Cleaner books without the busywork: How Mercury simplifies accounting by building it into your account

Ligia is on the Marketing Team at Mercury

Accurate, up-to-date financial records aren’t just a box to check or a set of files to fill out for tax season. Sound financials are the foundation for smart decision-making for all types and sizes of companies and businesses (even entrepreneurs), whether you’re tracking burn rate, planning your next hire, or gauging how much runway you truly have. They also play a critical role in fundraising because investors expect clarity and accuracy about your monetary positions as they mull partnering with you. Reliable books help build trust during the due diligence phase, too, and speed up conversations and decisions when timing matters most.

Clean financial books also simplify the less glamorous, but equally important, side of running a company: taxes, audits, and compliance. When records are well-organized and reflect an accurate real-time financial snapshot, you avoid last-minute scrambles, costly errors, and the stress of digging through old statements. Just as importantly, clean books set the stage for growth. Businesses with messy financials often find that problems compound as they scale, creating bottlenecks when they eventually bring on a dedicated finance team or external advisor. By keeping books accurate from day one, you ensure a smoother path to scaling operations.

However, for many founders and business owners, accounting is often a recurring source of friction from the start. Every month, hours disappear into manual transaction categorization, reconciling accounts, and ensuring the books are ready to be shared with investors, tax professionals, or finance partners.

What’s more, accounting software often isn’t optimized for the way these businesses actually work: fast-moving, resource-conscious, and not always backed by a dedicated finance team. That’s where Mercury comes in.

Accounting made easy, right in your Mercury account

Mercury has always been more than just banking. By embedding key financial workflows directly into your account, we help you spend less time clicking through multiple tools and more time running your business.

Instead of treating accounting as something separate from banking, we see them as deeply connected. Every transaction in Mercury carries context, whether it’s a team member, card, customer, or vendor, which helps your books stay organized as money moves in and out.

The result is bookkeeping that feels less like a monthly chore and more like an automatic outcome of how you already operate. With that vision in mind, we’re happy to introduce some exciting updates to our accounting workflow:

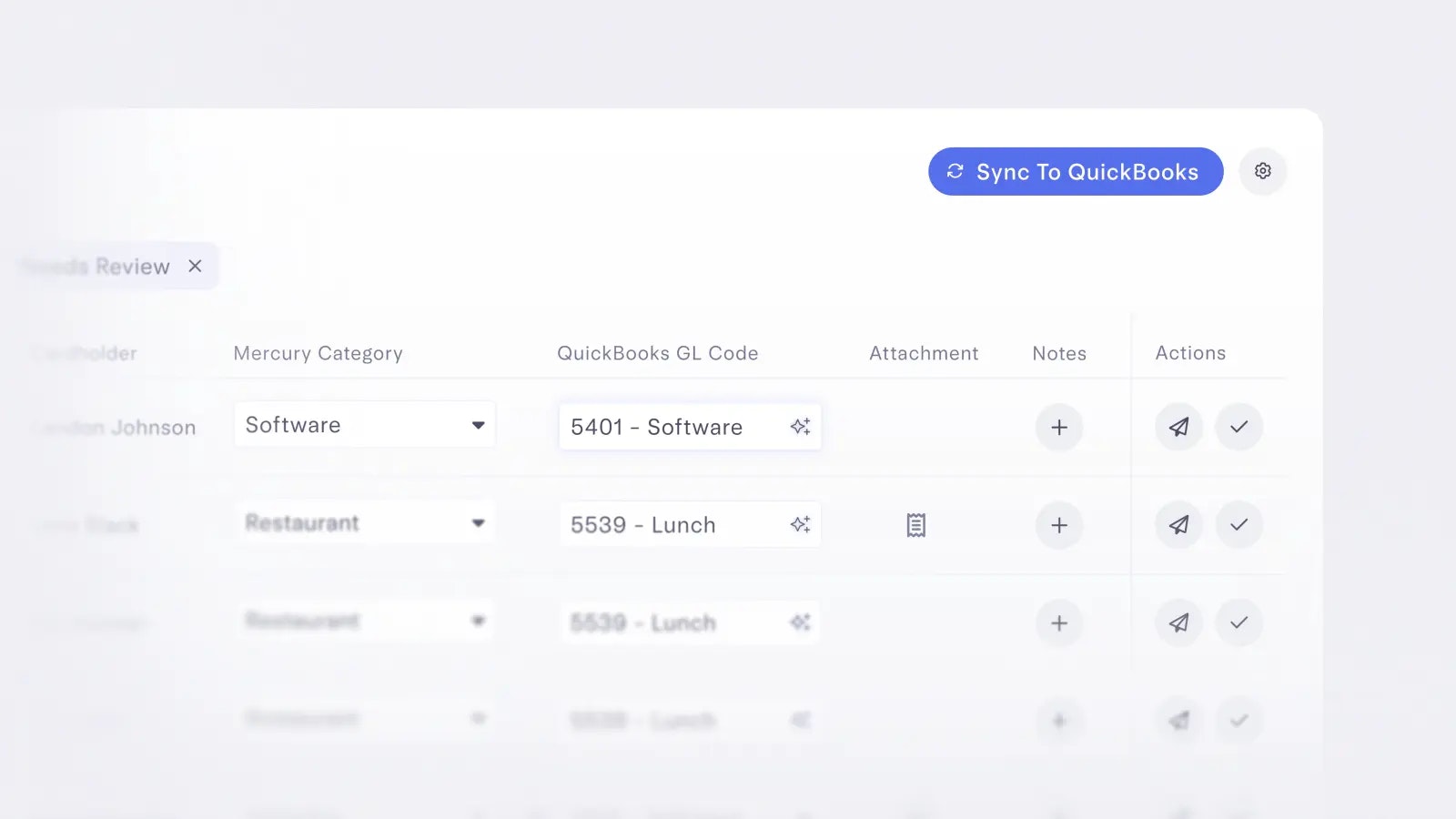

AI-powered auto-categorization

- Transactions on Mercury are now automatically assigned GL codes based on your categorization history and AI-driven suggestions.

- You can also create specific rules that apply GL codes to recurring transactions based on fields like team members, cards, or vendors.

- The more you interact, the smarter the system gets, learning your preferences over time.

Auto-categorization is enabled for all customers with an enriched accounting integration. Learn how to set it up on QuickBooks and NetSuite. Xero’s integration is enriched by default.

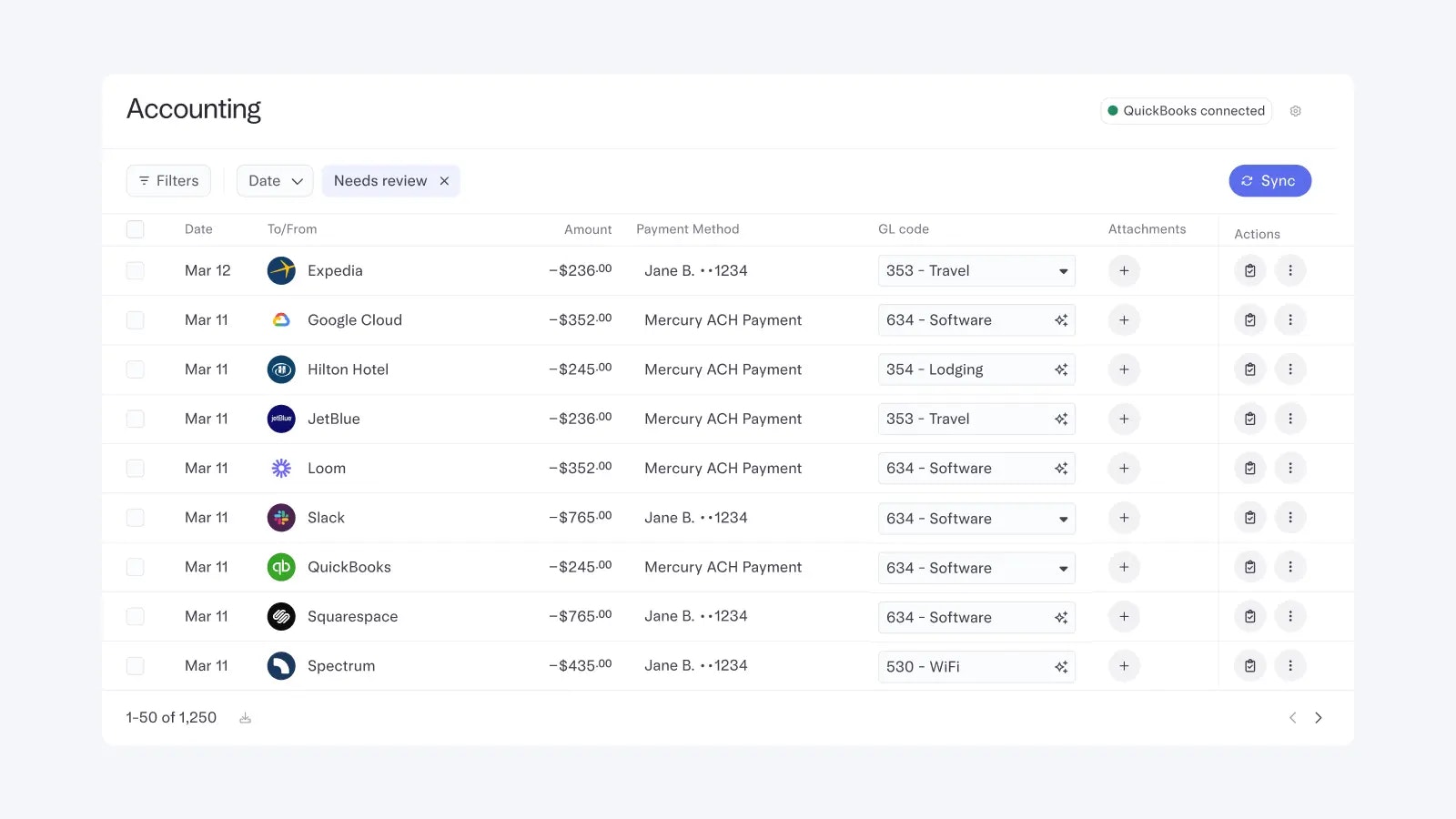

A more purposeful Accounting page

- Greater visibility into the status of the integration, error states, and the specific transactions that have synced, along with when the sync occurred.

- Built with an automation-forward mindset, the new page helps you get to “inbox zero” state faster and with fewer steps.

- Coming soon: a cleaner, more purposeful interface that makes it easier to manage categorization at scale.

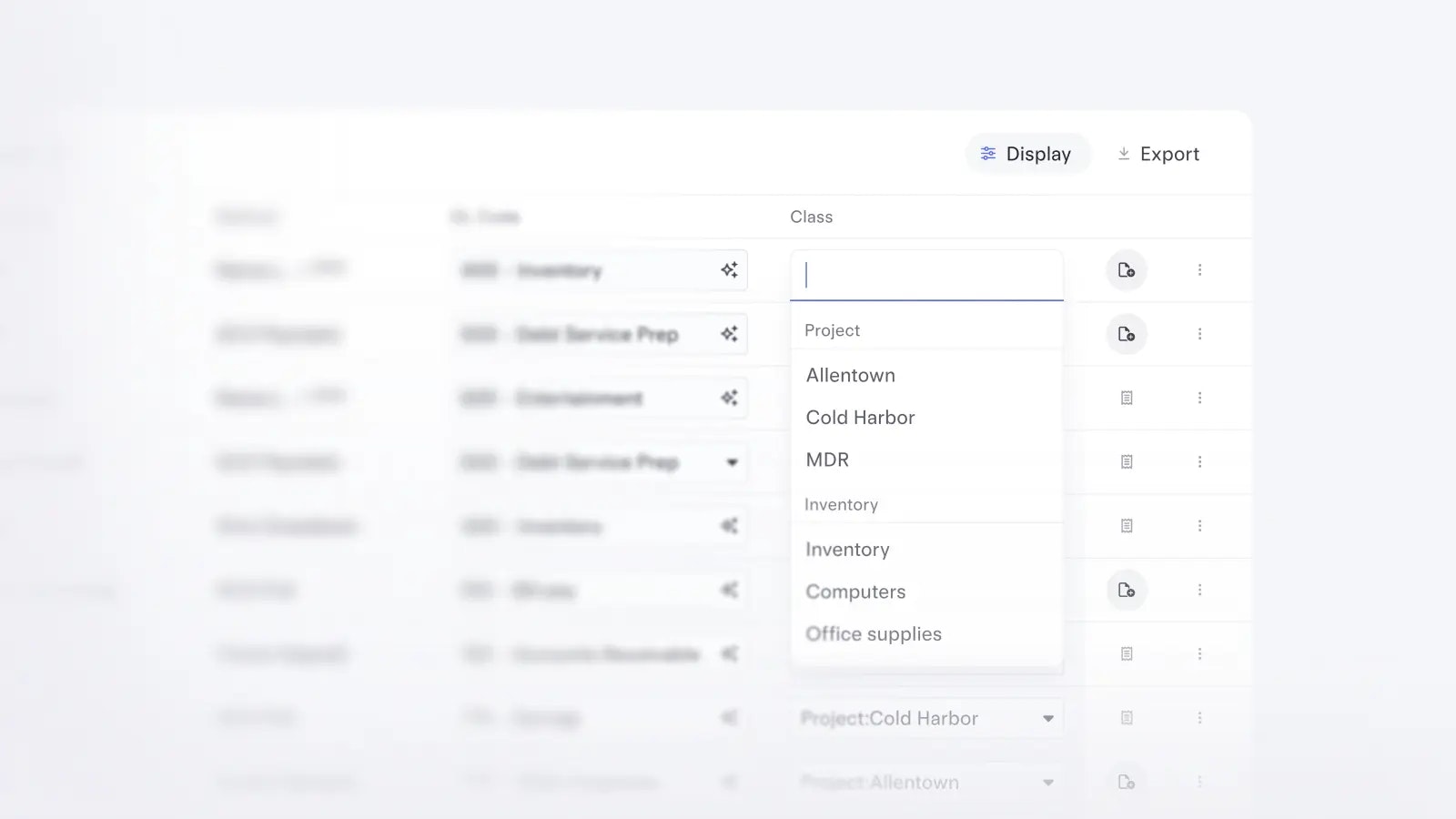

Support for Classes

- Classes are independent of GL codes and allow you to bucket transactions and create grouped views (such as P&L).

- Customers with enriched integrations to QuickBooks and NetSuite can now attach Classes to transactions on Mercury.

- Classes are pulled automatically from the accounting software into Mercury.

Bookkeeping best practices

Additionally, with a few simple habits, you can avoid costly errors, give yourself (and your accountant) clearer visibility into your business’s financial health, and stay ahead of the month-end without the stress. The key is building proactive routines that fit naturally into your preexisting workflow, so bookkeeping is a steady, lightweight process rather than a last-minute scramble. Here’s how Mercury helps:

- Set up an enriched integration to your accounting software: it allows you to sync attachments and notes for each transaction to your accounting software, creating a single source of truth to prevent discrepancies. It also enables auto-categorization of your transactions.

- Categorize consistently with AI support: enriched integrations let Mercury auto-categorize transactions for you according to your own rules to apply GL codes to recurring vendors, subscriptions, and more.

- Review regularly without the heavy lift: instead of waiting until month-end, review transactions as they come in. The new Accounting page makes this easier with grouping, bulk actions, and “exclude from review” options, so you only spend time where it matters.

- Collaborate with your accountant: invite your accountant or bookkeeper to access your Mercury account so they can look at transactions and categorizations and even tag you in comments on specific transactions with questions. Clean data at the source makes their job easier and saves you money on catch-up bookkeeping.

What’s next

Our team is working hard on expanding and improving our accounting products and automations to support more complex use cases, like departments, invoice and FX accounting, and more.

Accounting shouldn’t slow founders down. With features like auto-categorization and a redesigned Accounting page, Mercury turns bookkeeping from a manual burden into a seamless part of running your business.

Mercury does not provide tax, legal, or accounting advice. You should consult your own professional advisor for any decisions related to tax, legal, or accounting matters.

About the author

Ligia is a Product Marketer at Mercury, focused on accounting products. She lives in the Bay Area and loves coffee, movies, and international travel.

Related reads

What to look for in business bill pay software — beyond basic payments

Tax season stress-test: How ready is your startup’s financial stack?

How to evaluate external bookkeeping partners