Introducing Mercury Treasury

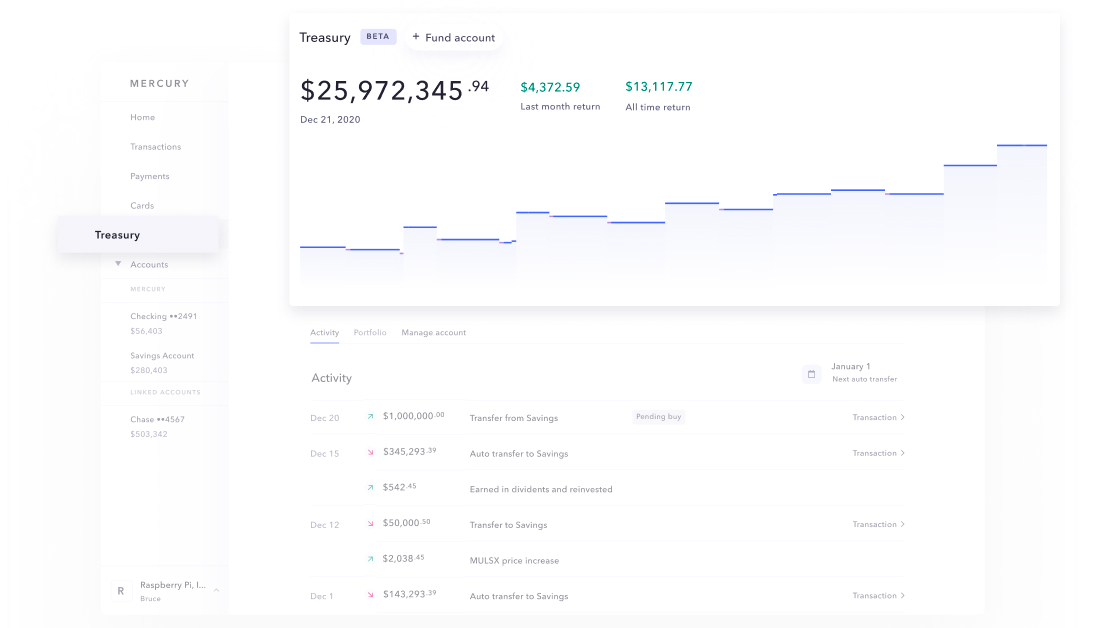

We’re launching the Mercury Treasury beta today. Mercury Treasury adds automated cash management to our services.

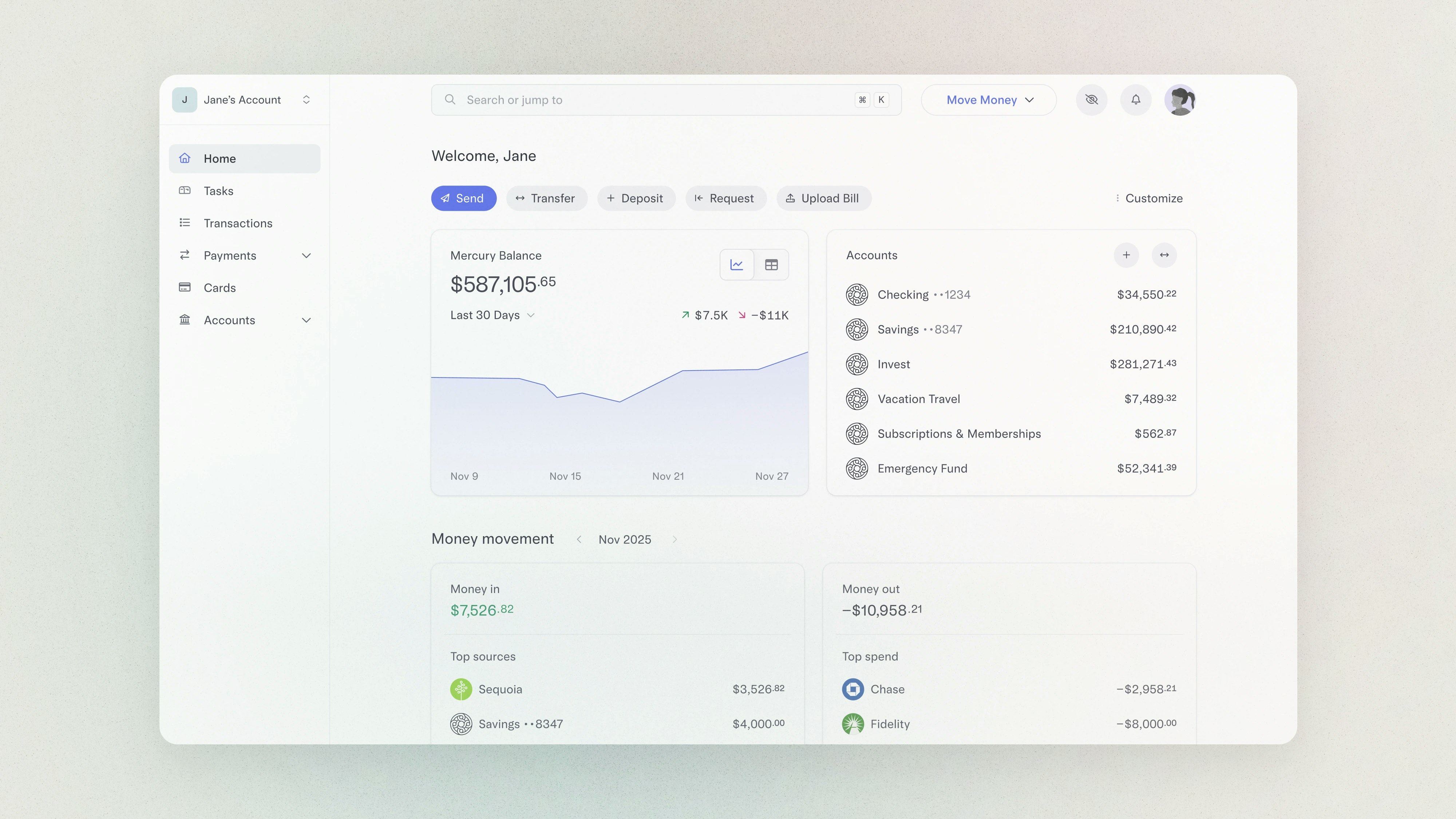

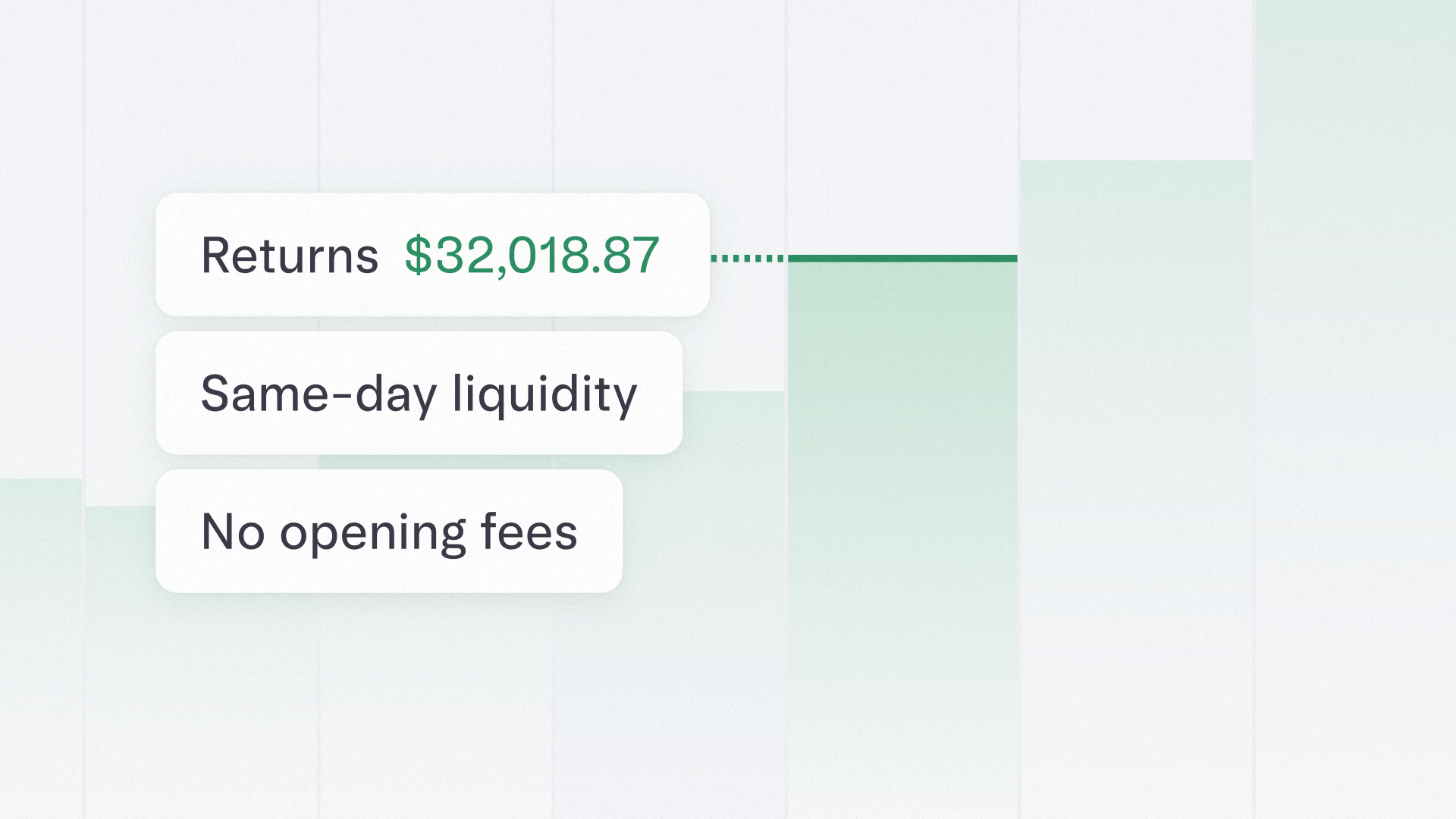

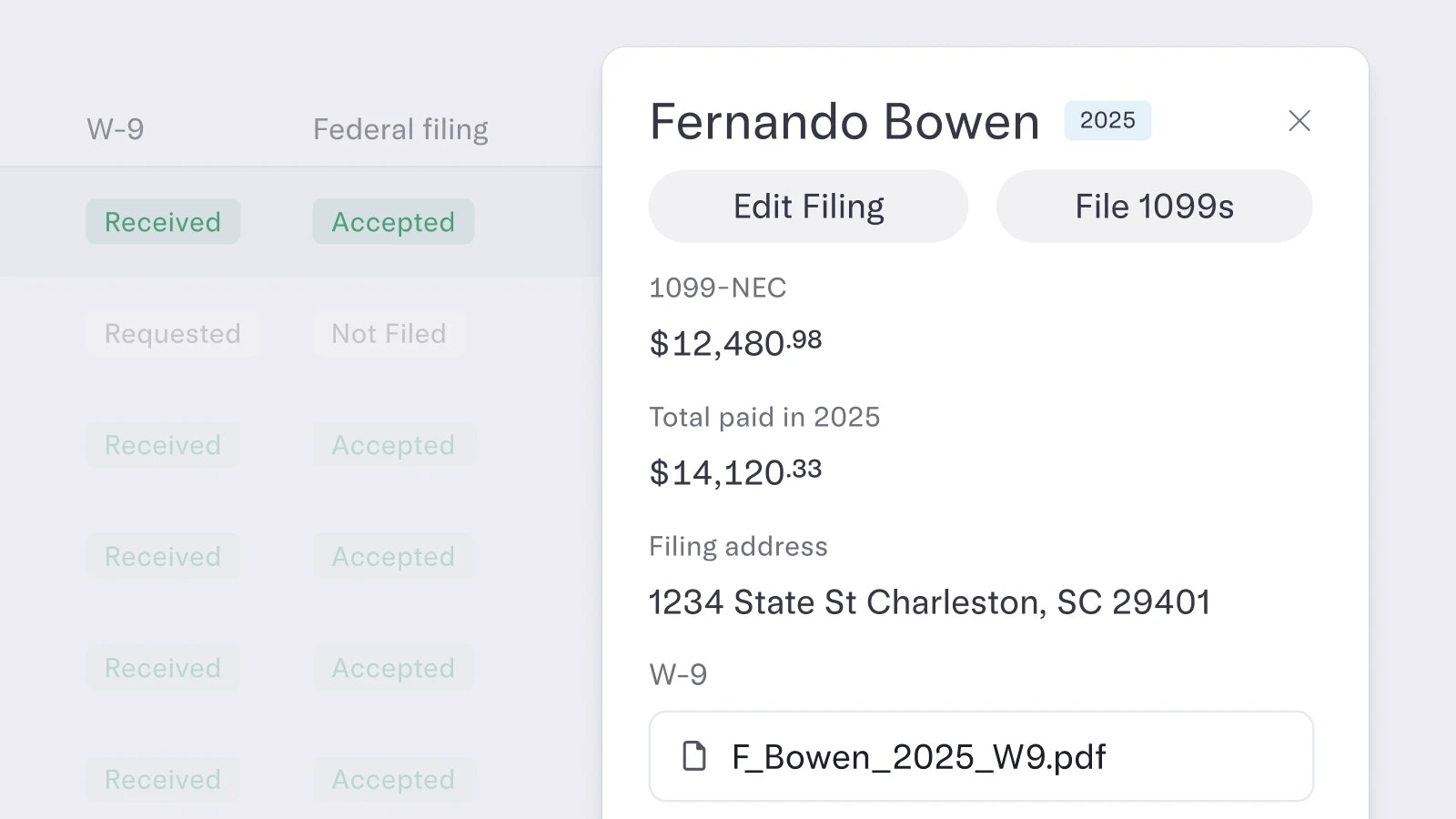

Mercury Treasury puts your extra cash into U.S. government securities and money market funds. You can set custom rules for auto-transfers, pick a treasury management strategy to match your cashflow, and follow your yield and transaction history—all from your Mercury dashboard.

Startups like Golden (backed by A16Z, Founders Fund), Linear (backed by Sequoia, Index Ventures), and Runway (backed by A16Z, Elad Gil) are using Treasury to automate ops on their idle cash.

Building Treasury

Startups raise cash to last 18+ months. Usually, that cash sits in a bank account earning absolutely zero yield—or if you have a CFO and finance team, they might manage it through clunky and manual processes.

We built Mercury Treasury to fix this. Treasury turns cash management into a product and opens it up to startups at every stage (you only need an account balance of $250k to join the beta):

- The newest product for the startup stack. Treasury productizes trusted funds from Vanguard and Morgan Stanley. Just tell us about your cash flow—we’ll recommend a custom portfolio strategy and manage your funds right through your dashboard.

- Optimized for automation. Startups need cash to be liquid but can’t waste time moving funds or checking balances. We baked custom auto-transfer rules into Mercury Treasury so you can make sure your cash is always where it should be.

- Integrated into Mercury. Mercury Treasury is built right into your core Mercury dashboard. Switch between taking care of your day-to-day operations and planning your long-term reserves with one click.

A few other fun facts about Treasury

- It took a team of 6 engineers and 3 designers about 9 months to build. Treasury was a big undertaking—big enough to be its own startup. We wanted a team with deep knowledge of our product and customers to build a cohesive user experience, so we chose four of the first five Mercury hires (and Immad) to spec, design, and build it.

- We talked to over 20 experts before starting work on the product. It’s common startup advice to talk to your users. When you’re building a financial product, you have to talk to the experts, too. Every financial product comes with new regulations and partners. To get it right, we went through a long research phase talking with lawyers, CFOs, brokers, clearinghouses, and consumer fintech CEOs to learn why this had never been done before, and how we could bring it to life.

- The economy changed, but the product didn’t. Interest rates fell sharply in March but we never stopped work on Treasury. We’ve stayed in close touch with our customers over the past year and have always gotten the same response: startups want better. Treasury builds a flexible foundation for us—Mercury is now an SEC-stamped RIA— to continue building out the financial stack for tech companies.

How to open a Mercury Treasury account

We’re opening up Treasury for Mercury Tea Room customers while it’s in beta. You can get in the Tea Room by depositing $250,000 in your Mercury account, or via a few referral channels. To get started, apply for a Mercury Treasury account here.

If you want to learn more about Mercury Treasury or have questions about getting in the Tea Room, you can check out our FAQ or send us a message through [email protected].