Centralizing a 2,000-property portfolio on a single financial platform

Vertical: Real Estate

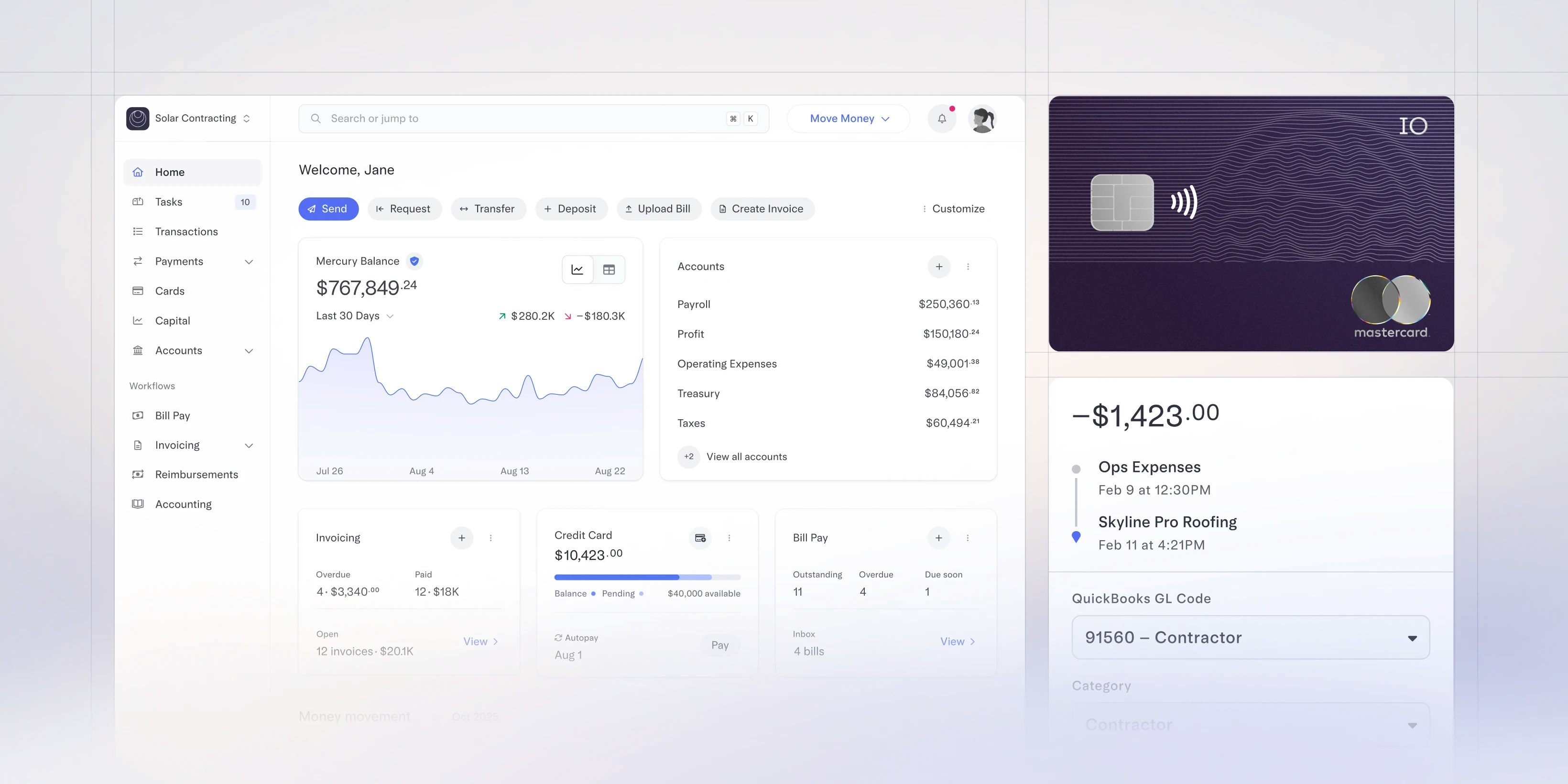

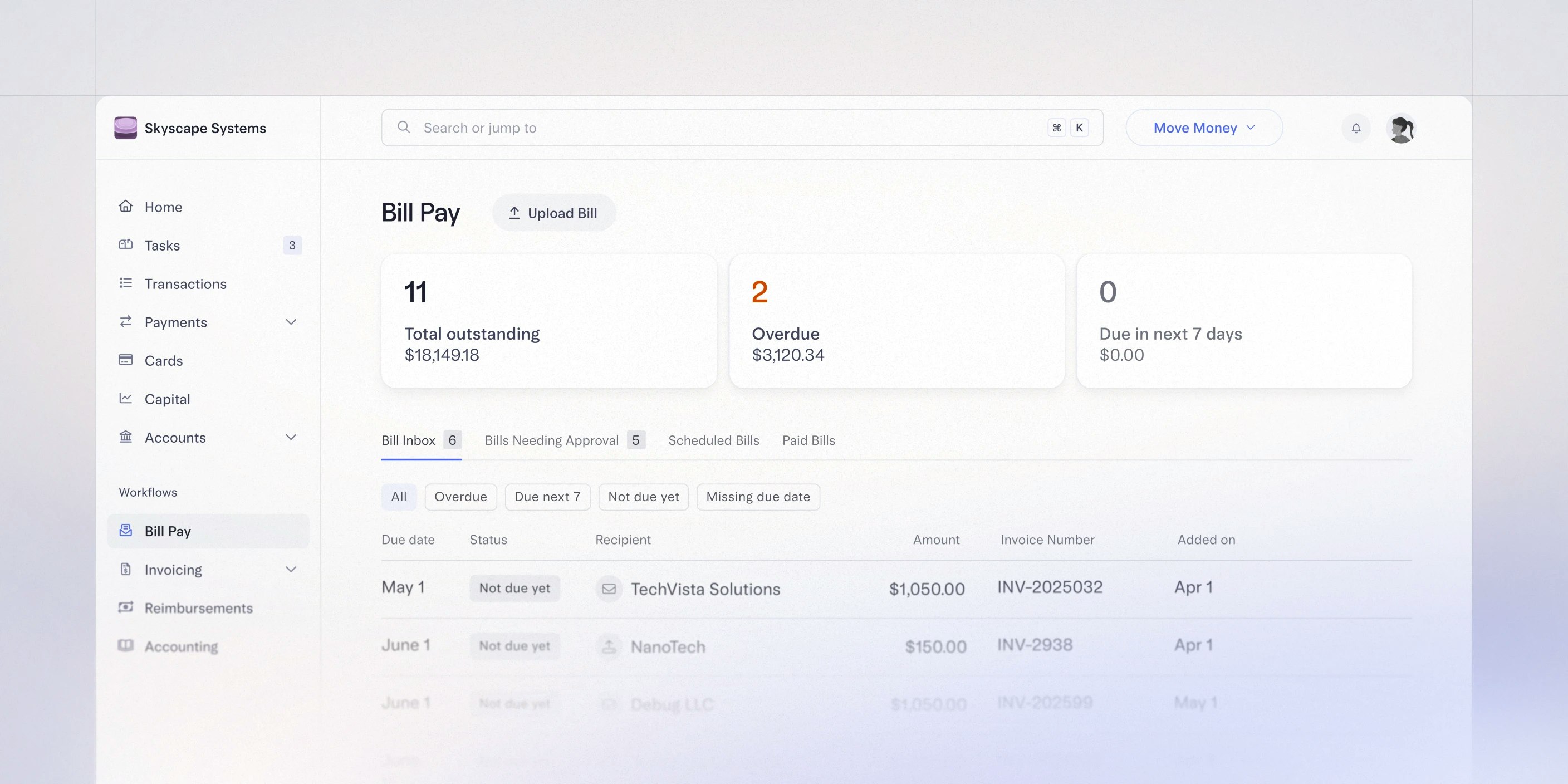

Mercury products: IO, Treasury, Bill Pay, Invoicing, Payroll, Quickbooks Integration

Founded by Chad Wachter as a solo venture out of high school, Investcore has grown into a diversified real estate development firm headquartered in Bismarck, North Dakota. Over three decades, Wachter has developed close to 2,000 properties and transacted on more than $1 billion in development projects, spanning residential subdivisions, commercial land, rental units, restaurants, and hospitality — adding over $500 million in tax base to the Bismarck-Mandan community along the way.

Chad Wachter comes from five generations of real estate developers. His family’s business dates back to more than a century of building in the Bismarck-Mandan area. But when Wachter started Investcore in 1994, he built it from scratch, buying distressed and tax-foreclosure properties, holding them through recovery cycles, and reinvesting the returns into increasingly complex development projects.

Today, Investcore operates across residential land development, homebuilding, rental properties, five restaurants, and a boutique hotel. Its flagship project, Silver Ranch, is a 1,200-acre planned community in northeast Bismarck that will deliver 2,800 homes over the next 25 to 30 years. Wachter himself donated 10 acres for a career technical education center and has donated a residential lot to Bismarck State College’s carpentry program every year for five consecutive years, giving students the chance to build a home from the ground up with the sale proceeds funding skilled-trades scholarships. He created a parallel partnership with Bismarck Public Schools in which students construct a home and the profits cycle back into student scholarships, and he helped raise the funding to build a new hockey facility in Bismarck.

Managing a portfolio this broad means coordinating dozens of vendor relationships, construction draws, property tax allocations, and entity-level accounting, all of which touch cash timing and reporting. As the business grew, Wachter and his team cycled through multiple banks, fintech platforms, and payment tools trying to find a system that could keep pace with the operational complexity. What they found instead were bottlenecks, errors, and hours lost to manual processes.

One invoice, one payment, no exceptions

Before consolidating on a single platform, Investcore’s payment process ran through a patchwork of local banks and fintech tools. Invoices arrived from dozens of contractors and vendors, and multiple team members processed them across disconnected systems. The consequences were tangible:

“We went through a period of time where we were paying invoices twice,” Wachter said. “We paid a $300,000 bill twice because the invoice number went in, and then somebody else in the office manually input it. The system we were using did not get the invoice number put in correctly when it read it.”

The root cause was a familiar one: when invoice data is extracted inaccurately, internal controls that flag duplicates can’t do their job. Wachter’s team tested several platforms for automated payables. Mercury consistently captured amounts, vendor details, and invoice numbers with high accuracy, restoring the duplicate-detection guardrails the team needed.

Project-level visibility from a single dashboard

Investcore’s operations require precise cost tracking at the project level. A residential subdivision, a restaurant build-out, and a hotel renovation each carry their own budgets, vendor relationships, and reporting requirements. Before, getting a new credit card issued meant a trip to the bank, manual paperwork, and a 30-day wait. Separating funds across entities or projects required opening accounts at multiple local banks, each with its own login and reporting interface.

Wachter now issues virtual cards tied to specific projects. Each card maps to a general ledger account, so every transaction automatically posts to the correct project’s books. When a team member buys materials for a specific subdivision, the expense routes to that project without manual reclassification.

“If we have a project, I can create a credit card just for that project. And when the bill comes in from an accounting standpoint, we have that card matched up with a general ledger account. So everything coming in automatically is posting to that project. We can’t do that with other systems.”

The same logic extends to operating accounts. Wachter set up automated monthly sweeps from the operating account to a designated property-tax reserve, ensuring year-end obligations are funded without manual transfers. Excess capital sweeps into Mercury Treasury, where the team selects the liquidity profile that fits their cash-flow cycle—lower yield for faster access when a draw is imminent, higher yield when funds can sit.

Audit-ready records in seconds, not weeks

During a recent IRS audit, the process of requesting records exposed a sharp divide between the team’s legacy banking infrastructure and what they now have access to.

“It was a nightmare getting information from the banks. We had to order reports from the banks, if that had been on Mercury, I would have been able to go in and generate those reports and have them in minutes.”

The difference is structural. With Mercury, Wachter searches by vendor name and pulls every associated transaction, invoice, and payment confirmation instantly. If ever a vendor disputes a payment posting, the team downloads the cleared-check image as a PDF and emails it in seconds, a process that previously took days of back-and-forth with local banks.

Fast enough to pay on-site, secure enough to catch fraud from the same screen

The operational speed extends beyond the back office. For a company that works with dozens of local contractors, tradespeople, and suppliers — many of them small businesses operating in the same Bismarck-Mandan community Investcore has helped build over three decades — payment timing is personal. Standing at a job site after a contractor finished work, Wachter opened Mercury on his phone and sent a wire. Within a minute, the contractor’s phone notified him the funds had arrived.

“Our vendors appreciate that. It builds trust,” Wachter said. “When you can go to a job site and you can pay somebody and it goes into their account before you even leave and they know it — that’s a pretty big deal in the business world. It makes people want to do business with you."

Compare that to the prior workflow: sending a wire through a local bank or national institution involved multiple authentication steps, manual entry, and processing delays that could stretch to hours. On Mercury, each ACH or wire takes seconds once authenticated — versus roughly three minutes per transaction at the local bank, where each transfer required a separate security code.

That speed does not come at the expense of control. At previous banks, security protocols meant re-entering a code for every single transaction, slowing operations to a crawl. Mercury inverts that equation.

"There’s the right amount of security and then there’s security that is intrusive and makes it impossible to do your job. I feel that Mercury has got the right amount of security that protects me and allows me to do what I need to do quickly and safely.”

Take real-time transaction alerts as an example. When a debit clears his account, he can accept or reject it directly from his phone. If a check or payment looks fraudulent, he flags it instantly. No waiting for a bank to investigate, no back-and-forth phone calls. The security layer is embedded in the workflow, not working against it.

Focusing on what matters

Across a portfolio that spans nearly 2,000 developed properties, a $1 billion+ development track record, and community commitments ranging from student scholarships to a 2,800-home planned neighborhood, Investcore’s finance operations now run through a single platform. This means:

- Roughly 10 hours saved per month on payment processing and reporting

- ACH and wire transactions completed in seconds, down from hours per transaction at legacy banks

- Real-time audit trail eliminates days-long waits for bank records

- Project-level cards auto-post expenses to the correct general ledger accounts

- Automated sweeps fund property-tax reserves and Treasury positions without manual transfers

- Duplicate-payment risk eliminated through accurate invoice capture and matching

Wachter and his team get to focus on what drives them: building homes, funding scholarships, and investing in the Bismarck-Mandan community they've been part of for five generations.

Tags