How to approach building your investor network in a downturn

An established network has always been a valuable asset when it comes to raising capital, but it’s especially important for early-stage founders in today’s market.

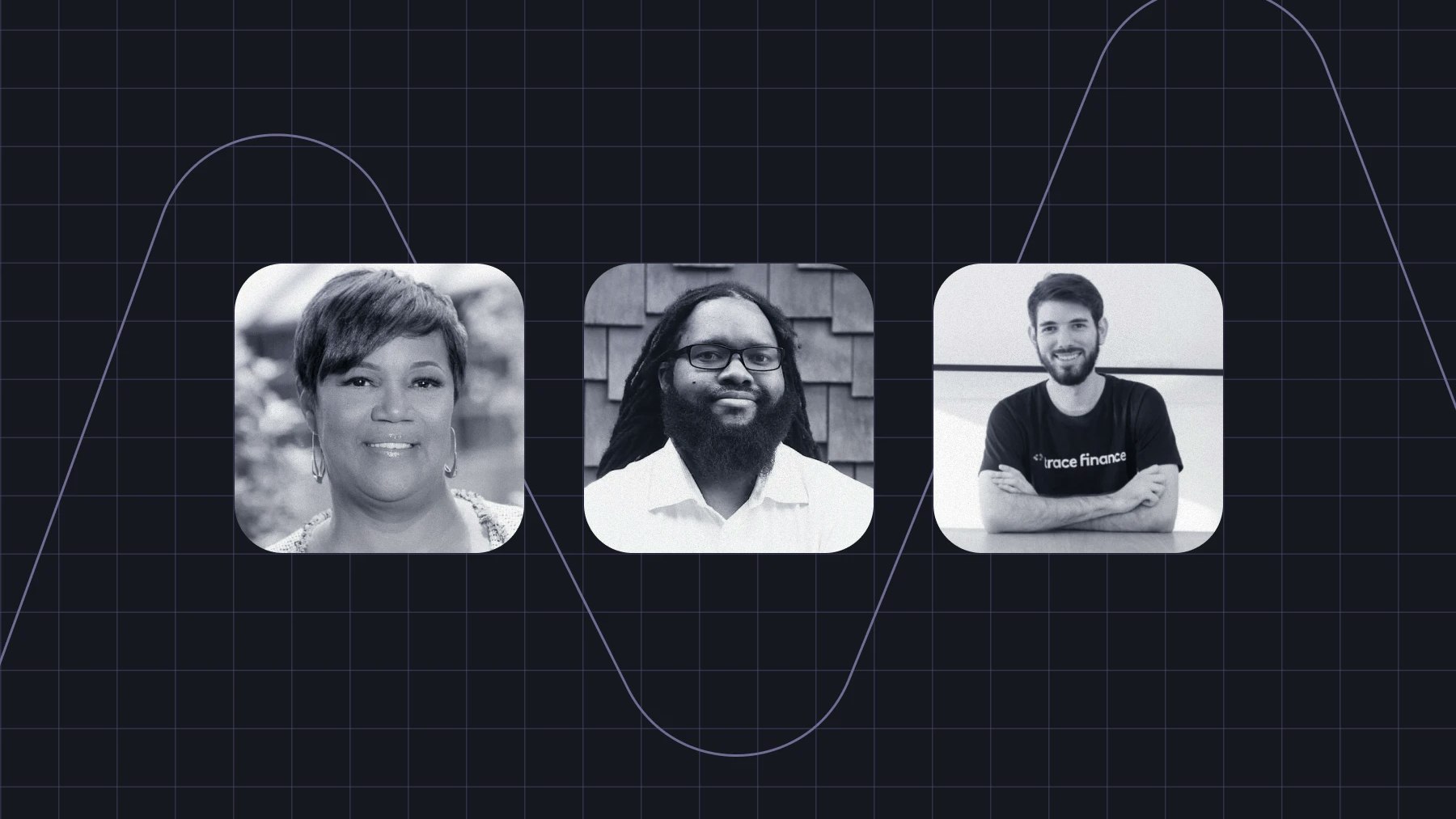

Shila Nieves Burney (founder & managing partner, Zane Venture Fund) recently sat down with Mac Conwell (founder & managing partner, RareBreed Ventures) and Bernardo Brites (co-founder & CEO, Trace Finance) for a Mercury-hosted discussion around Building your investor network in a downturn.

Here are some of our key takeaways:

- Founders can still raise successfully, even though it may be more challenging than it was before.

- Building an investor network takes time – and diligence.

- There’s no “trick” to building a network, but you should always do your homework.

Watch the recording here:

Raising money, Mac said, has never been easy. Even over the past 13 years of unprecedented liquidity, raising money was difficult. And now, it’s even harder. But that doesn’t mean it’s impossible.

Today, he continued, your seed valuation won’t be $40M; it might be $15M — and that’s okay. It just means the process is a little different. We may see valuation decreases, or — in the case of early-stage startups — slower timelines, as well as more advanced terms and structures (e.g., liquidation preferences).

The market’s current conditions underscore what has been important for pre-seed and seed founders all along: building strong investor networks. Why? A startup’s first two rounds of funding are very dependent on your network, said Mac.

So how do you build that network, especially when you’re starting from scratch? Some investors do respond to cold outreach, Shila said, but you’ll probably get varying results. Mac elaborated, “The [investors] that take cold outreach get a lot of cold outreach. I’m not going to look at all 40 companies that reach out to me every day.” He continued: “You want to find someone who works at a firm . . . [You’ll want to] network, go to events, [and] find people who want to help you, to be your mentor. You’ll meet other entrepreneurs you want to become friends with. You want to authentically try and build a relationship.” Mac emphasized: “[T]his all takes time! There is no hack for this.”

Even if there isn’t a single, one-size-fits-all hack for building your network, Mac, Shila, and Bernardo shared a few important insights into best practices for purposeful outreach:

- Do your homework. Always do your due diligence on investors before you approach them, said Bernardo. See if they’ve invested in companies similar to yours.

- Start early – but not too early. Foster relationships with VCs early enough in the startup process to build rapport, but don’t start too early, Mac said. “It’s a little bit of a dance,” he continued. “Do it when you have momentum going so you can start raising.”

- Leverage existing investor relationships to network with other founders. “Most investors have a portfolio of companies they invest in,” Mac said. If one of your investors can introduce you to other founders within their portfolios, this can lead to more investor introductions — and opportunities — down the road.

- Consider joining an accelerator program. Accelerators can prove especially helpful if you’re having a tough time jumpstarting your network, said Shila.

- Take care to find the right investors. Not every investor will be the right fit, Mac said. If it will take your company longer to get significant revenue, for example, you need to make sure you have investors with that same long-term view.

- Don’t just pitch, build real relationships. If an investor says no, wait until your next fundraising round to ask them again. In the meantime, try to build a stronger relationship with them. It’s useful, Mac said, to do some personal outreach to previously hesitant investors as your company grows.

You want to authentically try and build [relationships]... this all takes time! There’s no hack for this.

Mac Conwell, Managing Partner at RareBreed VC

We’re always looking for more ways to support founders. If you’re interested in fundraising support as a Series A company, keep an eye out for the next round of Mercury Raise Series A. To start connecting with investors directly, head to our Investor DB. To explore more financing options, take a look at our Venture Debt program.

Related reads

Bridge rounds, SAFEs, and venture debt: How to stack capital without boxing yourself in

How emerging managers can win LP trust — and what founders can learn

Is a merchant cash advance right for my ecommerce company?