How Mercury Treasury funds balance risk and return for high-growth startups

Nailing your cash management strategy is about maintaining homeostasis and nurturing steady growth. One useful tool to keep in your back pocket is a treasury management account that’ll allow you to put your idle cash to work while you focus on building your business.

We designed Mercury Treasury to fulfill this exact purpose, and we’ve taken it a step further by automating the process. You can schedule auto-transfers and create custom rules to shuffle money around your different accounts — allowing you to maintain the appropriate amounts of funds in each bucket of your business needs. Plus, you can always top off funds if you need to.

Our carefully chosen mutual funds allow us to offer competitive yields, low fees, and high liquidity. They are hand-picked to optimize your money's safety and give you access to your capital as soon as the same day. Keep reading to find out how we select our funds.

What is a mutual fund?

A mutual fund is a money-making vehicle that pools together cash from multiple investors to jointly purchase an assortment of securities. These securities are chosen by a professional fund manager who structures the portfolio with the end goal of producing returns. By investing in that fund, you participate proportionally in any profits and losses it generates.

Mutual funds tend to invest in two types of securities: equity funds and fixed-income funds, with additional classifications that combine the qualities of both. While an equity fund primarily consists of stocks, a fixed-income fund portfolio focuses on bonds, a traditionally more stable investment that benefits from an extra layer of diversification when packaged into a fund.

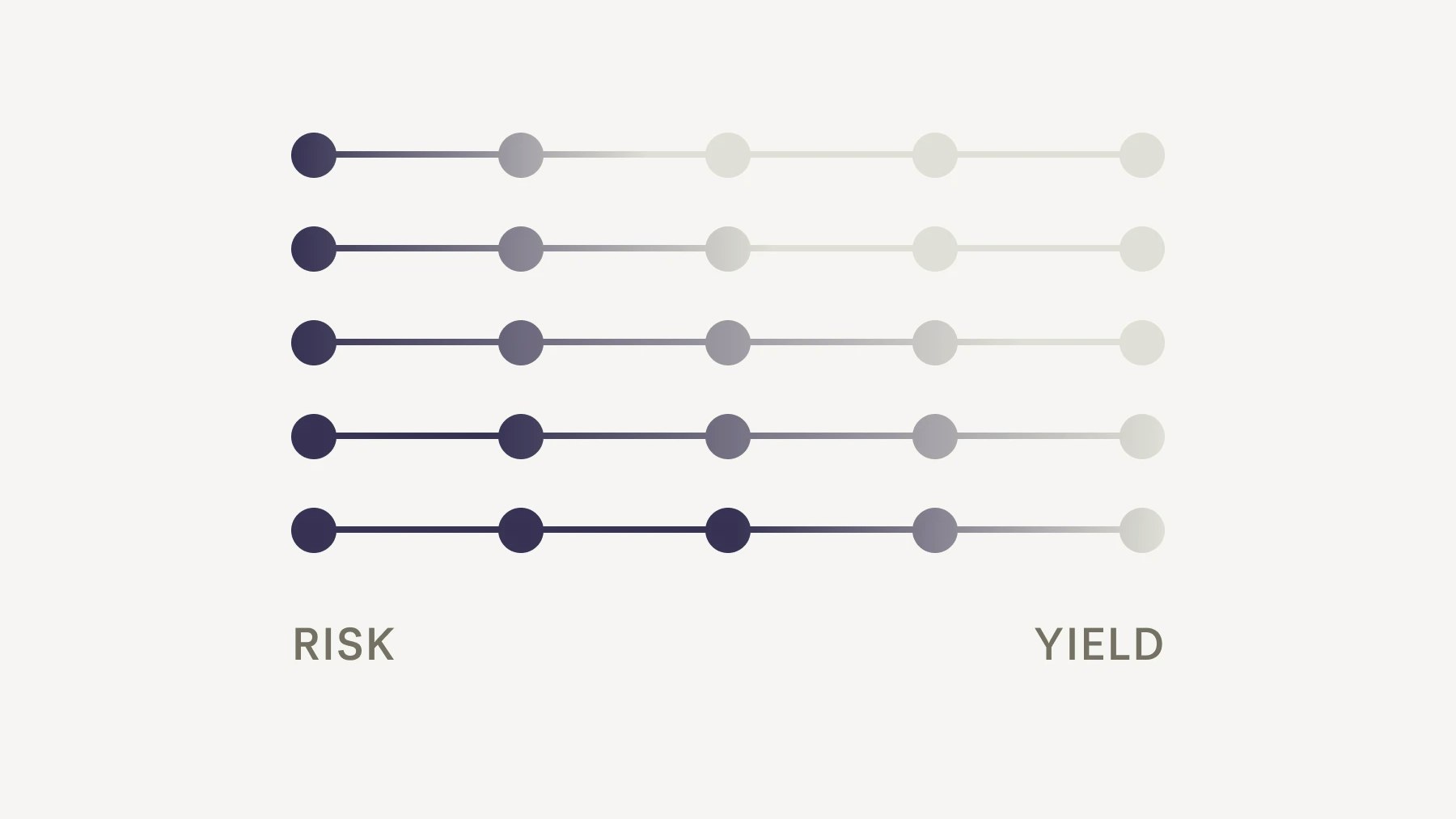

Within the fixed-income fund category, you’ll still find a range of risk and yield profiles. Take money market funds, for example: these are funds that specialize in highly liquid, short-term securities with high credit ratings. Conservative instruments like cash, cash equivalents, certificates of deposit (CDs), commercial paper, and U.S. Treasury bills also fall into this camp.

Slightly higher on the yield spectrum are ultra-short income funds — which, as the name suggests, exclusively invest in securities with very short maturity periods. Due to their brevity, these funds tend to carry lower credit risk and less interest-rate sensitivity, even if the securities they invest in are more volatile in nature.

What factors do we consider when selecting funds for Mercury Treasury?

As an individual investor, you might feel comfortable playing the market for higher potential returns, but when it comes to your business, you have to tread more carefully since your company may not be able to withstand the same level of exposure. A balanced treasury strategy enables your company to accrue meaningful yield while managing risk and also provides the flexibility to access funds when needs arise.

Mercury is an SEC Registered Investment Advisor, meaning we have a duty to protect our customers’ money — a commitment we take very seriously. When selecting mutual funds for Mercury Treasury, we try to mirror the rest of your business's cash management strategy by taking yield, safety, and liquidity into serious consideration.

Our careful vetting process begins with identifying well-accredited asset classes provided by reputable brokerage firms. Knowing that businesses need to store their money in places where they can also quickly access capital to meet their obligations, we’ve also prioritized liquidity. As a Treasury customer, you can buy and sell securities at any time, and when you do withdraw funds, you’ll see them in your checking account as soon as the same day if the transfer is initiated by 3 p.m. ET for our J.P. Morgan fund and within 1–2 days for our Morgan Stanley fund. This is the amount of time it takes for the securities to be sold, converted to cash, and wired back to your account.

Which mutual funds can you invest in with Mercury?

We currently offer two mutual fund options through Mercury Treasury. The first is the J.P. Morgan U.S. Treasury Plus Money Market Fund (JTCXXOpens in new tab), a lower-risk fund that invests in U.S. Treasury bills, notes, and other obligations issued or guaranteed by the U.S. Treasury. The second is the Morgan Stanley Ultra-Short Income Portfolio (MULSXOpens in new tab), a higher-yield fund that primarily invests in commercial paper, CDs, and repurchase agreements.

How and where are your Mercury Treasury funds held?

Your Mercury Treasury account is held in your name — and we’re able to do this through our partner, Apex Clearing Corp, a FINRA-regulated broker-dealer that has been in business for over 40 years. This means that every time a customer signs up for Mercury Treasury, we open an account in their name at Apex, which holds their funds in custody. Apex maintains a detailed record of each Treasury customer's holdings and is prohibited from using any of these funds or securities for its own purposes — or from commingling them with its own customers’ holdings.

The mutual funds themselves are managed by Morgan Stanley and J.P. Morgan Asset Management, which are Registered Investment Advisors regulated by the U.S. Securities and Exchange Commission and two of the most long-standing and reputable players in the mutual fund industry.

How are my Mercury Treasury funds protected?

Mercury Treasury accounts are insured up to $500K through the Securities Investor Protection Corporation (SIPC), the investment account equivalent of the FDIC. The funds you deposit are unequivocally your own. They’ll remain safe — even in the extremely unlikely event that the associated broker-dealer or RIA fails. Additionally, as a broker-dealer that holds custody of funds for its clients, Apex is legally required to keep a minimum reserve of excess capital on hand as an extra level of protection for customer funds.

Apex, as well as Morgan Stanley and J.P. Morgan Asset Management, are each regularly evaluated and regulated by the SEC and FINRA. Apex’s independent financial audit submissions to the SEC are publicly available here.

As with your checking and savings deposits, we approach protecting your Treasury funds with the same level of prudence. If you’re interested in a safe way to start earning yield on your idle cash, learn more at Mercury Treasury.