April 2023 — $5M FDIC insurance, automated payroll, weekly card limits & more

Mercury is engineered to make sure you don’t lose sleep thinking about banking. We’re constantly innovating and iterating on our product because we believe your banking tasks should feel simpler, more intuitive, and maybe even a little enjoyable. Keep reading to discover the most recent updates to your banking experience.

🔐 Get 20x the peace of mind with Mercury Vault

Safeguarding your cash isn’t just your priority — it’s ours, too.

This month, we launched Mercury Vault to provide you with personalized insights that can maximize your company’s deposit protection. This includes suggestions like:

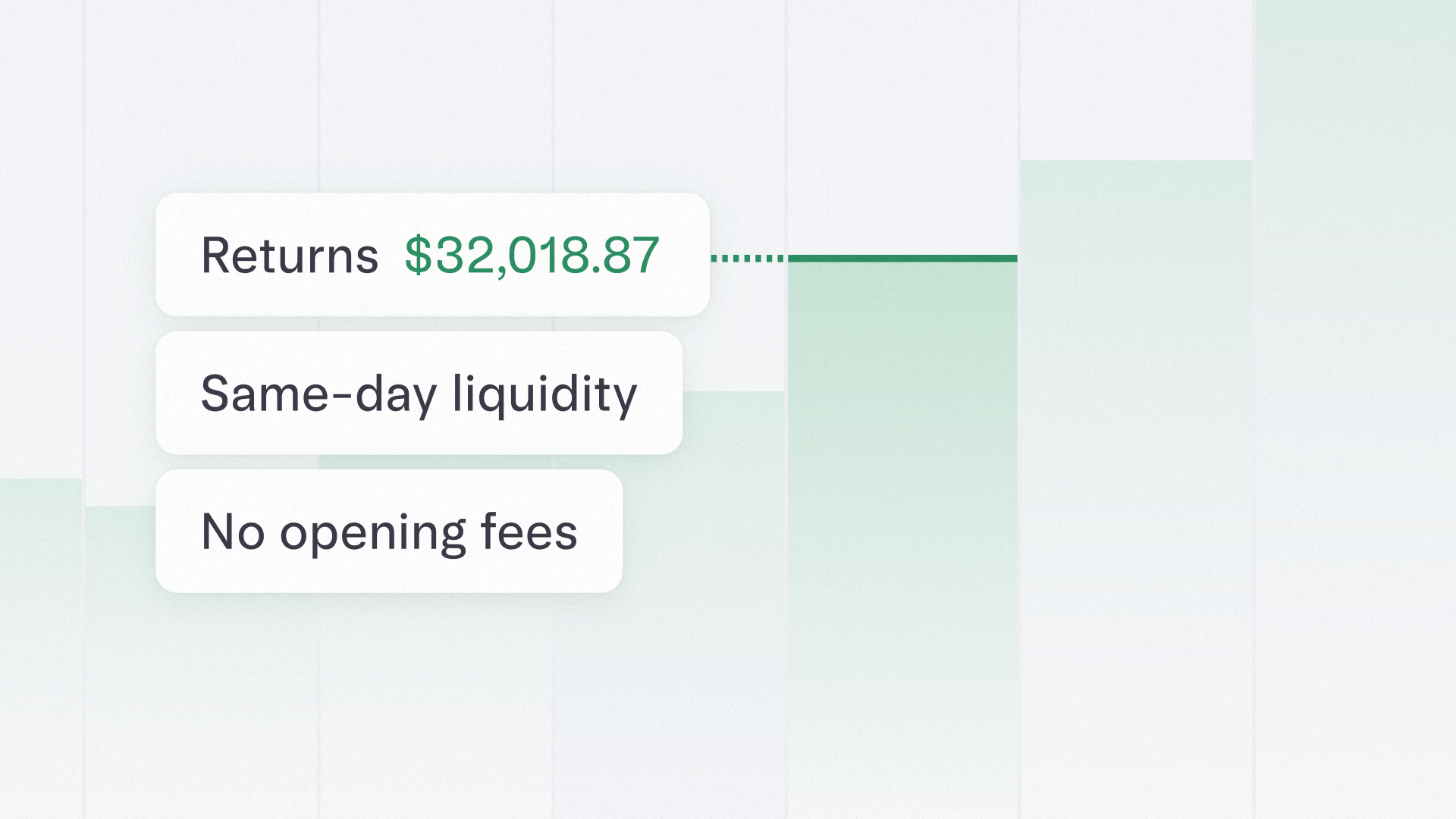

- Upgrading the FDIC insurance coverage on your checking and savings accounts up to $5M — 20x the standard per bank limit — through our partner banks and sweep networks. This is enabled on every new Mercury account by default, and for existing users, Vault will prompt you to opt into the sweep networks if you haven’t already.

- Moving any uninsured cash into a Vanguard money market fund with Mercury Treasury for additional safeguarding.

By the way, there’s no action required on your end to enable Vault — every Mercury account is already equipped by default.

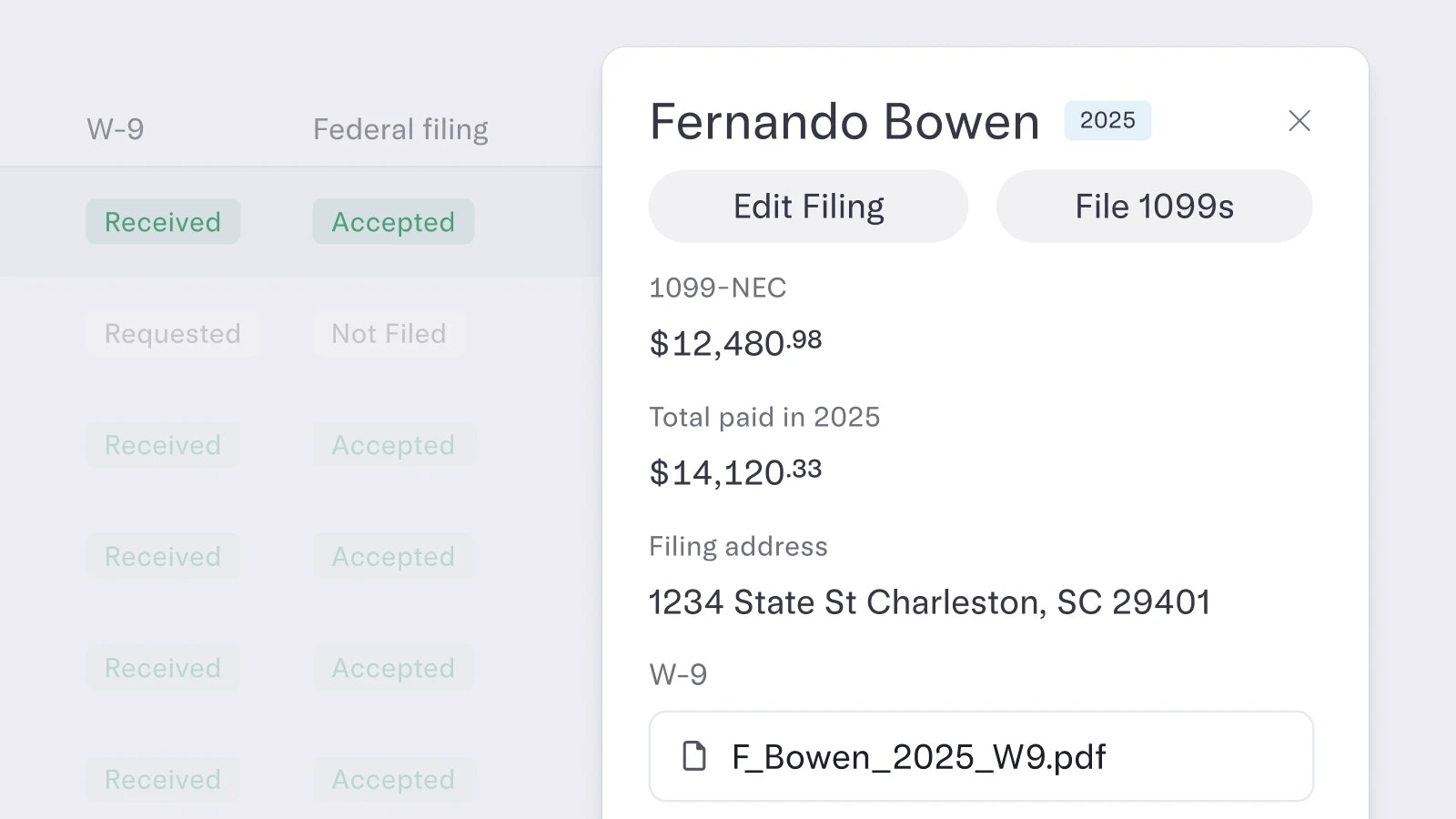

🧾 Orchestrate your payroll processing with wire drawdowns

In the spirit of spring cleaning, it’s time to scrap manual payroll. Wire drawdowns, sometimes referred to as “reverse wires,” are a convenient way to authorize someone — like your payroll provider — to withdraw funds from your account via wire. Simply visit the Payments page to authorize your payroll provider to pull the funds directly — and from there, contact your payroll provider so they can complete setup with a few final steps.

Currently, wire drawdowns are only available to customers with Choice accounts. If you're interested in this feature but don't see the option in your Mercury dashboard, please reach out to [email protected].

💳 Set weekly card limits to protect your bottom line

Daily card limits, monthly card limits. But what about weekly limits? Add one more layer of control onto company spending that you can adjust however and whenever you please. Our favorite use case? Managing spend on employee travel.

💸 Elevate your cash management strategy via Mercury Treasury Solutions with Morgan Stanley

If your account balance is over $25M, you can access custom portfolio management from a dedicated team of fixed-income traders and analysts at Morgan Stanley. Mercury Treasury Solutions with Morgan Stanley allows you to craft a cash management strategy that mitigates risk, maximizes yield, and preserves liquidity for your growing company. Reach out to your relationship manager for more details.

Bite-sized improvements:

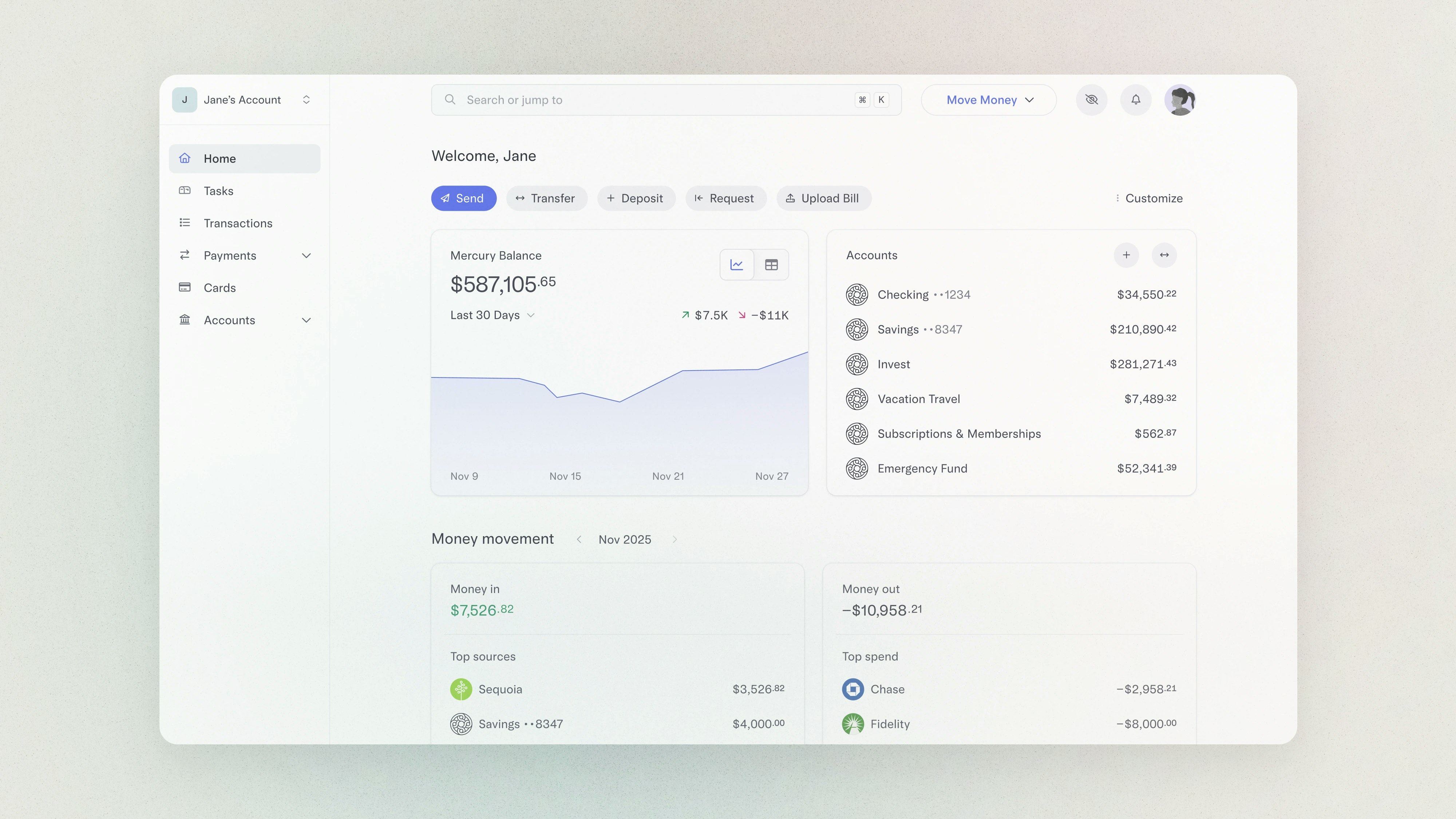

- Your account dashboard now comes with a carousel of tailored recommendations to help your team make the most of Mercury — think of it like a personalized tasting menu.

- We know your webcam doesn't always know your best angles. In the future, any time you have to take a selfie or video on Mercury — like to reset your 2FA — you’ll have the option to capture it on a camera device of your choosing.

- The Mercury Android app has gained a few performance upgrades, as well as a whole new feature: the ability to send wires via "Pay Someone" on mobile.

- If you’re a Mercury Venture Debt customer, get ready to view, accept, and download your term sheet directly from your Mercury Venture Debt dashboard. (In case you missed it, our tech-enabled venture debt process earned us a spot on Fast Company’s annual list of the World’s Most Innovative Companies.)