Everything you need to know about working capital loans

What is working capital and why is it an important liquidity metric?

Working capital is the difference between a company’s current assets (like cash, accounts receivable, and inventory) and its current liabilities (such as accounts payable and short-term debts). It is one of the most essential liquidity metrics because it indicates whether a business can cover its short-term obligations with its short-term assets (in other words, if you have the money to pay the bills and keep operating).

A positive working capital balance means a company has enough to fund its day-to-day operations and weather fluctuations in revenue or expenses. Negative working capital suggests potential cash flow problems and a need for outside financing.

Working capital formula:

Working Capital = Current Assets - Current Liabilities

This simple formula is one of the first indicators investors, lenders, and founders look at when assessing financial health. The answer you get from this formula can indicate if you need a working capital loan and how much you need.

Types of working capital

Working capital isn’t one-size-fits-all. Different business models and industries measure working capital in distinct ways, including:

- Gross working capital: The total value of a company’s current assets.

- Net working capital: Current assets minus current liabilities. This is the most commonly used definition.

- Variable working capital: The additional working capital required during peak seasons or for unexpected needs.

Each type plays a role in cash flow planning and helps determine how much external financing a business might need to stay agile.

When startups and ecommerce businesses need working capital loans

Even profitable businesses can run into temporary cash shortfalls. Working capital loans help smooth out these bumps and keep operations running. Here are some common scenarios when a startup or ecommerce company might seek working capital financing:

- Seasonal inventory needs: Businesses with peak seasons often need capital to purchase extra inventory before revenue starts flowing.

- Slow invoice collections: If clients take 30–90 days to pay, a working capital loan can cover payroll, marketing, or other expenses in the meantime.

- Rapid growth: Scaling quickly usually means higher costs — hiring, software tools, infrastructure — that may come before revenue catches up.

- Unexpected opportunities: A flash sale opportunity, supplier discount, or new marketing channel may justify short-term financing to move quickly.

In each of these cases, a working capital loan helps businesses bridge the gap between expenses and revenue without slowing down momentum.

Operational cash flow is the lifeblood of your ecommerce company, yet can be notoriously difficult to manage. Preparing for busier sales months, such as during the holiday season, can extend cash conversion cycles and strain your working capital.

Having an extra source of cash that you can tap into during these seasons can significantly help manage higher rates of inventory replenishment, add new product lines, staff overtime, and increase ad spend. This is where working capital loans come in, helping smooth the timing mismatch between your accounts payable and accounts receivable.

What are working capital loans?

Working capital loans offer short-term financing to bridge the gap between outgoing expenses and incoming revenue, making them a vital lifeline in moments when your company’s cash is tight. These funds can help cover expenses such as payroll, rent, inventory purchases, and other short-term liabilities that you might otherwise have trouble covering when dealing with cash flow fluctuations.

Types of working capital loans

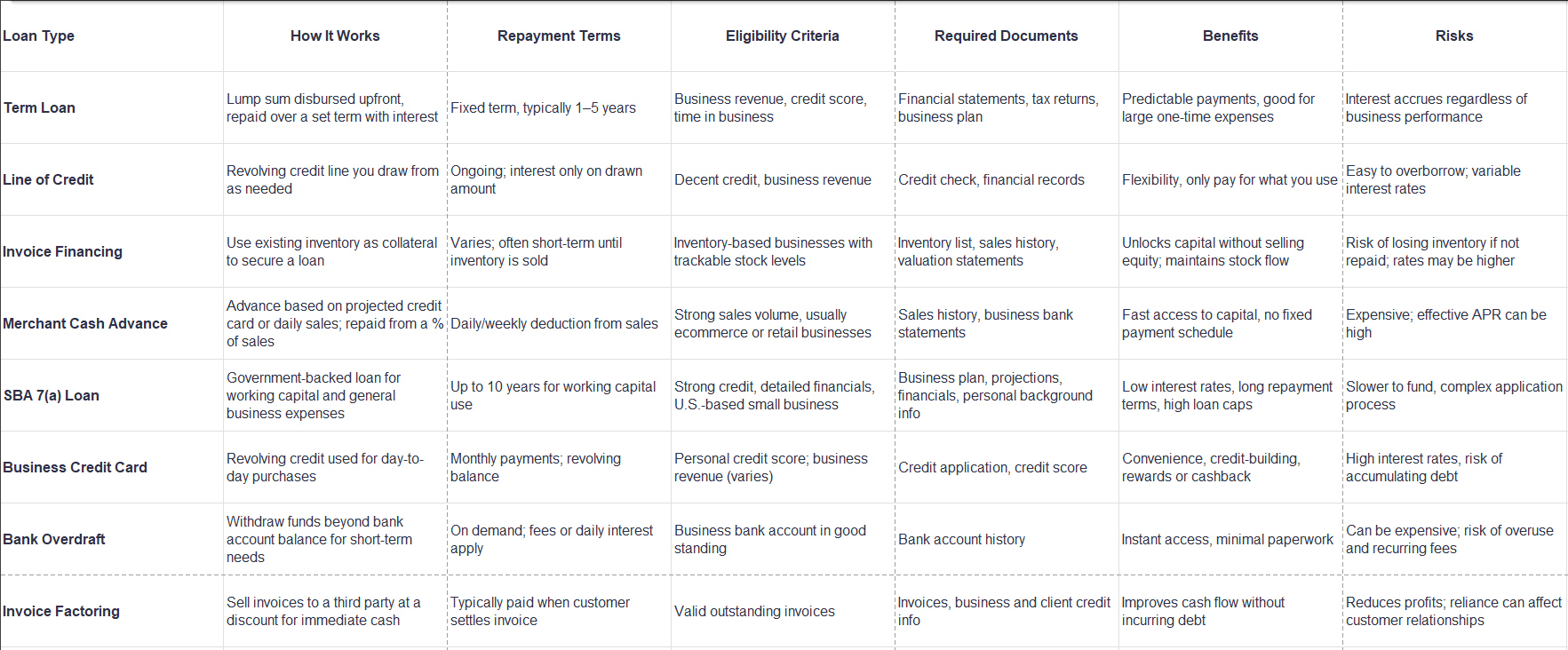

Understanding what types of working capital loans are available can help companies effectively secure cost-effective funding to manage their short-term cash flow needs, while minimizing the risk of falling into a debt cycle.

Traditional term loan

Traditional term loans, when used for working capital financing, provide companies with access to funds needed to cover immediate expenses such as payroll, rent, or inventory purchases. These loans typically have a shorter repayment period, often within a year, making them a flexible option for managing cash flow gaps and unexpected expenditures. Traditional term loans can either be secured or unsecured. A secured loan requires collateral, such as inventory, equipment, or accounts receivable, which the lender can seize if the borrower defaults. Alternatively, an unsecured term loan does not require collateral, relying instead on the borrower's creditworthiness.

Business lines of credit

A business line of credit gives companies flexible access to funds whenever they need them, much like a credit card. You only pay interest on the funds you use, and once repaid, are free to borrow again on a rolling basis, as needed, making a line of credit ideal for handling surprise expenses or capitalizing on new opportunities. The biggest callouts with a line of credit include being sure not to overborrow, paying attention to fees, and keeping an eye on interest rates.

SBA 7(a) loans

SBA 7(a) loans are government-backed loans designed to support small businesses, including startups. They can be used for working capital needs such as inventory purchases, payroll, rent, or other short-term expenses. These loans are partially guaranteed by the U.S. Small Business Administration, which allows lenders to offer lower interest rates and longer repayment terms — often up to 10 years. Because of their favorable terms, SBA loans are highly competitive and best suited for businesses with strong credit profiles and thorough financial documentation. The application process can take several weeks and typically requires a detailed business plan, financial projections, and personal and business credit history.

Inventory financing

These loans are secured by a company's current inventory, allowing the purchase of additional stock without immediate cash outlay. Inventory financing helps ecommerce businesses maintain optimal inventory levels and meet customer demand without disrupting cash flow. Downsides include higher interest rates when compared to traditional loans, as well as the risk of losing inventory if the loan isn’t paid back in full according to the repayment terms.

Business credit cards

Business credit cards offer quick access to revolving credit, enabling businesses to manage short-term expenses while earning rewards like cashback. They provide the convenience of immediate purchasing power and help build credit history, making it easier to qualify for other financing options in the future. However, high interest rates on unpaid balances and the potential of accumulating excessive debt can make this type of short-term financing a risky choice if not managed effectively.

Invoice factoring

Invoice factoring helps companies get quick access to cash by selling their outstanding accounts receivable, at a discount, to a factoring company. This boosts cash flow and helps meet immediate operating needs without waiting for customers to pay. The downside is that factoring typically costs more than other financing options, and relying too much on it can reduce already slim profit margins.

Revenue-based financing

Revenue-based financing provides companies with timely access to capital in exchange for a percentage of future revenue, offering a flexible repayment structure that aligns with cash flow. This helps businesses access needed funds without fixed monthly payments. However, the total repayment amount can be higher than traditional loans, and committing a portion of future revenue can strain finances, especially during slow sales periods.

Merchant cash advances

Merchant cash advances (MCAs) are a popular type of revenue-based financing, providing a lump sum cash advance based on a company’s past and projected sales. The lender is repaid through a fixed percentage of daily or weekly sales, known as the "remittance," which is automatically deducted until the advance is fully repaid. Because there is no fixed payback term, it can be difficult to compare costs with other loan types. If your business does well and you end up paying off your MCA quickly, it can be more expensive than other short-term financing options.

Bank overdraft

A bank overdraft allows businesses to withdraw more money than they have in their account, offering a buffer for temporary cash flow shortfalls. This provides flexibility and quick access to funds without the need to apply for a new loan. However, high interest rates and fees for overdraft usage can create a cycle of debt if the overdraft is relied upon too heavily or not repaid promptly.

Below is a summary of the most common working capital loan options, how they work, and what to consider before applying:

Key factors to consider when choosing working capital financing

When applying for working capital financing, it's important to consider factors like the frequency your company experiences cash flow shortages, the shortfall amount, costs and terms of the loan, what you need to qualify, and how flexible the financing terms are. These points are crucial in finding the right funding fit for your ecommerce business.

Determine the size and pattern of cash flow shortfalls

To identify periods of cash flow shortages, start by assessing your company's financial statements and looking for patterns. Understanding the typical duration and frequency of these shortfalls will help you determine the loan amount and repayment schedule that best suits your needs. Additionally, consider any seasonal fluctuations or cyclical trends that might impact your cash flow, helping you choose a financing option that accommodates these variations.

Analyze costs and terms

Take time to understand the cost of capital and determine whether it makes sense for your company. Look beyond the interest rate to understand the total cost of the loan, including origination fees, service charges, and any penalties for early repayment. You’ll also want to evaluate the repayment terms to ensure they align with your startup’s cash flow capabilities — the wrong terms could be a bigger strain on your finances, rather than a cushion.

Check eligibility requirements

Review the lender’s criteria to determine if your business qualifies for the loan, paying close attention to credit score requirements, revenue thresholds, and business history. Understand how your business credit score impacts loan approval and interest rates, and take steps to improve your creditworthiness if needed. To make the application process frictionless, it also helps to gather necessary documentation like financial statements, tax returns, and business plans as early as possible.

Consider the flexibility of loan terms

Evaluate the flexibility of repayment terms to ensure they can adapt to your company’s changing needs, allowing for adjustments in case of fluctuating revenues. Look for financing that offers the ability to scale financing as your business grows, giving you access to additional funds without needing to reapply. Assess whether the loan allows for early repayment without penalties, providing the option to reduce debt quickly if cash flow improves.

Choosing the right type of working capital loan is crucial for maintaining a healthy cash flow that ensures the frictionless operation of your business. With various options available, from traditional term loans to flexible credit lines, understanding the key factors involved can help you make an informed decision that aligns with your startup’s needs, now and as you scale.

Want to hear directly from a founder? Watch our video with Mango Puzzles co-founders Kemal Didić and Svet Lovoukhin on launching their business with sound fundamentals:

Tags

Related reads

The hidden costs of financial fragmentation

6 signs you’ve outgrown your bank (and what to do next)

What healthy money habits look like in 2026