How our Venture Debt dashboard is setting a new standard in lending

Head of Credit at Mercury.

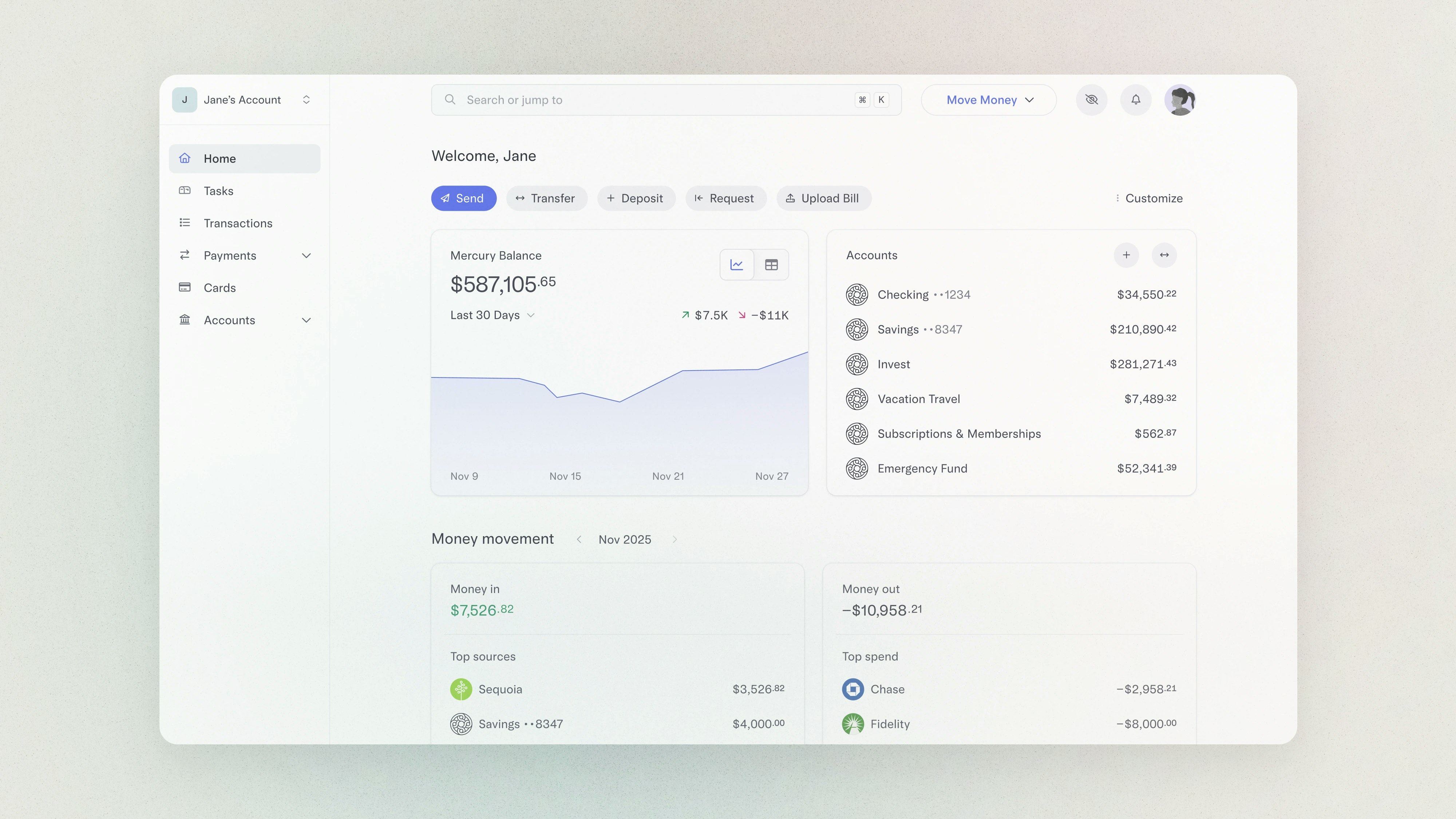

Earlier this year, we launched Mercury Venture Debt. As with everything we do, we approached this product with the end-user in mind: founders and operators. To help inform the process, we carefully recruited an experienced team of capital advisors and former founders to ensure that we were designing from the startup perspective.

After rolling out an online application, expanding our Capital team, and lending out millions of dollars in just a few months, there came a time for us to decide where we would invest our resources next. Over the course of our planning conversations, the answer to this question began to make its way to the surface: to bring speed and transparency to the existing venture debt process.

We wanted to make the venture debt process as clean and simple as we’ve made your checking and savings accounts. It’s our belief that modern companies deserve to build with modern tools, especially if that tool gives them the incredible opportunity to preserve ownership, extend their runway, and accelerate the timeline for reaching their goals. Selfishly, we also wanted to bring a fresh take to our role as a funding partner — and we realized we could do this by reimagining a process where manually underwriting loans in Excel and facilitating diligence requests over email are still the norm.

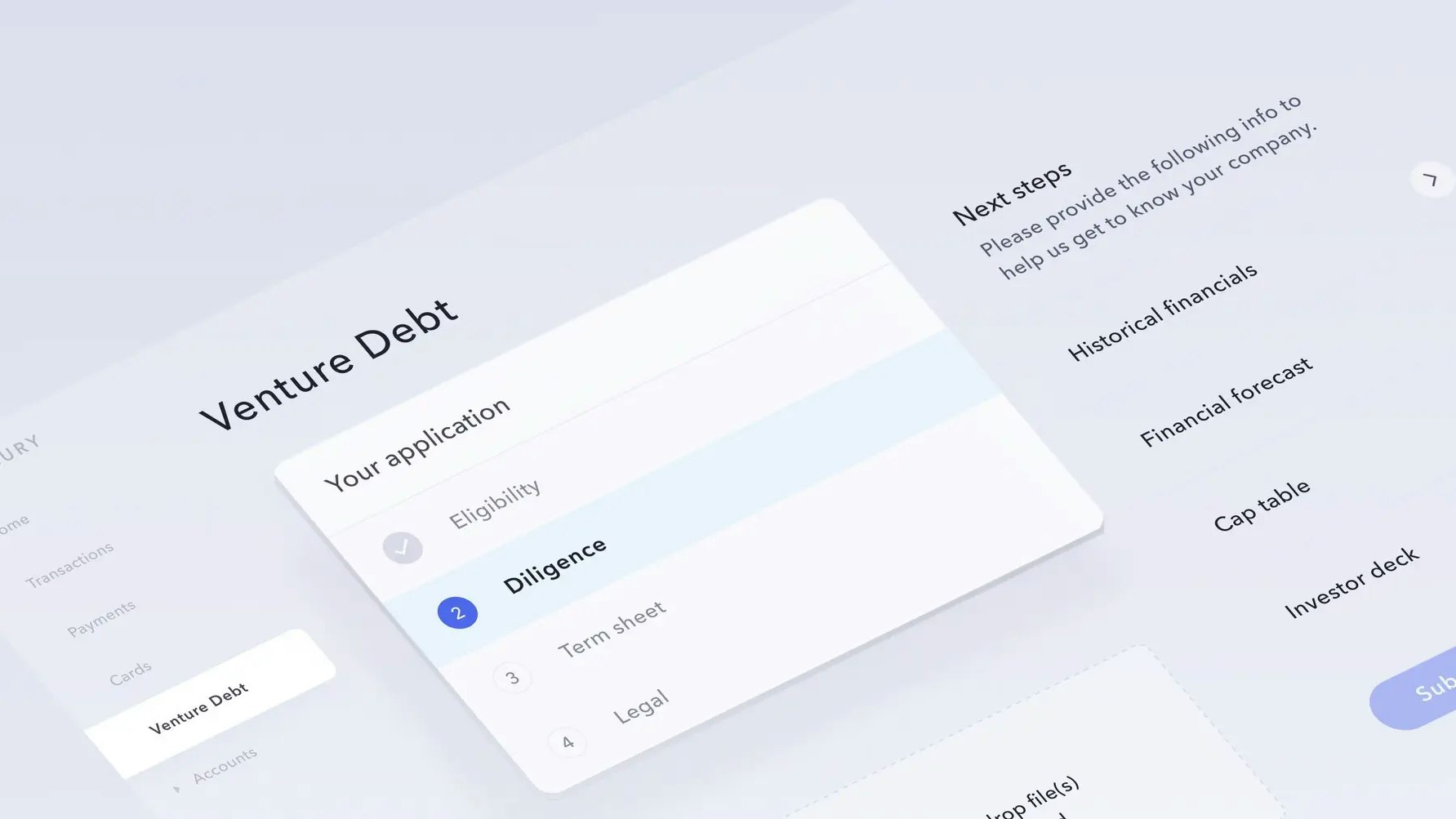

Innovating on the venture debt process is a challenge that requires committing to a long-term vision, and the new Mercury Venture Debt dashboard is the next phase in that journey. We’ve imagined it to be the secure place where your entire experience with Mercury Venture Debt lives, from applying for your funds to accessing them once you’ve been approved. Here's what you can do with our process:

- Fill out a simple questionnaire to determine your eligibility

- Get started on diligence by uploading your first four documents directly to your dashboard

- Access easy-to-use templates for your diligence documents

- Conveniently request loan funds, see how much you have left, and track your repayment schedule

- Automate your monthly financial reporting using direct integrations with leading accounting software services

The Venture Debt process is one stop on our roadmap to streamlining the entire process end-to-end.

What to expect from Mercury Venture Debt

From application to deal close, a typical venture debt process can take three to six months. The Mercury Venture Debt process aims to expedite the typical venture debt timeline with our current and upcoming product innovations.

Here’s a glimpse of what to expect as you go through our Venture Debt process:

1. Determining your eligibility

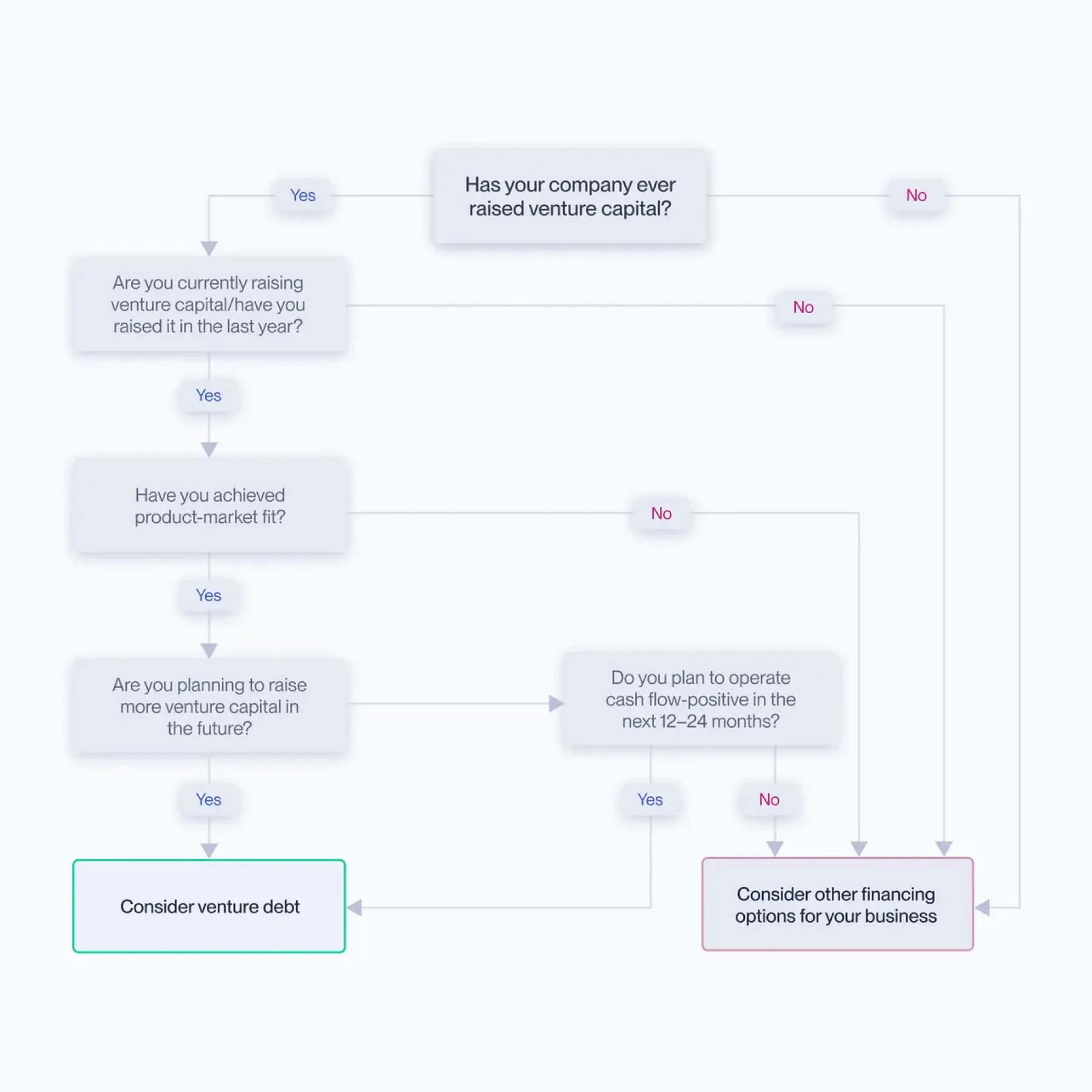

The first step of applying for Mercury Venture Debt is to complete our online Venture Debt eligibility questionnaire — this is how we’ll conduct our initial screening of your company. During this part of the process, you’ll tell us whether you’ve raised venture capital before, how much you raised in your last round, who led that round, and what business category your company fits in. For an in-depth look at how to determine whether your company is a good fit to apply, click here.

Based on your response, our team will determine whether your company is suited to move to the diligence stage. Here’s a flowchart to help you understand what we typically look for in an eligible Venture Debt candidate:

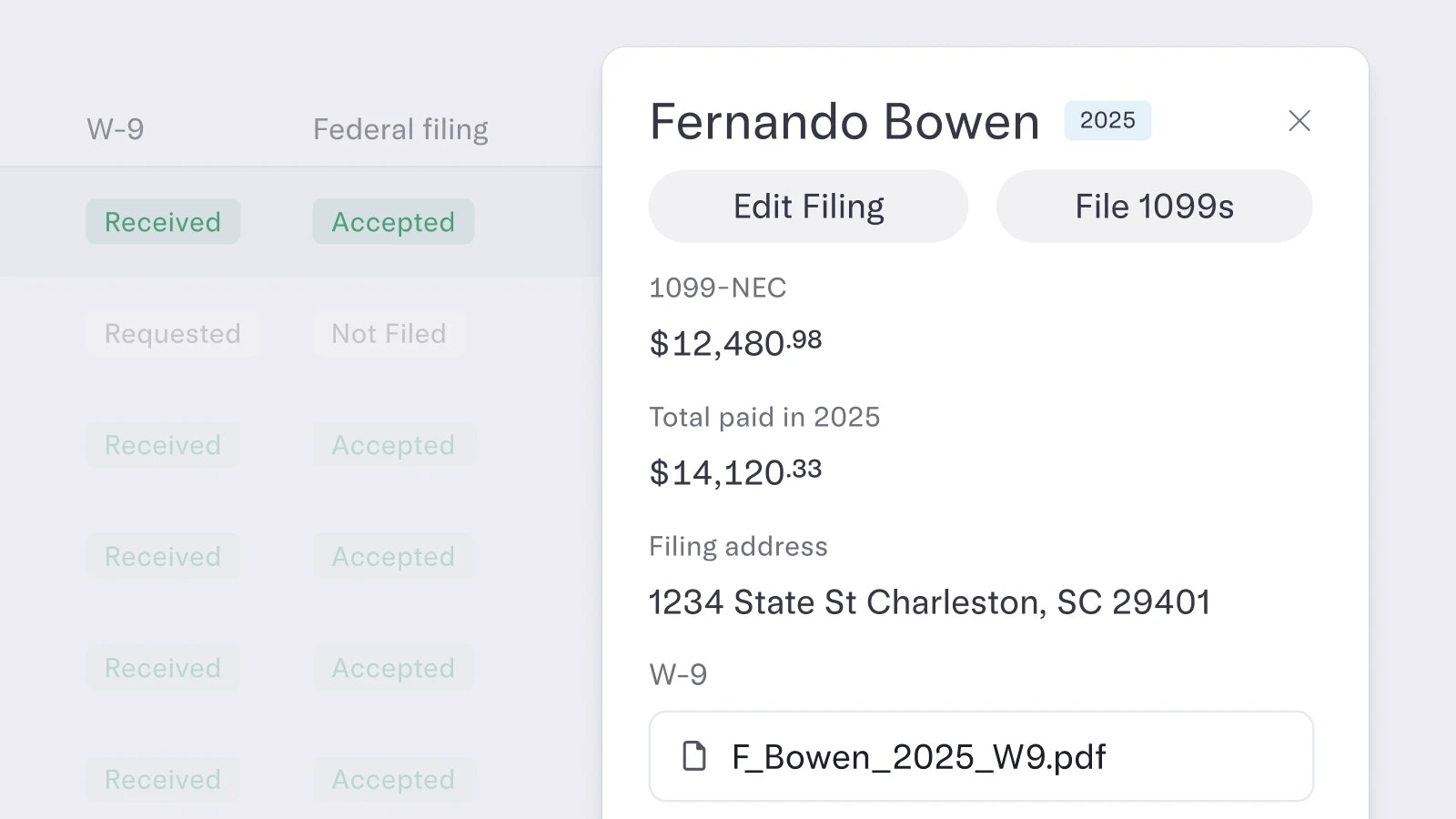

2. Preparing for due diligence

Before being presented with a term sheet, your business will need to go through a preliminary diligence process to establish creditworthiness. This is how we assess whether a company has a healthy amount of runway left and if it’s on a sustainable growth trajectory. At an even higher level, we’re evaluating your business’ potential for repayment through subsequent equity fundraising or future cash flow.

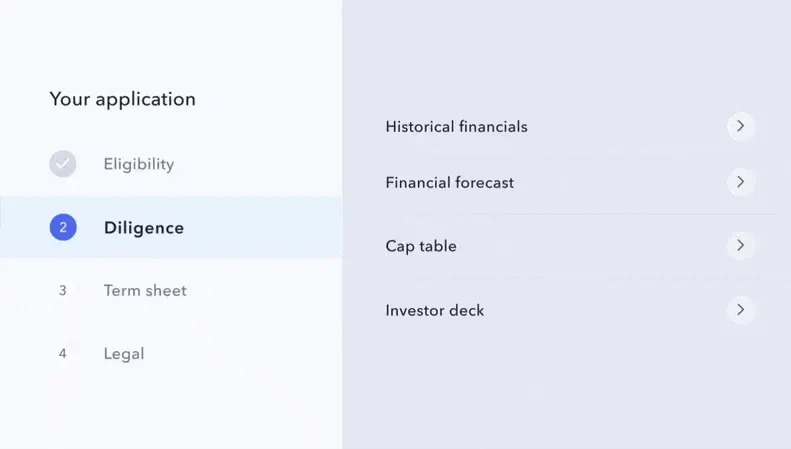

While the required documents have traditionally been shared over email, we’ve created an industry-first digital diligence flow to make it easier for startups to upload everything they need online. In just a few clicks, you can directly upload the necessary diligence files, starting with four documents that you’ve likely already shared with your VCs:

- Historical financials: We’re looking for an income statement and a balance sheet, each showing either monthly or quarterly financials that span the past two years and year-to-date monthly.

- Forecasted financials: This refers to your forecasted income statement and balance sheet, both shown monthly or quarterly for the next two years. If you don’t have a forecasted balance sheet, we’ll also accept a cash flow forecast.

- A cap table: To get an understanding of your company ownership, we’ll want to see a detailed copy of your cap table, including all shareholders, share amounts by share class, and share price per round.

- Your investor deck: Show us your latest and greatest pitch deck that reflects your most recent equity round.

Beyond these four documents, there may be additional information or clarification needed based on your industry or unique business model. If that's the case, you'll be notified and our team will work with you to swiftly wrap up the diligence process and get your application over the finish line.

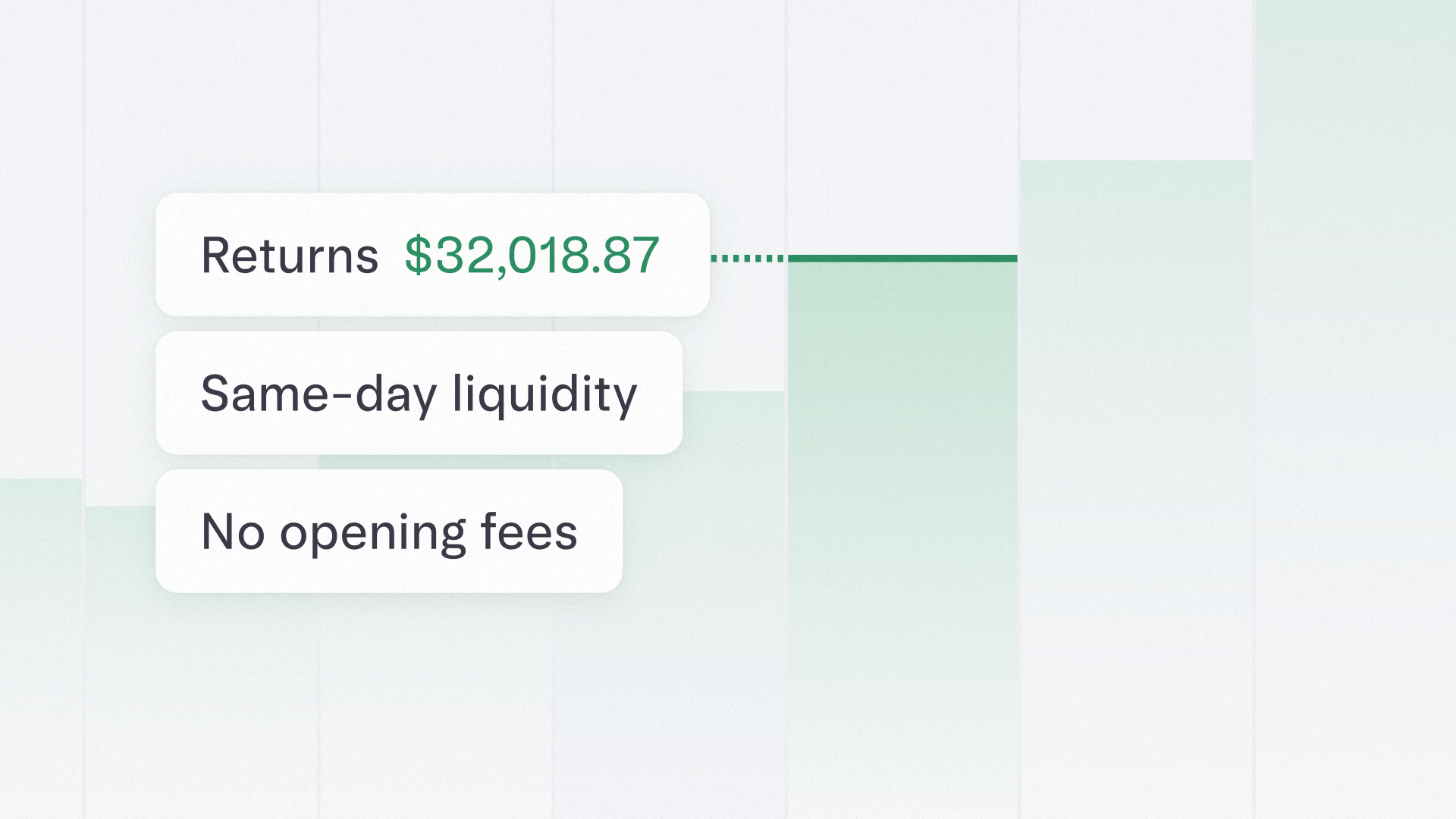

3. Drawing on your loan

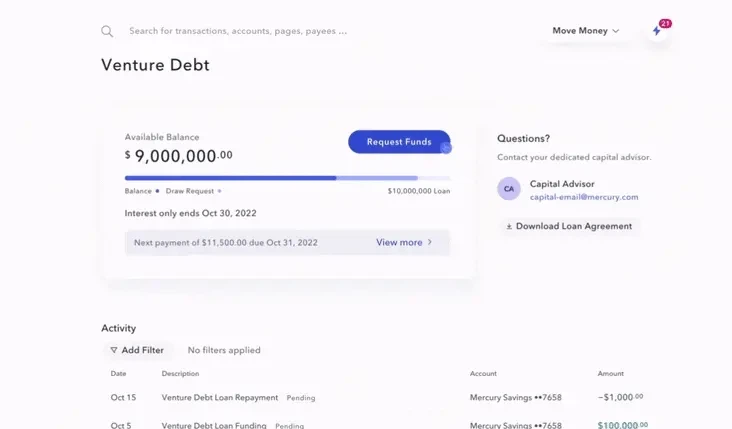

After your company has successfully gone through the diligence process, you’ll be presented with a custom term sheet laying out the conditions of the Venture Debt agreement. Upon signing this term sheet and closing out the legal process, you’ll officially unlock access to your Venture Debt funds.

These are funds you’ve secured on your own terms. To that end, you deserve to have transparent oversight of how they’re managed. Forget having to manually keep track of your loan or go through us to pull statements — with the Venture Debt dashboard, you’ll be able to check on your loan status, easily request a transfer of funds to your checking account, and view your most updated repayment schedule — all on your own time. And if you ever need assistance, your dedicated capital advisor is only one email or phone call away.

To make the experience even more seamless, we’ve incorporated direct integrations with leading accounting software services. This way, you have the option to automate your loan’s monthly financial reporting rather than having to manually send your updates via email. It’s just one piece of our grander vision to streamline the entire underwriting and portfolio management process.

At Mercury, our goal has always been to build products that help you scale, while also bringing some unexpected magic to the experience along the way. With this launch, we hope to put even more power in the hands of founders as they take on new ways to build their companies.

If you’re interested in learning more about Mercury’s Venture Debt product, click here.

About the author

Head of Credit at Mercury.