Mercury is a fintech company, not an FDIC-insured bank. Banking services provided through Choice Financial Group, Column N.A., and Evolve Bank & Trust, Members FDIC. Deposit insurance covers the failure of an insured bank.

How we keep your funds safe

Your deposits are held in your name

Every Mercury account is structured as an individual demand deposit account (DDA), giving you full ownership, transfer rights, and FDIC insurance eligibility by law — with no middleware in between.

Read More

Never lose sight of your funds’ protection

With Mercury Vault enabled on every account, you have an automatic and up-to-date view on exactly how your funds are protected.

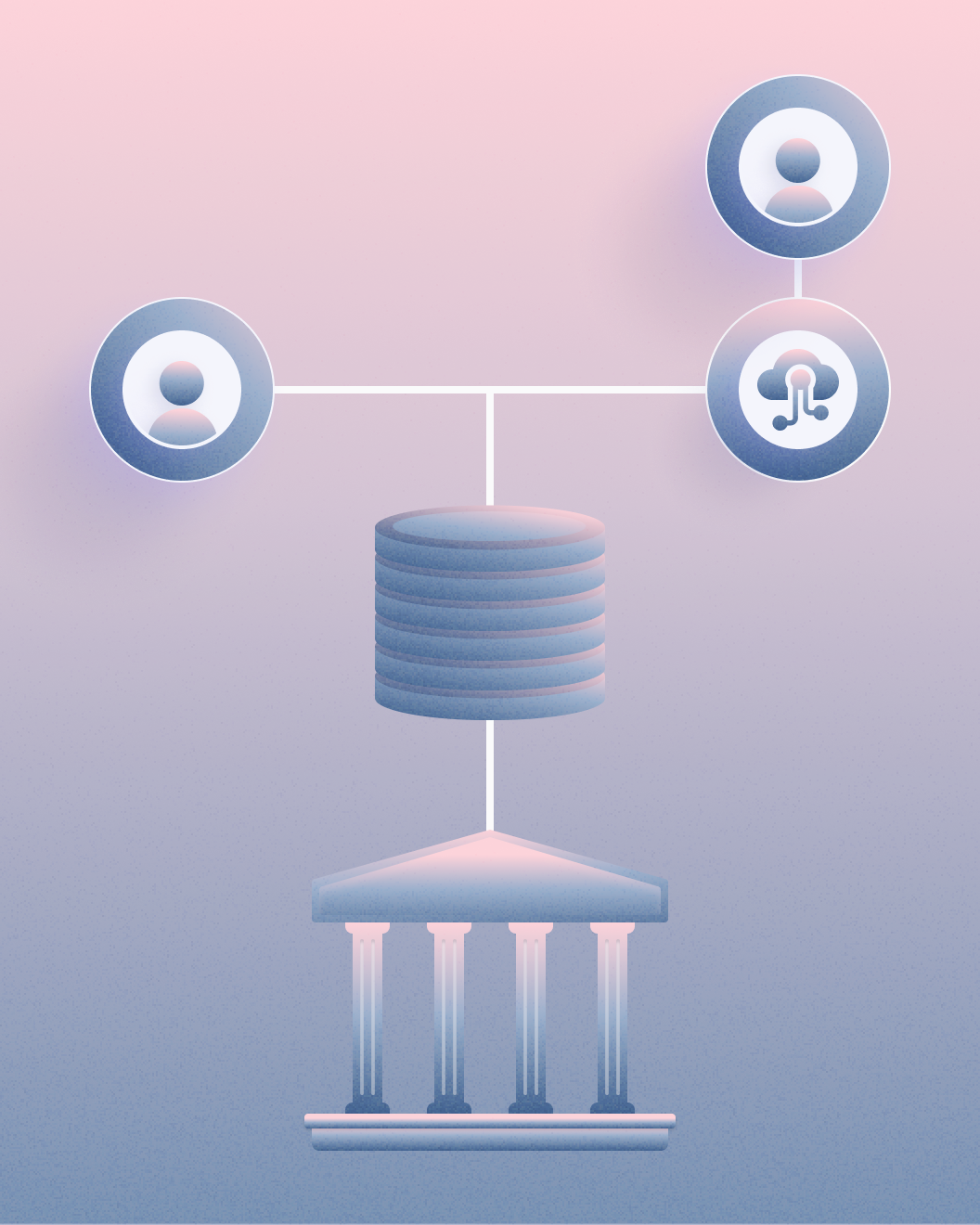

Diversified by design

We spread your deposits across a network of FDIC-insured banks via our partner banks’ sweep networks. The result is your team’s optimal, diversified banking setup — all through a single dashboard.

Learn How Mercury WorksHow we protect your account

Automated fraud monitoring

Our world-class fraud detection and compliance teams work together to build tools and processes that spot unusual activities and stop them in their tracks.

Uncompromising MFA

We enforce multi-factor authentication across all your accounts using methods like Touch ID, never settling for insecure options like SMS.

Proactive protection

We use device verification to ward off phishers and services like HIBP to keep leaked credentials from being reused.

Dark web monitoring

To prevent fraud attacks, we monitor the dark web for phishing domains, infostealers, malware, and account sales.

Robust ACH authorization

Designate which vendors can initiate ACH debits from your account and receive notifications about any unauthorized payments.

Explore DemoControls that keep you in control

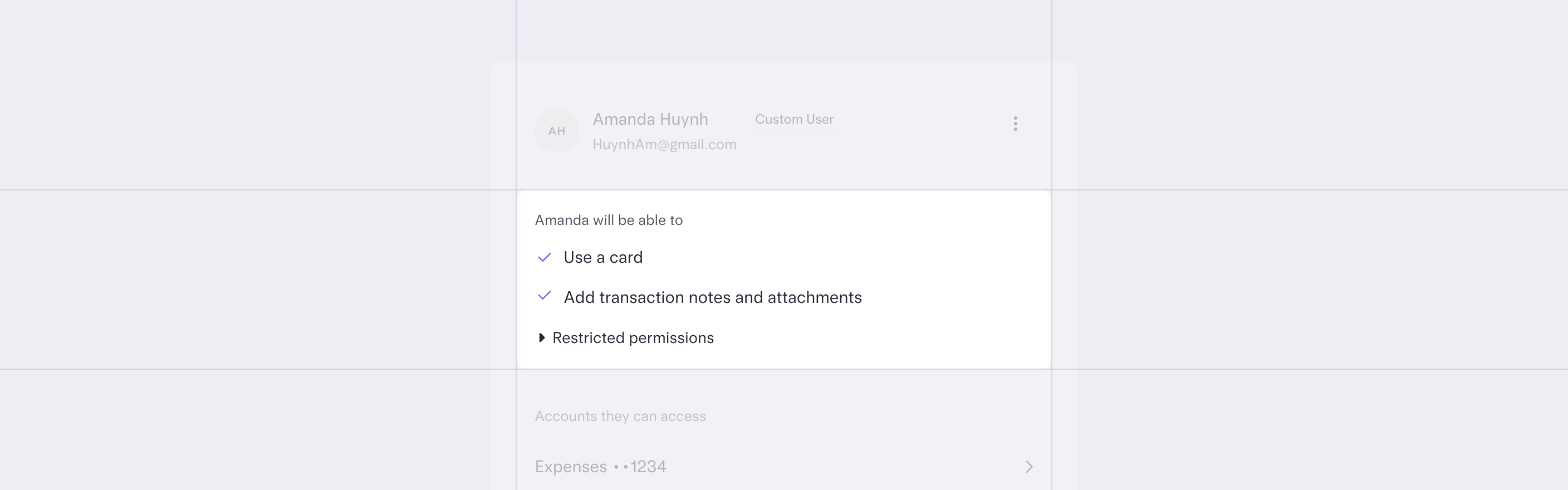

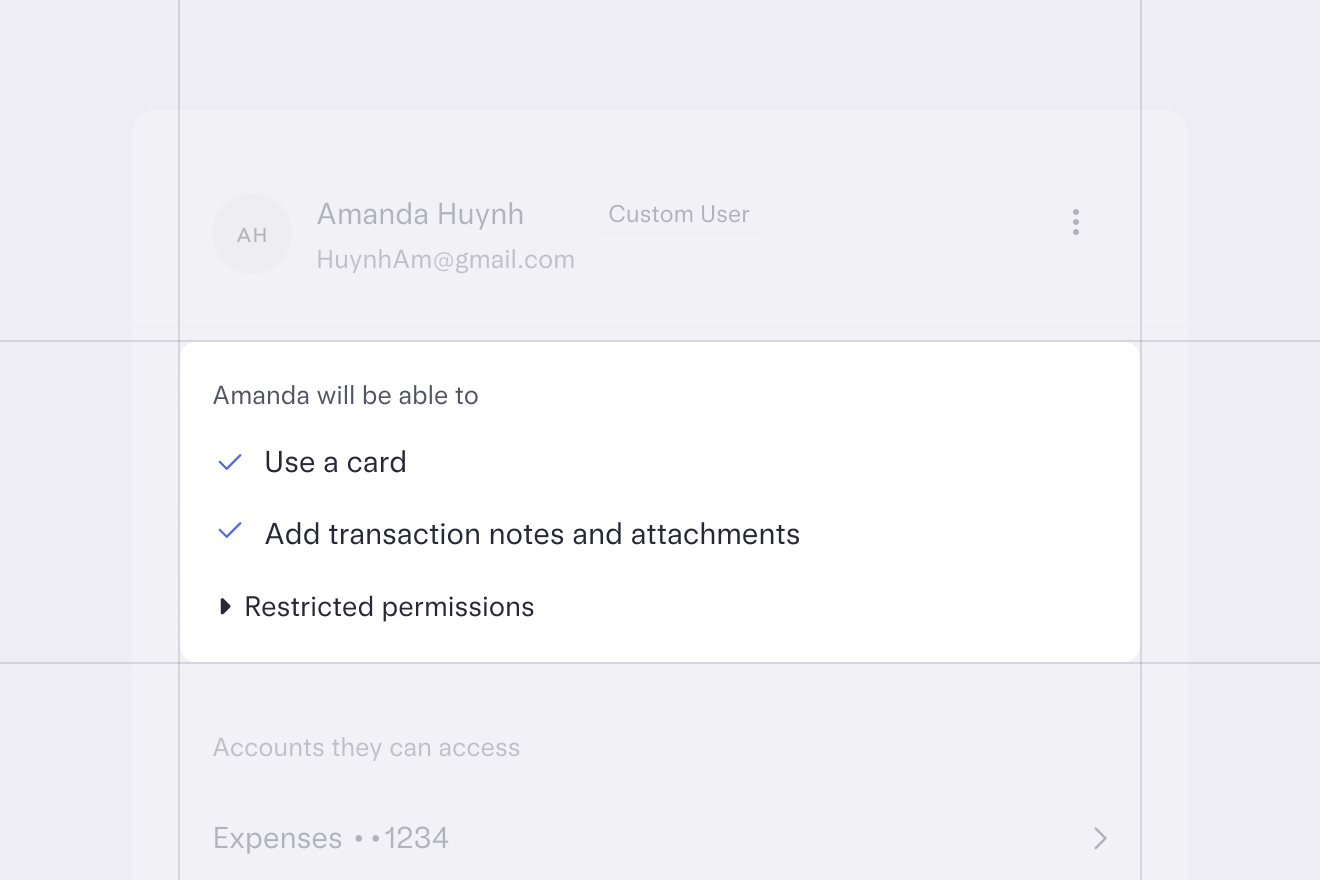

Set user permissions

Give the right level of access to the right people by assigning tiered user permissions to co-founders, accountants, and employees.

Your data. Your eyes only.

Stress-tested by the best

On top of regular internal and external audits, we pressure test our own security system through bug bounty programs and red team assessments. With ongoing employee trainings, we emphasize security as a shared responsibility across the company.

SOC 2 Type II compliance

Our security protocols and processes are first rate, and we undergo rigorous independent auditing to maintain them.

Robust encryption

We use strong, industry-standard protocols to keep your data safe and confidential, at rest and in transit.

PCI standards

We understand how important your credit card information is and we uphold PCI compliance to ensure it stays safe.