Pitching Mercury to your clients

New to Mercury? Want to talk to your clients about Mercury? We’ve created a co-branded deck with notes that allows you to focus on the most-needed information and answer your clients’ questions when switching one or more accounts to Mercury.

Read on to get a sense of what’s in the deck and how you can use it to discuss banking and a potential bank switch with your clients.

Speed, clarity, and control

Modern banking platforms like Mercury aren’t just digital versions of old-school banks, they’re built from the ground up for speed, clarity, and control. Mercury gives your clients the necessary financial workflows and features for their business to operate at its best, from banking and savings accounts to credit cards, bill pay, invoicing, reimbursements, and integrations.

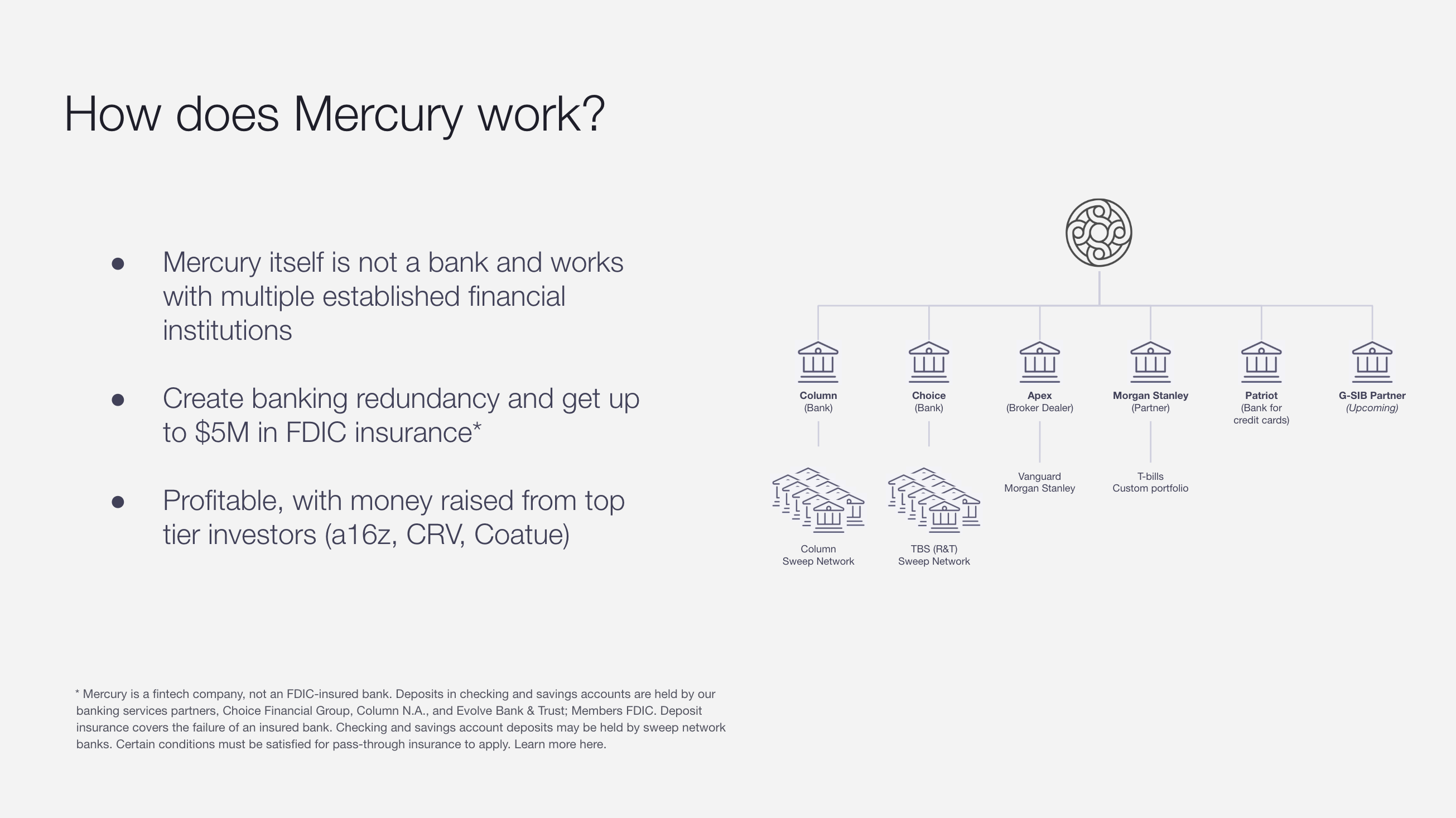

How Mercury works

Your clients will likely (and rightly) want to know that their funds are safe and secure with Mercury. By working closely with its FDIC-insured partner banks, Mercury can make your clients’ money both quick to access and insured up to $5M in FDIC insurance.

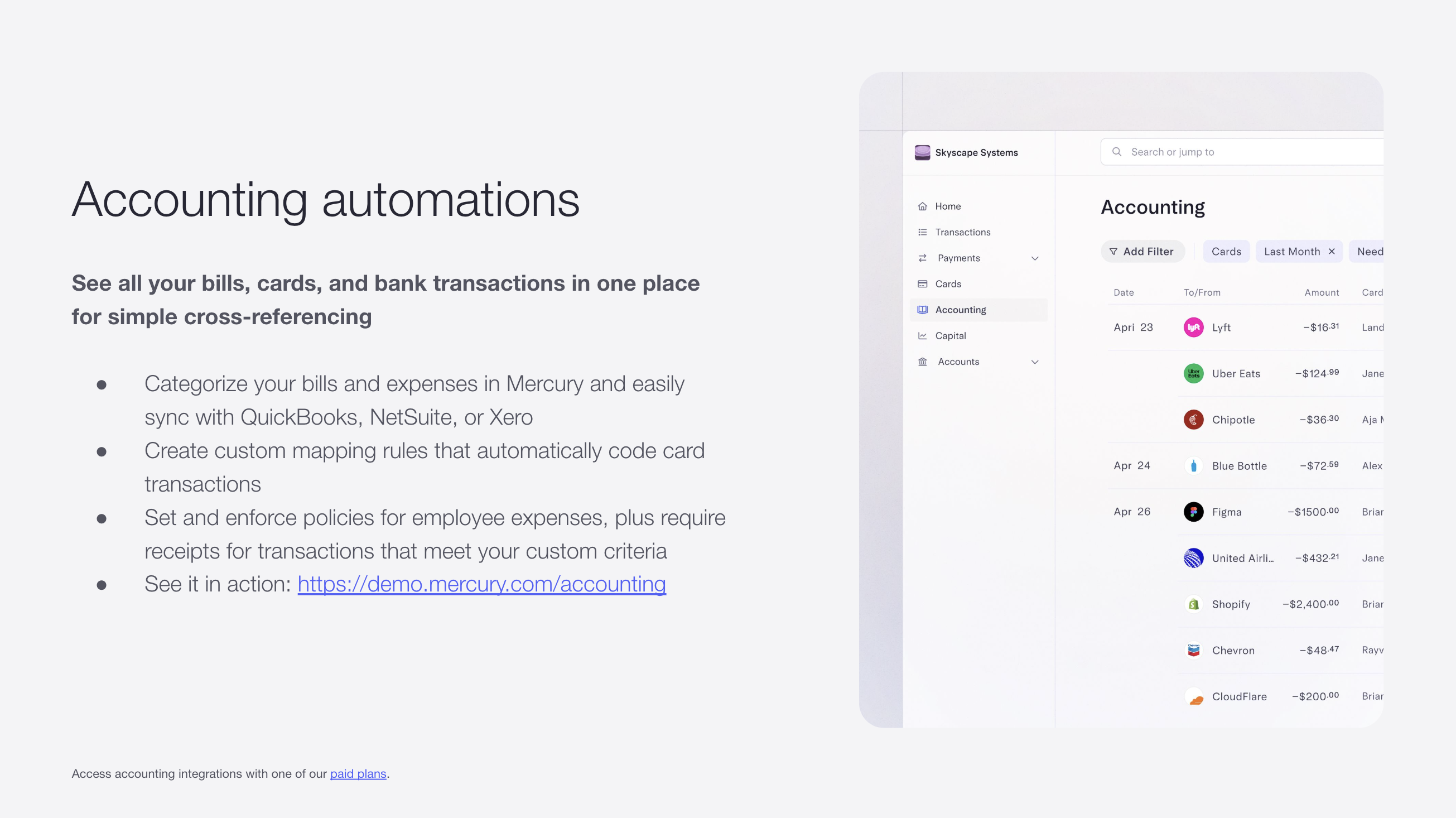

Accounting integrations

Mercury’s accounting integrations with QuickBooks, NetSuite, and Xero are meant to create a seamless experience for your firm to offer your clients. We work closely with our accounting partners to make sure Mercury is meeting their and their clients’ needs — so they can focus on providing higher-value services.

Mercury subscriptions

Mercury has plans to suit all clients depending on their needs, budget and whether they want to be in Mercury with one account or all. Check out the latest features in Mercury subscriptions here.

Curious if your clients are a good fit for Mercury?

Join Mercury for Accountants

Ready to join Mercury for Accountants? Sign up here and gain access to resources like this for you and your team.

Already a Partner and planning your first client call? Your Partner Manager would be happy to help you prepare for talking about Mercury — just email [email protected].

Take the next step in the Mercury for Accountants journey

Step 6: Client identification, assessment and conversation

Step 8: Stay connected