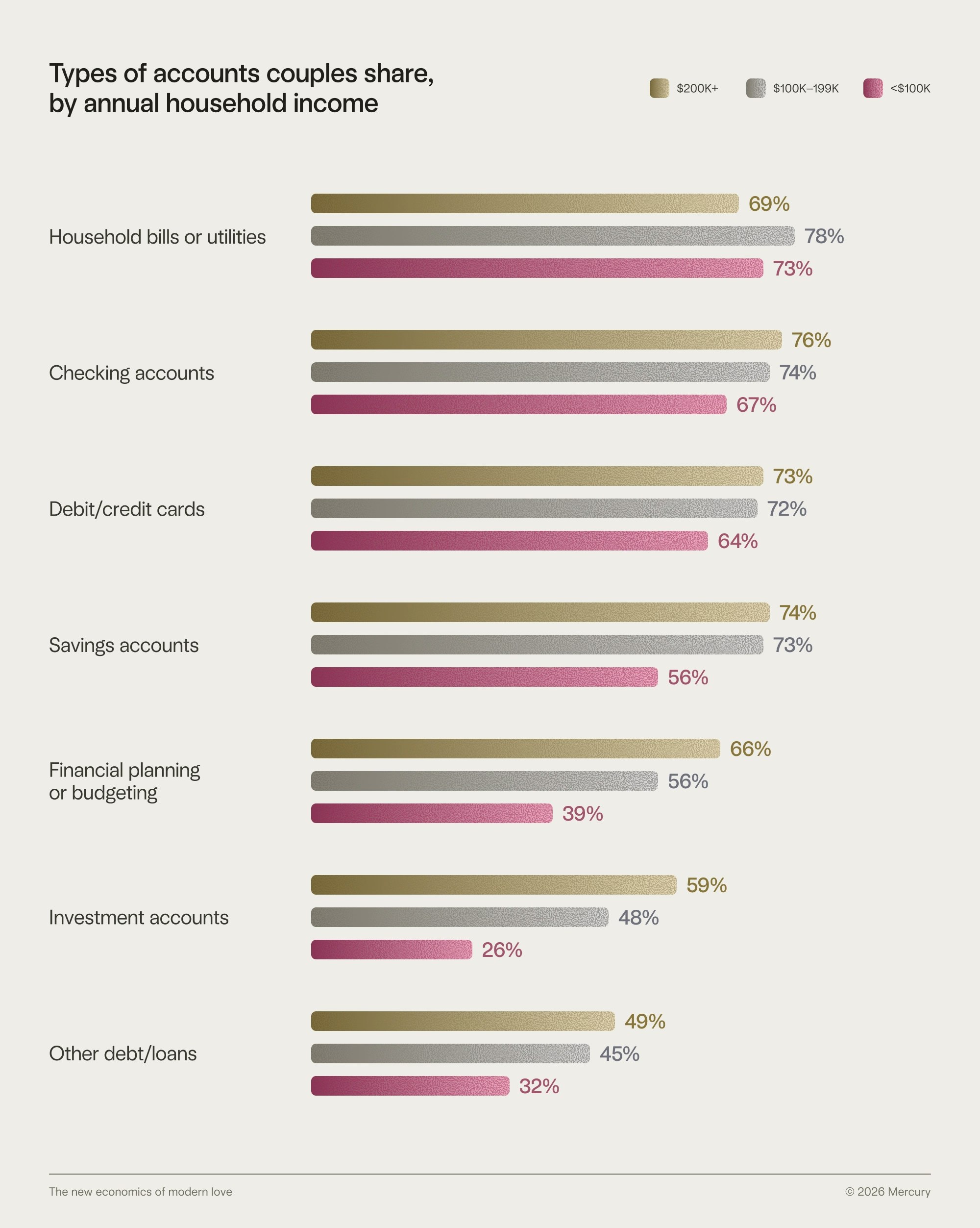

And as income shifts, so too do many of those behaviors.

First, we saw that higher-income households were more likely to share more types of accounts:

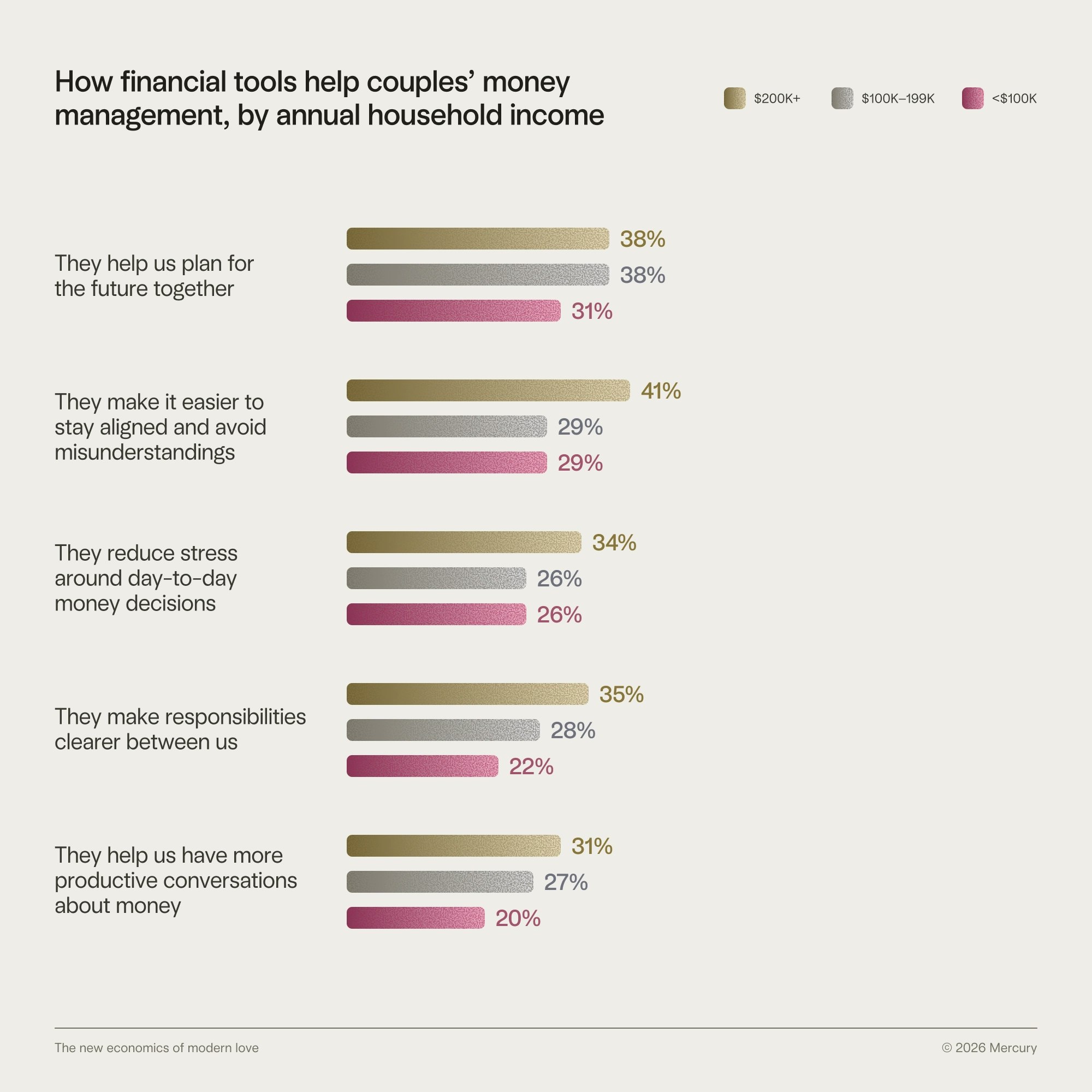

Also, while 17% of respondents don’t currently use any shared financial tools, higher-income couples generally tended to find financial tools more useful for shared money management.

Those higher income households were also more likely to plan and budget together (66% of couples with HHI over $200K say they do versus 39% of for HHI under $100K; respondent average was 50%.)

Generationally, things get interesting with sharing, too. For example:

- Boomers (50%) were far more likely than Gen Z (18%) to use pooled money from a shared account to pay the bills.

- Gen Z (17%) were more than 3x as likely as Boomers (5%) to split bills proportionate to income.

Still, not sharing finances doesn’t necessarily signal distance or distrust. For some, it seems like a way to reduce certain flavors of friction. Among respondents who keep finances separate to some degree:

- 32% say it helps avoid conflict around spending

- 29% value financial independence

- 29% cite different values or habits around money

- 22% say it feels simpler

What’s fair in love and money?

How couples perceive financial balance, leadership, and equity

Anyway — how does all that sharing shake out?

- Overall, 80% of respondents say their financial arrangement feels at least somewhat fair.

- Men found things a little more fair at 87%, versus 74% of women.

- That sense of fairness dipped to 70% for those with the lowest household income (under $50K.)

And respondents were most likely to report that responsibilities were about equal between them and their partners (45%), though Baby Boomers (54%) were the most equitable on this front, ranking 11+ percentage points ahead of all other generations.

That said, it certainly wasn’t the case for everyone.

In relationships where things didn’t feel quite so equal, perceptions of leadership had meaningful skews by gender:

- Men self-identified as the financial “leader” in their relationship almost 2x as often as women (38% vs. 21%).

- On the other hand… Only 16% of women say their partner leads.

If we assume same-sex couples account for a few percent of the relationships reflected here, that’s still a sizable gap in how men and women perceive the roles in their financial power dynamic. Women were also more likely than men to say they each lead different areas of their shared financial lives.

54%

of Baby Boomers report that financial responsibilities are about equal in their relationship — the highest among all generations.

Whatever the malleable truth there, when we get into the whodunit and how, the gulfs by gender collapsed. Nearly half of respondents (48%) say these financial roles happened organically, while just 16% say they were explicitly discussed and 33% say it’s some mix of the two. (The rest said things were still evolving.) Men and women were very aligned here.

And, regardless of who’s in charge or how they got there, when asked what would happen if partners switched financial roles for a month, things were a bit all over the map: people were pretty split on whether it would be stressful (23%) or easy (21%), whether their partner could use their financial apps (20%), and not too many distinctive patterns to dig into.

That said, there was one standout: women seem to be the password keepers. Or, at least, they were quite a bit more likely than men (22% vs. 14%) to say their partner wouldn’t know where all the passwords are. Which leads us to…

Love in plain sight

Transparency, privacy, and what being (financially) open actually looks like

Sharing doesn’t necessarily have to mean sharing everything. Still, 62% of respondents said they were completely open with their partner about their finances; another 28% called themselves mostly open. Asked about their partners, the numbers shifted just a bit: 54% believe their partners are fully open, and 30% think they mostly are.

90%

of respondents say they are mostly or completely open with their partner about their finances.

And 51% said both partners have full visibility and access across shared and individual accounts.

But, of course, the amount and specifics of sharing vary. When asked what keeps them from being fully open about money, respondents most often cited a desire to avoid unnecessary stress or worry (41%).

But other reasons included wanting to keep some finances personal or independent (32%), noted differences in income, debt, or financial history (24%), or just a general preference for privacy (19%) — underscoring the idea that no matter how much you do share, some things are truly just yours.

One generational divide stood out, too: Gen X (22%) and Boomers (21%) were 10x more likely than Gen Z (2%) to say they hold back financial information in their relationship because they don't think their partner understands finances. (Millennials land in the middle at 9%.)

Money talks

What triggers financial conversations — and what those conversations are really about

Of course, all the coordination and pontificating only matter so much when you really get down to it. Realistically, money is tangled up with feelings, opinions, and the individual financial realities that contribute to the bigger picture.

We asked respondents how they and their partner stack up individually when it comes to earning, saving, and investing — and it’s interesting that, more often than not, respondents felt they were in the stronger position than their partner. (It sort of makes you wonder about what might be happening in those accounts folks aren’t sharing, doesn’t it? 👀)

How couples assess their comparative financial positions

Earning money | Saving money | Investing | |

|---|---|---|---|

I am in a stronger position | 38% | 38% | 36% |

My partner and I are in similar positions | 30% | 41% | 36% |

My partner is in a stronger position | 26% | 16% | 14% |

A slight majority of men (51%) said they were the high earner (perhaps supporting the data that the gender-pay gap in the U.S. has been narrowing a bit).

And, of course, some money moments tend to get couples talking — though what that looks like varies depending on relationship status.

What typically triggers money conversations in relationships

Married | Not married | |

|---|---|---|

A large or unexpected expense | 57% | 47% |

Something going wrong (e.g., a missed payment, overdraft, fraud, surprise bill) | 26% | 41% |

Stress or tension around money | 23% | 32% |

(Of note, about 5% of respondents said in their relationship, money conversations are rarely initiated — though that spikes to 10% with Baby Boomers.)

A few other generational patterns when it comes to talking money:

- Half of Gen Z (50%) and Millennials (51%) noted planning for the future as their number one trigger for money conversations, versus 37% across both Gen X and Baby Boomer couples. (Which certainly tracks with the earlier finding that older couples feel less alignment around planning for the future — or maybe they have the future figured out and don’t feel the need to talk about it as much?)

- Gen Z were 2x as likely as Boomers (32% vs. 16%) to tout stress or tension around money as typical conversation triggers.

- Gen Z were least likely to have conversations around large or unexpected expenses — just 39%, compared to 56–60% for all other generations.

And speaking of large expenses… the good news is that only 10% of respondents felt their partner often spends too much money — a number that held pretty steady across the board. While plenty of folks (36%) have occasional misgivings, a majority of respondents (52%) don’t see any issues with their partner’s spending.

That said, most respondents (67%) say they have a spending threshold where they feel a purchase should be discussed first. Most commonly, this was between $100–499 (32%) or $500-999 (25%). And, perhaps, unsurprisingly, the threshold scaled pretty linearly with income.

Finally, when asked what would most improve their shared financial life, respondents mostly pointed to things that have to do with orchestration:

- Better communication (29%)

- Easier coordination and planning (23%)

- Better tools for shared goals (20%)

But the most common answer? Nothing. One third of the respondents think they’re just fine where they are.

What it really takes to build a financial life together

Feeling comfortable together financially seems to have less to do with any specific financial setup, merging of money, or dollar amount in the bank (though the latter doesn’t hurt). Instead, it’s more about whether expectations are clear and decisions are made with context. Regardless of age, gender, income — and any of the awkward human bits around perception, power, the lot of it — we found that people felt most confident handling finances with their other half.

Maybe the key to modern financial partnership is something timeless: building a life with someone you love, and committing to the ongoing work of making money easier to live with together.

Thank you to Kate Apostolou, Stephanie Baumann, Adam Berg, Celeste Carswell, Jordan Horsman, Heather MacKinnon, Dani Moalem, Tamara Rahoumi, and Andrew Shen for contributing to this report.

Related reads