The magic of Mercury, now for personal banking

Product Manager for Mercury Personal.

Mercury is getting personal. Starting today, the power of the Mercury experience is no longer reserved for high-growth startups alone. Now, the builders and leaders behind those companies can tap into the same beloved banking and financial software for their personal accounts with Mercury Personal.

Today also marks Mercury’s fifth anniversary. That’s five years of iterating, innovating, and building better products to keep pace with the customers’ ambitions that inspire all we create. One of our community's most highly requested products along the way has been personal banking. Countless conversations, rounds of testing, and incremental improvements later, we couldn’t be more excited to share Mercury Personal with the world.

Read on for a sneak peek of everything it promises, then get on the waitlist to experience it yourself.

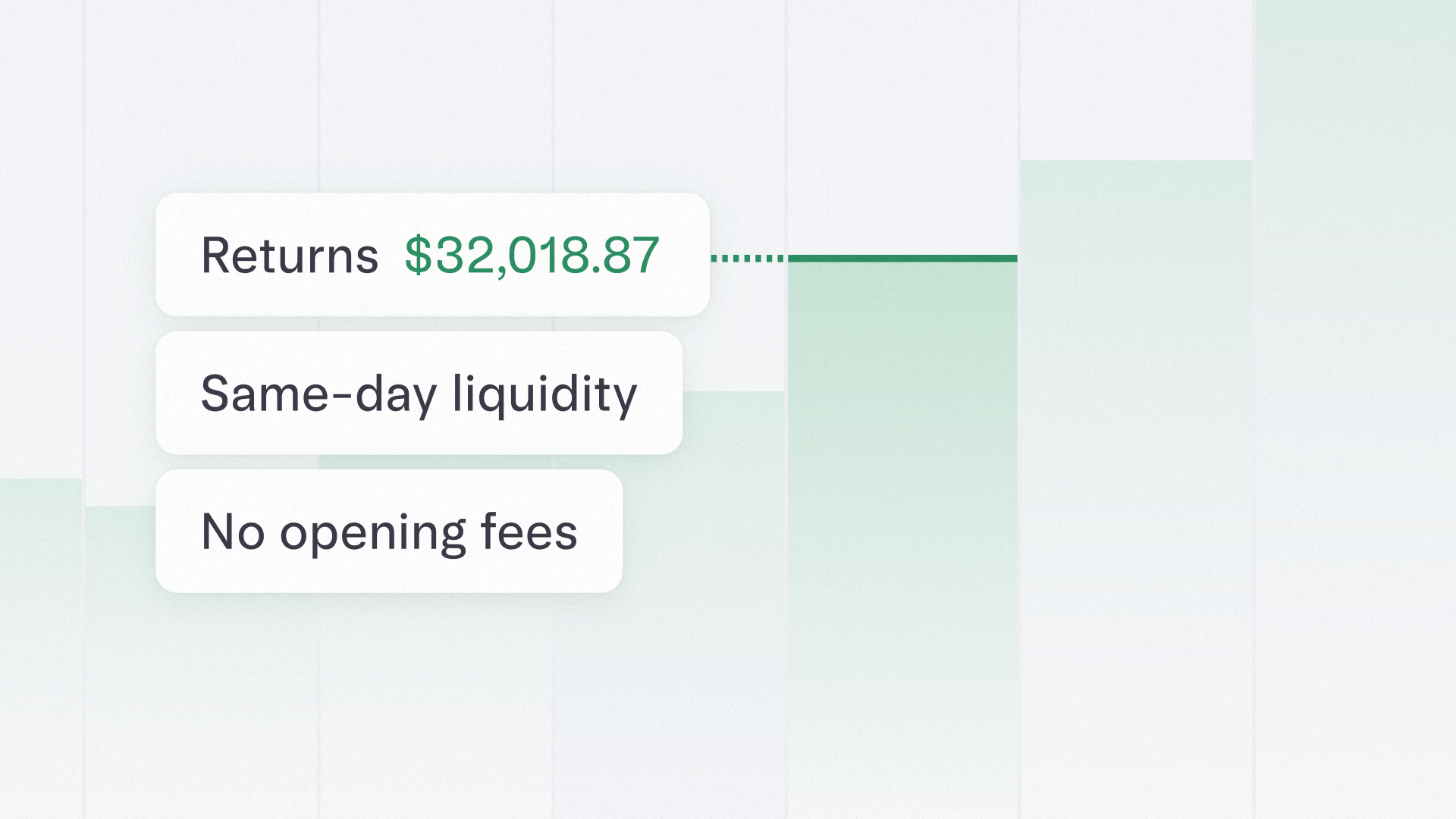

Never miss a chance to grow with 3.25% APY

Mercury Personal offers a competitive annual percentage yield of 3.25% on your savings without any minimum balances. You can even set funds aside for any use case by creating multiple savings accounts and earn a yield on them. For instance, you could create savings accounts for taxes, an emergency fund, and capital calls — and earn money on them all without commingling or locking up your money.

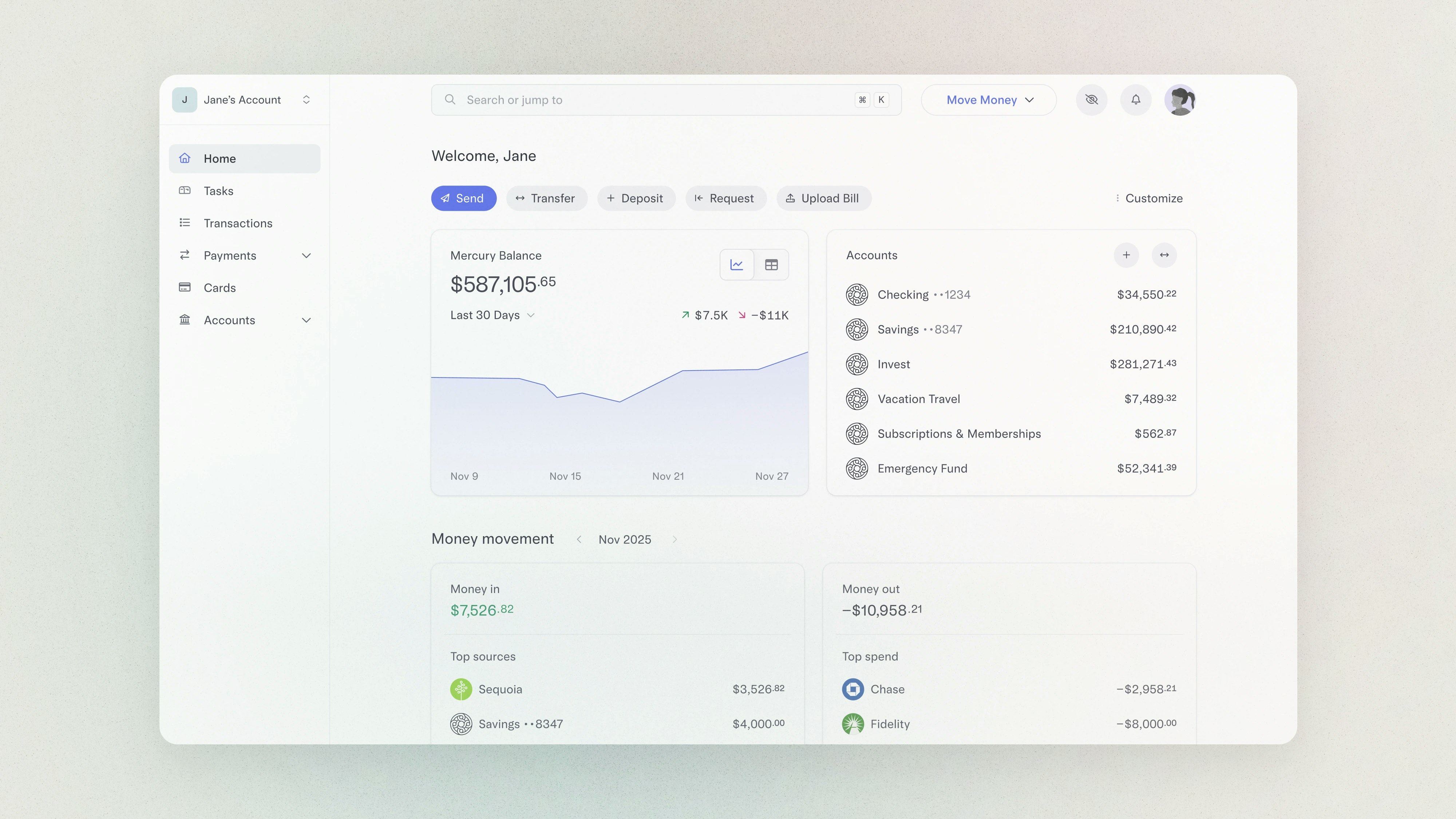

Optimize your money on autopilot

Those familiar with Mercury’s UI and near-mind-reading automations will be glad to know Mercury Personal offers the same frictionless experience. You can handle any banking task in no time via simple prompts designed to speed up workflows, get the complete picture of your finances, and toggle between your Personal and Business accounts with a click. Open multiple accounts and create auto-transfers between them to set your personal financial strategy to cruise control.

Plus, you’ll enjoy the peace of mind that comes with up to $5M in FDIC insurance through our partner bank and their sweep network. Your money’s protected with up to 20x the standard per bank limit without the need to open multiple bank accounts.

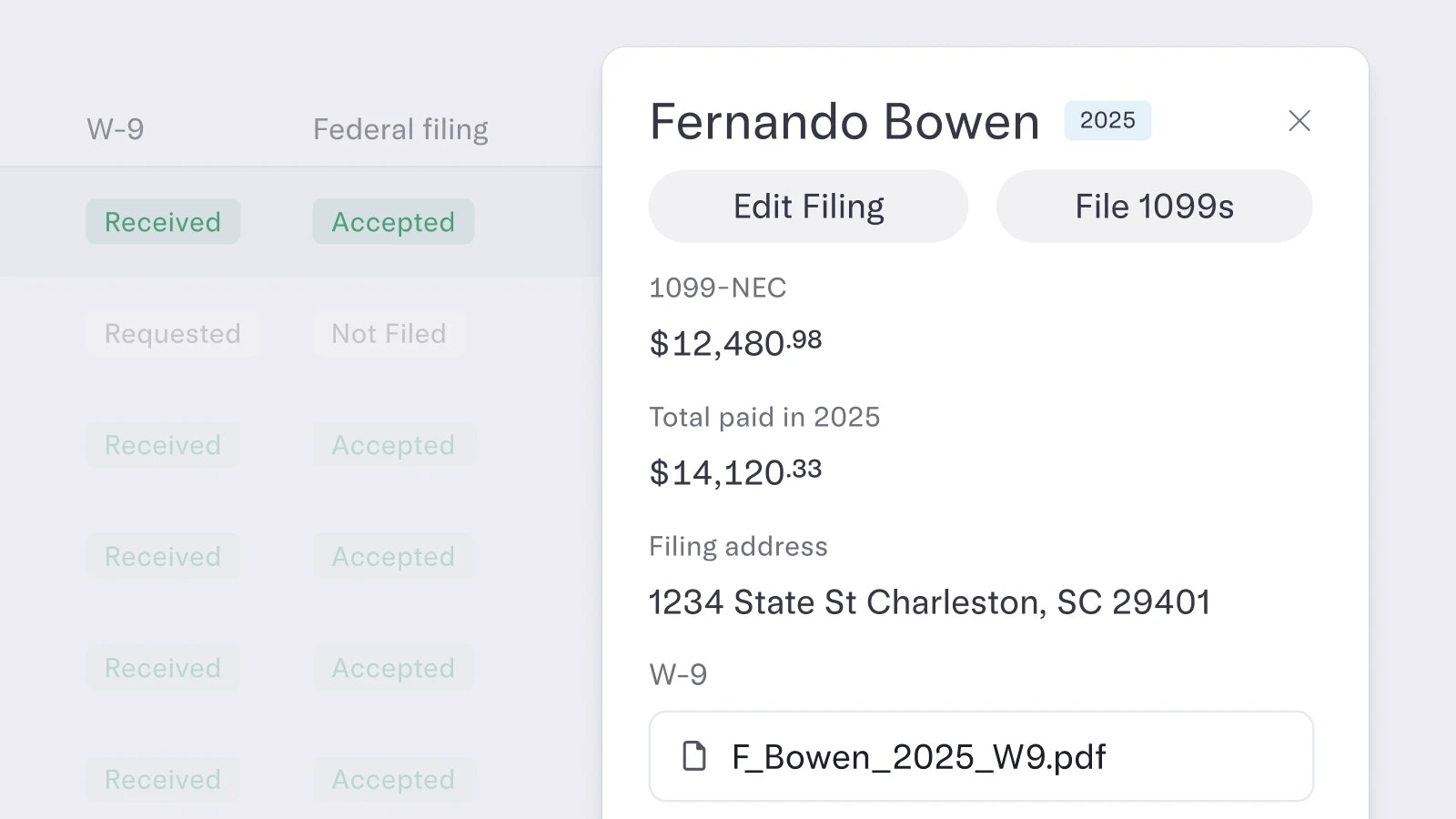

Invite collaboration with shared access

With Mercury Personal, there’s room for everyone in your life. Easily add accounts for your family and team and customize spending limits and permissions for each. For instance, you could create an account for your children’s nanny and set a rule to transfer funds into it each week — even issue cards. for set use cases, such as groceries with daily, weekly, and monthly limits. Invite your financial advisor or bookkeeper with access to view your financial statements. Whatever the case, there’s a way to customize your account to fit it.

Do it all for one annual subscription

Mercury Personal is all-inclusive for one transparent $240 annual subscription. Rather than countless surprise fees, send as many domestic wires, ACH payments, and checks as you please — they’re all included in your subscription. Take advantage of zero foreign transaction fees and get your ATM fees reimbursed wherever you go. Plus, set up accounts and cards for any user or use case. With a balance of just $7,500 in your savings, you’ll earn more than $240 at the current 3.25% APY over the course of the year, covering the cost of your annual subscription.

In the spirit of constantly building better and smarter tools, this is just the start. With joint accounts, Mercury Treasury, and international wires on the way, the future of personal banking is looking bright.

Mercury Personal is live now, however, we will be welcoming new users to the platform slowly to ensure the smoothest possible experience. To be among the first to enjoy Mercury Personal for yourself, join the waitlist at mercury.com/personal-banking.

About the author

Product Manager for Mercury Personal.