5 ways to improve your invoicing process

Controller at Mercury

In the earliest days at a startup, you may not follow a specific process or cadence to send invoices. You keep track of money owed, prepare an invoice, hit send, wait for a reply… and the reply is money.

While this may work when you have only a few customers, eventually, you’ll need a more defined process to handle volume, track payments, and manage overdue invoices. And since it’s easier to build processes before you need them, you should consider starting even when your customer base is small. Let’s take a look at a few easy things you can put in place that can make invoicing much easier down the road.

Identify the correct billing contact

It may seem almost too simple — but getting your invoice to the right person at the right time can make quite an impact on getting paid. Payments can be delayed if you send invoices to the wrong contact — they ignore the invoice or never forward it to accounts payable, and you’re left wandering in the woods.

So it goes that identifying a billing contact should be part of your overall contract management. When you sign a new customer, make sure you don’t just know who your contact is — but who you’ll be sending invoices to. In some cases, you may need to send the invoice to an accounts payable department and cc another person (like a founder, manager, or “approver”) to ensure your invoice is processed promptly.

Clearly identify products/services on the invoice

Your invoices should include a very clear description of what was delivered. The more information you include, the more you can reduce back-and-forth questions that may delay your payment.

For example, if you provide a service and send an invoice on November 1, indicate the service period. (Make it clear whether your customer is paying for the prior month or for the upcoming month.) If you’re invoicing for products, provided a detailed itemization of what was delivered. Think: “3 black t-shirts (small)” rather than “shirts.”.

Offer multiple payment options

Your customer base may have very clear payment preferences, such as using a credit card or sending a payment via ACH. Or you may have customers with many different preferences — and limiting their payment options can hurt your business. A customer with poor cash flow may pay late if they can only pay via ACH and can’t use a credit card.

Offering multiple payment options gives your customers choice and control over how they’re managing their cash flow. It also sets you up for the future when your customer base starts to evolve, and your customers expect to be able to pay invoices using their chosen method.

Use automation

Invoicing can be a bit laborious to execute, manage, and track. An Excel spreadsheet might work to track invoices when you only have a few customers, but it can become very inefficient before you know it. If you don’t have a specific cadence for sending invoices, you’ll have to prepare and email them to the billing contact manually. If everything’s manual, you might miss sending an invoice on its designated day or see delayed payments as you rely on manual follow-ups for past-due invoices. It also creates a bad experience for the customer if the timing of invoicing changes.

Automation can help with all of this. The method of invoicing may also vary based on how customers sign up for your product or service. Are they signing up online and expect to pay instantly, or are they signing a contract that details the payment terms, such as monthly or annual billing or milestone based?

Automatically email invoices

With automation, you can set up a cadence to email invoices to your customers from your accounting software (or even your bank account), rather than manually attaching an invoice to an email that you send (also) manually.

You’ll also want accounting software that can set up recurring invoices to eliminate manual creation of future invoices for customers with recurring or subscription-based services.

Send automated reminders

Automations can send reminders to your customers that their invoices are due in advance of the due date and again on the due date. Automated reminders can also inform customers that their invoices are past due.

Reminders are often the difference between being paid on time and an invoice going past due — but the higher your invoice volume, the less bandwidth you’ll have to send them manually, and the more important automated reminders will become.

Automate your cash application

Cash application is the process of matching an open invoice to a received payment. If your cash application is manual, this might be a process you need to complete daily. Otherwise, your accounting software may start sending automated reminders to a customer that an invoice is overdue, when, in reality, you’ve received payment — you just haven’t matched the payment to the invoice yet.

Automated cash application will do the matching for you so that you can take advantage of timely automated reminders.

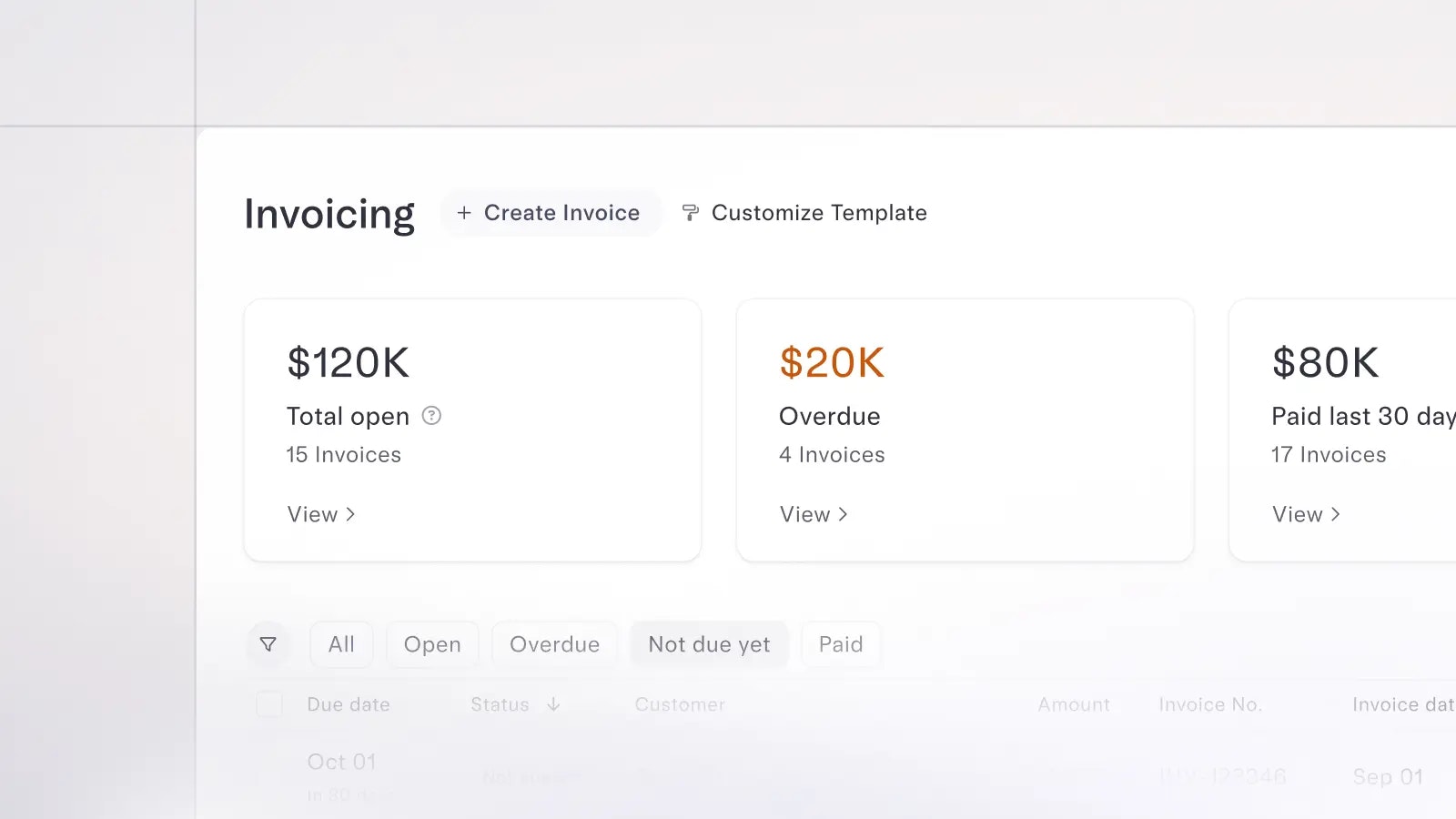

Mercury Invoicing

When you send invoices through Mercury you can best take advantage of automated cash application when payments are received.

Define your process for overdue invoices

Inevitably, some of your customers won’t pay their invoices on time (or may not pay the full amount on time). You should decide whether or not you want to charge interest or a late fee if you think that will motivate your customers to pay promptly. Each state in the U.S. has its own laws regarding maximum late fees and whether or not you’re required to give a grace period, so that’s something to consider.

You can also consider other measures, such as cutting off a customer’s access to a subscription product or pausing services if you’re mid-delivery within a project. You may also opt not to continue the relationship with the customer going forward.

While automated reminders can prompt a customer to make a payment if they simply forgot, in other instances, you may need to take a more hands-on approach. You might ask your sales person, account executive, or someone else within your organization who has a relationship with the customer to reach out if you’re not getting a response.

If your escalation process identifies the next steps for late invoices, it will be easier to maintain a consistent process. In your accounting system, you can identify any invoices that are overdue and take action based on the severity (such as 30 days overdue versus 90 days overdue).

The more you streamline, the smoother your invoicing process

A poorly defined invoicing process can hurt your business in several ways. It can impact your cash flow if you don’t send invoices promptly or are delayed in collecting payments. And it can also impact your customer’s impression of your company. Good invoicing processes will convey professionalism and maintain consistent communication with your customers.

By having a clear process and relying on tools for accounts receivable, you can make it easier for customers to pay you and spend less time on invoicing.

Don't have a Mercury account yet? You can create professional, personalized invoices in minutes with our free Invoice Generator — no sign-up required.

About the author

Controller at Mercury

Related reads

How AI is influencing early roles at startups

Should you launch on eBay? A viability checklist by product category

The 8 most common inventory mistakes (and how to fix them)