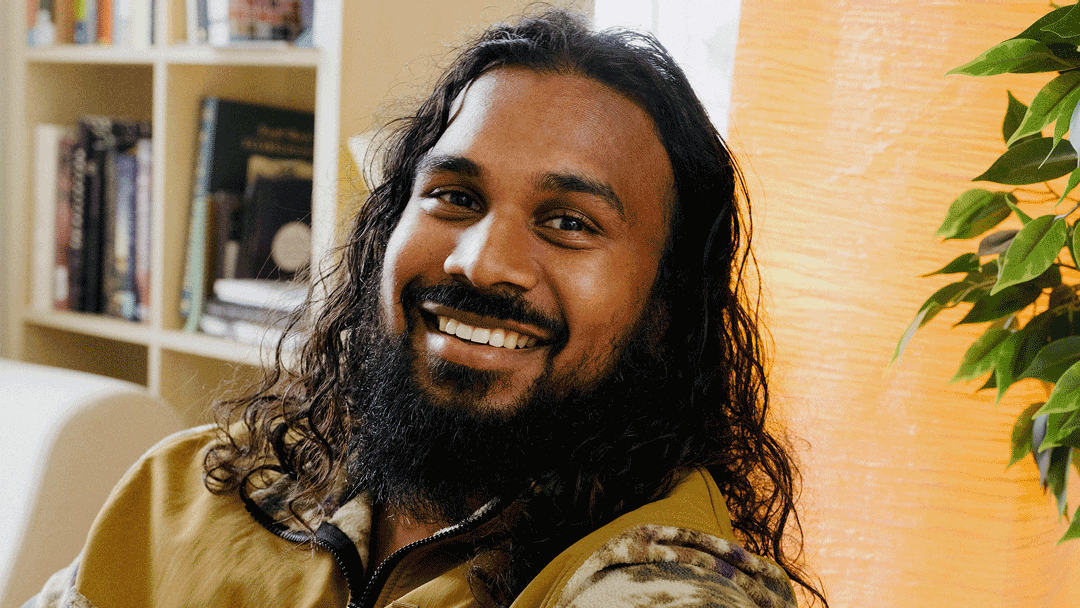

Q&A: Peer Richelsen, co-founder of Cal.com

Each month, we turn the spotlight onto a founder in the Mercury community to learn about their story and the company they’ve built. This month we sat down with Peer Richelsen, co-founder of Cal.com, an open-source software for calendar scheduling.

Check out our Q&A below to learn how Peer got his start in entrepreneurship, long before he took his first investor meeting.

This interview has been lightly edited for clarity.

Do you remember when you decided that you would want to start a company one day?

I was born and raised on a small farm in Germany. My dad is a farmer and thereby self-employed and always working. I think for me it’s always been obvious to do something on my own, but I’ve learned early on that pure physical hard work does not immediately yield high returns.

I got drawn into tech at a very young age and have spent most of my childhood exploring hardware, software, gaming, and internet culture. I was leading a gaming “clan” — nowadays you’d call that an Esports team — which led me to learn HTML to make a website for us.

Soon after, I started selling websites to friends and local businesses. I believe once you make your first dollar selling bits and bytes, you get hooked and you start to understand how big the opportunity really is online.

My first “business” was actually a physical product called bordifies.com, which was a plastic sleeve for Magic: The Gathering trading cards. After going viral on Reddit, I was selling those packs of protective sleeves globally before starting university. My interest in Magic turned into a new startup called Mage Market in 2017, which turned into a peer-to-peer marketplace to buy and sell those cards and got accepted by Y Combinator in 2019, but ultimately had to shut down in 2020 during the pandemic.

After spending many months in the Bay Area, during YC and after, really helped me think bigger and unlearn a lot of European opinions on business. This made starting the next couple of startups a lot easier.

How did the experience of having to shut down a startup during the pandemic impact you? Did it change your perspective on entrepreneurship at all?

Honestly, I was pretty bummed out. We’d been running this company for almost four years and it was heartbreaking to lay off the team and call it quits. As a founder, you don’t really have access to a decent salary and the equity turned out to be worthless. I remember being completely broke, sleeping on my best friend’s couch because I had moved out of my flat months earlier for my U.S. trips.

I remember having about a thousand euros in my bank account when I started my next project: Leanhire.com, a marketplace to turn contractors into full-time team members. It was created out of my own need for a job.

Initially, I bootstrapped the supply on the marketplace, working on a ton of projects that were coming on to the platform until we had enough other contractors who were interested in joining teams full-time. Most of them were previous founders who had to shut down their business during COVID as well!

The pandemic definitely left a systemic shock in the startup ecosystem, but for me, it was a great way to change my mindset and focus on bigger problems. In the end, while Magic: The Gathering is a fun hobby, it’s still fairly niche and I think it’s equally hard to build a startup in a small market than in a big market, you still deal with the same shit every day anyway!

So, while Cal.com isn’t your first startup, it’s the first startup you’ve co-founded that has made it beyond a seed round. How did that feel?

Indeed. I had a startup from 2017 to 2020 that made it into Y Combinator and another bootstrapped company called Leanhire.com which was sold within the same year. This time with Cal.com, a lot of things seemed less surprising and honestly, also less exciting. As a first-time founder, you focus a lot more on the importance of “fundraising” and the glamor behind it whereas as a second-time founder, my focus was more on the product and our customers.

The two most important milestones for me and Bailey, my cofounder, were the initial launch on Product Hunt — which immediately made it to Product of the Month — and then the announcement of our rebrand to Cal.com quickly after.

Those two points in time were a lot more exciting than the fundraises. Don’t get me wrong, it feels surreal to partner up with some of the best people in Silicon Valley, but at the end of the day, the product, customers, and community are what’s most important — not the headlines. We never made any huge press pushes either. I think to this day, only two papers reported about our fundraises.

You and your co-founder are both European. How would you say your approach to building a startup is informed by your upbringing — especially as you build what is technically an American company.

Growing up in Europe but mostly being exposed to American entrepreneurial culture brought some of the best traits to the table. I think a lot of Europeans don’t focus on the bigger picture and prefer to have a big piece of a small pie. On the other hand, it is good to have a more traditional way of looking at businesses and build something that is more sustainable and solves a real problem for your customers.

Germany is known for building durable, sustainable, high-quality machines, but the culture is too slow to make it in tech. When it comes to money, the differences between the United States and Germany are even more visible. Personally, I’ve never been in debt. In Germany, public universities are taxpayer-funded and I haven’t had a reason to go into debt. A lot of Europeans try to not live above their income, which I think is a healthy habit. Consumer debt is not really a thing either — unlike my American friends, most of my German friends have no credit card (although debit cards are very common).

This lack of risk-taking is also mirrored by a lot of European founders, which is interesting. Venture capital is fairly risk-free for founders in comparison to personal loans. You’d think this would encourage European founders to raise funding, but it doesn’t really look like it has manifested yet in the culture.

I am not sure if this is also due to the local venture capital environment. In my opinion, it’s all connected — the lack of IPOs in Europe reduces the likelihood of “big swings,” which are required to fund the startup ecosystem, whether it is by returning money to LPs or by founders turning into angels.

This lack of exits creates a forcing function to “enter” at lower startup valuations — and it overly dilutes newly formed European businesses. There is often simply “not enough left” of a growing company when consecutively raising at low valuations for the founders and employees who are actively working on the company, leading to lower exit valuations and the cycle repeats. I think being a European with an American startup mindset can help a lot in this regard if you’re able to combine both.

Sadly, I’ve mostly turned my back to European entrepreneurship and also haven’t spent a lot of time in Germany in the past 5 years either. Ideally this will change when the ecosystem matures and startup regulations become more friendly — one may hope.

That’s an interesting point about the differences in how Americans and Europeans think about money, and how that can change the approach to building a company. Looking back, can you point to any formative experiences in particular that influenced your relationship with money and how it should be used?

I am grateful that my parents introduced me to the concept of money very early in my childhood. While other kids at school got their pocket money straight to the hand, my parents decided to have an accounting book for me and my siblings where every week we could add or subtract money from our “account.” We would do things like mow the lawn or bring out the local newspaper to increase our balance.

We still have that accounting book at my parents’ house. At some point, I saved up enough money to buy a PlayStation Portable (PSP). I worked for several months just to save up to 200€ in my account.

It was a life-changing amount of money for me. When we went to the electronics store, my dad asked: “Are you sure about this?” And I remember thinking: “Yes, I really earned this.” For me, it really put into perspective how important saving was and how you should reflect on your spending if you really want to buy something. I kept my PSP like a treasure. To this day, if I see it at my parents’ house I feel like wow, this is the first thing I ever saved up for.

You’ve said you’re building a company with longevity in mind. And how does your cash management at Cal.com reflect that?

Being open-source helps a ton. We’ve written a blog post about longevity on our blog and it’s something we take really seriously. I think when you build infrastructure, the question is: “Okay what if this works? How can we make sure this won’t disappear one day?” And open source is the best answer to this.

On the other hand, for our aggressive product roadmap to make sense, and to fix security vulnerabilities and bugs, you need a decent team, which requires either revenue or funding. With the two fundraises in the past, we were quite fortunate to have covered many years of runway, and with the recent influx of revenue, we could be looking at our first profitable month this year if we don’t end up hiring more aggressively.

We’re big fans of Mercury’s Treasury account as well, especially during a time where we’ve seen system shocks to SVB and other banks. It’s great to have access to an easy-to-use option to diversify and keep funding safe.

How many meetings do you take every week? Matter of fact, what’s the ideal number of meetings to take every week?

I use a lot of limits and settings to preserve focus time during the week, and our company mostly runs async. That doesn’t mean sync meetings are not happening. I use cal.com specifically for sales, hiring, fundraising, legal, compliance audits, and due diligence. Everything that can be done over email or Slack will be done async.

I also prioritize my mornings by creating a two-hour block for breakfast and booting up — I also have a two-hour break during lunch. Luckily my timezone lines up perfectly with my sync colleagues so I can work in the late morning, late afternoon until late night, and go to bed at around midnight to have about 8–9 hours of work per day.

There are periods of time where I am back-to-back booked, for example during hiring or fundraising. Cal.com comes in very handy here too, reducing the amount of back-and-forth to a few clicks. Last month we hired a Senior QA Engineer and had around 250 applications. Without a scheduling tool it would’ve been a mess to manually schedule them all accordingly.

What facets of European entrepreneurship and American entrepreneurship do you plan to instill in the next generation?

One of the most interesting things I’ve learned from American entrepreneurship is something I heard Henrique Dubugras, co-founder of Brex, say that kinda went like: “It’s equally hard to build a successful small business than a big business, so you may as well build a big business.” I really agree with that based on my experience. A very similar amount of stress and anxiety comes with running a small business alone versus a big business with great people around you, so you may as well go big.

What I really like about European entrepreneurship is that it’s rooted in deeply caring about mental health, working hours, freedom, safety, and respect. We’re still a small startup and 9-to-5 is quite rare but we really care about bringing in European values, such as mandatory 30-day vacation days, paternity leave, and a strong focus on mental health and healthcare. We have an in-house personal trainer and we monitor team morale and happiness as a core KPI. And the results are quite nice — after two years of running the company, no team member has quit yet.

What's the best Magic: The Gathering card you own?

I sold all my cards when I shut down my startup Mage Market to disconnect a bit. The best card I’ve ever owned was a near-mint “Moat” from Legend, which is now selling for several thousand dollars. Funny enough, I actually made local news when I sold mine to pay my rent!

What’s the most recent thing you saved up for?

To be honest, I am not really saving up for any specific thing. I am very happy with the things I have and consider myself more of a minimalist. Most of my savings go into supporting my family and the people that are close to me right now.

Will you have an accounting book for your kids?

Absolutely, though it’ll likely be Bitcoin-based.

Zoom or Google Meet?

What’s the most important meeting you’ve ever taken?

The first date with my girlfriend fiancée.* Sadly we didn’t use Cal.com for this.

*Editor’s note: Two years after publication, Peer informed us that his then girlfriend is his now fiancée. We're thrilled to make the correction.

Related reads